December 2, 2025

Market Overview 26-11-2025 to 02-12-2025

Highly Unpredictable Movements in the Precious Metals Market

Over the past week, major precious metals experienced significantly divergent price movements. These shifts were undoubtedly driven by conflicting economic and geopolitical signals across the global landscape. On one hand, investors awaiting a FED interest rate cut are watching weak U.S. economic indicators and expect this environment to support the rise in precious metal prices. On the other hand, improving geopolitical stability is reducing the interest of conservative investors in traditional precious metals.

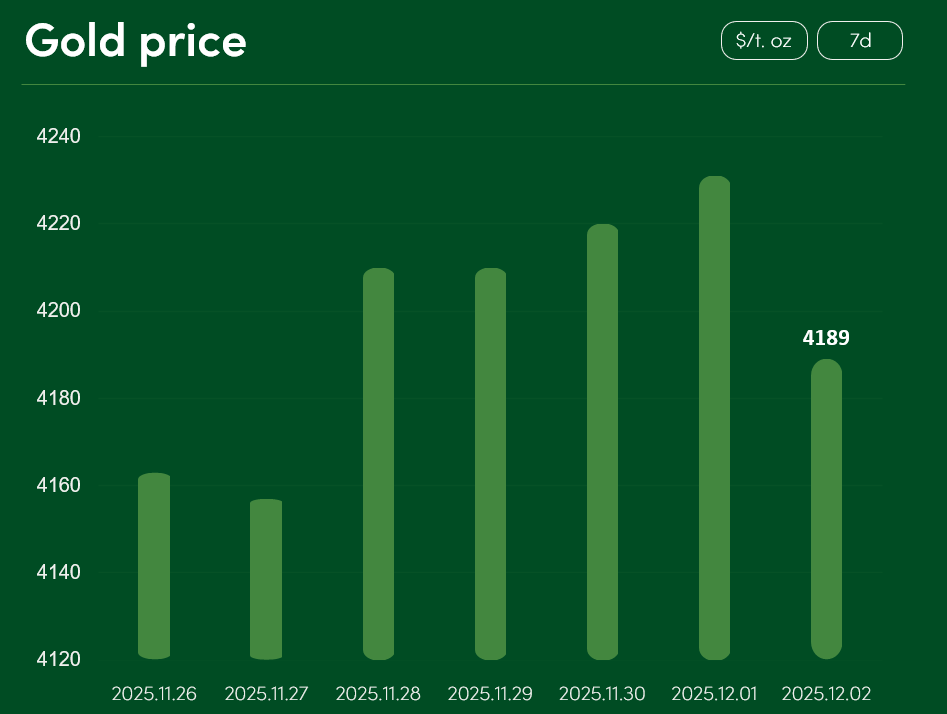

Global gold price recorded minimal changes from November 26 to December 2. On December 2, the price of gold reached $4,189 per troy oz.

Although expectations of a FED rate cut are supporting gold prices, the potential of this metal as an investment hedge is limited by decreasing geopolitical tensions.

Following media reports that the Ukrainian delegation largely agrees with the U.S.-proposed peace plan, an intensification of peace negotiations has been observed. After the U.S.–Ukraine representatives’ meeting, reports indicated that a special U.S. delegation is heading to a peace negotiation meeting with Russia’s President Vladimir Putin.

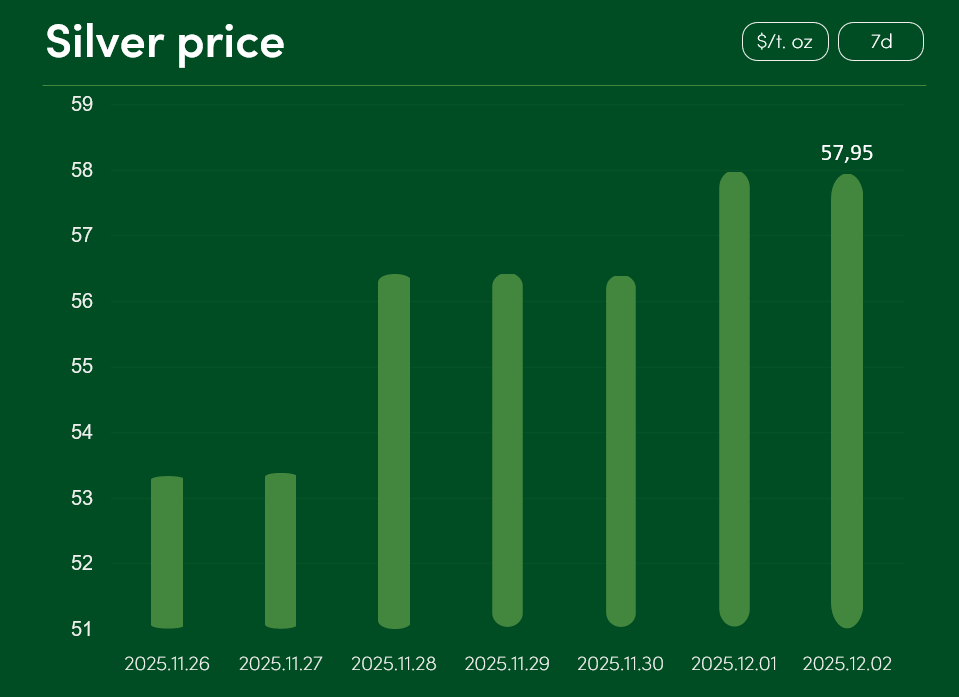

Global silver price increased by more than 8.6% between November 26 and December 2, reaching $57.95 per troy oz.

Silver’s price growth is undoubtedly driven by the challenging U.S. economic situation. As problematic labor market results emerge in the United States, expectations of a potential interest rate cut are strengthened by other economic indicators as well. According to popular index data, the U.S. manufacturing sector contracted for the ninth consecutive month.

Considering the decisions of exchange traders and prevailing market sentiment, the probability that the FED will announce another rate cut in December currently stands at 89%.

A potential reduction in U.S. interest rates may trigger a correction in the U.S. dollar and thus increase the attractiveness of dollar-denominated precious metals (gold, silver, etc.) for holders of foreign currencies.

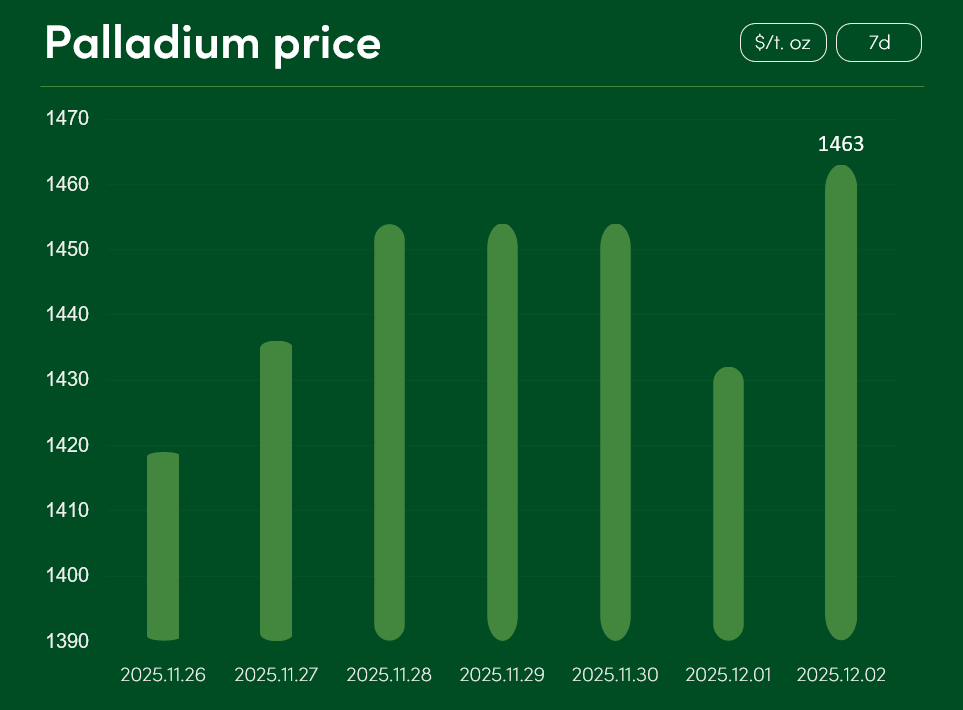

Global palladium price rose by more than 3% from November 26 to December 2, reaching $1,463 per troy oz.

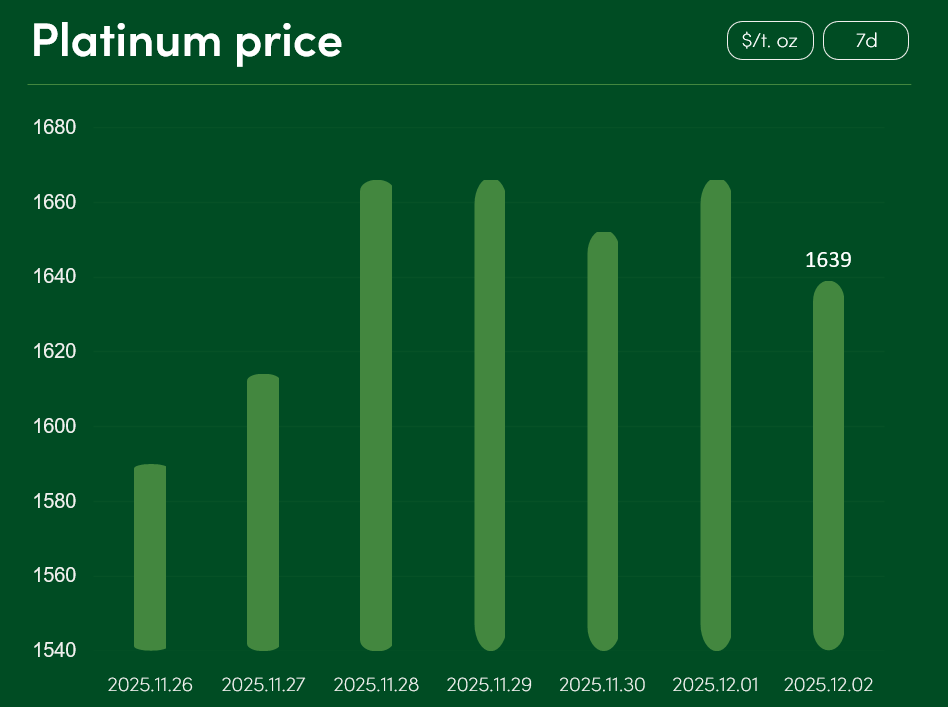

Global platinum price increased by more than 3% over the same period, reaching $1,639 per troy oz on December 2.

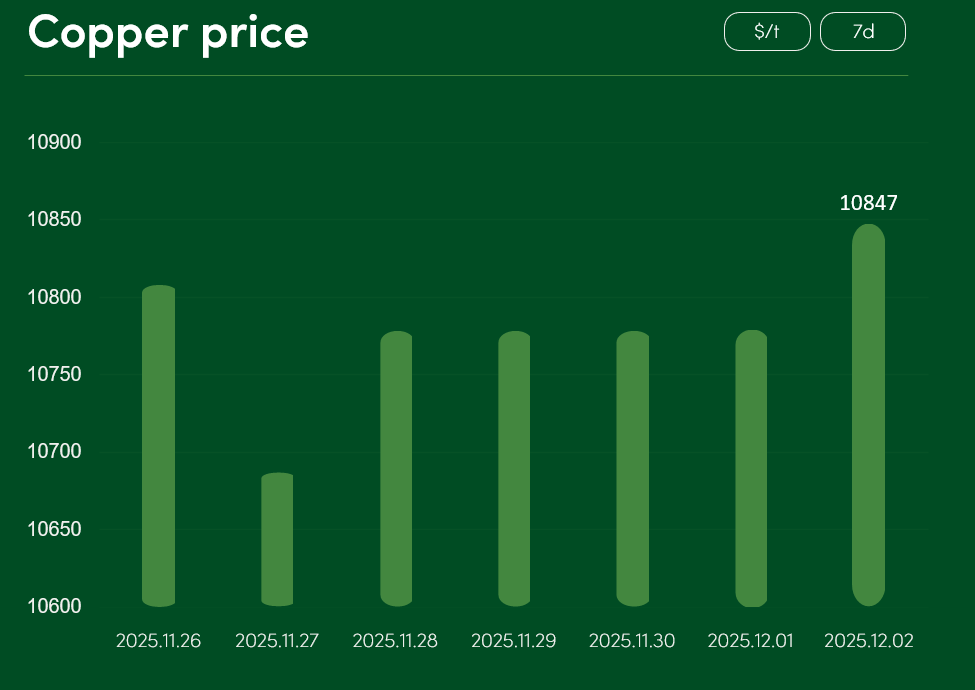

Global copper price saw only minor fluctuations from November 26 to December 2. On December 2, the price of this metal reached $10,847 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.