May 6, 2025

Market Overview 30-04-2025 to 06-05-2025

Last week, precious metals have overcome minor price corrections in unison to end the period of last 7 days on an upbeat note. The return of investors to precious metals has been boosted by controversial news on trade wars as well as the emergence of new geopolitical crises.

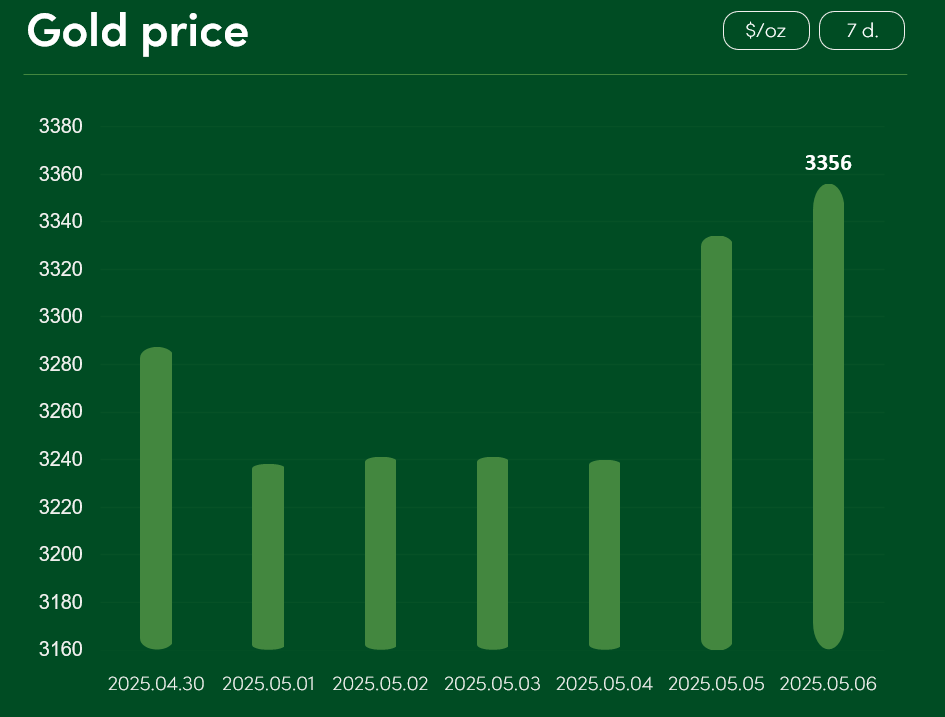

The global gold price rose by ~2% between 30 April and 6 May. On 6 May, the price of this precious metal reached 3356 $/oz.

The escalation of the US import wars contributed to the increase in gold demand over the past week. The country’s President Trump formally announced to reporters on Monday a plan to apply new specific tariffs targeting the pharmaceutical sector in the next two weeks. Trump also shared on his personal Truth Social account last Sunday that he has already authorised the US Department of Commerce and the US Trade Representative to immediately start applying 100% tariffs on all films made in foreign countries.

While the latest tariff news has been greeted with trepidation by many multinational companies in the pharmaceutical and cinema industries, news on possible optimistic trade deals between governments is gaining momentum in the public domain. In the negotiations between the US and India, the latter’s government is reported to have made a “zero-for-zero“ tariff offer on specific products (steel, auto parts, pharmaceuticals). There are also media reports of possible trade deals between the US and Japan and US-South Korea.

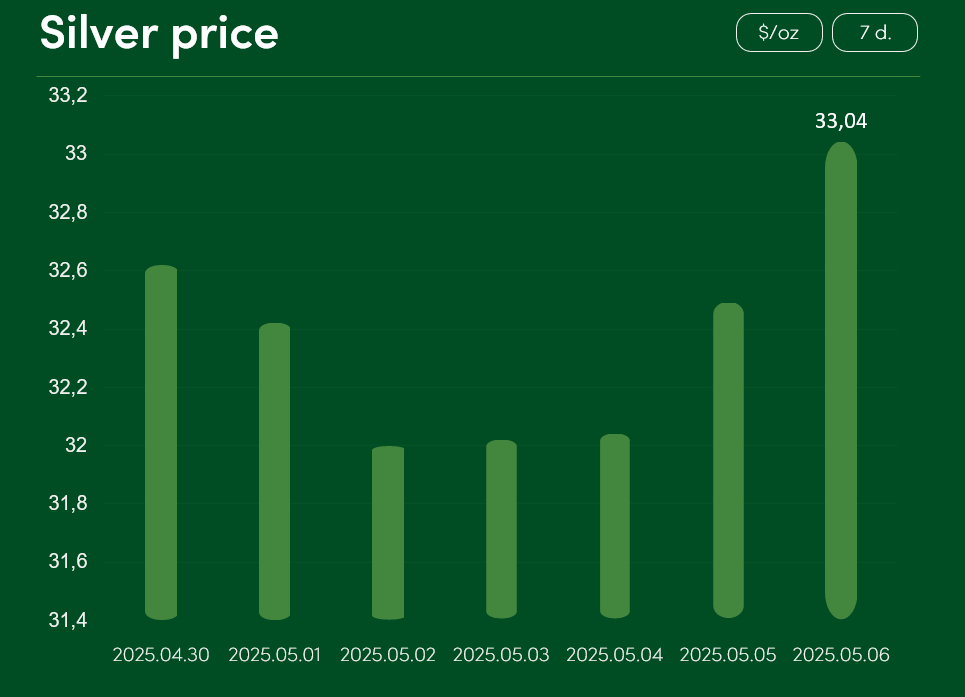

The global silver price has overcome a slight correction and increased by ~1.3% between 30 April and 6 May. On 6 May, the price of this precious metal reached $33.04/oz.

The demand for silver as an investment metal has recently been driven both by the uncertain future of international trade and the emergence of new geopolitical crises. At the end of April, a terrorist attack on Indian tourists took place in the Jammu and Kashmir region administered by the government of India. It led to an escalation in the already tense India-Pakistan relationship and heightened the risk of a large-scale armed conflict.

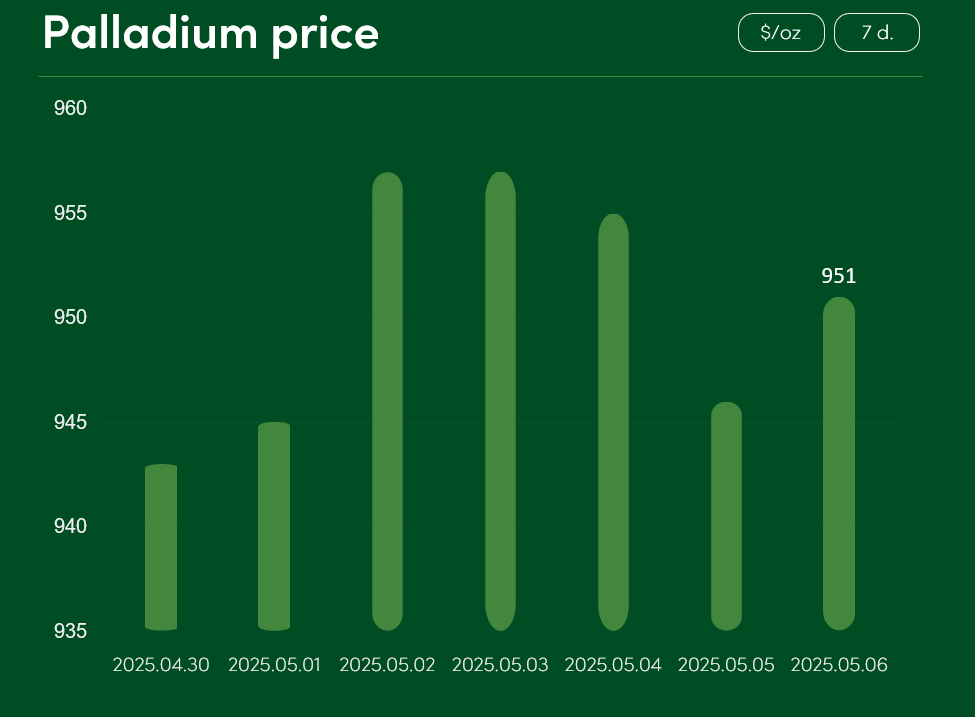

The global palladium price recorded minimal changes between 30 April and 6 May. A ~0.9% price gain allowed the metal to reach a price of $951/oz on 6 May.

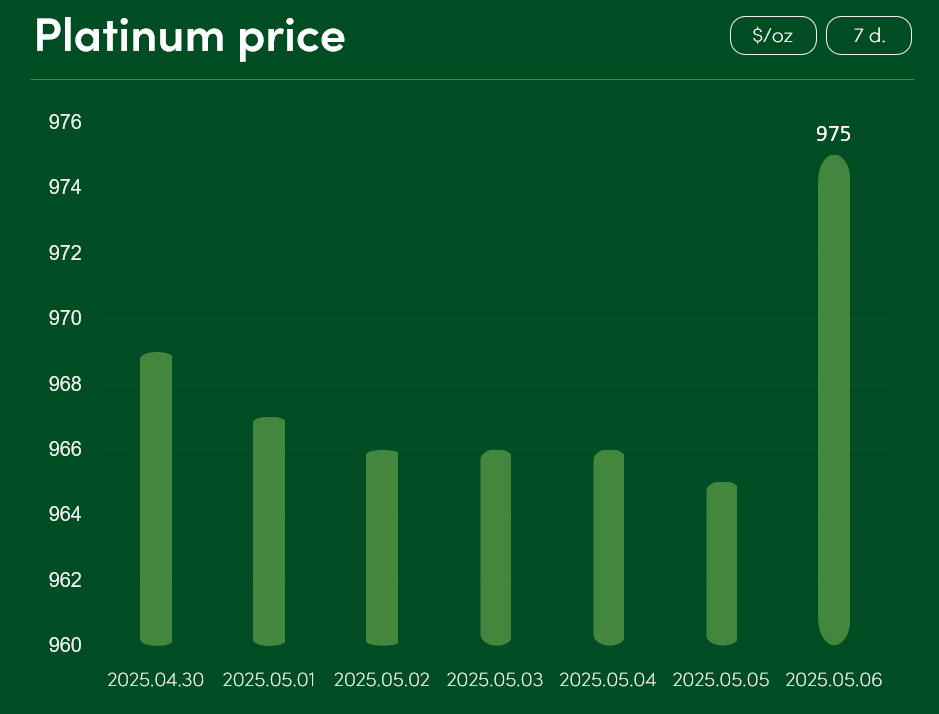

The global platinum price increased by ~0.7% between 30 April and 6 May. The market price of platinum reached $975/oz on 6 May.

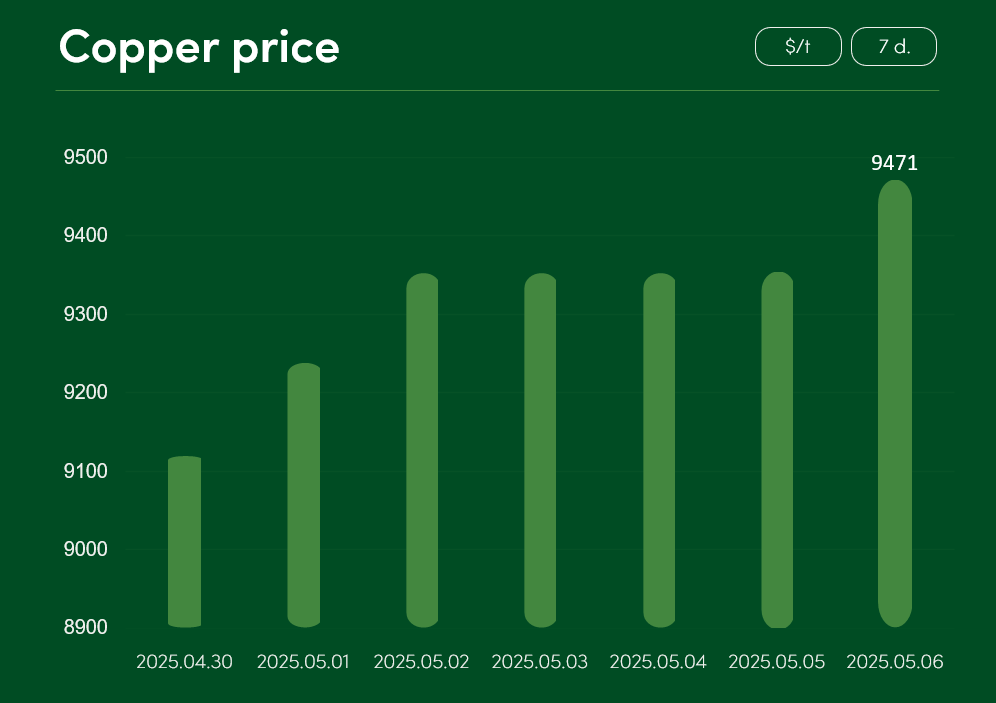

The global copper price experienced a period of bullish growth over the past week. The metal recorded an increase of ~3.85% between 30 April and 6 May, allowing copper to reach $9,471/t on 6 May.

Copper prices were boosted by upbeat news on the US-China trade war. After the Chinese government announced that Beijing is evaluating the US proposal to enter into trade talks, the global copper market immediately experienced a positive growth. Tangible tariff agreements between the world’s two main markets are likely to provide a significant boost to global trade and consumption volumes (including copper demand).

Optimism in the industrial metals sector is also supported by promising US employment figures. The world’s largest economy added as many as 177,000 jobs last month, well ahead of forecasts of 130,000 new positions.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.