February 3, 2026

Market Overview 28-01-2026 to 03-02-2026

Price Collapse in the Precious Metals Market!

Last week, precious metal prices experienced an exceptionally sharp correction. Some commentators have attempted to explain this price collapse by pointing to recent political and economic developments in the United States. However, the deeper causes of the correction lie in changes to exchange-traded derivative markets and temporary restrictions on precious metals trading conditions.

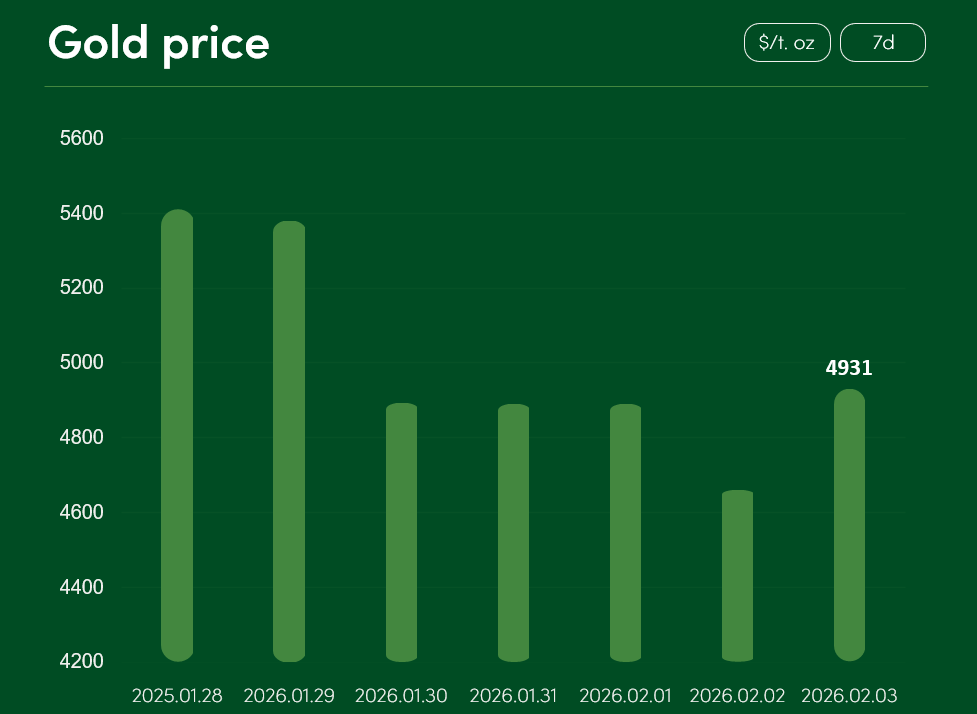

Between January 28 and February 3, the global gold price recorded a pronounced decline, although it managed to partially recover by the end of the period. Overall, gold prices fell by more than 8.8% over the past seven days. On February 3, gold was trading at USD 4,931 per troy ounce. The average gold price in January 2026 stood at USD 4,744 per troy ounce.

When assessing the sharp decline in gold prices, market participants initially focused on news related to the nomination of a candidate for the future Chair of the Federal Reserve. Following President Donald Trump’s nomination of the conservative economist Kevin Warsh for this position, U.S. markets began to reassess expectations regarding future Federal Reserve interest rate cuts and the potential growth in gold and silver demand.

However, not all analysts note that this particular development was the primary driver behind the decline in gold prices. The correction was largely driven by financial decisions taken by the CME Group.

CME Group — the world’s largest precious metals futures exchange — implemented significant changes to its leveraged trading system in mid-January. Instead of applying a fixed collateral requirement for leveraged precious metals trading, CME introduced a percentage-based margin calculated from the full contract value. This substantially increased the equity capital requirements for holders of large leveraged positions.

Further pressure emerged when, within a ten-day period, CME Group raised margin requirements for leveraged precious metals trading five times. This decision triggered a wave of forced liquidations of leveraged positions and led to a sharp decline in precious metals prices.

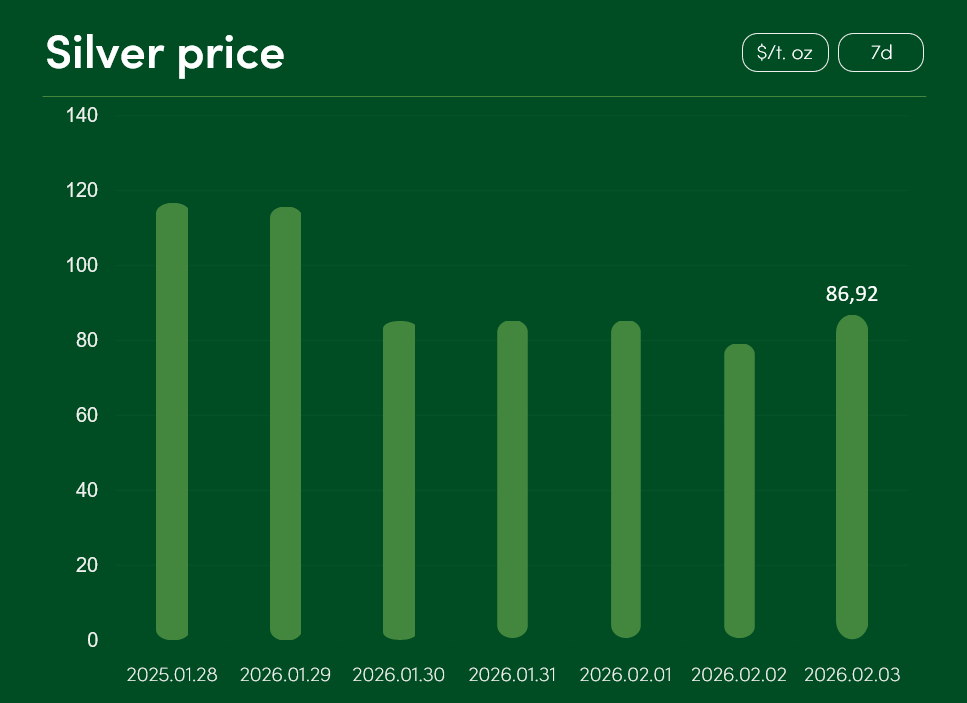

Between January 28 and February 3, the global silver price fell by more than 25%. On February 3, silver was trading at USD 86.92 per troy ounce. The average silver price in January 2026 stood at USD 92.13 per troy ounce.

The unprecedented correction in silver prices was not driven solely by the drastic trading changes introduced by CME Group. While precious metals futures were already under significant pressure, on January 30 the Shenzhen Exchange suspended trading for a full day in the only publicly traded silver futures fund in the Chinese market.

Unable to sell their silver contracts in the domestic market, Chinese investors were forced to reduce risk by opening offsetting positions on international trading platforms (including CME Group). This further intensified selling pressure on silver prices and resulted in a historic sell-off in precious metals futures.

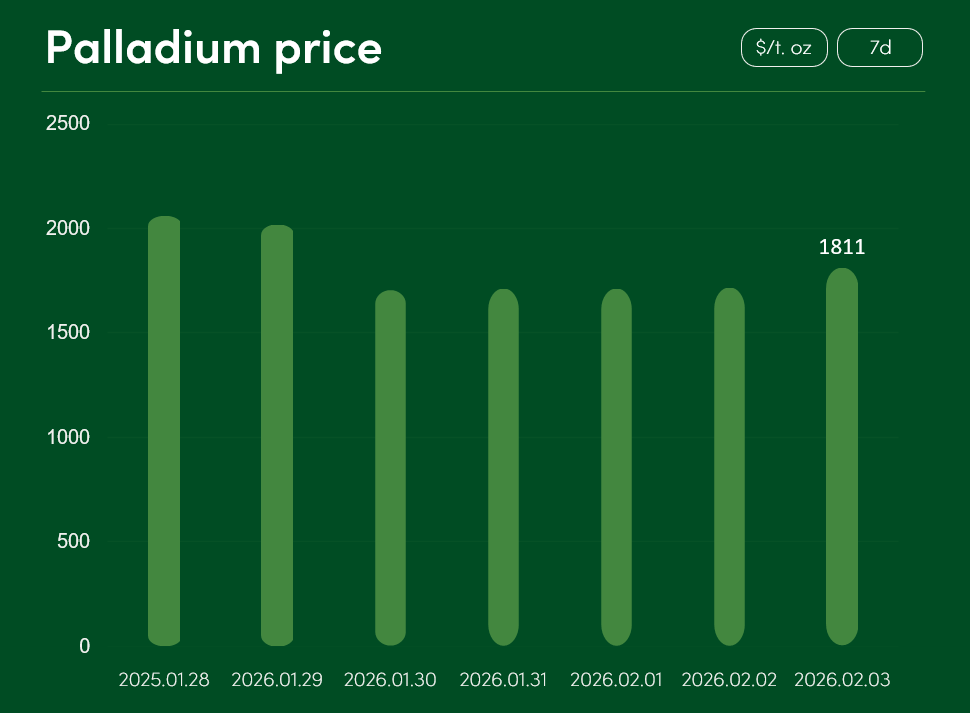

Between January 28 and February 3, the global palladium price declined by more than 12%, falling to USD 1,811 per troy ounce. The average palladium price in January 2026 stood at USD 1,854 per troy ounce.

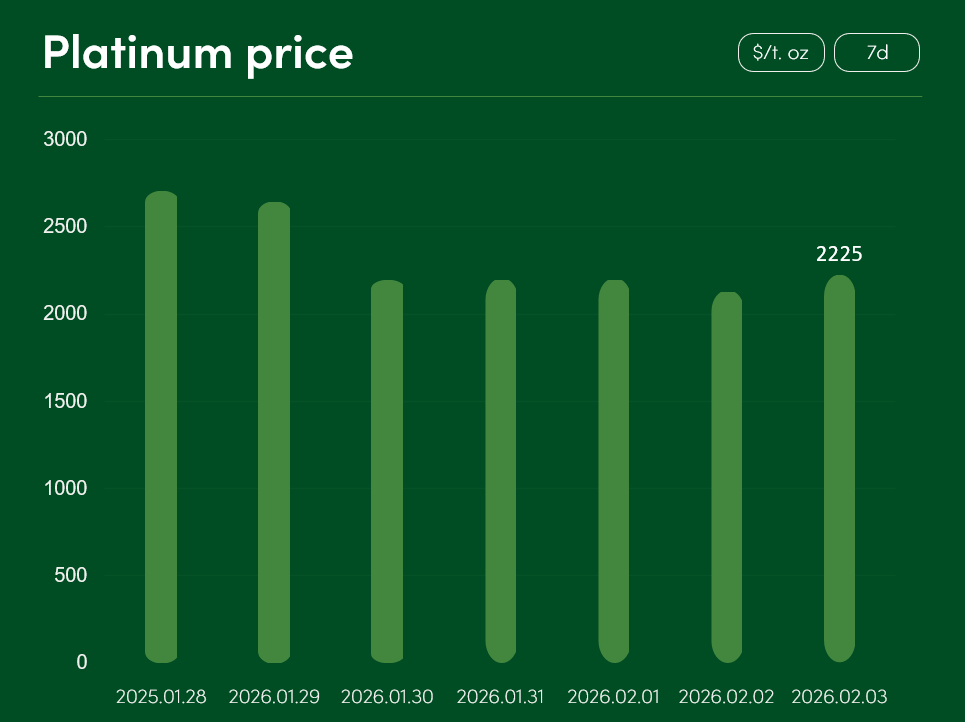

Over the same period, the global platinum price fell by more than 17%, reaching USD 2,225 per troy ounce. The average platinum price in January 2026 was USD 2,432 per troy ounce.

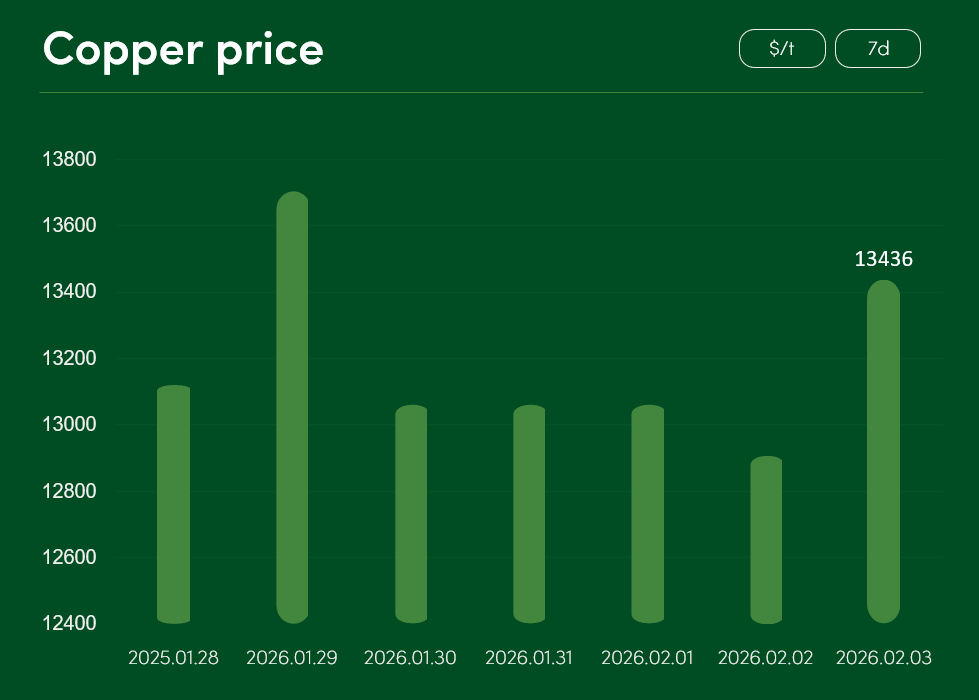

In contrast, the global copper price increased by more than 2.3% between January 28 and February 3, reaching USD 13,436 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.