July 23, 2024

Metal Market Overview 17-07-2024 to 23-07-2024

Last week, the market of precious and semi-precious metals recorded a contractual price drop. Looking for the reasons for the correction, we can see the growth in profitability of savings-investment instruments that compete with gold and silver, and the global strengthening of the US dollar exchange rate.

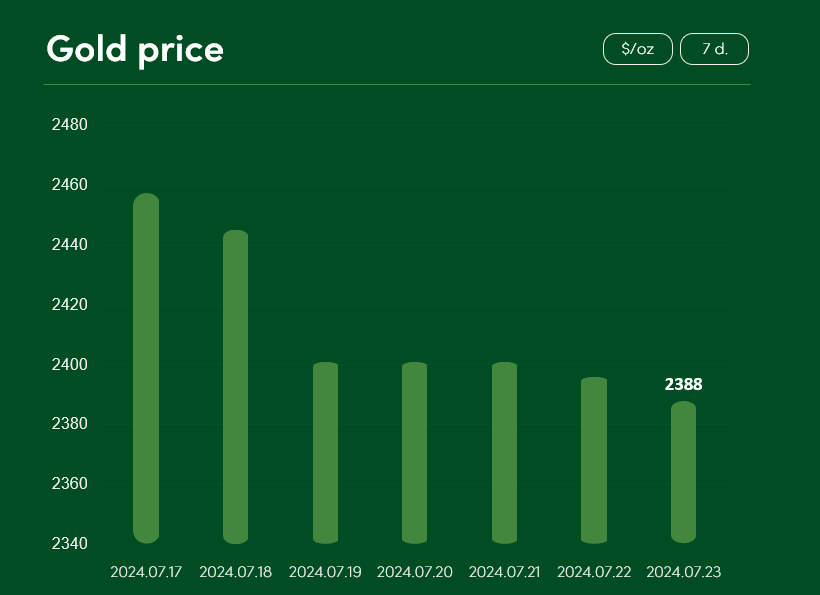

All-time highs (~$2482.9/oz) on July 17 were reached by gold. After that, until July 23, its price fell by almost 4 percent (to ~2388 $/oz). The sharper decline can be explained by both economic market sentiment and financial events unfavorable to gold.

Gold prices usually rise amid times of financial uncertainty. However, with interest rates in the US market stabilizing (and expected to be cut soon), and Europe already enjoying first bank rate cuts after long time, it seems that the all-time highs have appeared to be a sing of gold’s overvaluation for some investors.

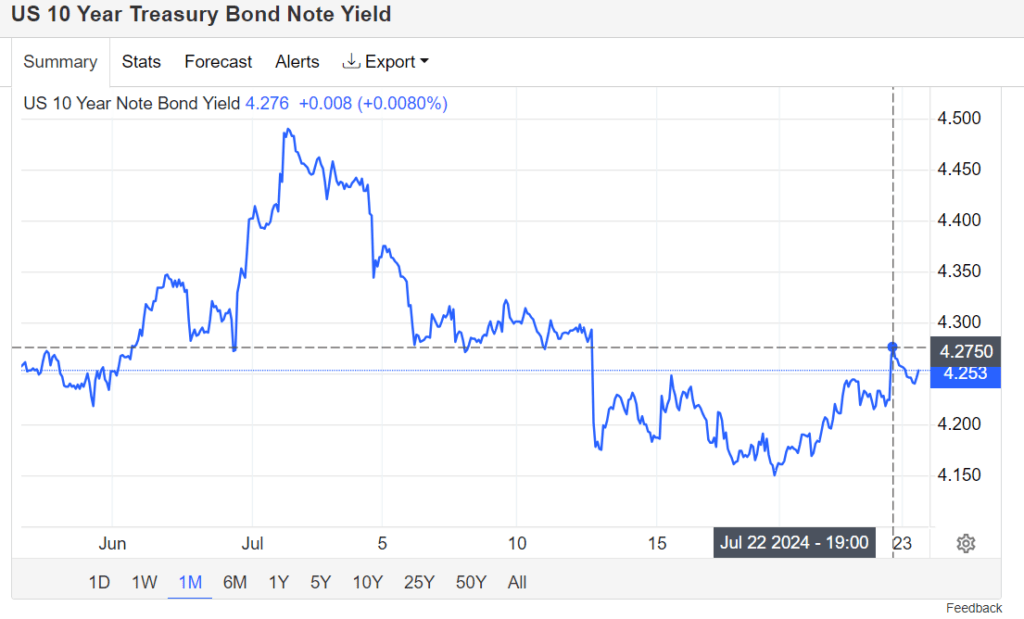

Also, according to the CNBCTV portal, the correction of gold prices was probably prompted by the global 0.1 percent growth of the US dollar exchange rate, as well as by the increase in the yield of US 10-year treasury bonds. According to the treasury bond price chart, provided by TradingEconomics, we see that the rise in annualized yields of US treasury bonds to 4.27 percent on July 22 may have prompted some investors to choose this asset as a more viable and reliable investing return option.

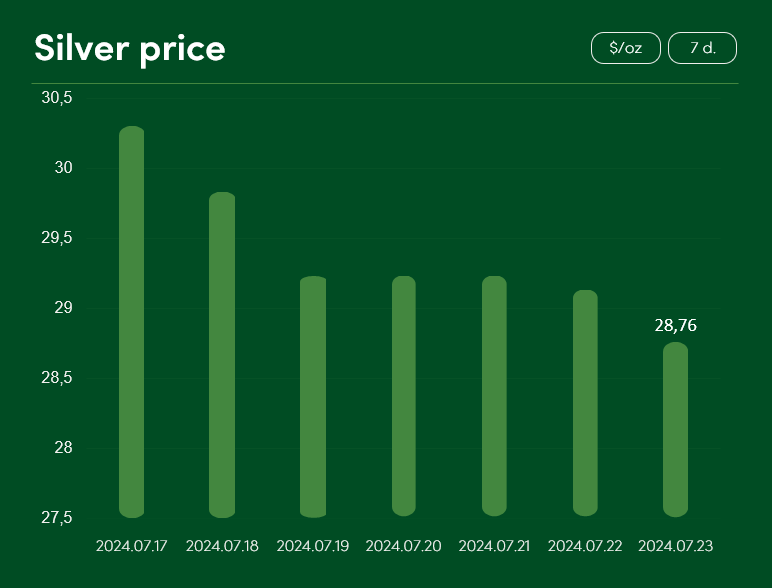

Silver, which is closely related to gold, moved in a similar direction. From the weekly price highs, reached on July 17th (~$30.3/oz), silver fell by more than 4.5 percent throughout the week and reached a much more modest price level of ~$28.7/oz. on July 23rd.

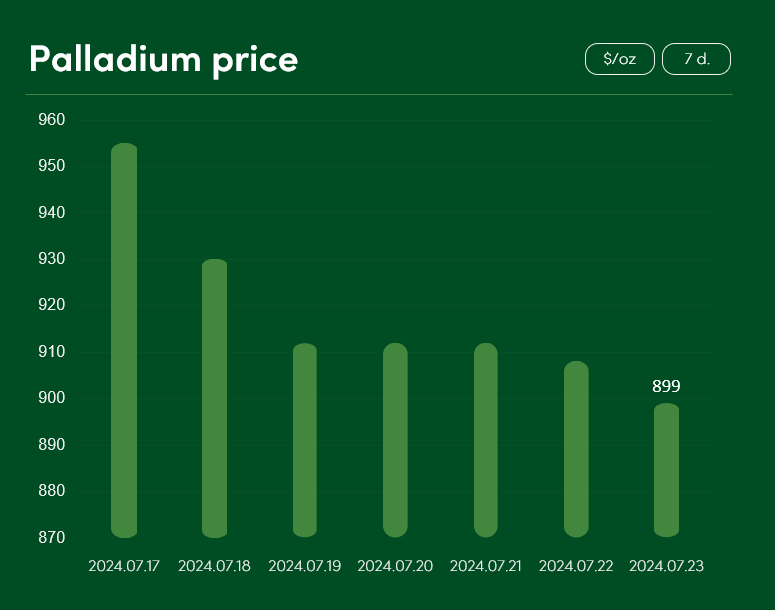

Meanwhile, palladium and platinum prices surprised with even sharper price corrections. On July 23, palladium was down more than 6% (~$899/oz) from its price on July 17 (~$955/oz). Long-term fall and stagnation of palladium prices can be partly explained by the trends of the global car market: the increasingly popular hybrid cars use significantly lower amounts of palladium than vehicles with internal combustion engines.

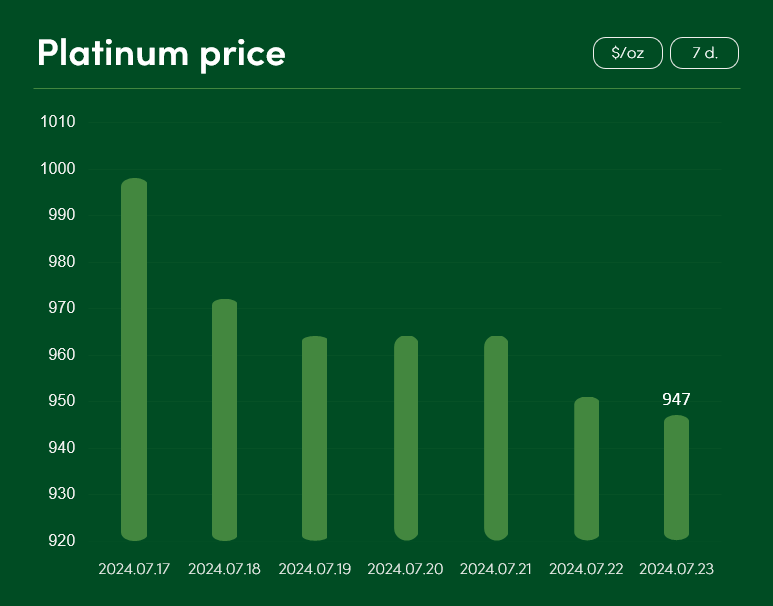

Closely related to palladium in terms of both investment and production demand, platinum also recorded a sharp drop in price during the 17th-23rd of July. Platinum price fell from 998 to ~947 $/oz during the mentioned period. However, the expert forecasts for platinum, published by Morningstar, are favorable. It is said that this year, the demand for metal, driven forward by hydrogen energy sector, will experience a significant rise.

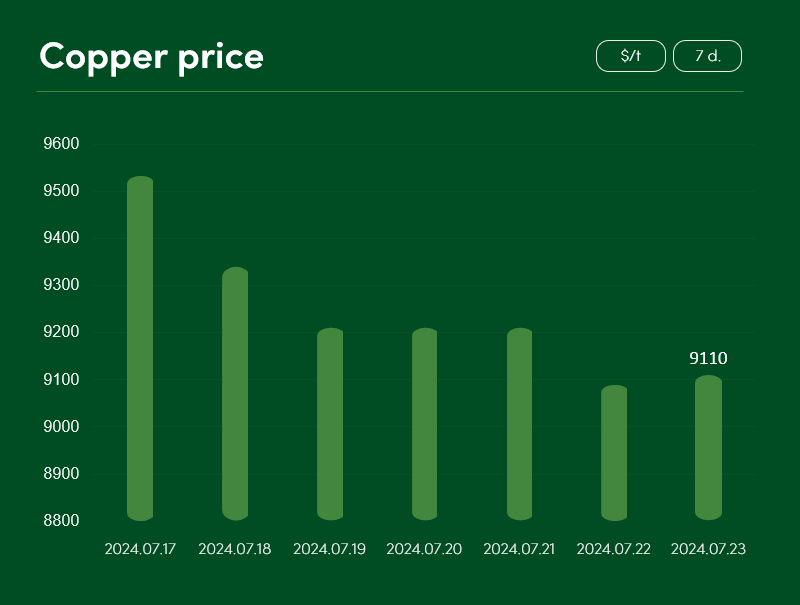

Massively affected by price corrections this week, copper metal has “shrunk” from $9,533/t on July 17th to ~$9110/t on July 23rd. Such a change is strongly related to China, the main market for copper sales. Last week, the country reported weaker-than-expected economic results for the second quarter of 2024. This sign has raised significant doubts and concerns about further demand for metals and new copper orders from China. Although China’s central bank cut short-term and long-term bank interest rates on Monday, investor sentiment remains relatively skeptical about copper and the Chinese market.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.