November 5, 2024

Market Overview 30-10-24 to 05-11-2024

During the first week of November, the precious metals markets experienced a slight correction after a period of sharp growth, which revealed the indecision of the investors regarding the future direction of precious metals prices. Although the expected Fed’s November US interest rate cut should theoretically have a positive impact on precious metals markets, investors are anxiously awaiting the outcome of the United States presidential elections. In the face of the difficult-to-predict events, the market is in no hurry, neither to strengthen its precious metal positions (that are, in some cases, nearing all-time highs) nor to sell off most of its current gold and silver holdings.

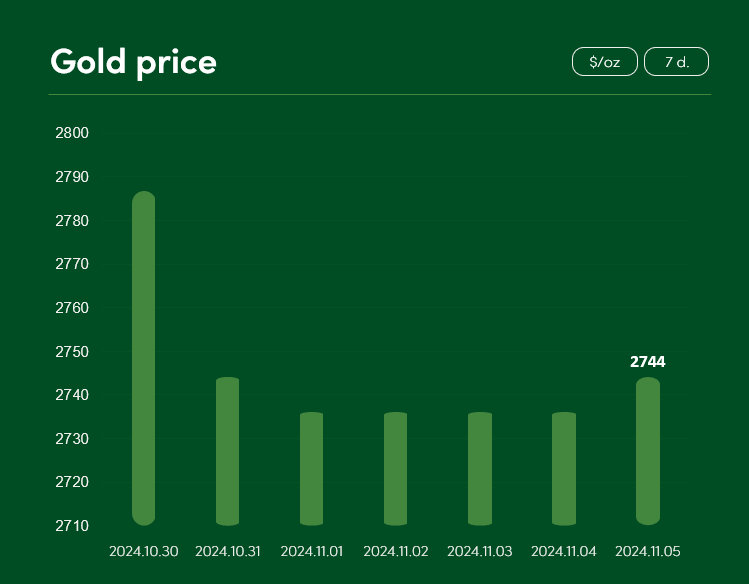

The gold market price fell by ~1.5% between 30 October and 5 November to a price point of $2744/oz.

The investment community is most expectant of a 25-basis-point (0.25%) cut in US interest rates from the upcoming Fed meeting on November 6–7. Although this result should theoretically contribute to a strengthening of gold positions, the unknown outcome of the US presidential election and the uncertainty of the financial policy plans of the elected leader of the world’s largest economy raise doubts about the further rise of the precious metal.

While investors are anxiously spectating ongoing US elections, UBS, the world’s largest private bank, shares an optimistic outlook. According to ChinaDaily, UBS analysts predict that gold prices will reach $2,800/oz by the end of this year and that the precious metal could even reach a price point of $3,000/oz next year.

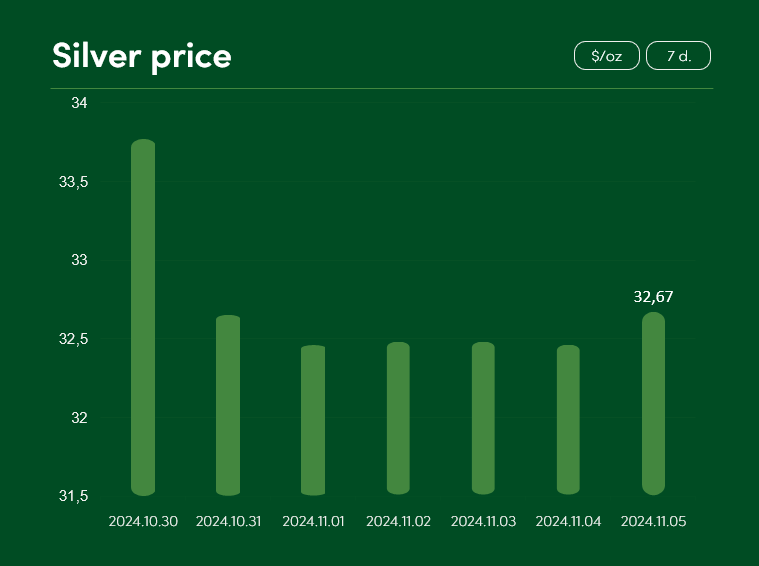

Silver prices fell by ~3.4% between 30 October and 5 November to a price point of ~$32.67/oz.

However, silver investors are not quick to judge the correction of early November as a danger signal for long-term investing: the precious metal managed to increase its price by ~20% between September and October this year, reaching price highs only seen in 2012. Therefore, short term correction is accepted as logical and expected market’s reaction.

Several factors are in favour of the precious metal’s price growth when trying to determine the future direction of silver prices. The almost guaranteed 25 bps cut in US interest rates will contribute to the growth of consumption and investment indicators and will possibly encourage other countries (UK, Australia, Norway, Poland, etc.) to adopt similar monetary policies in the near future.

Also, according to TradingEconomics experts, a monetary stimulus of 10 trillion yuan (~$1.4 trillion) to revive and grow the Chines economy may be discussed at the National People’s Congress Congress Congress on 4-8 November. If such plans would come to fruition, China – the largest user of silver – should make a strong contribution to the further rise in the price of this metal.

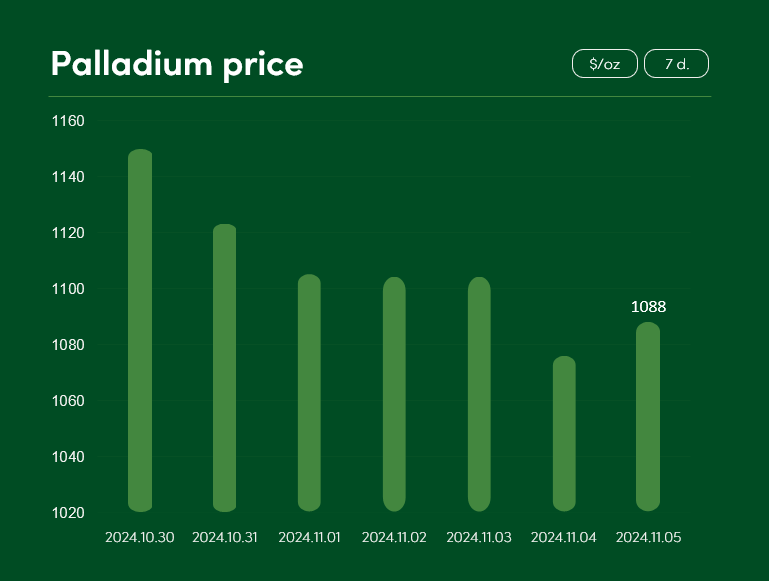

Between 30 October and 5 November, the palladium price fell by >5% to $1088/oz.

However, the short-term downturn does not overshadow the long-term optimism of the palladium market: the pre-correction proposals by the US to impose sanctions on Russian palladium pushed the metal’s prices to highs not seen since December 2023.

Also, the prolonged period of low palladium prices this year has led to the decrease in metal’s mining and extraction. Increasing numbers of mining companies announce plans to reduce their palladium output. One of the latest of these, according to Reuters, is Sibanye Stillwater. This global mining company is planning to reduce its palladium output by 200 000 ounces at a time when the precious metal is already facing a significant deficit in global supply (according to MiningWeekly, the global palladium supply deficit accounted for ~1.02 million ounces in 2023).

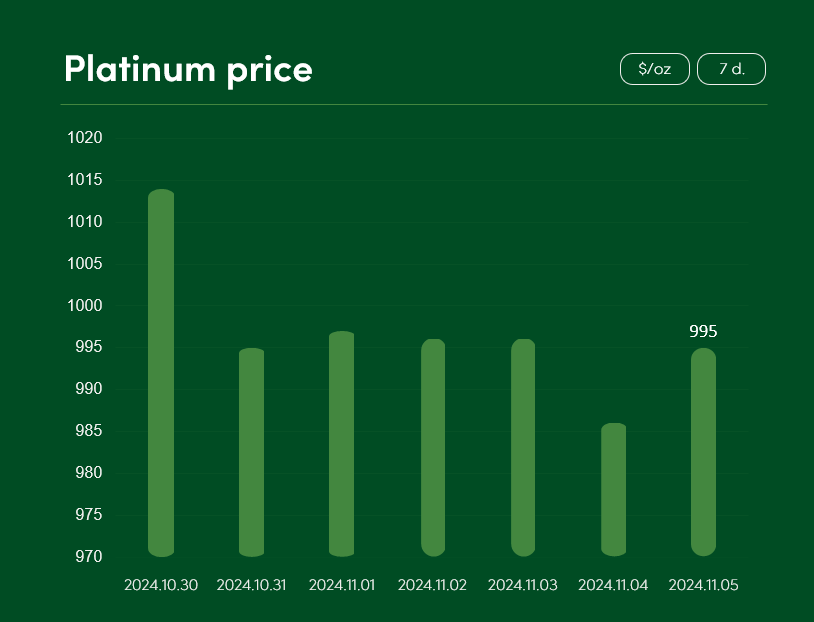

The platinum price recorded a slight correction of ~1.8% between 30 October and 5 November to reach $995/oz.

Meanwhile, the semi-precious copper metal, which has been struggling this year to settle within the $10,000/t price range, recorded a price gain of ~4.4% between 30 October and 5 November and reached a price point of $9751/t.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.