August 20, 2024

Metal Market Overview 14-08-2024 to 20-08-2024

Although the precious and semi-precious metals markets last week were characterized by investor and buyer indecision about the validity of current prices, almost all major precious metals ended the last 7-day cycle with price gains. When looking for reasons for market optimism, investors turned to both the increasingly likely autumn federal interest rate cut in the US as well as unforeseen events in the metals mining industry.

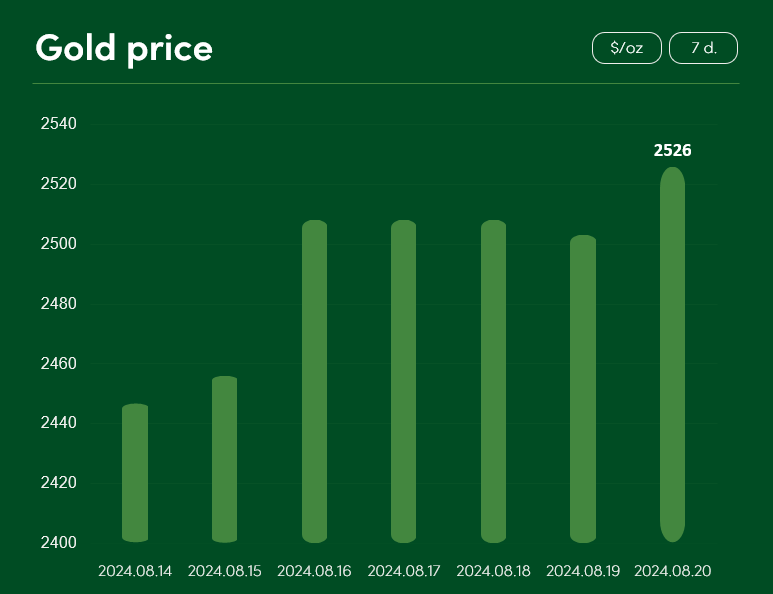

The price of gold rose by >3% between 14 August and 20 August, ending the past week with the metal’s all-time price highs. The $2526/oz price peak was partly driven by signs of continued inflation shrinking in the US market as well as the growing probability of upcoming US bank rate cuts.

A commentary by N. Seth (Chief Investment Officer and head of APAC Fundamental Fixed Income at Blackrock) in the EconomicTimes highlights that the continued retreat of US inflation and the cooling of country’s economy create opportunities for a long-waited cut in federal interest rates. The media and various economic experts are now almost certain that the United States banking sector will see at least one rate cut this September. It is also likely that we will see a total of around 3-4 interest rate cuts in the US during the next 6 months.

Lower interest rates automatically mean cheaper borrowing for investment capital for various businesses and easier access to larger loan amounts for home loans or other non-essential purchases for private individuals. Gold buyers likely reacted enthusiastically to such favorable economic scenario.

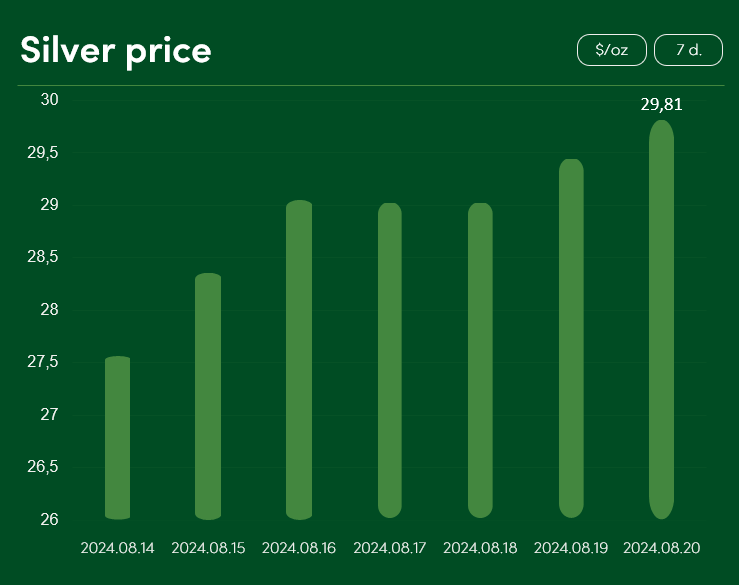

Silver, which often mirrors gold’s price movements on the market, outperformed its direct “competitor” this week, recording a price of $29.81/oz on 20 August and ending the last 7-day period with a total gain of around 8.3%.

Silver’s success can be attributed not only to the optimistic economic sentiment in the US market, but also to the sustained industrial growth in demand for this metal. Expert commentary from InternationalBanker suggests that a further increase in the global silver supply deficit is likely in 2024. According to the experts’ forecasts, the deficit could increase by 17% or 6695 tonnes this year alone. The growing silver deficit and the huge demand for this metal in innovative areas (such as solar panels) are likely to lead to a sustained consolidation of higher silver price and it‘s further growth.

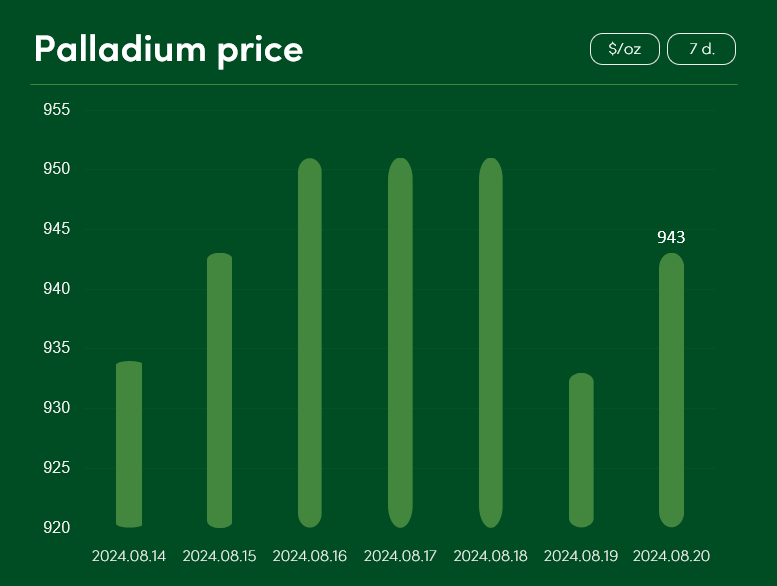

Last week, palladium prices were characterised by intense battle between buyers and sellers of this market. At the end, palladium ended this 7-day period with a small upside: from a price of $935/oz on 14 August, palladium price rose to $943/oz on 20 August.

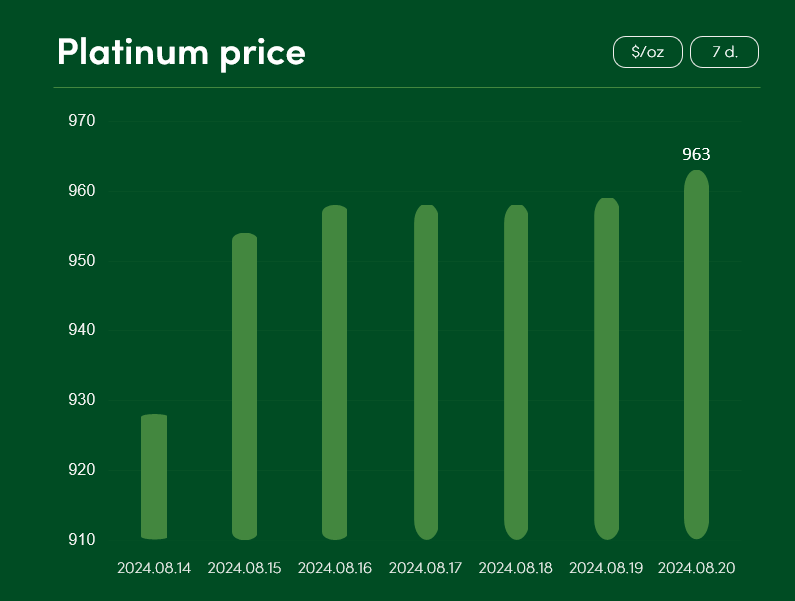

More striking for investors were the changes in platinum prices. Platinum, which has recorded a 3.3% price gain over the last 7 days, reached a price point of $963/oz on 20 August.

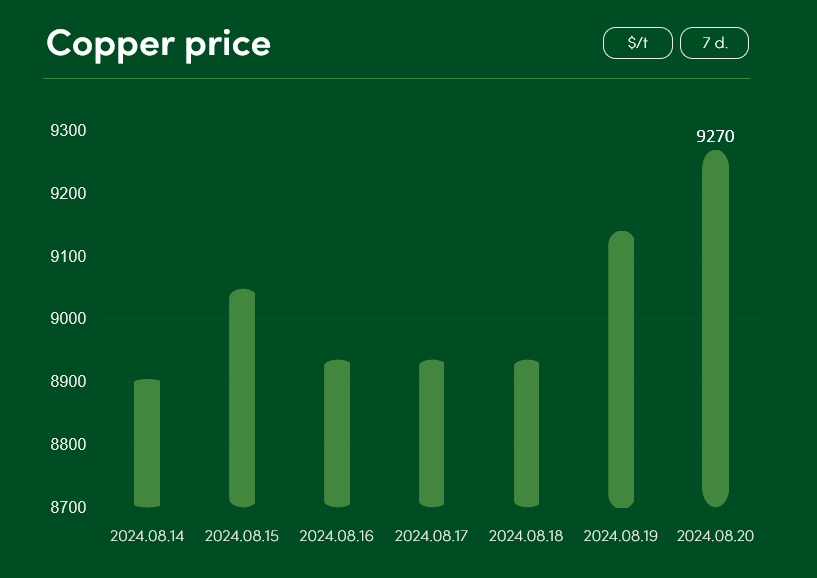

Meanwhile, semi-precious copper metal prices are finally pleasing investors with continuous growth. Copper price rose by more than 4% between 14 August and 20 August, reaching a point of $9,270/oz.

While it is easy to justify the optimistic outlook for copper prices in the longer term by pointing to the huge demand for the metal in electric vehicles, renewable energy equipment and other innovative industries, it is likely that the mid-August rise in the metal’s price was triggered by a temporary disruption in the copper mining sector.

A mass strike by workers at the Chilean copper mine of BHP Group, the world’s largest publicly traded mining company, may have resulted in a disruption of around 5% of the global copper supply. This situation was likely viewed as a clear “buy“ signal for investors who have been closely monitoring the copper market. However, according to Reuters, an agreement with the striking workers was reached on Sunday.

One thing is clear: it will be very interesting to see the struggle in the coming weeks between investors, who see the stabilization of supply as a harbinger of a downturn in the copper market, and buyers, who believe that prices for the promising copper metal should at least consolidate at the point that was reached on 20 August.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.