December 3, 2024

Market Overview 27-11-2024 to 03-12-2024

Although precious metals have been on a concerted upward trend over the past week, the exchanges have not recorded any drastic price spikes. The calmness of small investors can be partly attributed to the upcoming holiday season and the increase in non-essential spending. Meanwhile, the general market optimism, which persisted even after several corrections in November, can be attributed both to the favourable financial outlook of the US market and to the resumption of the geopolitical crisis between Israel and Hezbollah.

The gold price rose by ~0.25% between 27 November and 3 December and reached $2642/oz.

Following the very successful gold price rise in 2024 and the multiple beatings of metal’s all-time price records this year, investors remain optimistic about gold’s future perspectives. US monetary policy decisions are also contributing to such positive sentiment. With the United States having already cut its bank interest rates twice this year, investors and analysts now give as much as a 72.5% chance in favour for a further rate-cut decision by another 25 basis points (0.25%) on 17-18 December.

Further interest rate cuts in the US and Europe are likely to help attract even more capital into the precious metals sector. This likelihood has increased considerably since the ceasefire between Israel and Hezbollah on 27 November fails to stabilise the situation in the region. According to CNN, Israeli missile strikes in Lebanon on this Monday alone may have killed at least nine people; continuing missile strikes further concern about the possible breakdown of the ceasefire agreement.

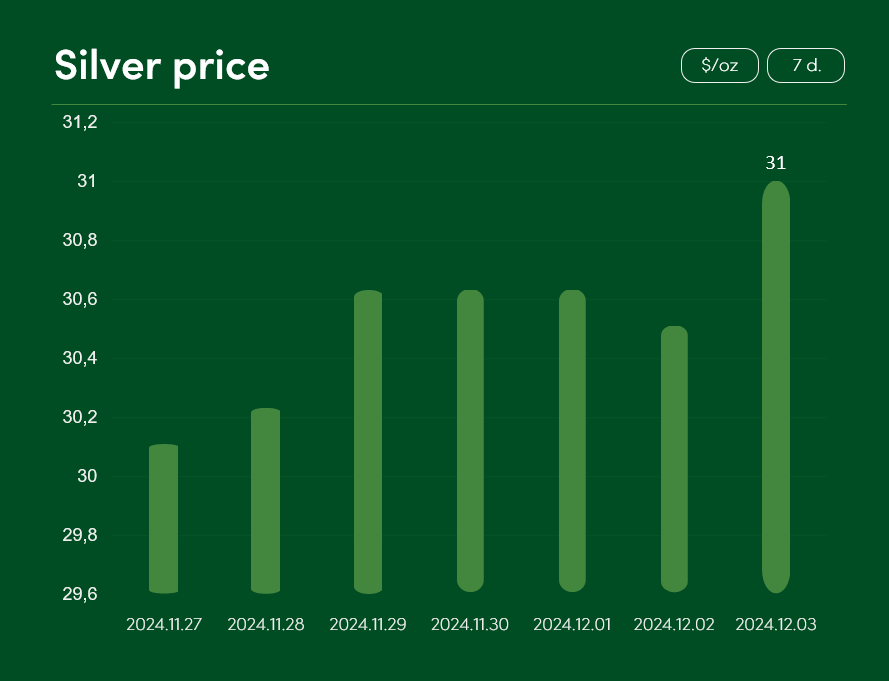

The global silver exchange price rose by ~2.8% between 27 November and 3 December to $31/oz.

Silver market prices were significantly boosted not only by the resurgence of political threats and the increasing likelihood of a decision by the US to continue cutting its interest rates this year, but also by investors’ bullish speculation on the Chinese market. According to TradingEconomics, markets are forecasting that the Chinese government will announce additional financial stimulus packages by the end of this month to help boost growth in China’s stagnant economy and increase demand for industrial consumption of metals in this giant market.

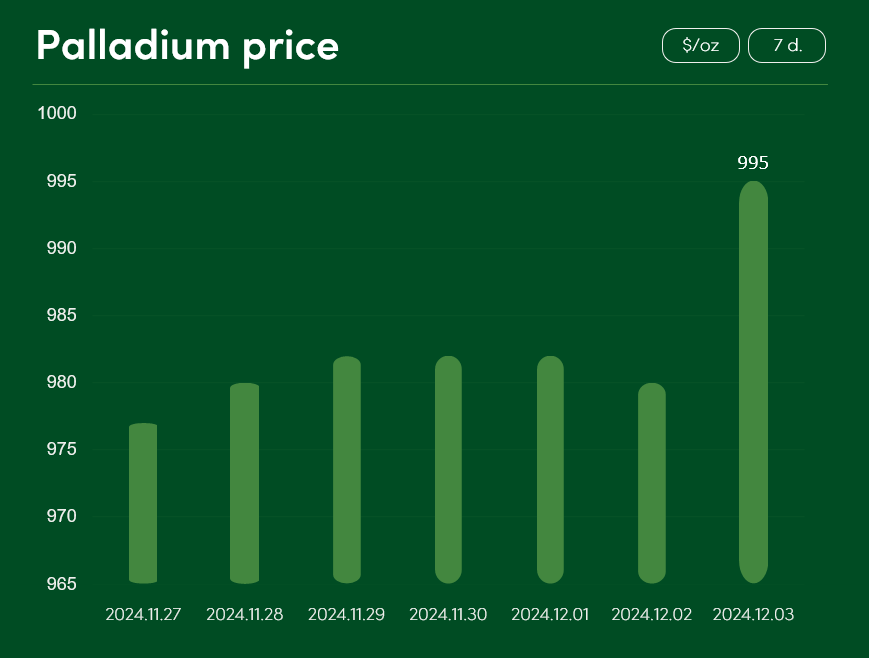

The market price of palladium rose by ~2% between 27 November and 3 December to reach $995/oz.

Although palladium prices have recorded a ~20% decline since the end of October and the investment community fears a further price decline due to Trump’s plans for additional tariffs on imports from Mexico, Canada and China, the long-term outlook for palladium does not look bleak. According to TradingEconomics, publicly traded palladium funds have increased their portfolio by 178,000 palladium ounces since the beginning of October; such growth has contributed strongly to the overall 278,000 ounce year-to-date gain in palladium funds. High interest and capital inflow into palladium funds reinforce the long-term upside outlook for precious metals’ price positions.

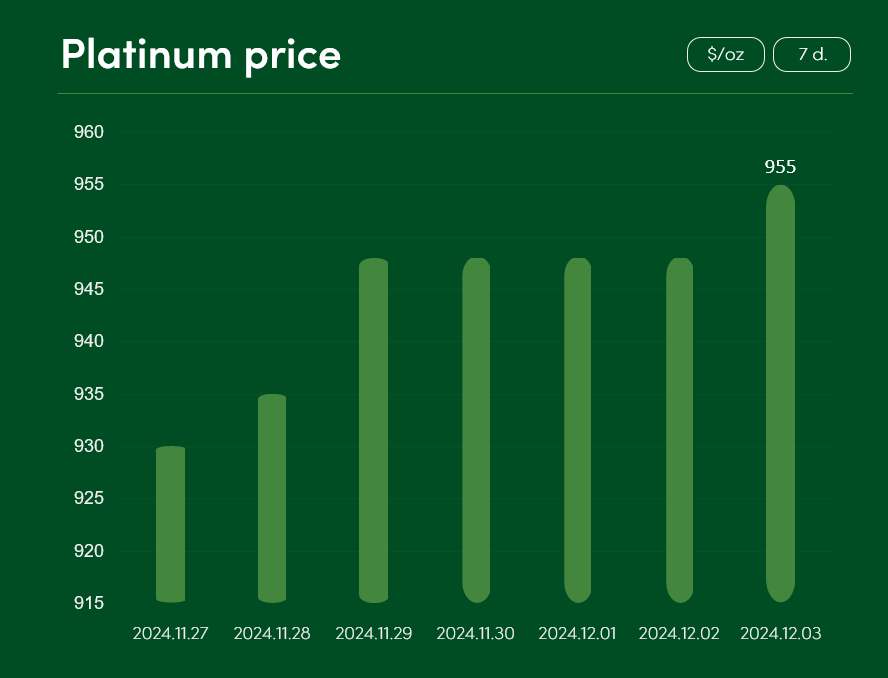

The platinum price on the exchanges rose by >2.5% between 27 November and 3 December to reach a price of $955/oz.

Copper has risen by ~2% over the last seven days on the exchanges and reached a price of $9084/t.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.