December 31, 2025

Market Overview 02-01-2025 to 29-12-2025

2025 – A Record Year for Precious Metals

This year, the markets for key precious metals have recorded exceptional price gains. New price records were repeatedly reached not only by gold and silver, but also by other precious metals. The investment appeal of precious metals was boosted by globally declining interest rates, rising geopolitical risks, favourable supply–demand deficits in precious metals, and growing central bank interest in this asset class.

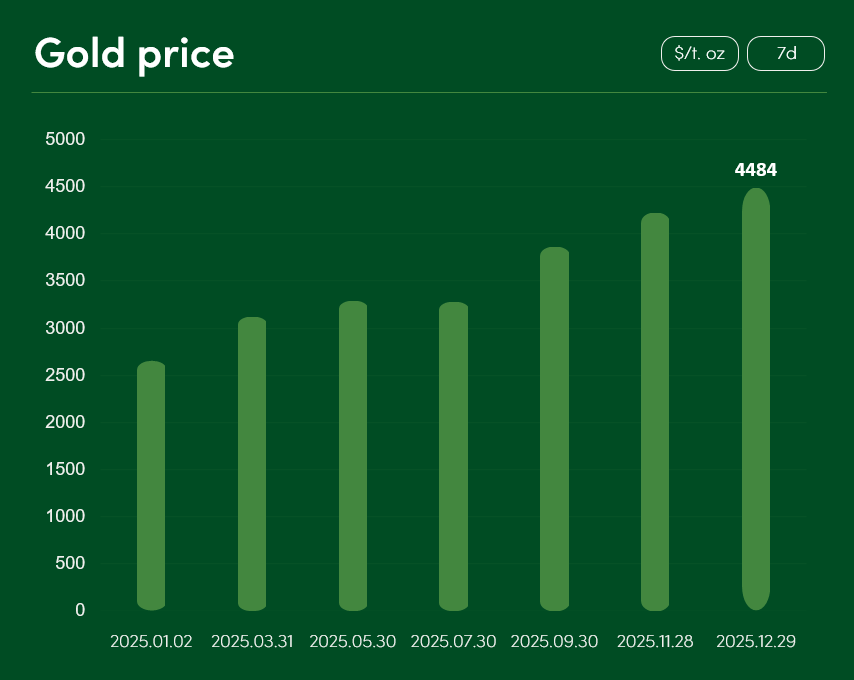

The global gold price increased by more than 68% over the course of the year. As 2025 drew to a close, the market price of the principal precious metal reached USD 4,484 per troy ounce.

The record increase in gold demand was partly driven by deepening global geopolitical crises. Conflicts in the Middle East have affected a number of sovereign states (Iran, Iraq, Israel, Lebanon, etc.) as well as several armed non-state groups (“Hezbollah”, “Hamas”, etc.). Fearing the risk of a large-scale military escalation in the region, investors also assessed the continued war in Ukraine and the tensions between the United States and Venezuela.

Gold’s appeal as an investment metal is supported not only by the tense geopolitical environment, but also by markedly increased demand from the world’s central banks. During 2022–2024, combined annual central bank gold purchases exceeded 1,000 tonnes. Importantly, this strong demand persisted even as gold prices surged to record highs in 2025. In October alone, central bank purchases amounted to 53 tonnes, while institutions such as the People’s Bank of China stood out for the consistency of their gold accumulation.

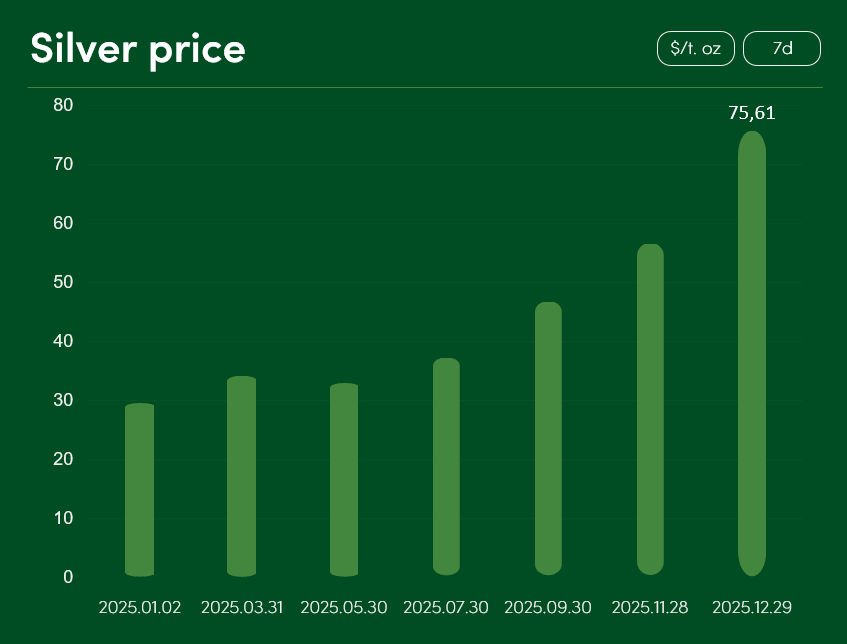

The global silver price rose by more than 156% in 2025. At the end of December, the market price of this precious metal reached USD 75.61 per troy ounce.

The exceptional rise in silver prices was strongly supported by aggressive central bank interest-rate cutting. The European Central Bank reduced its key interest rate by 1 percentage point this year. Interest rates were cut by the same magnitude by the central banks of Canada and the United Kingdom.

However, in the context of rate cuts, the most significant factor for silver was the easing of monetary policy in the United States. After the Federal Reserve lowered the federal funds rate by 0.75 percentage points (in total), the move contributed to a correction in the US dollar exchange rate and a significant increase in the attractiveness of USD-denominated precious metals (gold, silver, etc.) for holders of foreign currencies.

It is likely that the sharp increase in silver prices this year will continue to support optimistic trends in 2026. Official statistics also point in this direction. According to data published by The Silver Institute, it is forecast that this year alone the global silver market will record a total deficit of as much as 187.6 million troy ounces.

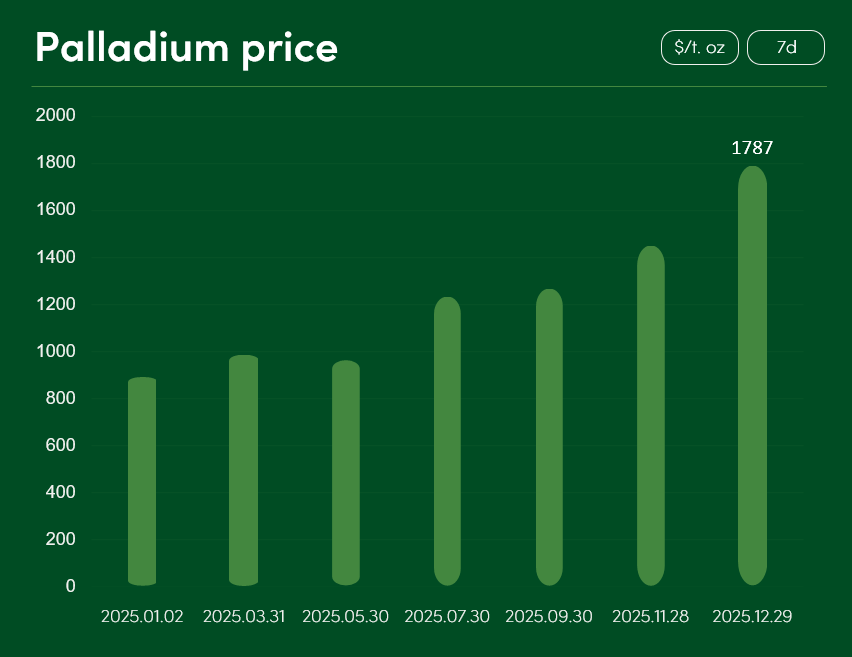

The global palladium price rose by more than 100% this year. By the end of December, the market price of palladium had climbed to USD 1,787 per troy ounce.

This sharp rise was driven by the escalation of global geopolitical crises, monetary policy decisions by central banks that encouraged investment in precious metals, and rumours and discussions regarding the possible introduction of US import tariffs on palladium mined in Russia.

Given that palladium is used very intensively in catalytic converters for internal-combustion vehicles, it also appears that the termination of the US electric-vehicle tax credit programme by the Trump administration and the slowdown in EV sales growth had a positive impact on palladium prices.

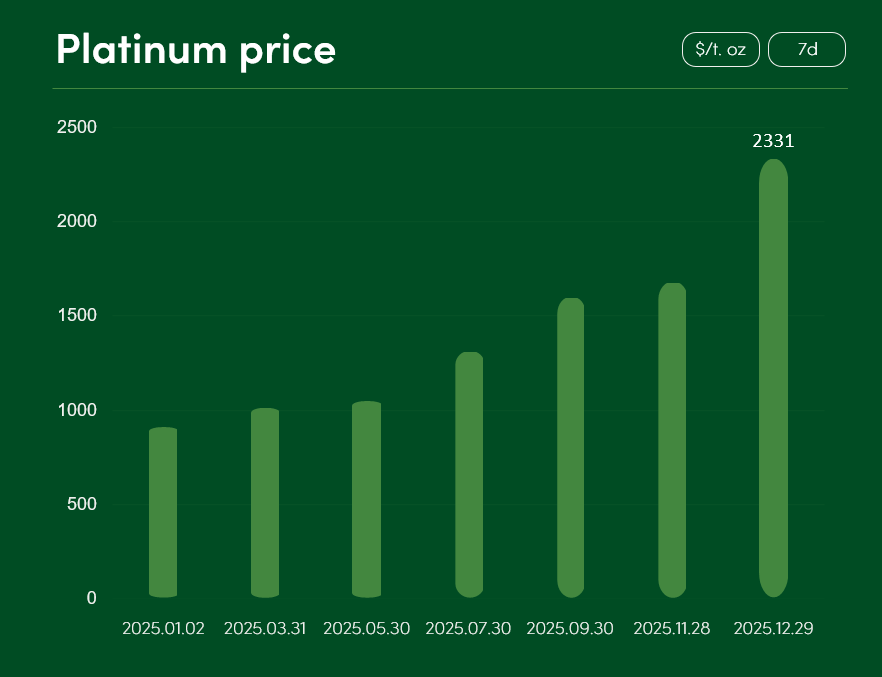

The global platinum price increased by more than 159% this year, reaching USD 2,331 per troy ounce at year-end.

One of the clearest reasons behind platinum’s price surge is the structural deficit of this precious metal in the global market. According to forecasts by the World Platinum Investment Council (WPIC), the global platinum supply deficit may reach around 692 thousand troy ounces this year. Considering that a pronounced deficit was also recorded in 2023 and 2024, the persistence of supply shortages may drive platinum prices to consolidate at higher-than-usual levels in the years ahead.

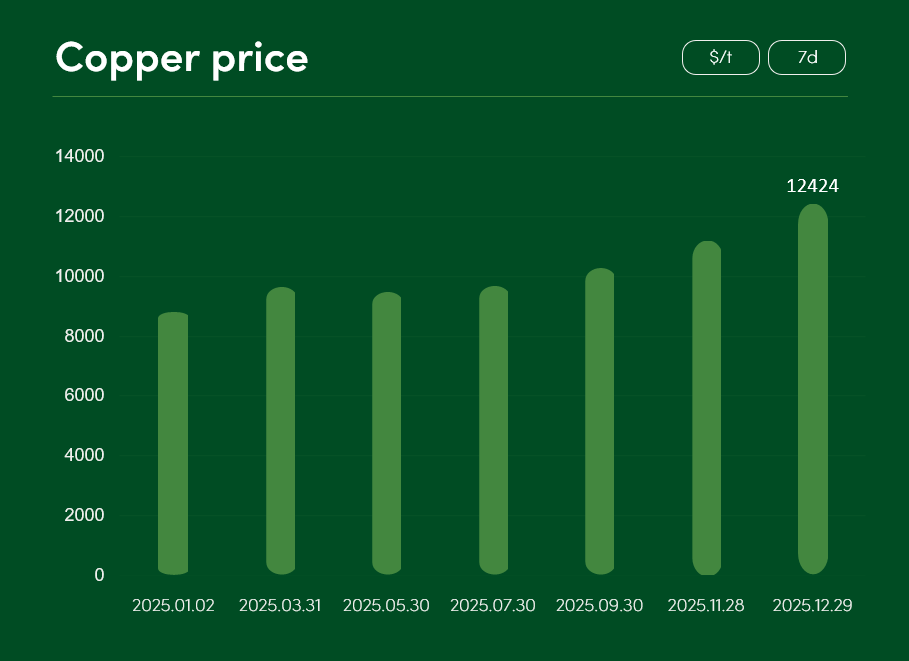

The global copper price rose by more than 41% in 2025, reaching USD 12,424 per tonne at the end of the year.

One of the more important drivers behind copper’s price increase was supply–demand distortions triggered by import tariffs. As the United States — the world’s largest economic power — introduced various general import duties and tariffs on certain copper products this year, this prompted a restructuring of global supply chains and a short-term increase in raw-material stockpiles.

Although market experts such as Goldman Sachs forecast that copper will trade in the USD 10,000–11,000 per tonne range in 2026, the longer-term outlook suggests a significant rise in both price and demand. Global copper demand will be further supported by expansion in sectors such as artificial intelligence and the advanced data centres required to support it.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.