November 4, 2025

Market Overview 29-10-2025 to 04-11-2025

In Precious Metals Markets – Temporary Price Stabilization…

Last week, the major precious metals markets avoided significant price fluctuations. The brief price consolidation can be explained by conflicting market news. Although U.S. interest rates were cut at the end of October, the growth in demand for precious metals remains constrained by factors such as the latest U.S.–China trade agreement.

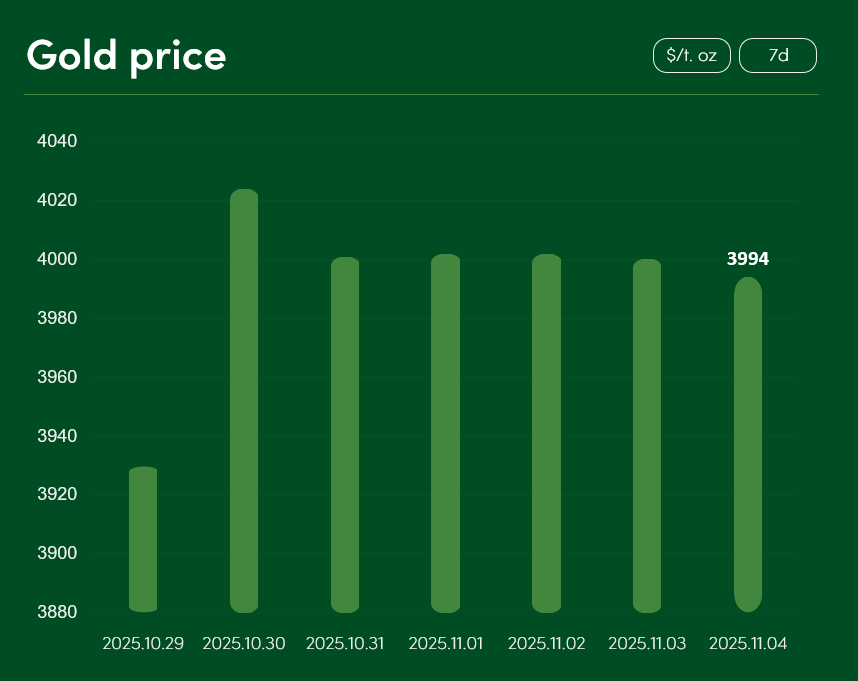

From October 29 to November 4, the global gold price rose by more than 1.6% to $3,994 per troy ounce.

The slight increase in gold prices, following a sharper correction in October, was partly driven by the U.S. Federal Reserve’s decision to cut interest rates by 0.25% (25 basis points). This move should increase the attractiveness of dollar-denominated precious metals (such as gold and silver) for holders of other currencies.

On the other hand, a stronger rise in gold prices is hindered by both the record-high price levels and policy decisions in major global economies that are currently unfavourable for gold trading. After China announced the termination of certain tax incentives for some domestic gold producers and retailers, concerns emerged about a potential decline in local demand and a reduction in gold’s global appeal.

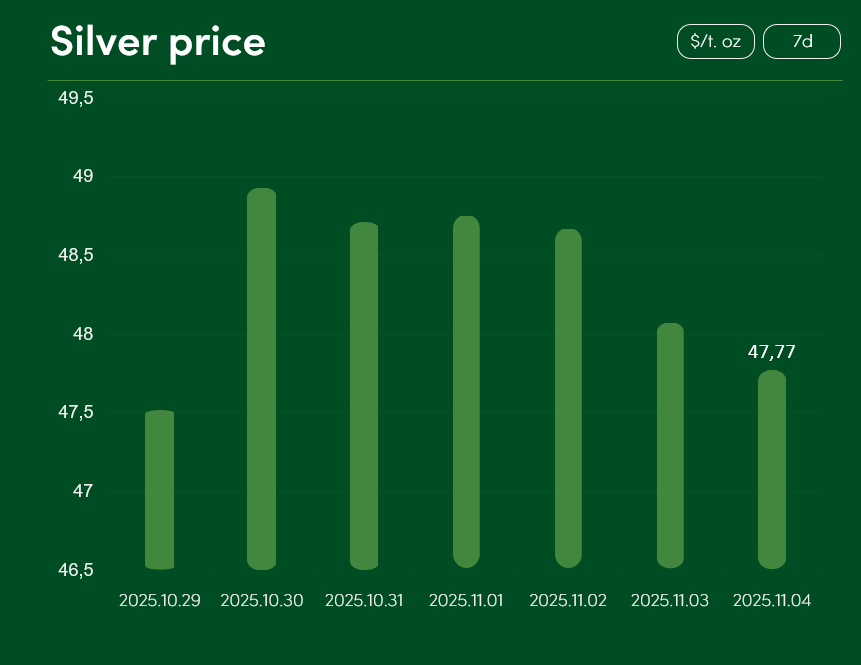

From October 29 to November 4, the global silver price showed relatively minor changes, reaching $47.77 per troy ounce on November 4.

Following this year’s record-high performance and a correction in late October, silver’s renewed growth is being limited by factors such as the easing of global trade tensions.

After the meeting between Donald Trump and Xi Jinping in South Korea, a one-year trade truce was officially announced. Under this deal, China agreed to postpone its planned tightening of export controls on rare earth elements, while the U.S. dropped its planned 100% import tariff.

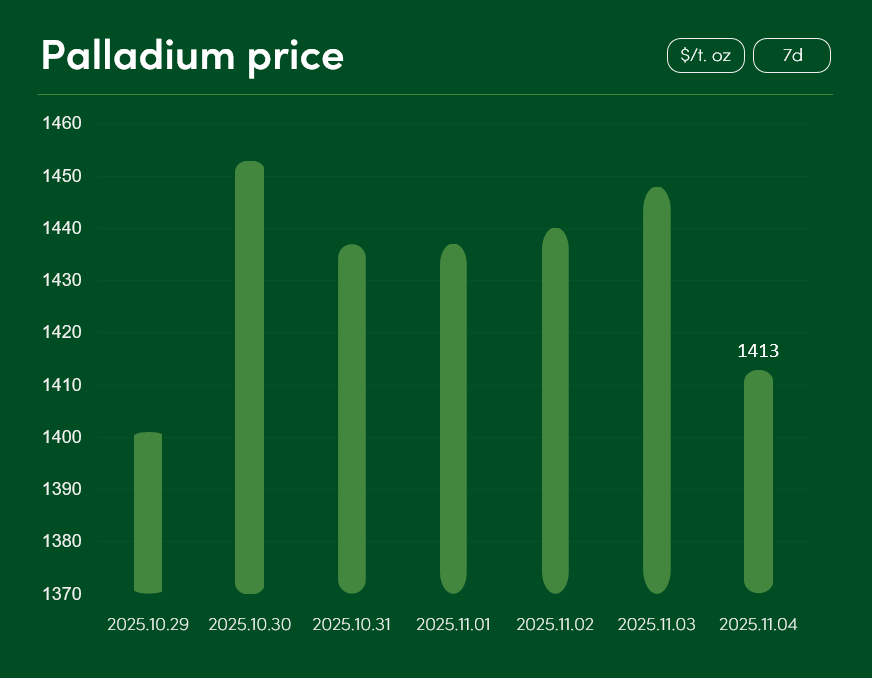

From October 29 to November 4, the global palladium price also saw minimal changes, reaching $1,413 per troy ounce on November 4.

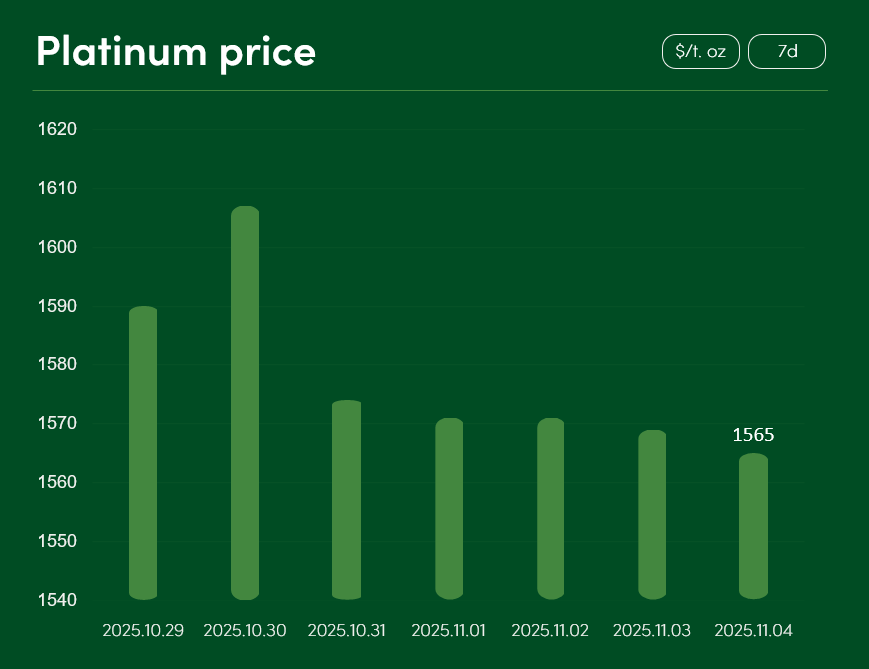

The global platinum price fell by more than 1.5% to $1,565 per troy ounce.

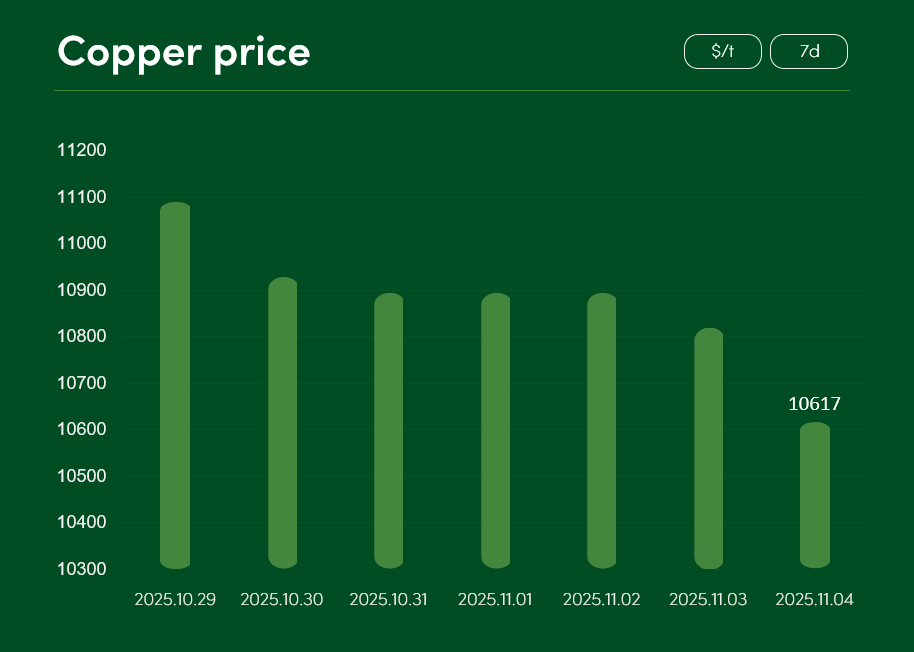

The global copper price dropped by over 4.2% to $10,617 per tonne during the same period.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.