March 4, 2025

Market Overview 26-02-2025 to 04-03-2025

A short-term correction, quickly replaced by exceptional price growth. This is a succinct description of the trend in the precious metals market over the last 7 days. The strong and rapid price movements have been triggered by radical political-economic decisions by the world’s most powerful countries, as well as by the return of investor anxiety about deepening geopolitical crises.

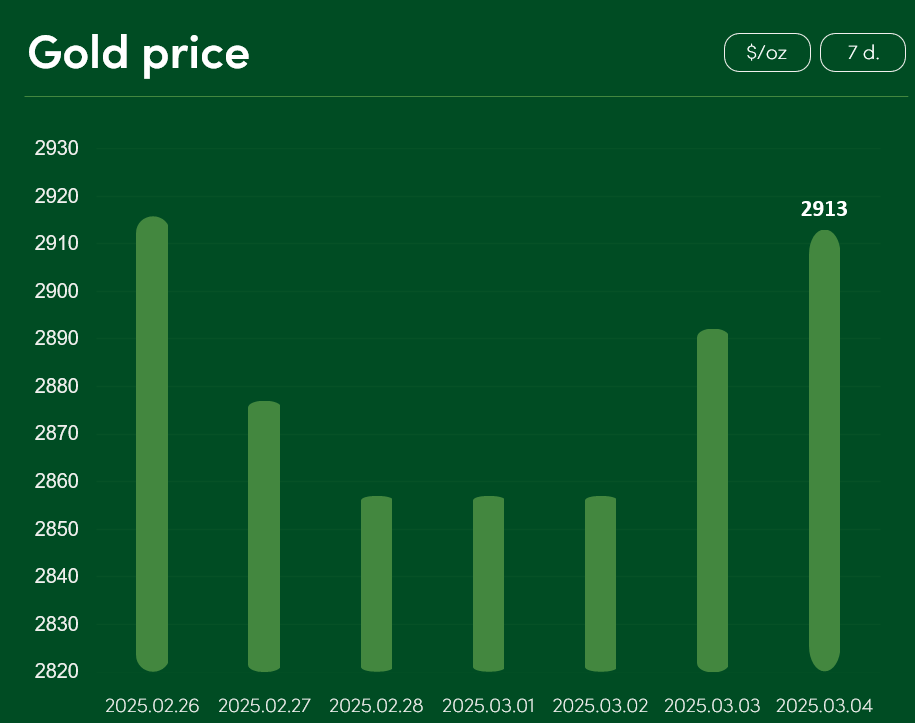

Although the global gold price fell by 2% between 26 and 28 February, the strong upward trend recorded in the second half of the week helped to recover almost 100% of the initial price positions. On 4 March, the global gold price reached $2913/oz.

The volatility in gold prices was undoubtedly driven by the rise in global geopolitical threats. The infamous meeting on 28 February between US President Trump and Ukrainian President Zelensky on peace in Ukraine ended in an open confrontation between the heads of state. The news of the non-signing of the Ukraine’s rare minerals agreement was followed by the news of Trump’s decision to temporarily suspend US military aid to Ukraine. Rising geopolitical risks are encouraging investors to opt for the gold as an additional investment hedge, even in the face of high metal market prices.

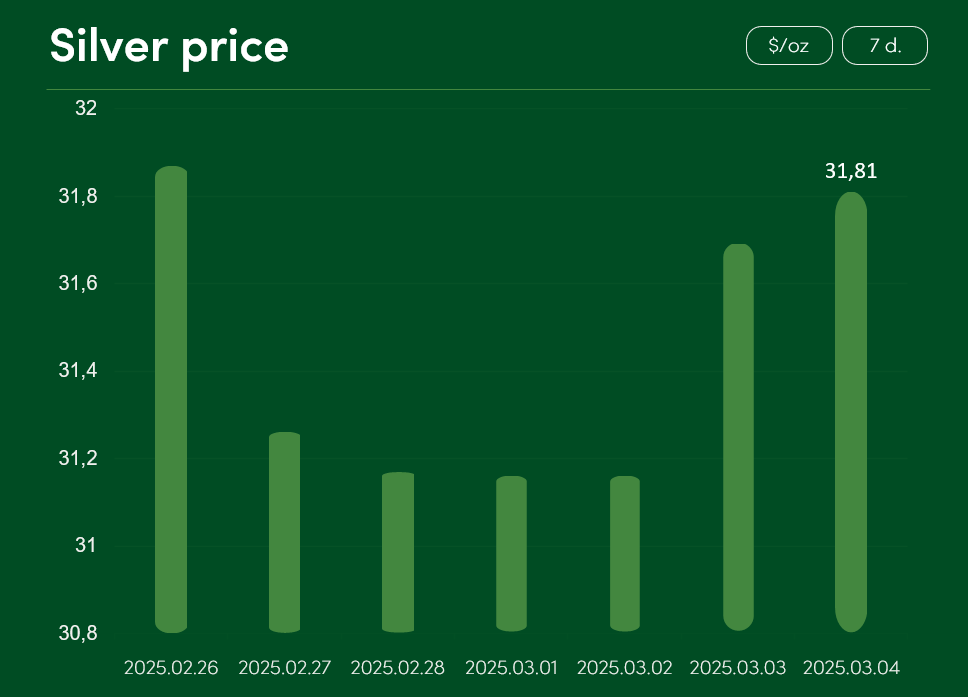

The global silver market price also experienced a sharper market correction of ~2.2% between 26 and 28 February. Also, as in the case of gold, the correction was quickly replaced by a period of exceptional growth, allowing silver prices to reach the price level of $31.81/oz on 4 March.

The volatility in silver prices was driven not only by geopolitical tensions but also by escalations in trade conflicts. Following the end of the temporary reprieve period, the import tariffs announced by Trump on goods entering the US from Mexico and Canada came into force from this Tuesday. US import tariffs on Chinese goods have also been increased from 10% to 20%. China and Canada immediately responded to these measures with tariffs on American imports, and investors are increasingly turning to silver, both as an investment protection measure and as a product whose prices could rise significantly as a result of the escalating trade conflicts.

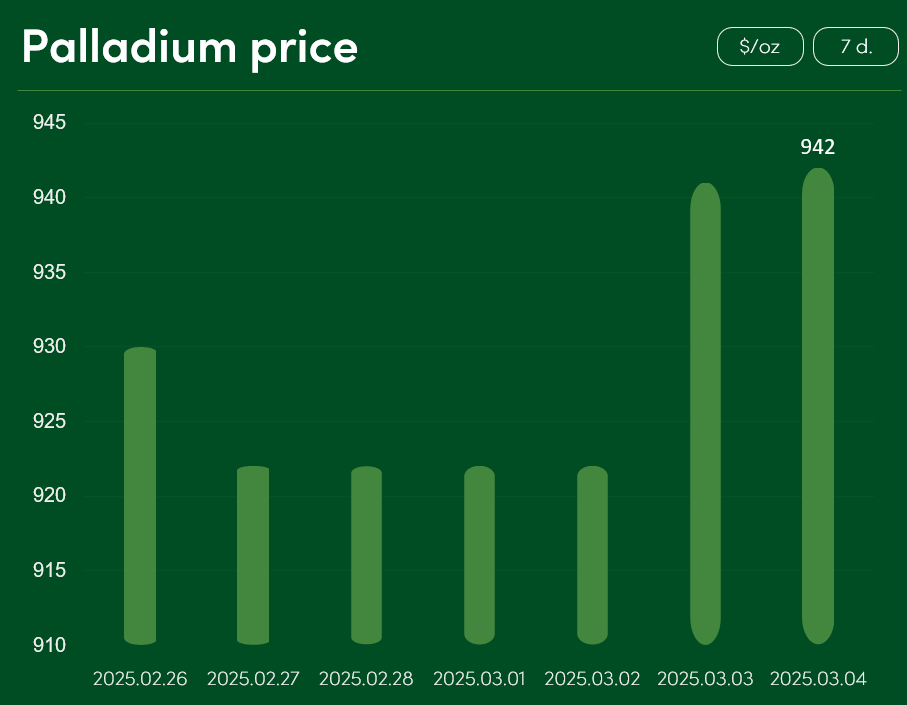

The market price of palladium rose by ~1.3% between 26 February and 4 March to $942/oz.

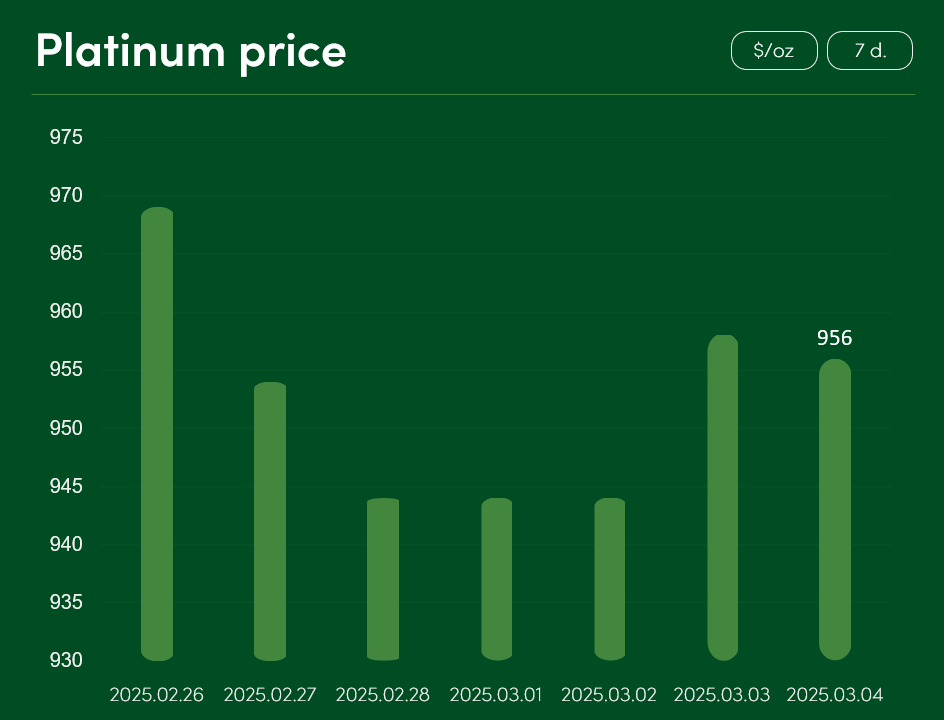

Global platinum prices fell by ~1.25% between 26 February and 4 March to $956/oz.

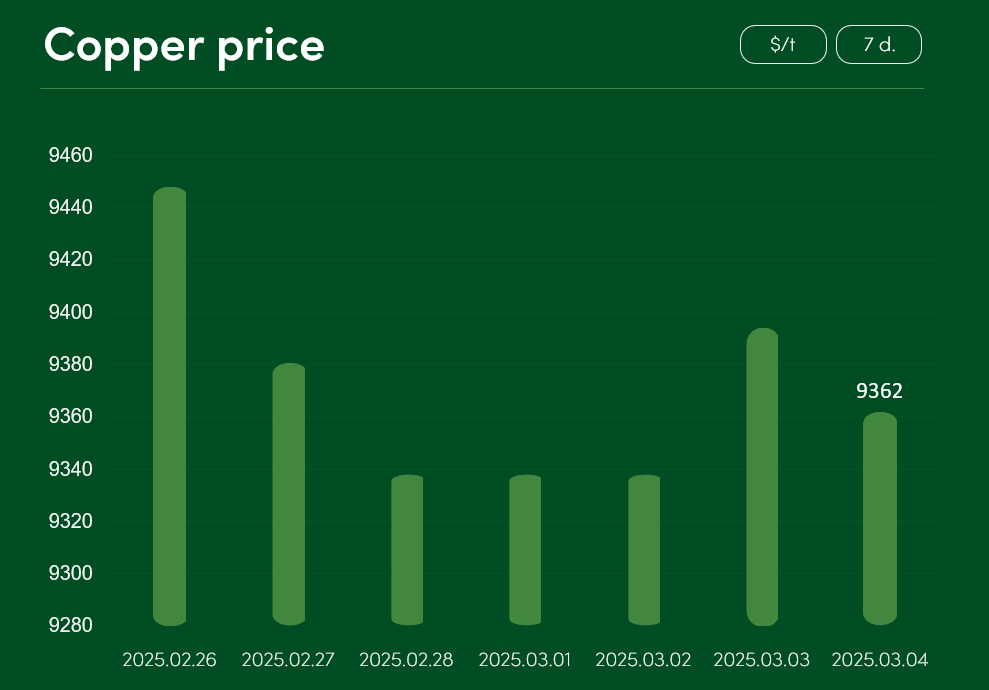

The global copper market price recorded a modest correction of 0.9% between 26 February and 4 March, reaching $9362/t.

Although copper recorded a very successful upward stretch at the beginning of this year, the metal is still not close to the $10000/t market price. The volatility of copper’s market price is compounded by the pronounced imbalance of copper production on the Chinese market.

For some time now, local copper smelters and refiners have been charging negative service fees for copper processing due to the perceived significant shortage of copper concentrate in the Chinese market. While such a shortage of raw copper material may be interpreted as a strong argument for an increase in metal prices, China also mentions in its latest reports a record stock of 270 000 tonnes of processed usable copper. Given this fact and the possible resumption of copper concentrate exports from Indonesia’s Grasberg copper mine, the Chinese market alone could provide a number of reasons that could complicate further copper price increases in the short term.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.