August 6, 2024

Metal Market Overview 31-07-2024 to 06-08-2024

During the last week (from 07-31 to 08-06), the precious and semi-precious metals markets went through a period of very uneven price changes. The gold, which is mostly associated with investment safety and conservative maintenance of money value, recorded mild corrections. Meanwhile, such metals as silver, platinum, and palladium unpleasantly surprised their investors with a >5% decline in market prices. As various experts around the world observe the pessimism of the market, they are not in a hurry to call this dip as “another great investment opportunity“.

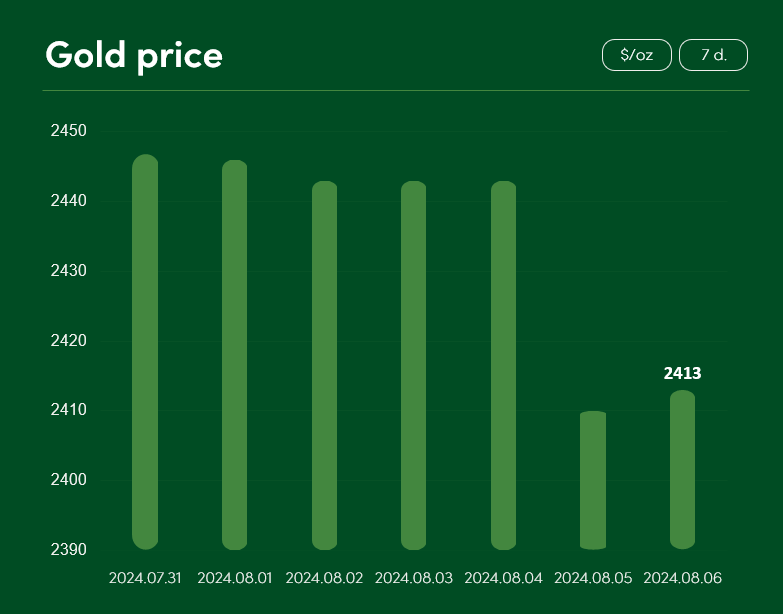

Analyzing the changes in gold prices during recent days, it is first important to mention that from July 31 to August 6, this metal recorded ~1.5 percent decline in price and met this Tuesday with a price of $2413/oz.

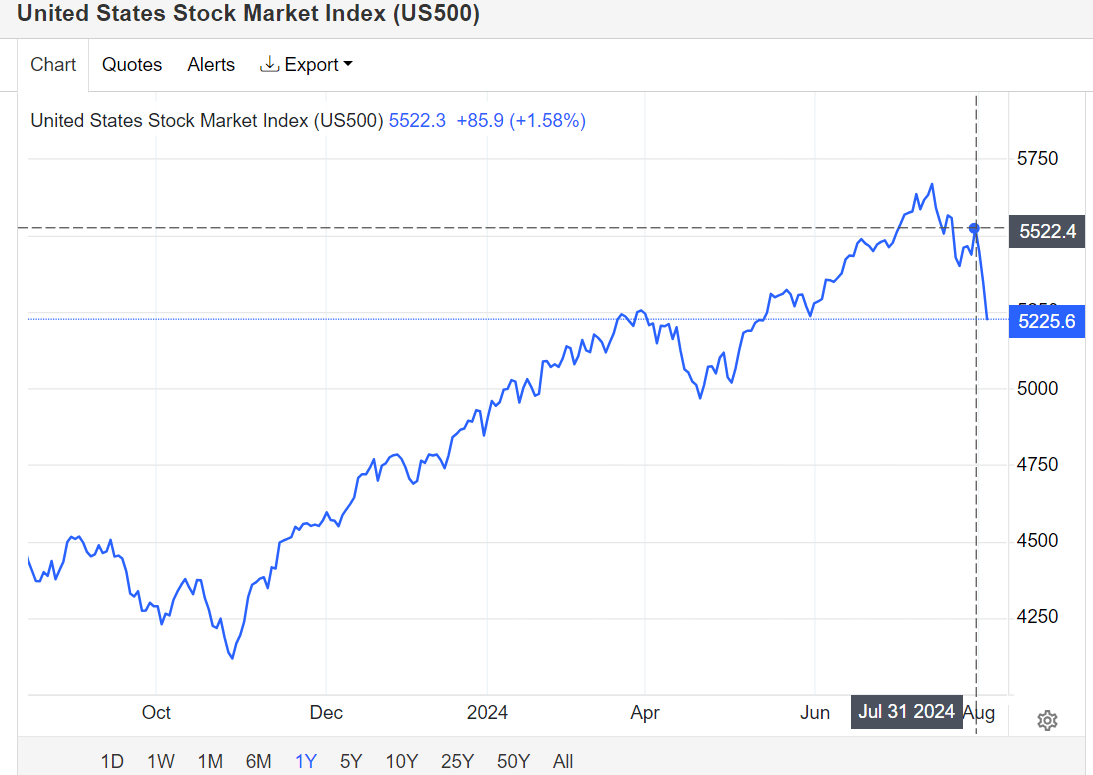

The decline in the price of gold can be partially explained by the turmoil in the stock markets. For example, the US500 (S&P500) index of 500 major US stock companies, which can be tracked on various portals, including TradingEconomics “dipped” by ~5 percent from July 31 to August 5. Similar results were also recorded by other major stock exchanges of the world.

When looking for the reasons for the relatively small gold price correction, it is first worth considering the fact that this precious metal is the main choice of investors when the markets are dominated by investment fear. This is likely why the major precious metal did not experience similar losses as most major stock indices.

However, expert feedback (such as Jim Rogers’ commentary in the EconomicTimes) does not bode well. Not only has this multi-millionaire sold off the bulk of his stock investment portfolio, he also mentioned that now is not the time to buy gold or silver. So maybe these market corrections are one of the first signs of a long-term decline?

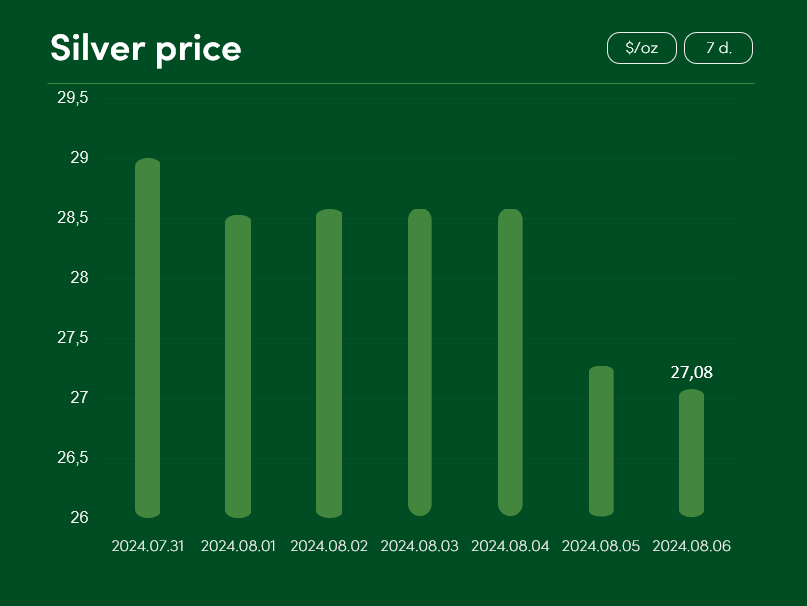

Silver, a less popular metal with roughly 15 times lower market capitalization (~$1.5 trillion) to that of gold, had a much harder time picking up last week’s stock market turmoil. Silver price fell by ~6 percent from July 31 to August 6 and reached the $27.08/oz mark. According to experts at TradingEconomics, the pessimistic views on the latest US employment statistics and the global manufacturing sector has led the markets to engage in a massive sell-off in industrially applicable precious metals, such as silver, palladium and platinum.

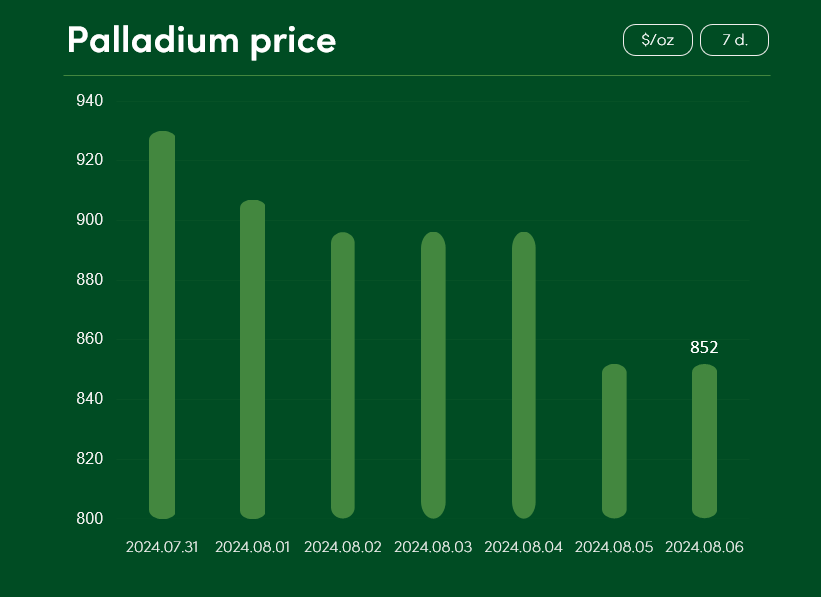

Palladium and platinum have been performing similarly to silver in terms of price corrections. Palladium recorded >7.5 percent price drop during the last week (07-31 – 08-06) and reached 852 $/oz.

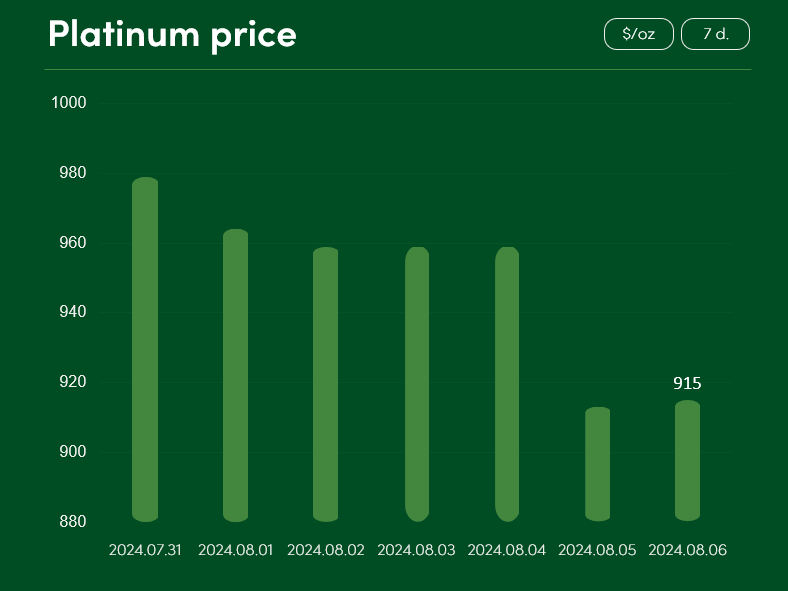

Platinum recorded a slightly more modest, but also significant (>6%) correction and reached $915/oz on August 6. Although not a single expert would question the short-term prospects of platinum at the moment, in the long term, due to the mass use of platinum in the hybrid transport and hydrogen industry, we see positive price forecasts for this metal. Experts of ANZ (Australia’s second largest bank by capitalization), whose predictions were published by Techopedia, claim, that platinum might reach the price level of $1,273/oz in 2025.

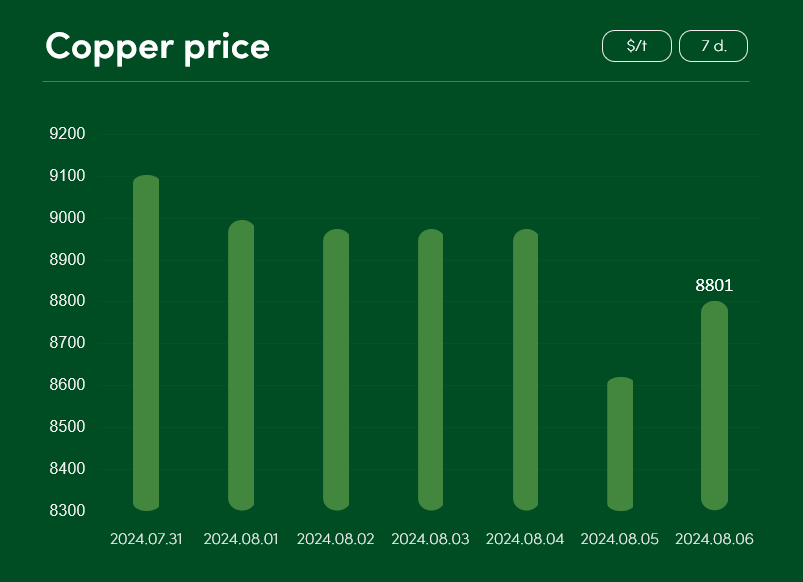

The price of copper fell by >3% last week and reached a price of 8801 $/t. TradingEconomics experts see the most obvious reasons for the corrections of this promising metal in the Chinese and US markets. In the United States, a country that generates about a quarter of the planet’s GDP, rising unemployment rates and sudden corrections in stock markets are viewed with great fear. And China, the main importer of copper, also adds its own share to the negative market sentiment due to country’s weakening economic growth.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.