Precious Metals Market in the First Half of 2025: What Triggered Record Price Surges?

In the first half of 2025, the precious metals market experienced record-breaking price increases. These were driven by escalating global trade conflicts, rapidly decreasing interest rates across various markets, and growing geopolitical instability. Faced with threats such as an uncertain future for the global trade sector, a weakening US dollar, and heightened risks of large-scale conflicts in the Middle East, investors are increasingly viewing precious metals as a more attractive safe haven for their capital.

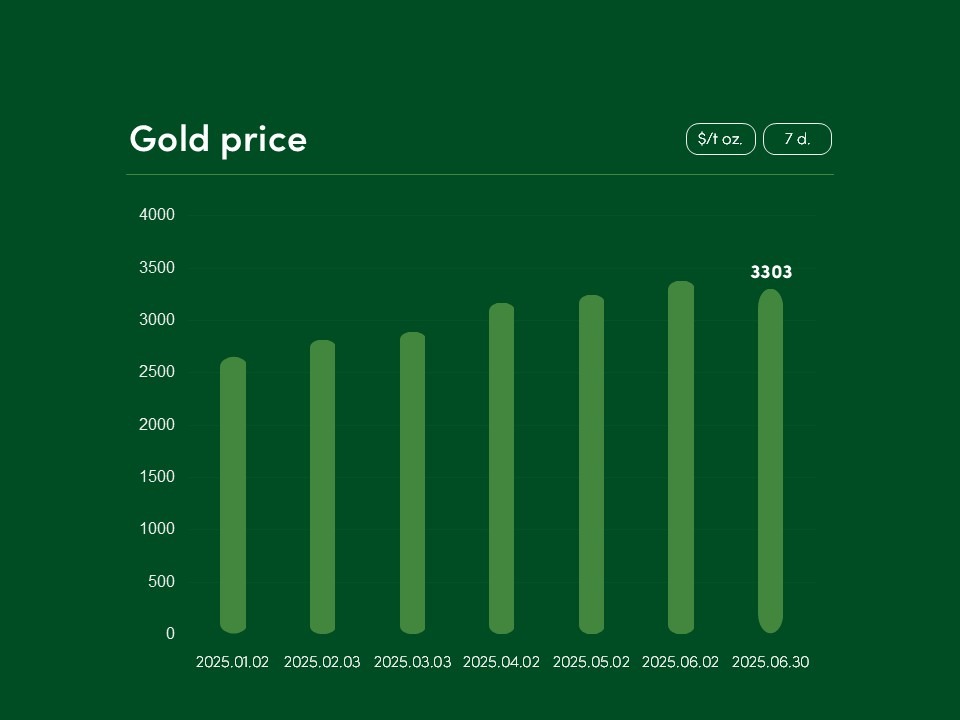

The global gold price rose by over 24% from the beginning of 2025 to the end of June, reaching $3,303/t oz.

This year’s surge in gold prices was significantly influenced by global political and economic instability. The armed conflict between Israel and Iran, as well as Israel’s invasions in the Gaza Strip and Lebanon, prompted investors to turn more actively to precious metals as a form of investment protection. Meanwhile, threats of new US trade tariffs—disrupting the global trade system—triggered a record decline in the US dollar’s exchange rate and stimulated more investment in precious metals denominated in that currency (such as gold, silver, etc.).

The global silver price also experienced significant changes during the same period, increasing by around 22% and reaching $36.1/t oz by the end of June 2025.

Silver’s price growth this year was fuelled not only by global geopolitical and economic risks but also by monetary policies in many world markets that favoured investment. To stimulate consumption among market participants, central banks such as the European Central Bank, as well as those of Canada, the United Kingdom, and other major economies, sharply reduced interest rates.

In addition, silver—widely used in industrial applications—benefited from increased demand driven by large-scale economic stimulus and infrastructure modernization plans. Germany’s government approved a €500 billion long-term fund focused on the infrastructure of Europe’s largest economy. Meanwhile, China—the world’s second-largest economic power—announced a significant increase in bond issuances and allocation of 3 trillion-yuan (~$415 billion) budget aimed at implementing national energy, infrastructure projects.

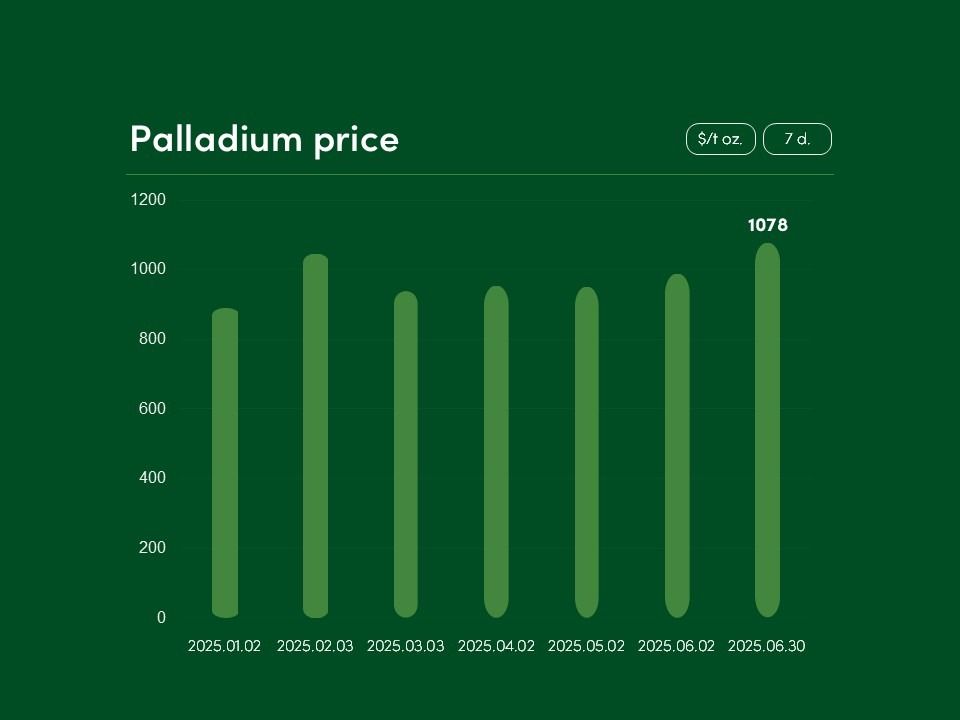

The global palladium price rose by approximately 21% during the same period, reaching $1,078/t oz.

The reasons for the increase in the price of palladium are closely linked to the difficult mining-supply situation in the global market. The period of 2012-2024 has witnessed a persistent global shortage of palladium, which goes hand in hand with the difficult situation in the main palladium producing markets of Russia and South Africa. Russia has been liquidating its palladium reserves to finance its military operations. While this move creates a short-term oversupply, it also raises serious long-term risks to global supply. At the same time, South Africa, influenced by previous periods of low palladium prices and deteriorating mine conditions, has been gradually closing palladium mines. A likely supply decline in both markets could, over the long term, trigger even more pronounced price spikes for this precious metal.

The global platinum price jumped by nearly 50% in the first half of 2025, reaching $1,361/t oz.

This record-breaking surge in platinum prices was driven by numerous political and economic factors. Investors not only turned to this metal as a means of financial protection but also sought to capitalize on the increasingly problematic state of the global platinum supply chain. According to data from the World Platinum Investment Council (WPIC), the platinum market will face a supply-demand imbalance for the third consecutive year in 2025. This shortage is exacerbated by temporary mine closures and supply chain disruptions in South Africa—the primary source of platinum. Additionally, a decline in the supply of recycled platinum has contributed to upward pressure on prices.

The global price of rhodium—the most expensive precious metal—rose by around 19.6% from the beginning of 2025 to the end of June, reaching $5,475/t oz.

This year’s increase in rhodium prices has been driven by factors such as a significant exchange-based demand from Anglo American (one of the world’s largest metal mining companies), and growing demand from US automakers and China’s glass industry.

Although current rhodium market dynamics appear highly optimistic, experts warn that continued price growth may be short-lived. They emphasize that the global rhodium deficit is expected to shrink to 74,000 ounces this year (down from 143,000 ounces in 2024), and that temporary disruptions to rhodium mining—such as extreme weather events in South Africa—have also contributed to the current price rally.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.