July 30, 2024

Metal Market Overview 24-07-2024 to 30-07-2024

The last week was characterized by somewhat uneven price movements in the markets of precious and semi-precious metals. Although a consolidation of market prices was observed in relation to gold and platinum, the prices of silver and palladium stabilized only after a sharper fall. In general, sentiment of expectancy can be clearly observed in the markets. It is related to possible future decisions in the banks of Japan and England, and to the assessment of new measures to stimulate the Chinese economy.

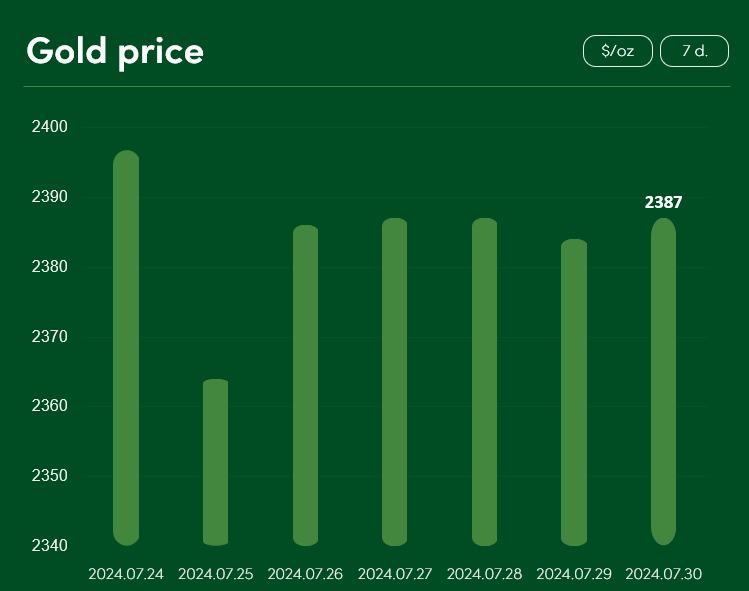

Gold prices recovered quickly last week after minor corrections and from July 26 to July 30 held within the range of ~2380-2390 $/oz. Investors are obviously waiting for news from the world’s big banks. It is expected that the central bank of Japan will raise its interest rates this Wednesday by 10 basis points (up to 0.1%) in order to protect the yen from the competitive threat of countries such as China. There is also active discussion about the possibility of the Bank of England to reduce interest rates at this time of the year. If the decision to cut rates is adopted, the fall of UK’s bond yields is likely to benefit the outlook for gold prices.

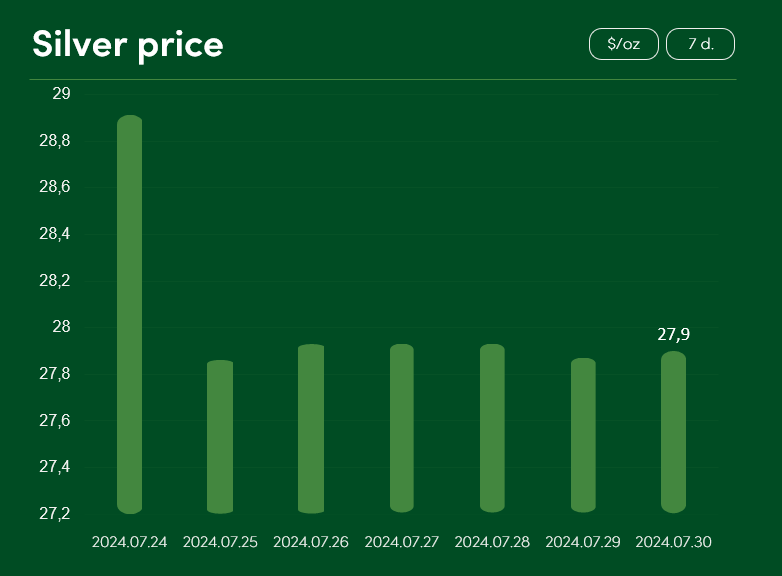

Silver prices consolidated last week at ~$27.9/oz after >3% price drop on July 25. According to experts at Kitco, silver is currently struggling to find support at $29/oz. Some analysts claim that the growing geopolitical uncertainty and the uncertainty of the outcome of the upcoming US presidential elections serve gold in particular.

Carsten Fritsch, a commodity market analyst at Commerzbank (one of Germany’s major banks) says that silver usually disproportionately follows gold price changes. But lately this disproportionality occurs only in the case of a price fall.

Carsten attributes the recent weakness in silver prices to the fact that it is a widely used industrial metal. And it is the basic industrial metals that are “bleeding” on markets these days due to the weakening demand from the strategically important Chinese market.

Investors are waiting for further information from the Chinese government, in the context of which it would be possible to more accurately assess the fact of the reduced interest rates of the country’s central bank and the impact of ~130 billion Chinese long-term bond issuance on future prices of silver and other industrial metals.

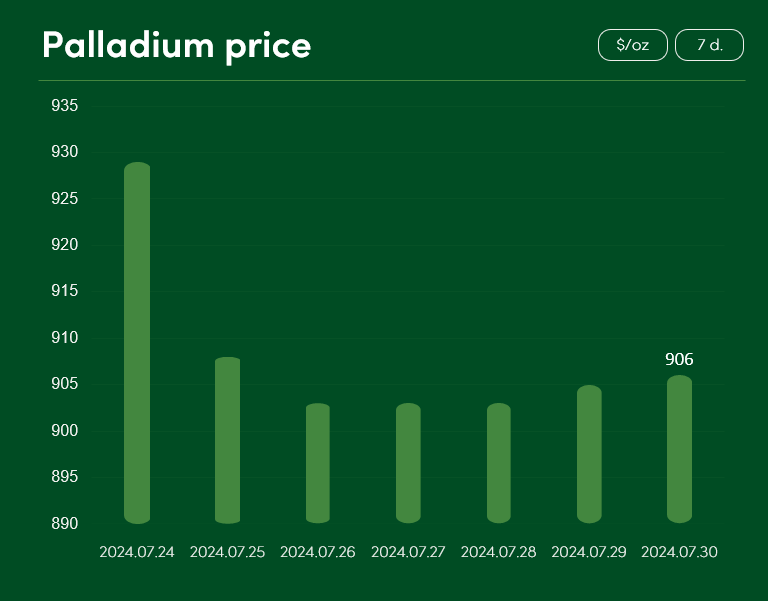

Palladium prices on exchanges have fallen by more than 2% in the past week from the range of ~929$/oz. Although the long-term prospects for the metal do not look bleak, palladium is currently suffering from completely sufficient market reserve situation and a partial decline in demand for the metal from the transportation industry.

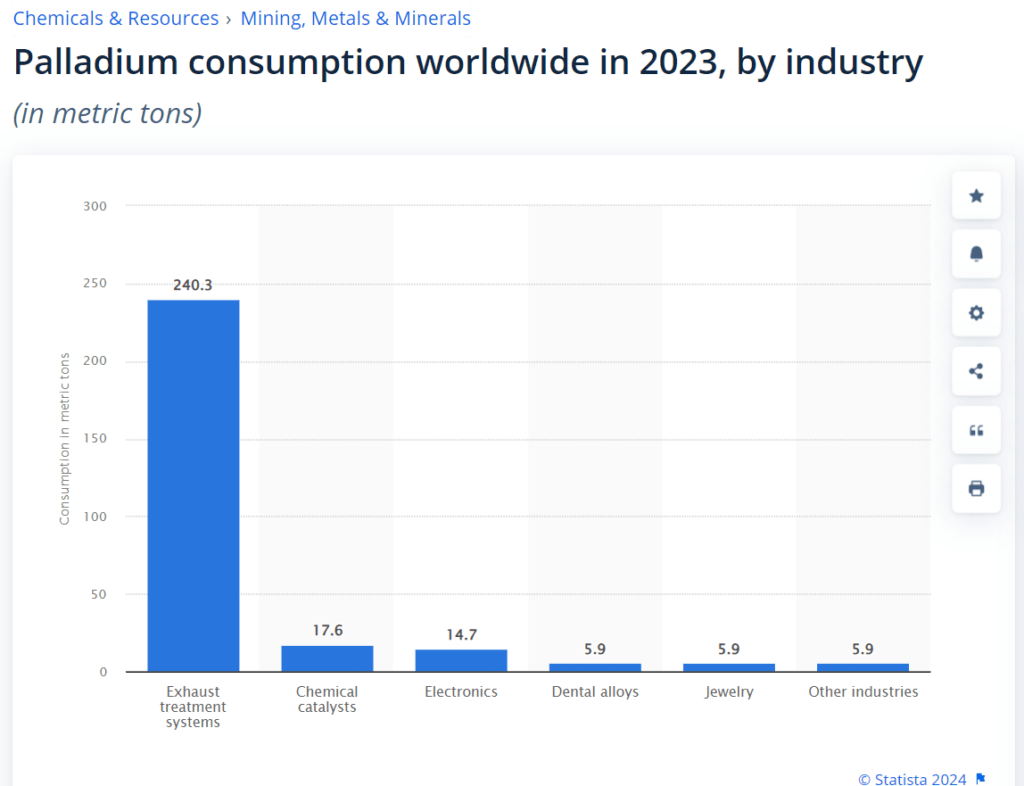

According to the Statista.com portal, in 2023 about 82 percent of all the palladium used in the world went specifically to vehicle exhaust systems. Since the popularity of electric cars (which do not have catalysts that contain platinum and palladium) has recently been observed, the current sufficient stock of palladium in the market encourages speculation that we will not see massive increases in the price of the metal in the near future.

However, when evaluating the price situation of palladium, it is important to remember the fact that this palladium is used by the increasingly popular hybrid and hydrogen cars. If those fuel types will regularly and significantly grow their shares of the future vehicle market, this will help palladium to secure better long-term market demand and potentially achieve greater long-term price growth.

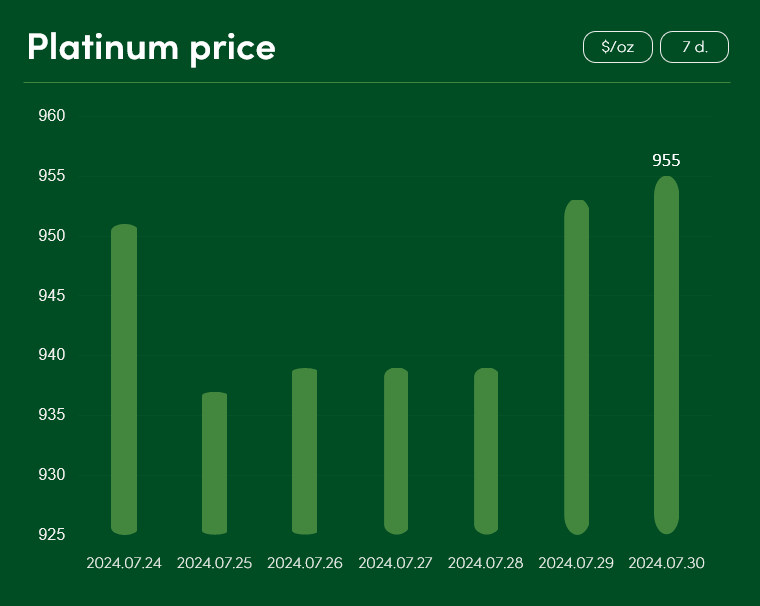

After a temporary dip in the first half of the week, platinum prices managed to return to the ~$955/oz range on July 30. According to the comments of the Johnson Matthey company on the Reuters portal, we see that the platinum market in 2024 is facing its worst supply shortage in 10 years. Therefore, if we continue to observe interest rate cuts by various central banks around the world, it is possible that they will help stimulate the growth of the price of this precious metal.

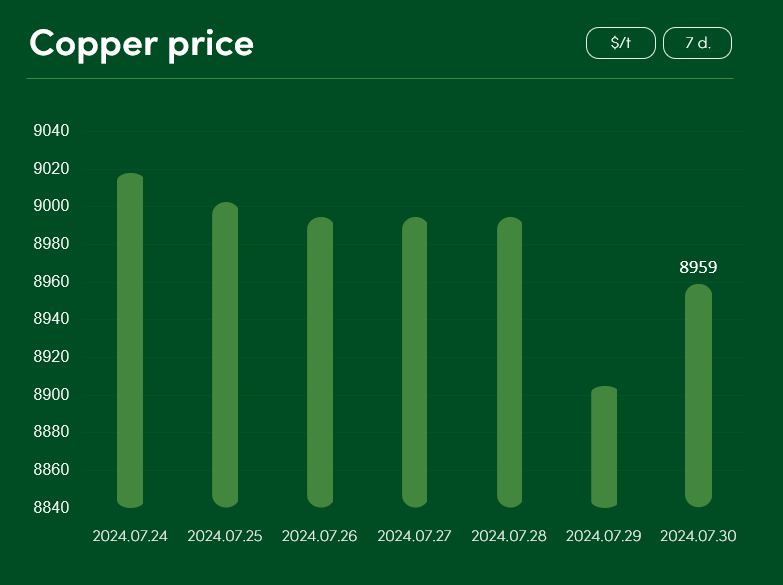

It looks like copper prices are also consolidating after a slight dip this week from $9020/t to ~$8959/t. The mixed market sentiment is related to the fact that the global demand for copper will grow unambiguously in the long term, and to the difficult situation in the Chinese market.

Investors took a gloomier view of China’s weaker-than-expected economic growth data in the latest quarter. On the other hand, we recently had announcements on the Chinese central bank’s interest rate cut and the issuance of special Chinese long-term bonds. Therefore, bearing in mind the global demand trends of copper and the decisions of the Chinese market, it is likely that the drop in copper prices that is ongoing since May of this year is only a temporary problem, and not a long-term tendency.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.