September 2, 2025

Market Overview 27-08-2025 to 02-09-2025

During the last week, the main exchange-traded precious metals experienced a period of more pronounced price growth. It was driven by unexpected legal decisions regarding U.S. import tariffs as well as corrections in the U.S. dollar exchange rate. Precious metal prices were also supported by the fact that markets are almost fully convinced of an upcoming U.S. interest rate cut at the next FED meeting.

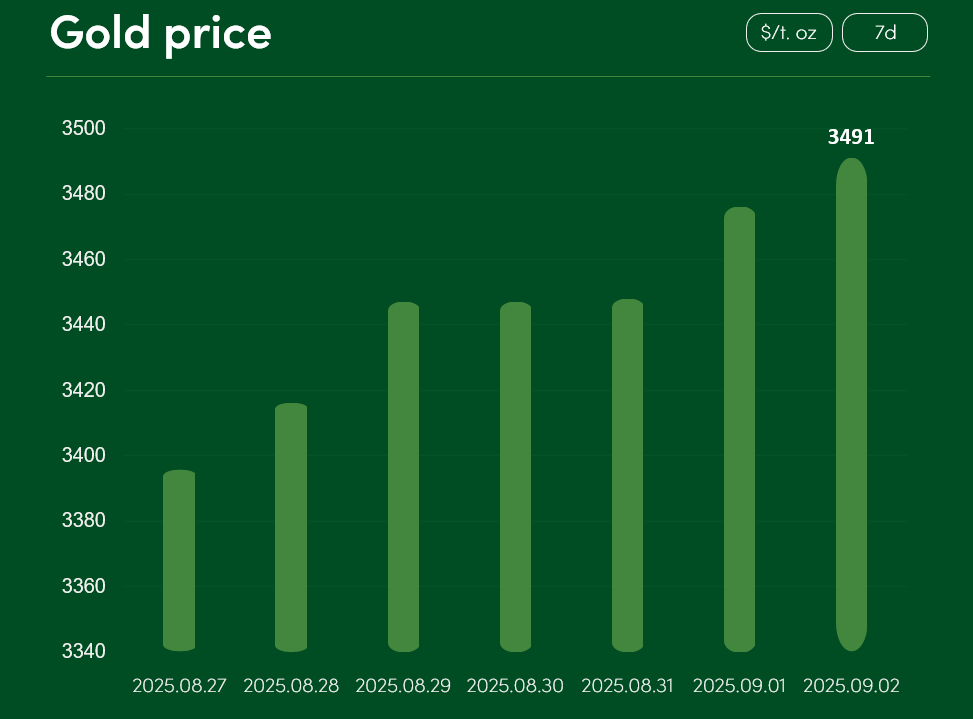

The global gold price rose by ~2.8% between August 27 and September 2, reaching $3,491 per troy ounce.

Gold’s upward movement has recently been strongly influenced by growing expectations of a U.S. interest rate cut. In response to dovish comments from FED board members, U.S. employment indicators, and other significant factors, market forecasts that rates will be lowered as early as the September FED meeting have exceeded 89%. This situation has fuelled corrections in the U.S. dollar exchange rate and contributed to the price growth of dollar-denominated precious metals (gold, silver, etc.).

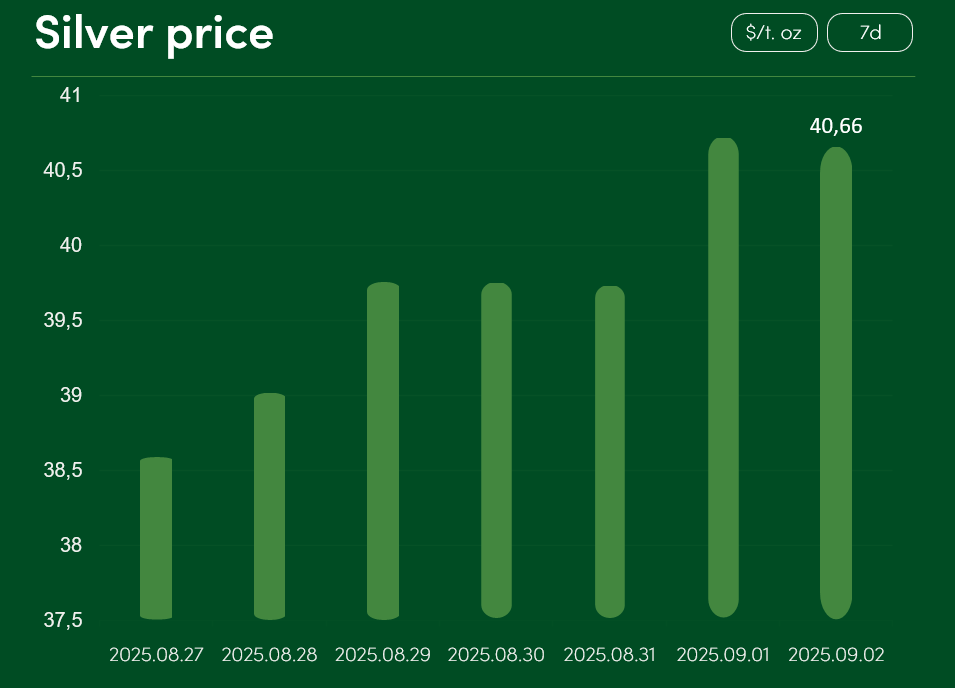

The global silver price rose by more than 5.3% between August 27 and September 2, reaching $40.66 per troy ounce.

Silver’s growth is driven not only by U.S. market expectations of rate cuts but also by chaotic news in the field of U.S. import tariffs. The U.S. Court of Appeals unexpectedly ruled that most of President Donald Trump’s trade tariffs are illegal. Nevertheless, the tariffs will temporarily remain in place until October 14, giving the Trump administration an opportunity to submit an appeal to the U.S. Supreme Court.

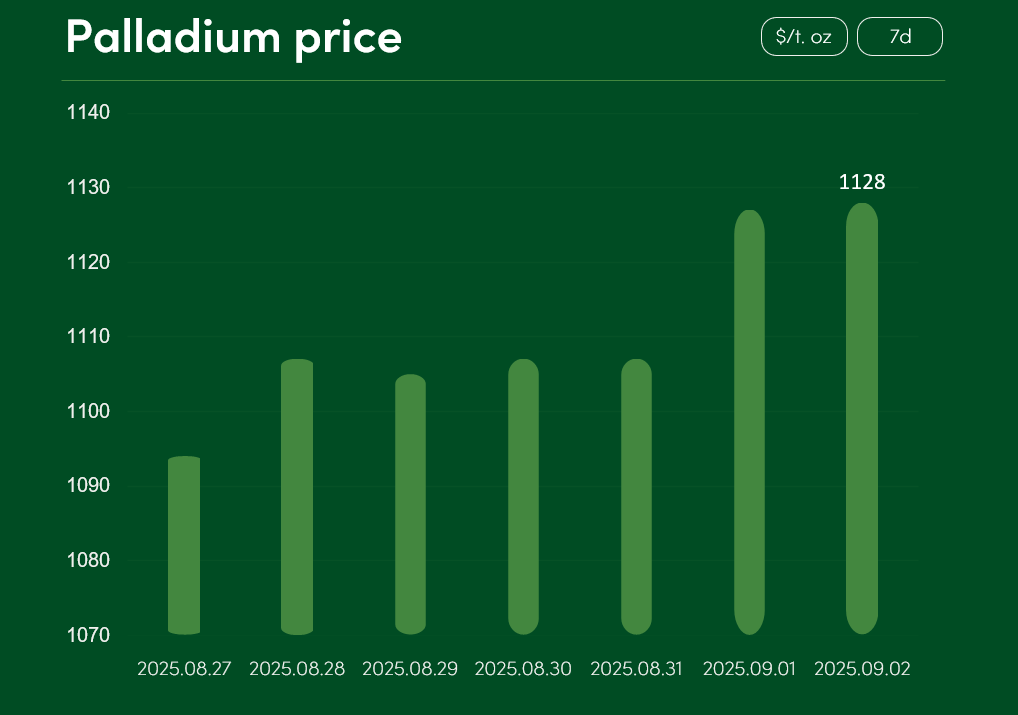

The price of palladium rose by more than 3% between August 27 and September 2, reaching $1,128 per troy ounce.

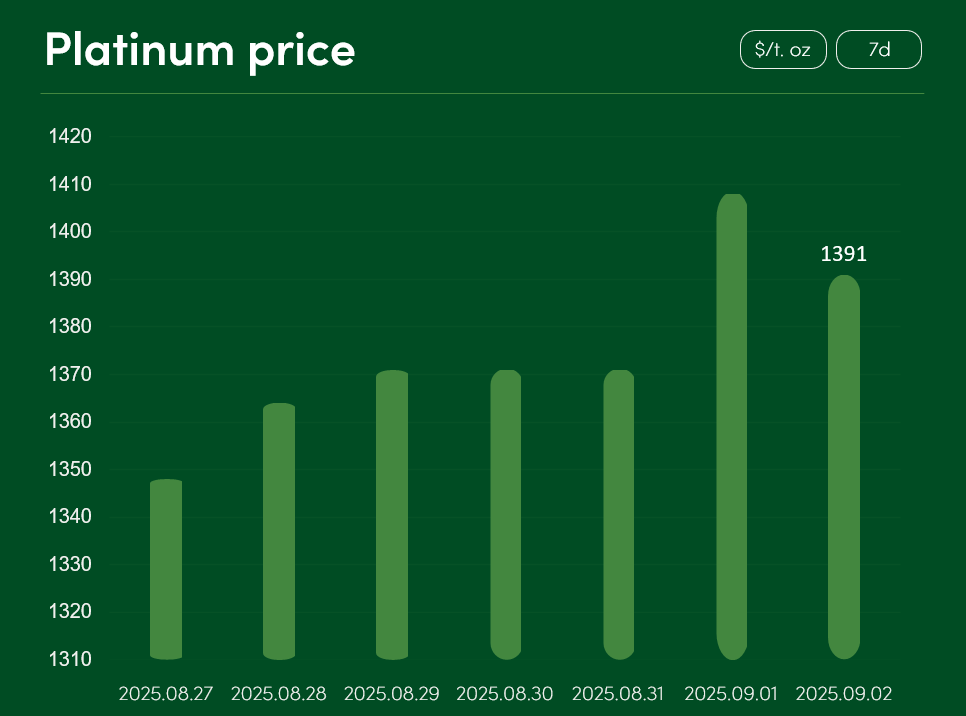

Over the same period, the global platinum price also increased by more than 3%, reaching $1,391 per troy ounce.

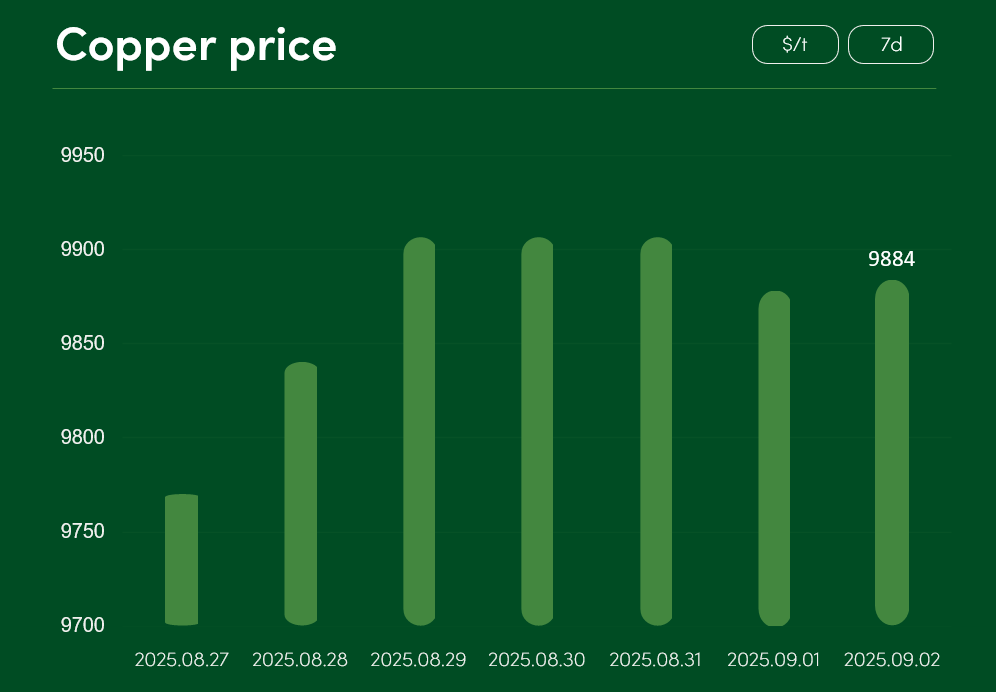

The price of copper rose by more than 1.1% between August 27 and September 2, reaching $9,884 per tonne.

Amid optimistic growth sentiment in the global copper market, China’s leading copper mining company Zijin Mining Group highlights strong demand for this industrial metal in the country’s data centre and electrification technology sectors. Nevertheless, experts forecast a decline in China’s refined copper production in September, linked to maintenance of the smelters and potential constraints in the supply of materials for refined copper production.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.