January 6, 2026

Market Overview 31-12-2025 to 06-01-2026

A favourable start to the year for precious metals

In the first week of 2026, the main precious metals markets opened the year with solid growth. The strong rise in prices was driven both by U.S. military action in Venezuela and by mixed economic indicators from the United States.

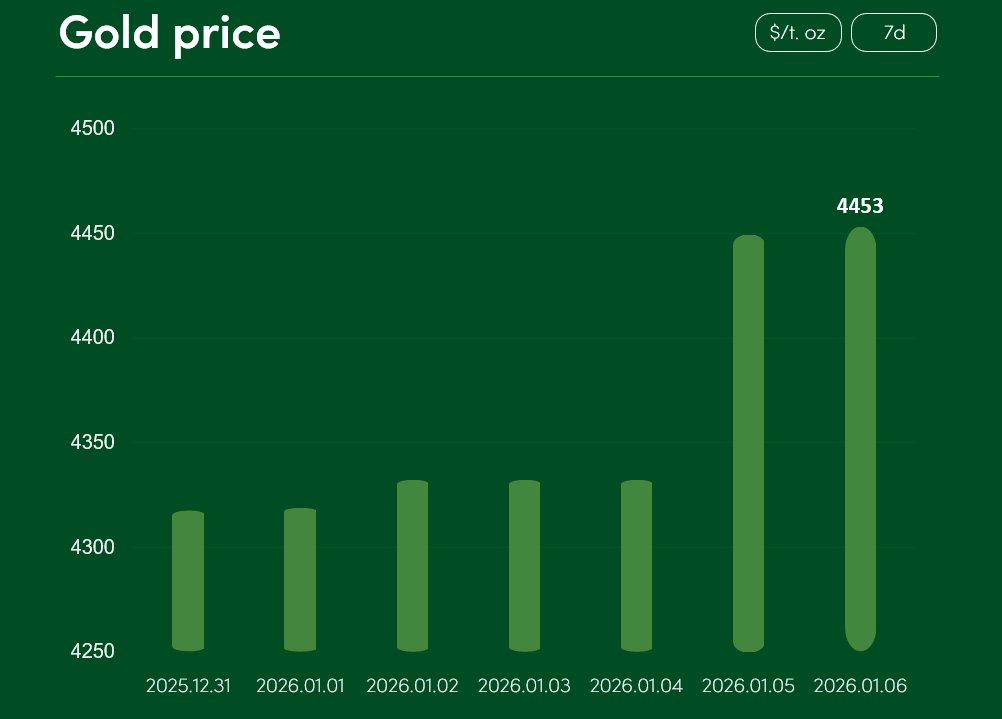

The global gold price rose by more than 3% between December 31 and January 6, reaching USD 4,453 per troy ounce.

Geopolitical tensions in Venezuela are making a significant contribution to the strong increase in gold prices. After U.S. military forces attacked Venezuela and arrested N. Maduro, D. Trump declared that the United States would control Venezuela until a “safe, proper and judicious transition of power” is completed.

Trump also hinted that U.S. oil companies would repair Venezuela’s infrastructure and “start making money for the country.” Investors are watching the latest developments in the U.S.–Venezuela crisis with concern and are cautiously assessing the risks and the prospects for stabilization in the region.

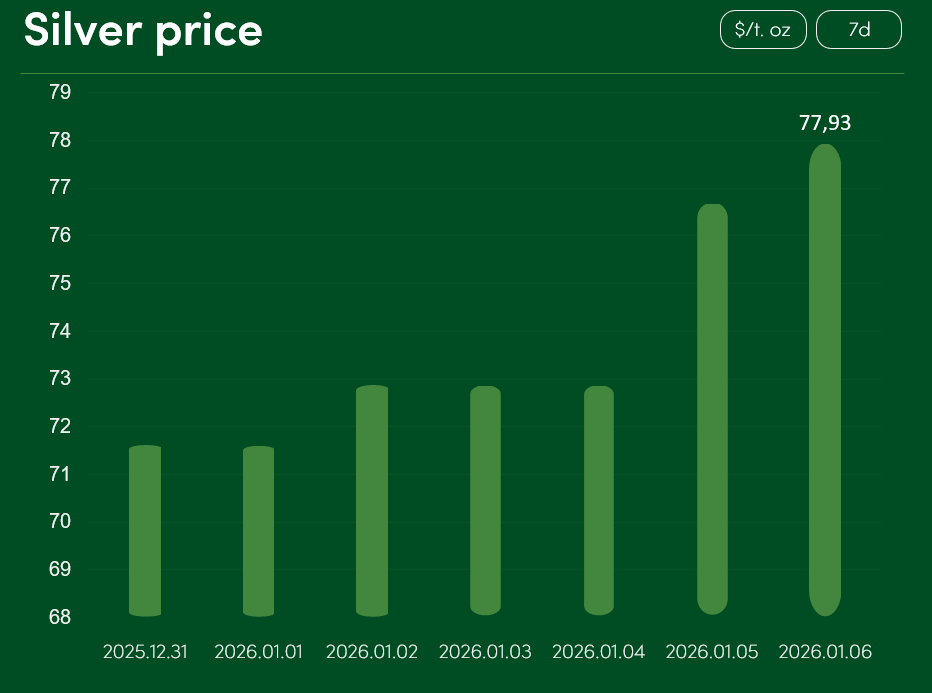

The global silver price rose by approximately 8.8% between December 31 and January 6, reaching USD 77.93 per troy ounce.

The popularity of silver is being supported not only by geopolitical risks in South America, but also by mixed U.S. economic indicators. Although the official U.S. ISM manufacturing index has now recorded contraction for the 10th month in a row and has fallen to its lowest level in the last 14 months, slightly more optimism is being registered in the country’s labour market.

According to expert forecasts, it is likely that in December of last year, 55 thousand new jobs were created in the United States (excluding the agricultural sector). Although this forecast is lower than the 64 thousand jobs recorded in November, such a result would allow the overall U.S. unemployment rate to decline by 0.1 percentage point.

The contradictory economic signals are also affecting expectations regarding Fed interest rate cuts. Although some Fed representatives are publicly stating that the point is approaching when rate cuts should be halted, the latest market data show that the probability of a rate cut at the upcoming Fed meeting still stands at around 16%.

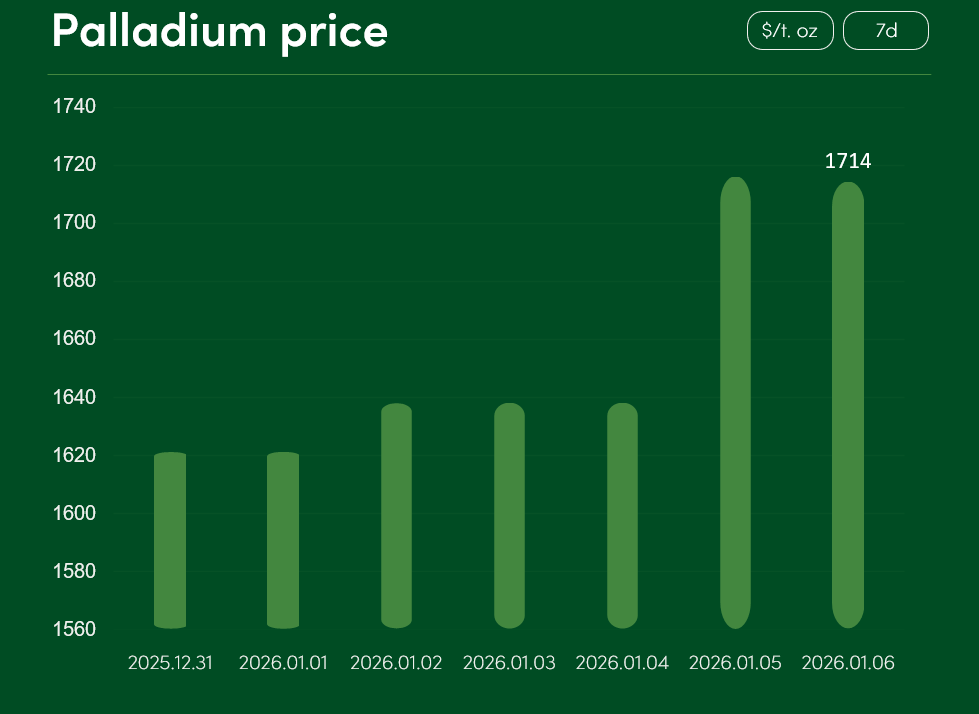

The global palladium price rose by approximately 5.7% between December 31 and January 6, reaching USD 1,714 per troy ounce.

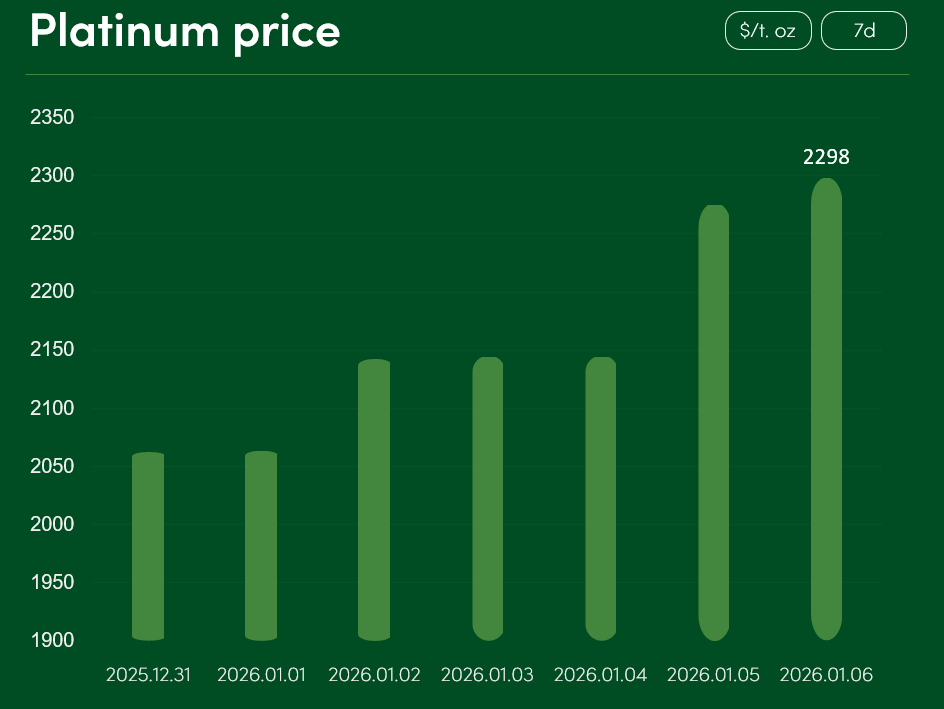

The global platinum price also experienced more pronounced growth. The price of this precious metal rose by more than 11% between December 31 and January 6, reaching USD 2,298 per troy ounce.

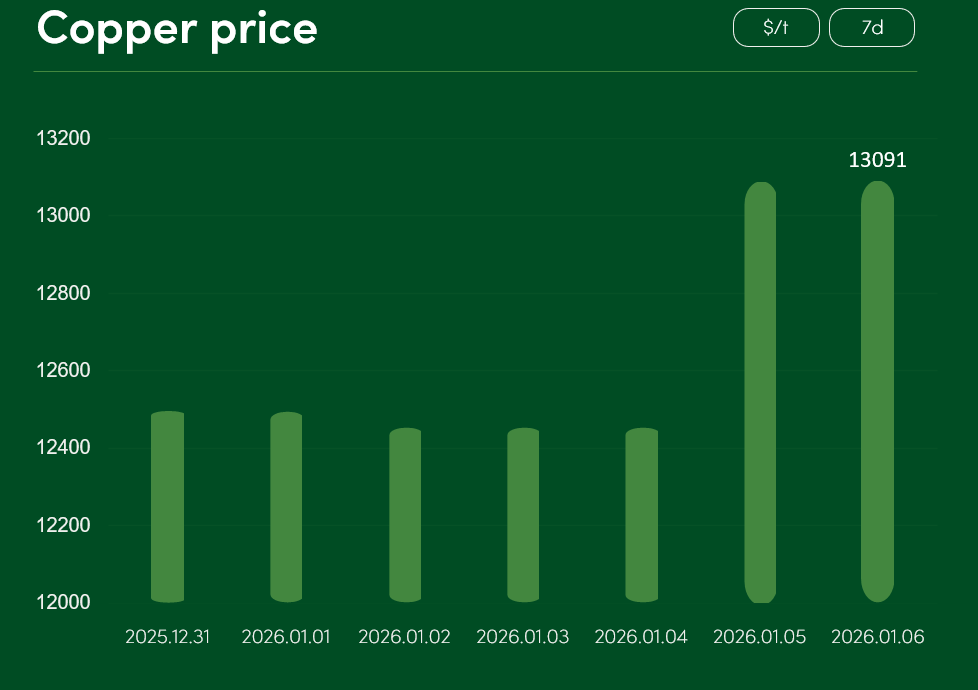

The global copper price rose by more than 4% between December 31 and January 6, reaching USD 13,091 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.