June 10, 2025

Market Overview 04-06-2025 to 10-06-2025

Last week, a wide range of commercial, financial and geopolitical factors contributed to the price formation of the precious metals market. Investors’ doubts about gold’s continued success are driving capital outflows from this precious metal. The latter situation favours the rise in prices of other popular precious metals. As investors eagerly follow the crucial global US-China trade negotiations, deficit supply trends for some precious and industrial metals are observed.

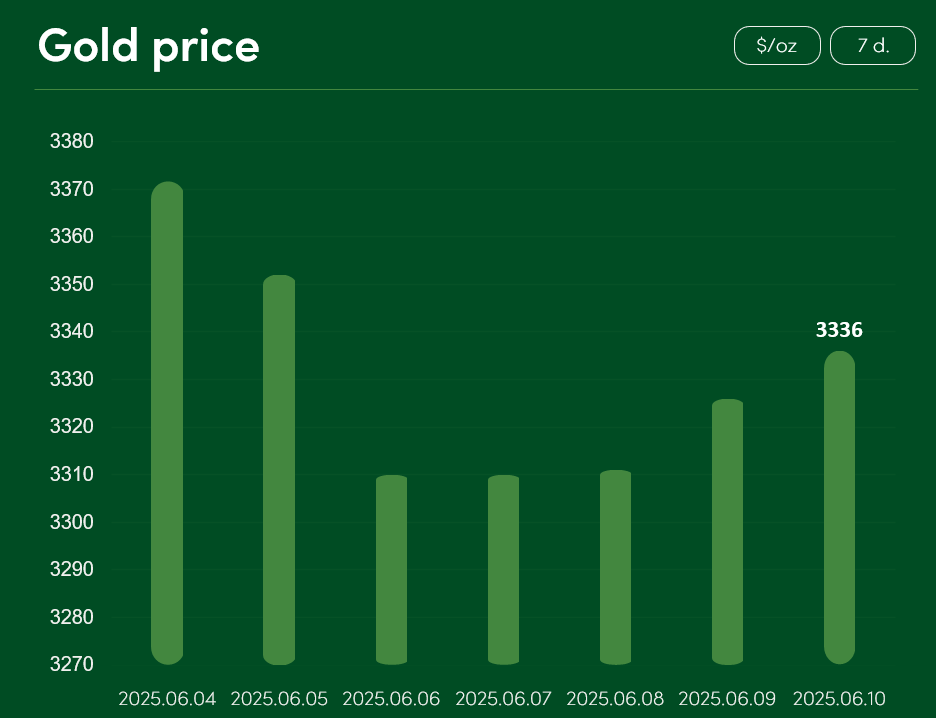

The global gold price declined by ~1.05% between 4 June and 10 June to reach $3336/oz.

The rise in gold prices is currently limited by positive trends in global trade agreements. The US-China government trade agreement talks, which have been taking place in London since this Monday, are progressing well, according to US President Trump.

Gold’s rise as an investment hedge will also be somewhat hampered by the relatively upbeat recent US economic results. The United States reportedly created 139,000 new jobs in May, slightly ahead of expert forecasts (126,000 job gains were expected).

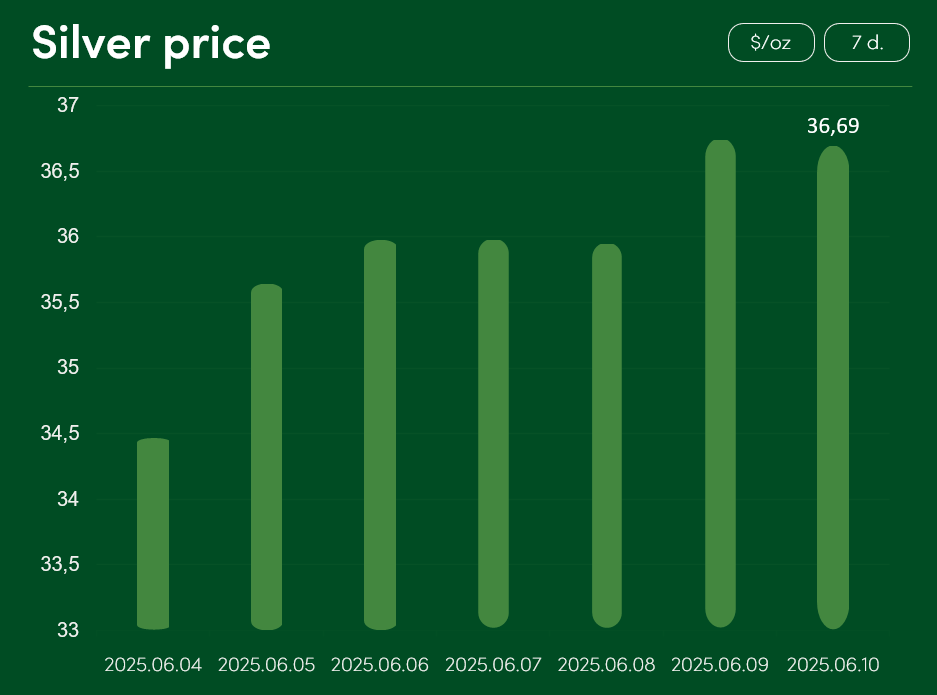

The global silver price experienced a very sharp price increase of >6.4% between 4 and 10 June. On 10 June, the price of $36.69/oz was reached.

The surge in silver prices is driven both by investors’ retreat from the gold and by favourable market supply-demand forecasts. Although the World Silver Institute expects the global deficit in the precious metal to decrease by 21% this year (compared to last year’s forecast), a significant global shortage of the precious metal (117.6 Moz) is still expected. For silver, which is actively used for both industrial production and investment, some analysts foresee a promising price increase in the near future.

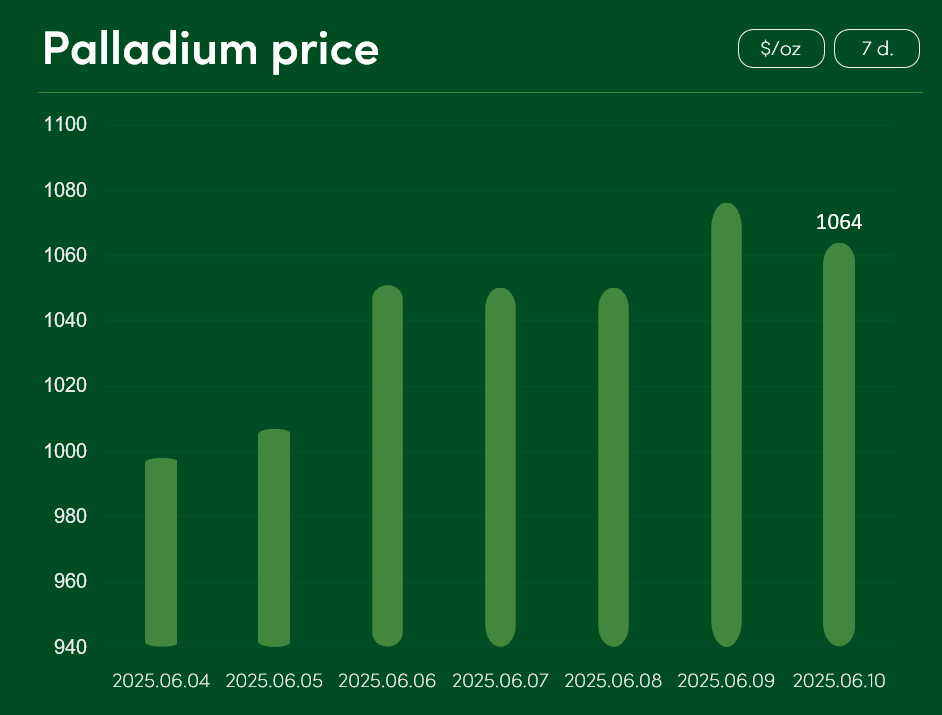

The global price of palladium rose by ~6.6% between 4 June and 10 June. On 10 June, it reached a price of $1064/oz.

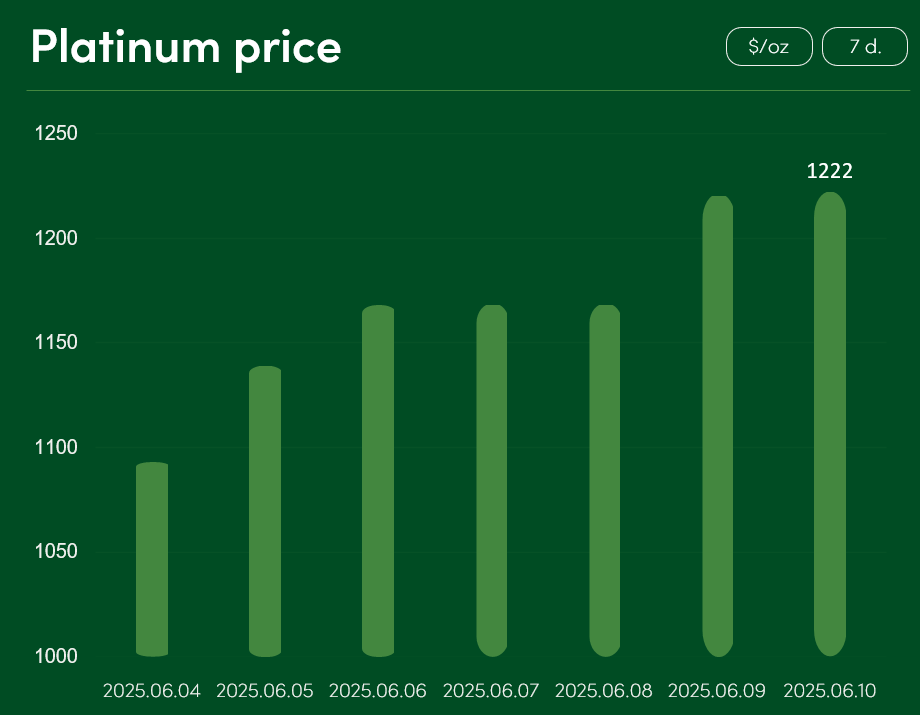

The global platinum price rose by ~11.8% between 4 June and 10 June to reach $1222/oz.

According to experts, the extraordinary surge in the platinum price was supported by metal-friendly expectations of tight supply, improving industrial consumption sentiment in the market, and technical follow-through from the broader precious metals rally. The World Platinum Investment Council (WPIC) forecasts a deficit of almost 1 million ounces for the precious metal in 2025.

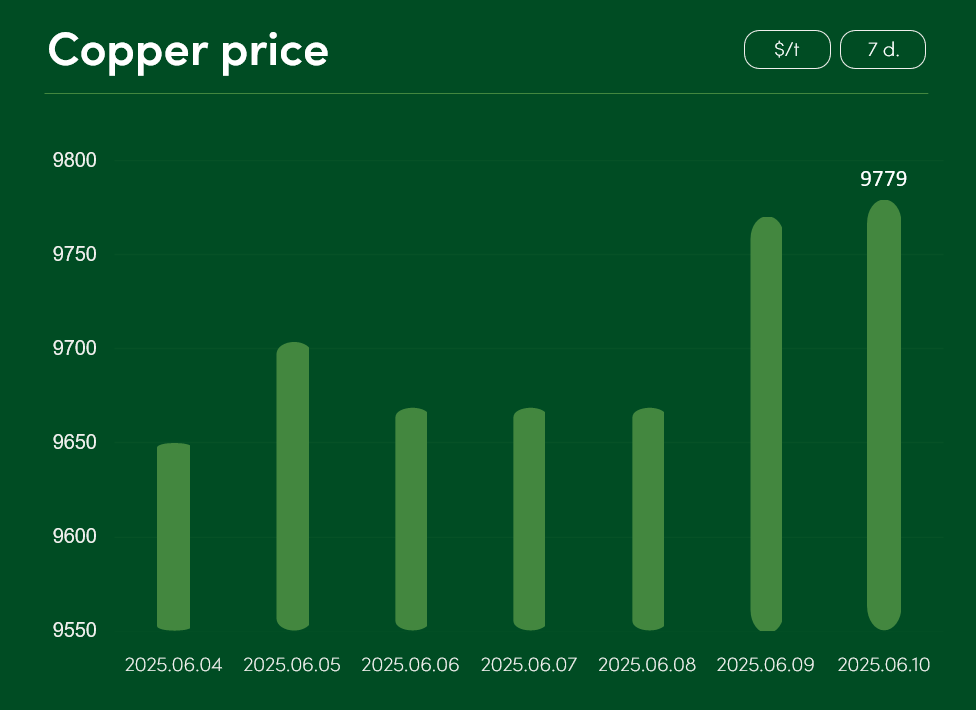

The global copper price rose by ~1.34% between 4 June and 10 June to reach $9779/t.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.