August 27

Market Overview 21-08-24 to 27-08-2024

Last week, the precious metals exchanges showed a clear consolidation in market price movements. Minimal price changes can be partly explained by the fact that the relatively high prices for some precious metals (gold, silver) were achieved while the market is still living under the hope of an increasingly likely US interest rate cut in September this year. It is clear that, although some investors are skeptical about the long-term scenario of rising precious metals prices, the market is finding fewer and fewer reasons for a more significant fall in prices. The deepening political crisis in the Middle East region and the attacks by the Israeli army and Hezbollah are fueling loud speculation about a possible escalation of the conflict in this region; considerable geopolitical risk is prompting investors to turn to safer investment options, such as precious metals.

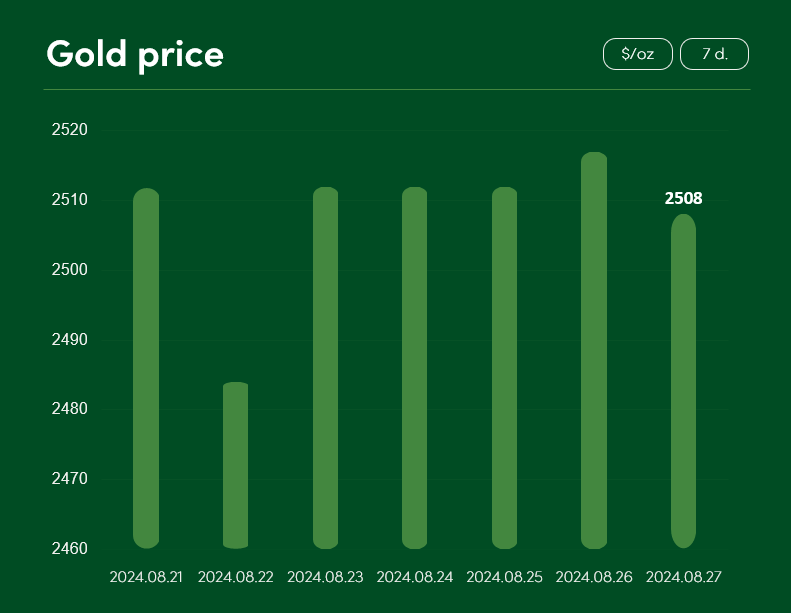

The price of gold has fallen from 2512 $/oz on 21 August to 2508 $/oz on 27 August. Gold, which broke all-time price records this August, remains on the radar of investors around the world. Together with an incoming near-guaranteed September‘s US interest rate cut and prolonged military conflicts in Ukraine and Middle East, gold looks like a safe haven and perspective investment for many investors around the world.

According to expert forecasts provided by the Reuters news portal, it is likely that the demand for gold will increase in the coming months in markets of China and India, which are also known as the main gold consumers. Optimistic market news and the complicated geopolitical situation suggest that gold investors can get even more favorable prices for this metal in the coming months.

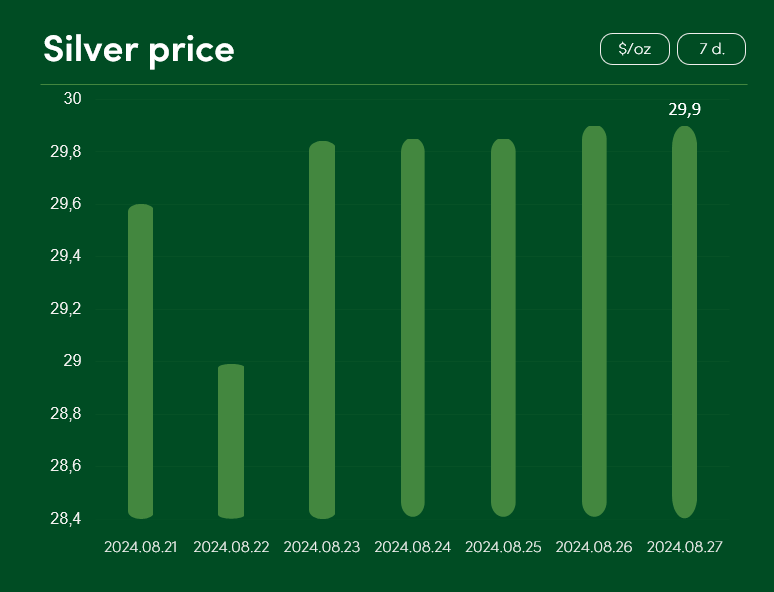

Strongly fluctuating silver prices recorded a slight increase this week: from $29.6/oz on August 21st, the price of silver on the exchanges rose to $29.9/oz on August 27th.

According to the experts from TradingEconomics, the silver prices, which have been fluctuating at their 6-week highs, are partly doing well because of US Federal Reserve Chairman Jeremy Powell. Last week, Powell publicly stated that the time had come to adjust interest rate policy in the face of rising potential risks in the US labour market. With an almost certain interest rate cut within reach, many investors are preferring the “anti-crisis” asset class of gold and silver, and looking forward to further increases in the price of silver, which is also a very popular industrial metal.

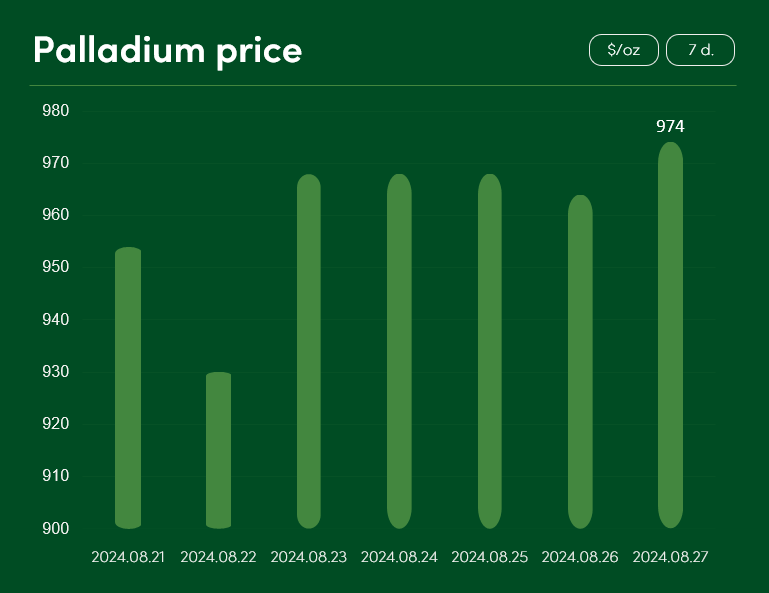

The palladium price also recorded a slight price increase last week: a ~2% positive gain over the last 7 days allowed palladium to reach a market price of $974/oz on August 27th. Palladium, which recorded its highest price in more than a month’s time, is tracking its success back to the risen popularity of publicly traded funds of this metal (according to TradingEconomics analysts). Since the beginning of the year, various publicly traded palladium funds have added 138,000 ounces of this metal to their portfolios. This growth has been driven in particular by demand from European investors: the current bullish market sentiment is that palladium might catch up with other precious metals. Who knows, if this idea is going to last for a longer period of time?

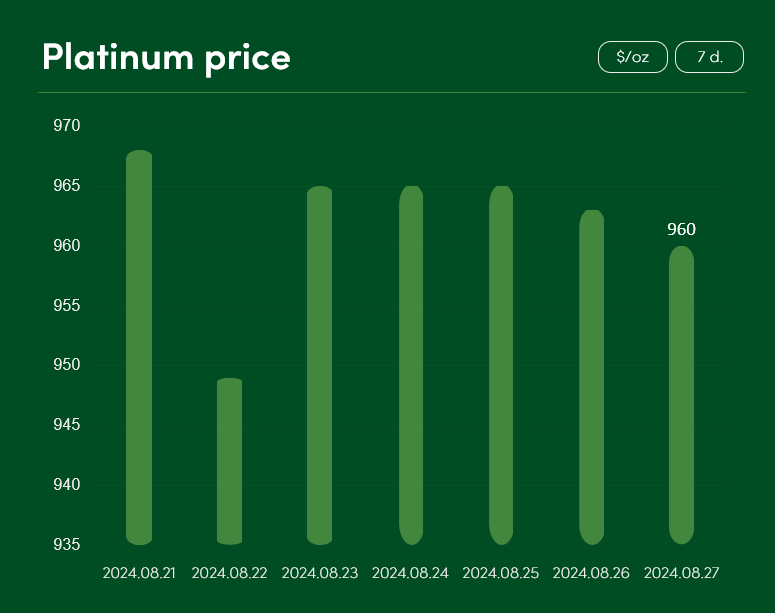

The price of platinum recorded a slight drop from $968/oz on 21 August to $960/oz on 27 August.

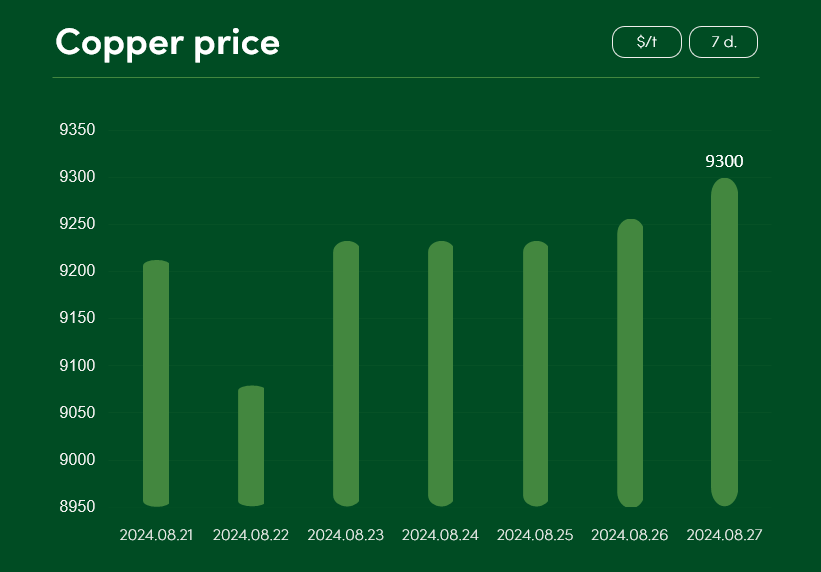

Meanwhile, copper prices have continued to delight investors with an ongoing recovery since the start of August. The precious metal prices rose by ~1% in the last 7-day period and reached $9300/oz.

Not only the long-term growth potential of the copper price, but also the stabilisation of the current metal’s supply situation looks promising. According to Mining.com, the copper mining industry is finding solutions and signing agreements with striking mine workers. Around 300 strikers at Lundin Mining Corp.’s mine returned to work this weekend. A week before that, the main workers’ union at BHP’s Escondida mine ratified a formal labour agreement after a short-term (3-day) work stoppage. The de-escalation of the unrest at the world’s largest copper mine has undoubtedly led to further optimism on the part of some copper investors and to bolder price forecasts as well.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.