July 16, 2024

Metal Market Overview 10-07-2024 iki 16-07-2024

The precious metals market has seen mixed price movements and overall sentiment of anticipation over the past week. It was driven by a combination of worrying geopolitical events (assassination attempt of D. Trump, unrest in USA, etc.) and waiting of potential stock market and US interest rate corrections in the fall.

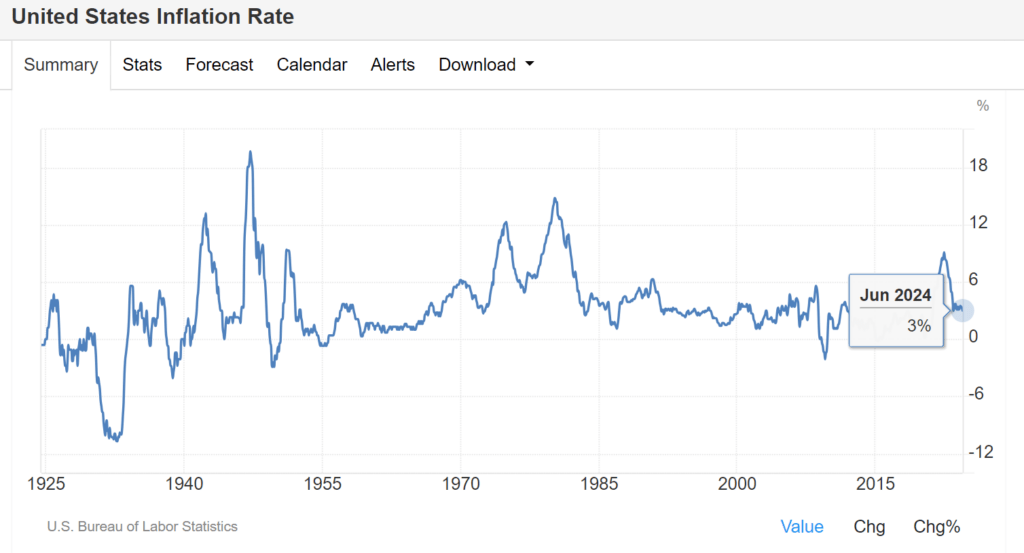

Gold prices have gained about 2.8% from July 10 to July 16, trading at around $1,840 per ounce in July 16. This rise is likely due to a combination of safe-haven buying on account of the assassination attempt on US presidential candidate D. Trump and political uncertainty in the US, UK and France. Rising gold price is also an optimistic reaction to the Federal Reserve’s claims that the central bank of US may not wait for inflation in United States to fall to 2% before cutting interest rates.

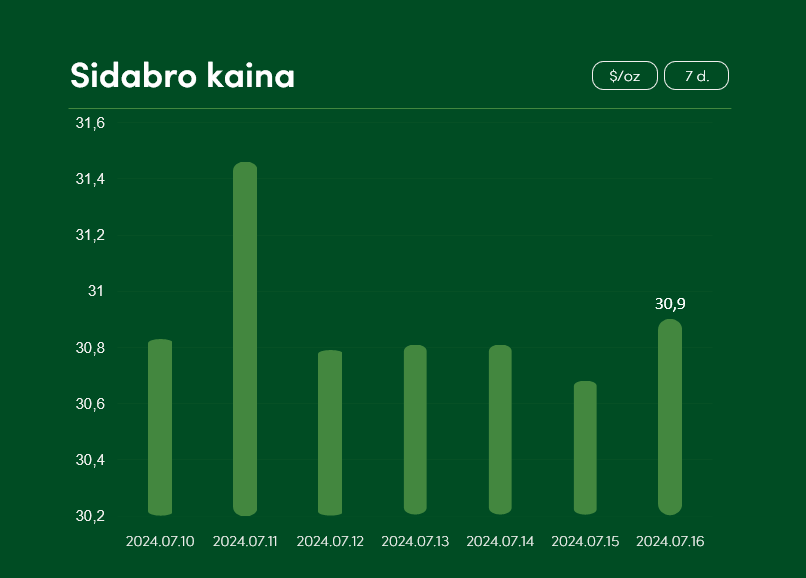

As yearly inflation rates are already down to 3% in US, analysts are more bullish on gold, with some predicting continuous soar of this metal price in case of possible US interest rate cut in September.

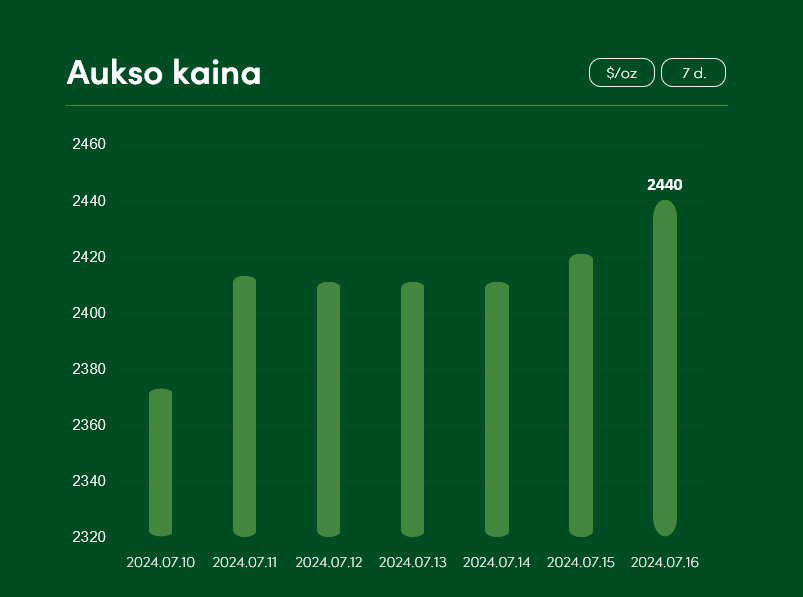

Silver prices have remained relatively rangebound this week, trading at around $30.9 per ounce. While some experts believe that silver prices will continue to rise, Morgan Stanley analysts have a more bearish outlook, predicting a price of $25 per ounce by the end of 2024.

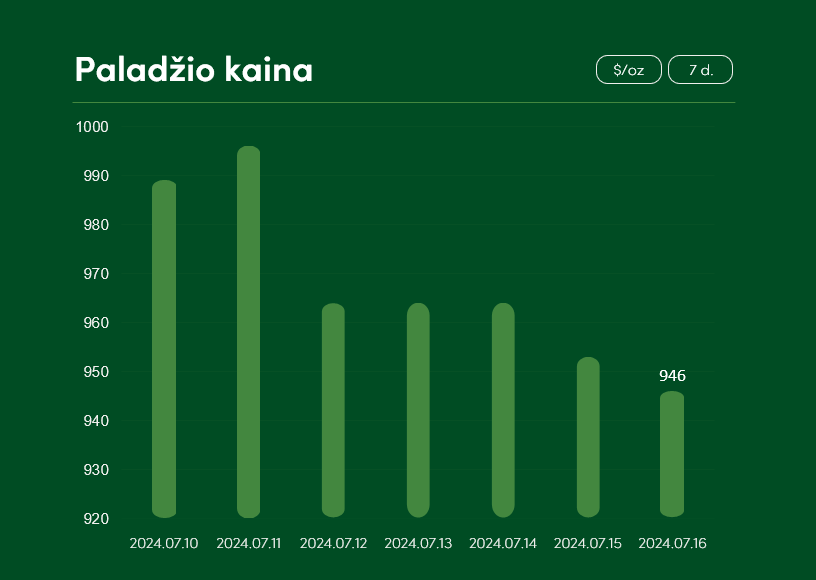

More significant losses during this week were recorded by palladium. Price of this metal fell by ~4.3 percent from July 10 by July 16 and currently sits at around $946/oz. Although deficit of this metal is felt in various industrial spheres, according to the Mining.com and Reuters portals, the lack of metal and the limited extraction due to falling prices will be compensated this year by the palladium reserves that have already been mined. According to UBS analysts, the price of palladium might fall to $900/oz until the end of 2024.

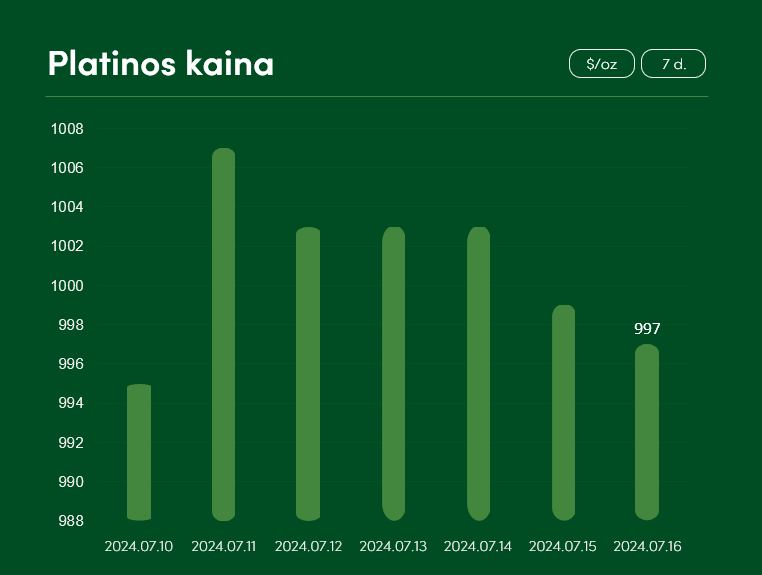

Platinum prices have seen a modest rebound this week, trading at around $997 per ounce. Most analysts predict that platinum prices will end this year in price range of $965.66 to $999 per ounce.

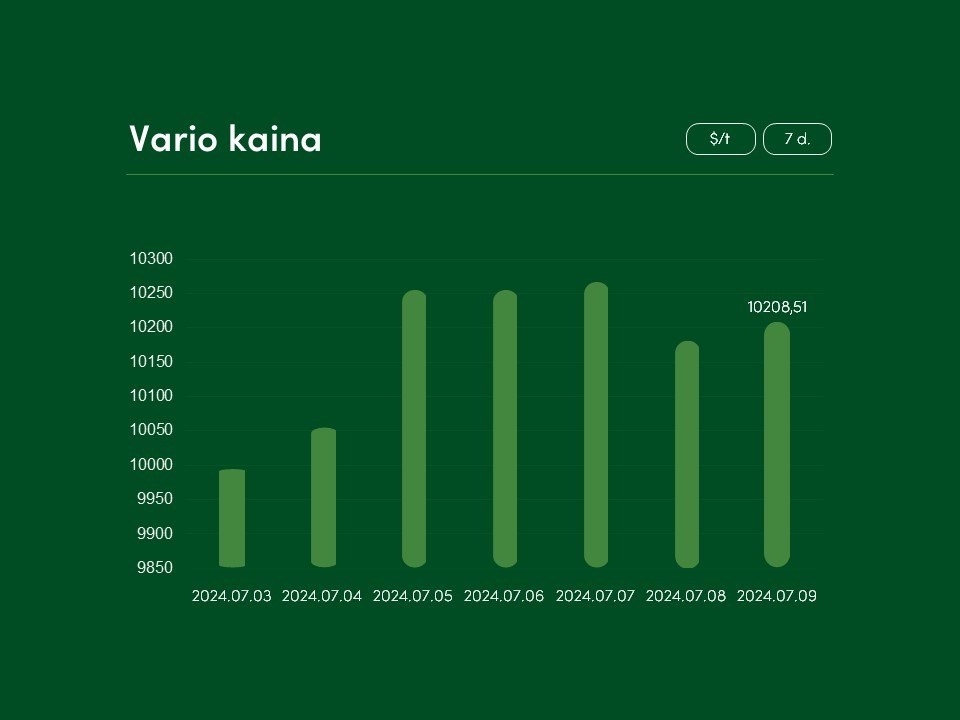

Copper prices did not change significantly in the last week and on July 16 amounted to ~9695 $/t. However, long-term copper price prediction of the well-known risk fund manager P. Andurand (published by Financial Times)is very bullish: according to the expert, the price of copper can grow up to $40,000/t in the next 4 years due to quickly growing demand for this metal in various technological and industrial spheres. In case of copper, long-term situation seems to be quite simple: quick growth in market demand cannot be met by equally fast growth in supply.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.