August 13, 2024

Metal Market Overview 07-08-2024 to 13-08-2024

Precious and semi-precious metals markets recorded solid, contractual price gains last week. This result can be partly explained by investors’ willingness to opt for “anti-crisis” investment instruments as a way of protection against the escalation of geopolitical events. It is also likely that the world, eagerly waiting for US interest rate cut, is slowly adjusting for a potentially optimistic autumn market sentiment.

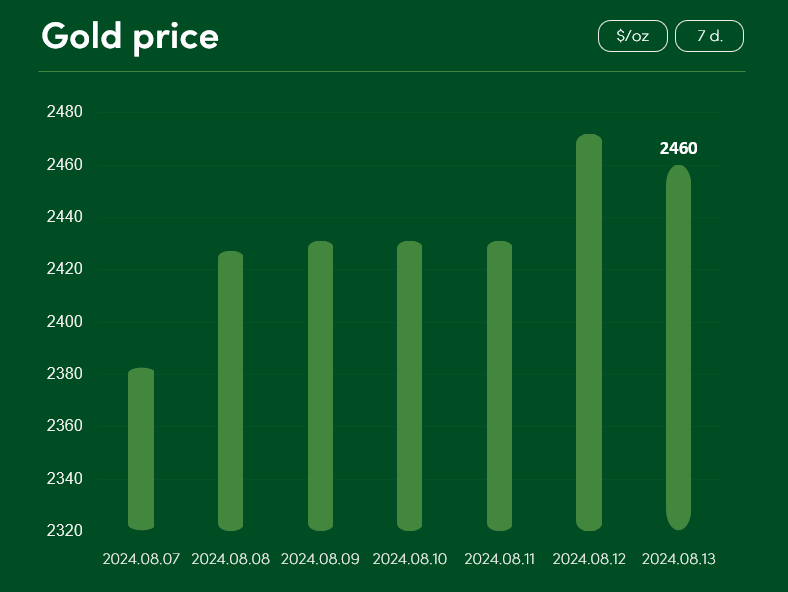

The gold price rose by >3% between 7 August and 13 August, reaching the $2460/oz level. According to TradingEconomics analysts, the recent escalation of hostilities in the Russia-Ukraine war and the Israeli offensive on Gaza have contributed strongly to the rising gold prices.

Gold metal price is also expected to appreciate in the near future due to the favourable economic situation for this asset class. A review by the news portal Reuters points out that gold is an excellent hedge that thrives in the face of geopolitical uncertainties and performs well in low-interest rate environments. With the US bank interest rate cut likely to be seen as early as this September, maybe it is worth paying more attention to gold at the end of summer?

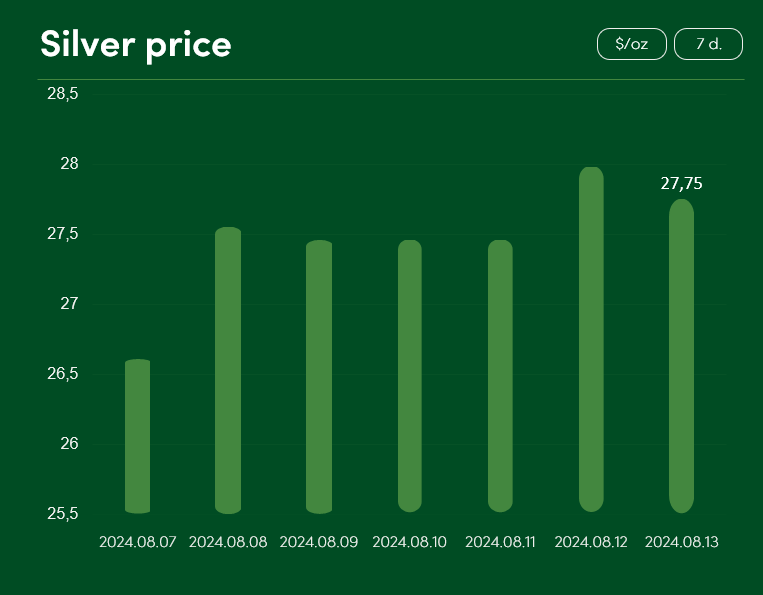

Silver also recorded solid price gains. Between 7 August and 13 August, this precious metal rose by ~4% to $27.75/oz. The observed increase in demand for silver is an encouraging factor for both miners and sellers of this precious metal. According to TradingEconomics data, the Perth Mint, Australia’s state-owned bullion trader, recorded a 91% increase in sales in July this year, which enabled it to reach a monthly minted silver sales point of more than 939 thousand oz.

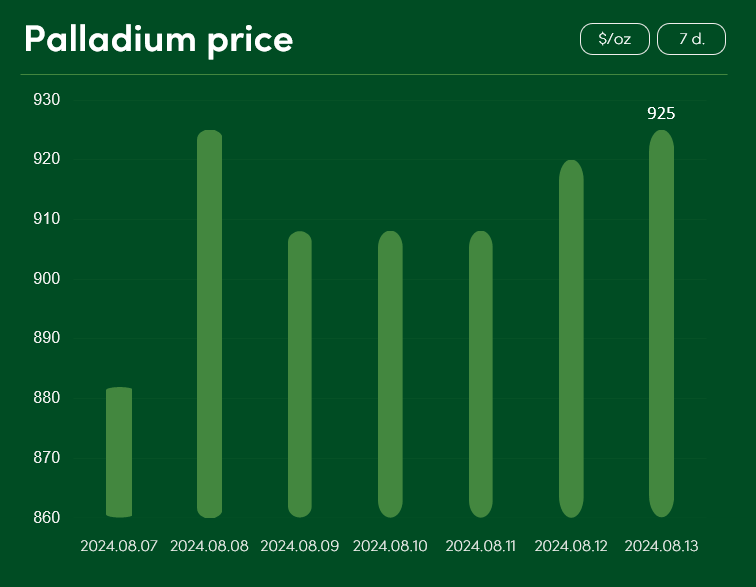

Platinum and palladium prices have also seen drastic changes. The price of palladium rose from 882 $/oz on 7 August to 925 $/oz on 13 August (a price increase of >4%). According to the expert insights provided by FXstreet, the sharp correction in the metals market at the beginning of August was an over-inflated event.

At the end of July (before the price correction began), speculative positions focused on profiting from the decline in palladium prices were close to record levels, according to the US Commodity Futures Trading Commission. Buyers, who had identified market sentiment as unduly pessimistic, have likely successfully anulled palladium shorting positions within a few days of the price spike downwards.

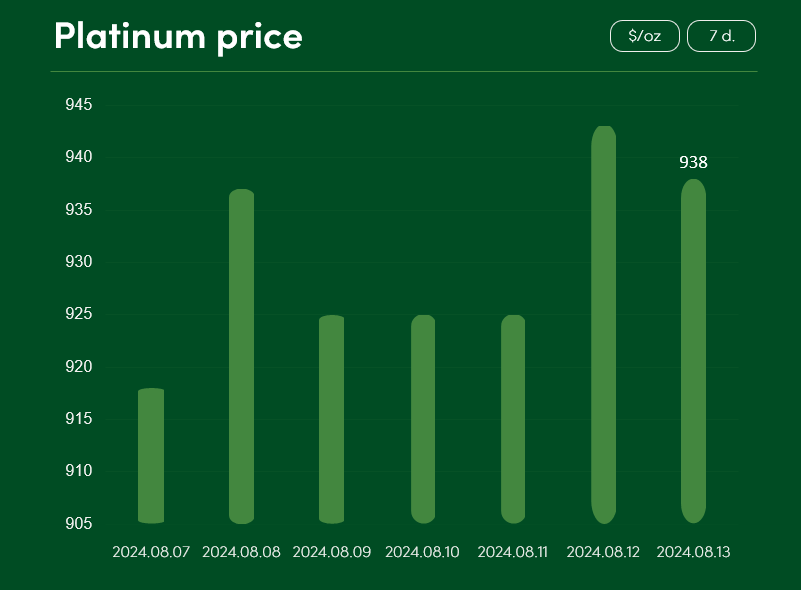

Platinum price followed the example of palladium and recorded an increase of more than 2% between 7 August and 13 August, reaching the point of $938/oz.

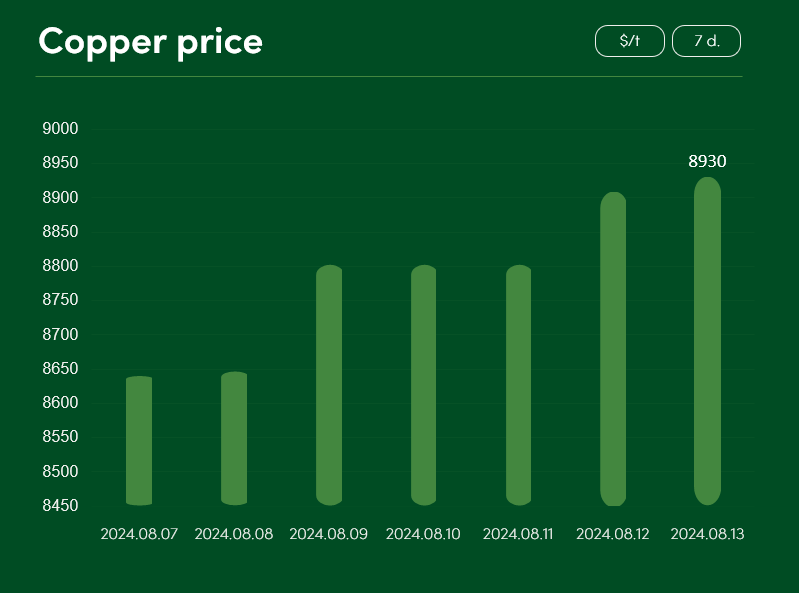

Semi-precious copper metal also recorded a successful week on the metals markets. On 7 August, copper prices were around 8640 $/t. On 13 August, copper was already at $8930/t, which allowed it to record a gain of almost 4%. Perhaps this price surge, coinciding with the forthcoming US interest rate cut, will help the promising copper metal to start a long-term price rise and gradually catch up with experts’ long-term price forecasts?

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.