September 3

Market Overview 28-08-24 to 03-09-2024

Although prices of various precious metals (gold, silver, etc.) recorded slight declines last week, the exchanges did not record any major trend-changing price movements. While some investors are living in a mood of anticipation for the almost guaranteed cut in US interest rates in September, the European Central Bank has also started to talk about further interest rate cuts. Lower interest rates, overvaluation of various major stock markets and the protracted geopolitical crises may, at least in the short term, be a serious cause for a significant boost to the prices of the main precious metals.

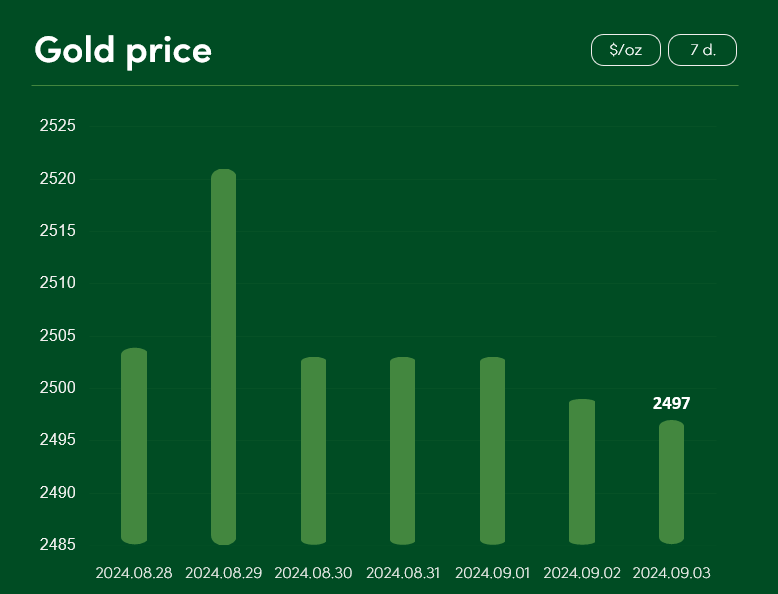

Gold prices on the exchanges declined by ~0.25% between 28 August and 3 September, reaching the 2497 $/oz level. The minimal corrections in gold prices after the all-time price records set in August can be seen as a relatively optimistic signal. After all, there are plenty of positive financial market events ahead that could lead to an autumn price rise.

According to the New York Times and other news portals as well as various financial analysts, annual US inflation, which has fallen to 2.9%, indicates that an interest rate cut is almost certain this autumn. It is very likely that FED’s chairman Jeremy Powell will announce positive news on 18 September, after the Federal Open Market Committee meeting.

Europe is also pleasantly surprising the markets with somewhat unexpected news: according to TheGuardian, the European Central Bank is monitoring the fall in inflation in the eurozone to 2.2% and is considering initiating another interest rate cut this September. If these considerations are confirmed in Europe and across the Atlantic, easier access to cheaper borrowing rates for western countries and their populations could contribute significantly to further increases in precious metals prices.

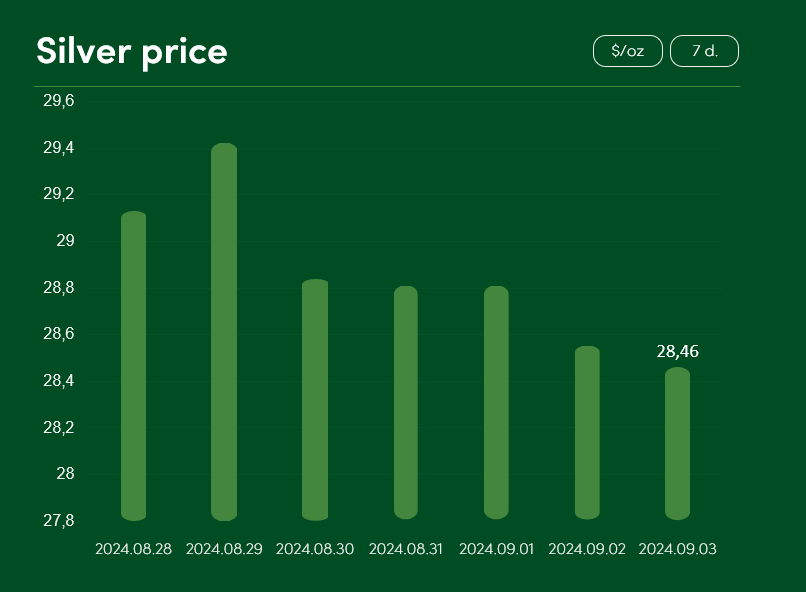

Silver prices fell by ~2.25% between 28 August and 3 September, reaching the 28.46 $/oz level in early autumn. Although a more significant price decline has been recorded in this case, the overall outlook for silver prices during this autumn is also very positive.

Not only silver is the second most precious metal in terms of market capitalization, but it is also a vital component in the manufacturing of various electronic products. Due to both practical applications and investment popularity, this precious metal has ample scope to increase its price more strongly in a lower interest rate environment.

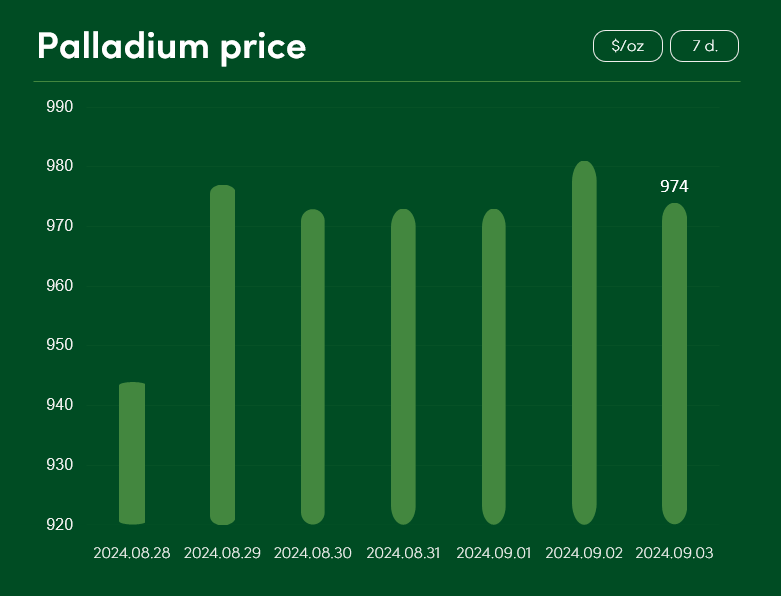

Although palladium started the week with a more pronounced price decline, looking at the price movements over the last 7 days, palladium ended the week with a total >2.5% price gain and recorded a rate of 974 $/oz on 3 September.

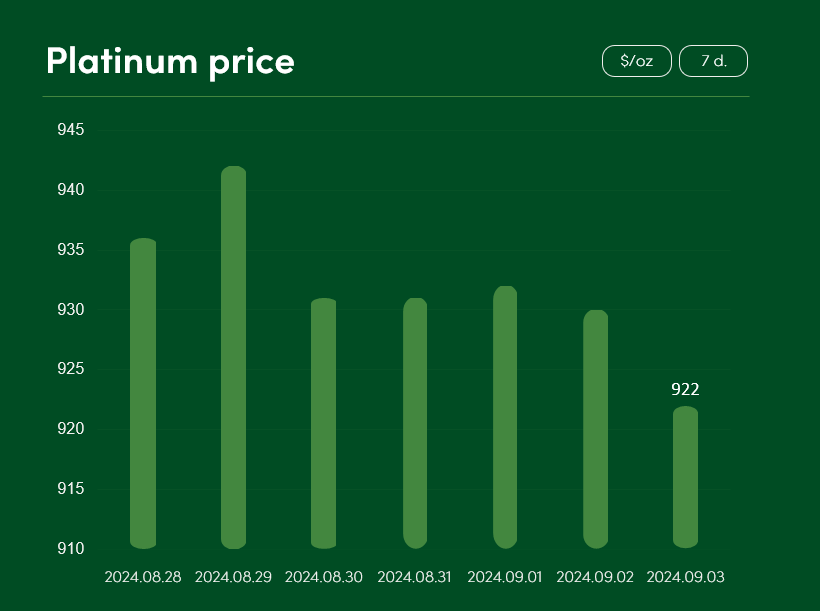

Precious platinum metal performed a little worse this week: from 936 $/oz on 28 August, its prices fell to 922 $/oz on 3 September.

Price of semi-precious copper metal has remained almost unchanged over the last 7 days, with the price levels per tonne of copper reaching 9130 $/oz mark on 3 September.

Looking at the longer-term evolution of copper prices, the popular industrial metal, which started to recover its price position in August, has also recently seen a more significant downturn. According to TradingEconomics analysts, this factor may have been partly driven by the forecast of a drop in copper demand from the Chinese market. This country is currently fighting a crisis in its domestic property market and serious economic restrictions from the US and EU countries.

The moderate trend in copper prices is also likely to have been fueled by rising inventories of this metal. With London Metal Exchange warehouses recently stockpiling as much as additional 8 700 tones of copper. At current market prices, the value of this stockpile increase is estimated at ~79.4 million USD.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.