August 5, 2025

Market Overview 30-07-2025 to 05-08-2025

Last week, the key drivers behind precious metals price movements were economic news within the US domestic market and unexpected announcements, clarifications related to import tariffs. As the US dollar continues to weaken, markets are increasingly anticipating a more favourable autumn season for various investment assets, and investors are now viewing the growth prospects of precious metals more optimistically.

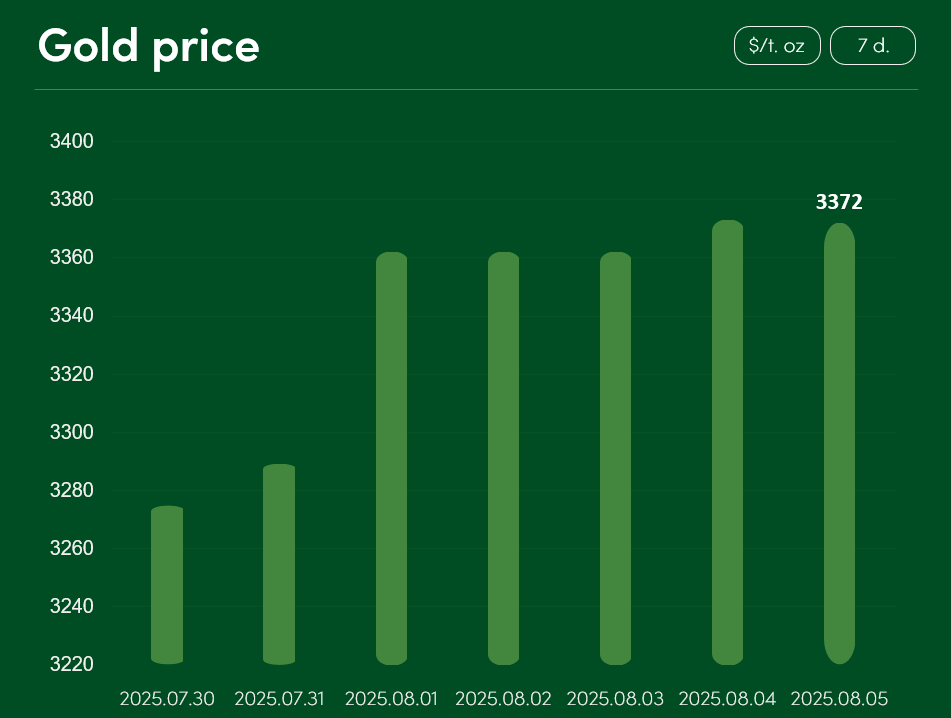

The global gold price recorded a ~3% increase between 30 July and 5 August, reaching $3,372/t. oz. on 5 August.

One of the main contributing factors to gold’s recent price rally is the more complicated-than-expected situation in the US domestic economy. Reports indicate that only 73,000 new jobs were created in the US in July. Additionally, revised employment figures for May–June show that just 33,000 new jobs were created during those two months combined.

These extremely weak job creation indicators are contributing to the US dollar’s decline and are fuelling expectations of an interest rate cut by the Federal Reserve at its next meeting in September. As a result, the challenging US economic outlook is clearly supporting an increase of demand for dollar-denominated precious metals such as gold, silver and others.

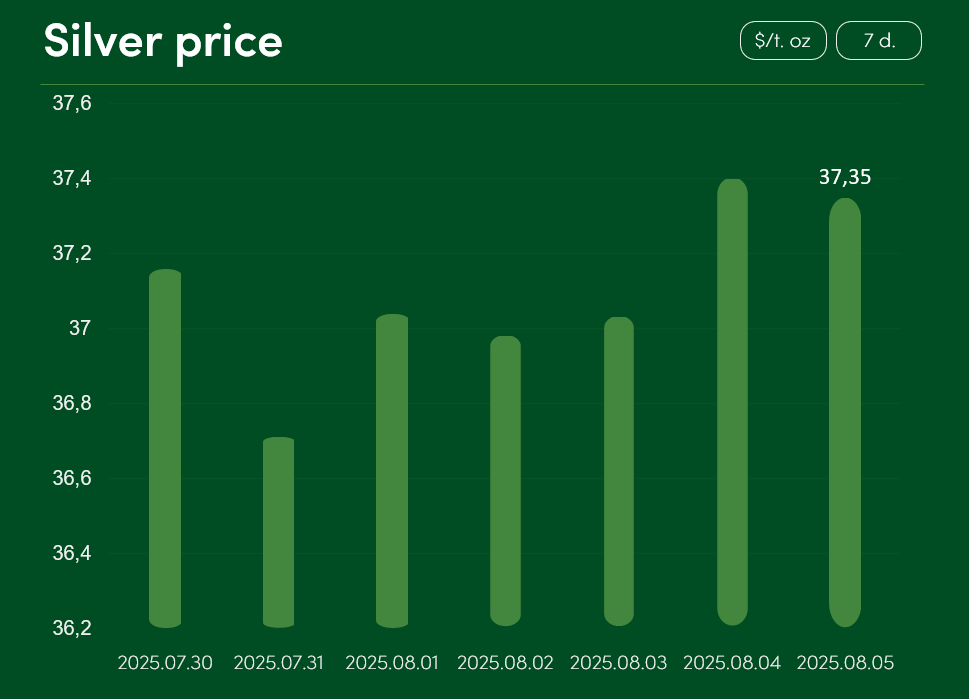

Silver prices showed relatively modest movements over the same period, with the metal reaching $37.35/t. oz. on 5 August.

Currently, silver price growth is supported both by economic disruptions within the US domestic market and by the continued aggressive US trade policy. Donald Trump confirmed that new import tariffs will be imposed on a wide range of trading partners from 7 August and, starting 1 August, a new, 35% import duty on Canadian goods was introduced without delay.

Trump also threatened to significantly increase tariffs on Indian imports if India continues purchasing Russian oil. This statement received a sharp response from Indian government representatives. Amid growing global trade tensions, precious metals – including silver – continue to hold their appeal as safe-haven investment assets.

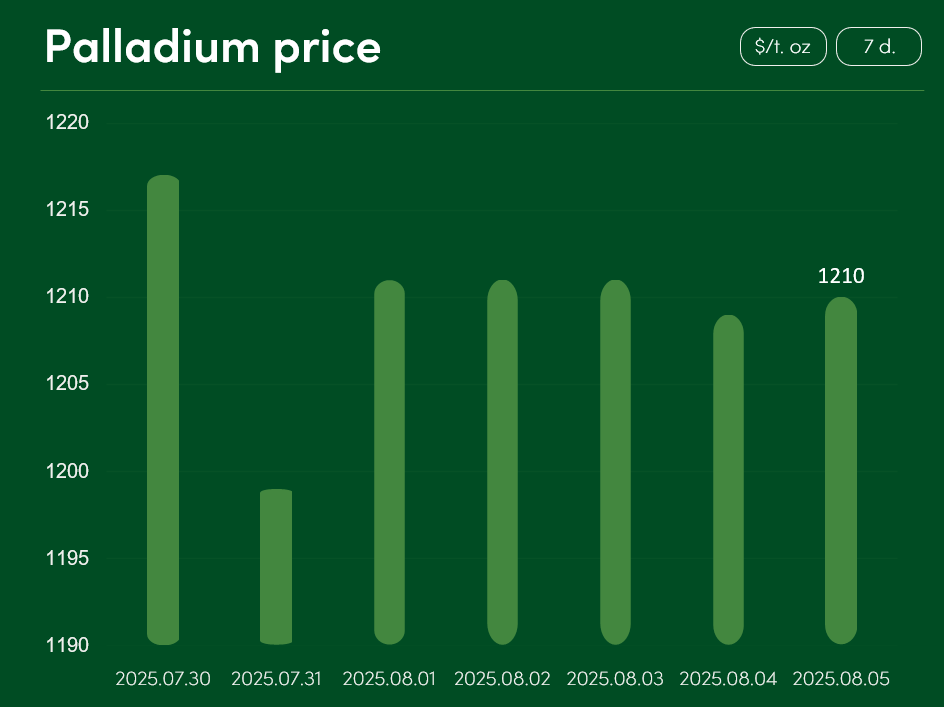

The global palladium price showed no significant changes between 30 July and 5 August, with the metal priced at $1,210/t. oz. on 5 August.

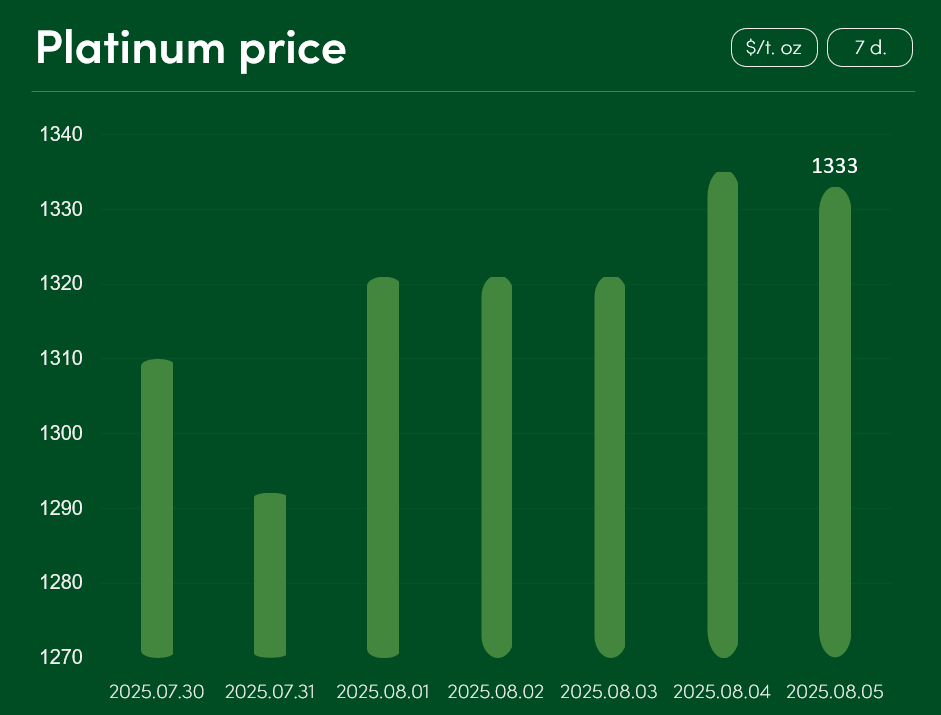

Platinum prices increased by approximately 1.8% during the same period, reaching $1,333/t. oz on 5 August.

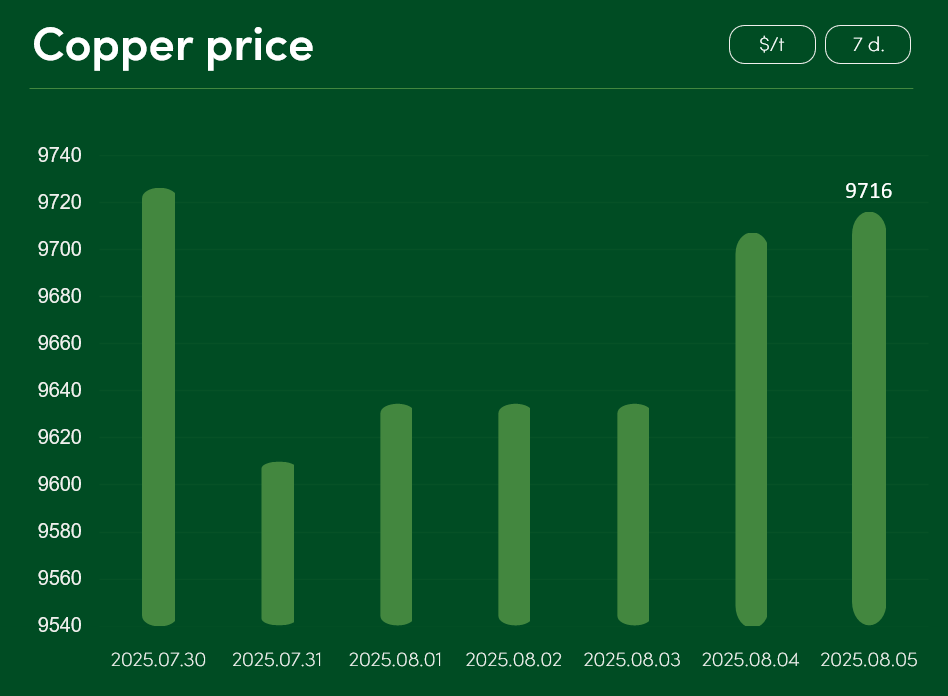

The global copper market has faced a sharp price correction since late July–early August. A partial recovery allowed copper to reach a price of $9,716/t on 5 August.

Copper price growth this month has been primarily constrained by recent developments in US trade policy. Following the implementation of new US import tariff on copper, the White House clarified that tariff would not apply to copper input materials or copper scrap imported into the United States. This clarification eased investor concerns regarding the future of copper trade flows and triggered more pronounced price corrections.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.