December 31, 2024

Market Overview 25-12-2024 to 31-12-2024

Precious metals markets did not record significant price changes during the last week. However, the pale price dynamics of the last 7 days did not overshadow the impressive overall price gains that were recorded during this year. These are due to the rising geopolitical tensions and the number of armed conflicts in 2024, as well as to the lowering of bank interest rates and the stimulus to encourage growth in various global consumption indicators.

Gold exchange prices experienced both a short-term increase and a slight correction between 25 and 31 December, but no significant change was recorded when the price is examined from a 7-day perspective. On 31 December, the metal price reached $2614/oz.

Looking at the overall trend for gold prices in 2024, the past year has been particularly favourable for the precious metal. From the beginning of 2024 to the present day, a price increase of ~29% has been recorded.

The record rise in the price of gold this year has been partly driven by interest rate cuts in the US, the European Eurozone countries and China. The availability of increasingly cheaper borrowed capital for consumption or investment purposes has stimulated the attraction of new investment funds into the precious metals sector. Gold has also gained in popularity as an investment hedge due to growing geopolitical threats: armed conflicts and invasions in Lebanon, Ukraine, the Gaza Strip and other hot spots have encouraged investors to opt for more conservative means of investing.

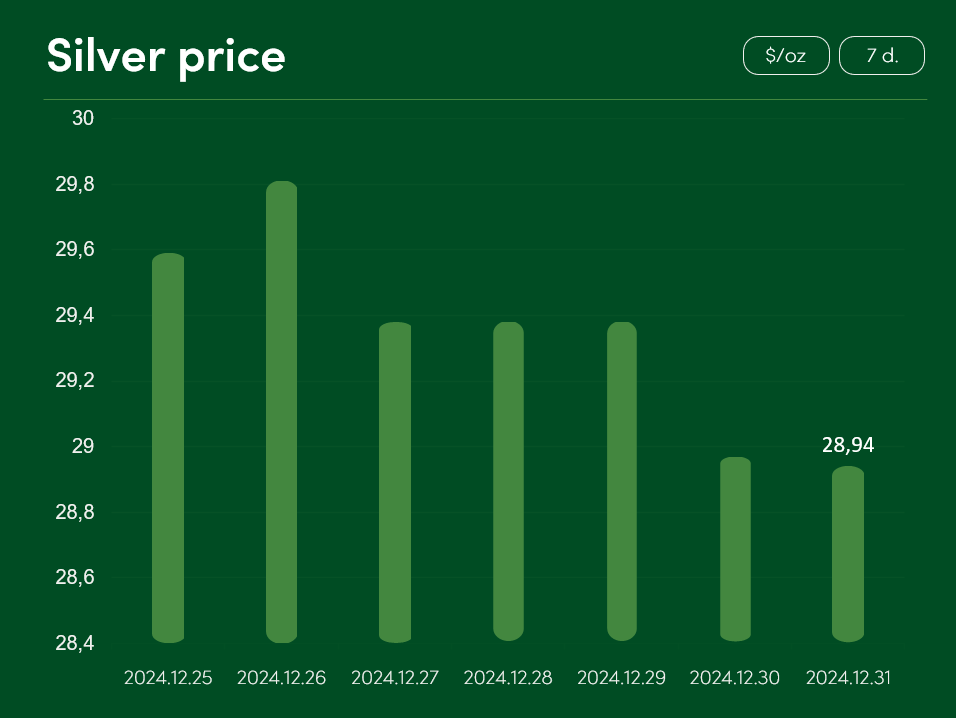

Between 25 and 31 December, the global silver market price experienced a slight correction, ending the last week at $28.94/oz.

The dim trend during this festive week does not reflect the general upward trend in the price of silver over the past year. Between the beginning of 2024 and the end of this year, silver market prices have risen by more than 25%, prompting some analysts to speculate that an even higher increase can be expected in the coming year.

Part of the reason for the rise in silver prices has been the fact that the precious metal, like gold, acts as an investment hedge in the face of geopolitical crises. Some small investors are impressed by the lower silver market valuations and prices and are more likely to opt for the latter instrument as a safe-haven option.

The variety of industrial uses for silver is also driving its growth. According to expert commentary on the analytical financial portal mint, silver’s industrial demand in areas such as renewable energy and electric vehicles could help the metal to even outpace gold’s growth rate in 2025.

The precious metal palladium ended the last week with a >4% price correction. Dim end of the year is also an accurate reflection of the overall price dynamics of this metal in 2024. The price increase of ~20% from the beginning of the year to the middle of autumn was erased by a sharp correction at the end of autumn of 2024. This correction also contributed to a further decline in the palladium market price. The year-end palladium market price ($910/oz) was ~8% lower than at the beginning of the year.

The platinum market price also recorded a significant price correction of ~3.5% last week, reaching $914/oz. Although the overall annual price trend for platinum is more optimistic than that for palladium, during this year the market price of this precious metal had fallen by >2%.

The platinum market has been under pressure partly due to the changing demand for the metal in the transportation sector: TradingEconomics analysts note that the declining demand for platinum in the production of catalytic converters for internal combustion engines and the slowing economic growth in China have contributed to the market’s sharply decreasing expectation of a deficit in the metal’s demand in 2025. It is difficult to predict further trends in the metal’s price, but one thing is clear: platinum is no longer a very viable option for many experts in the precious metals sector.

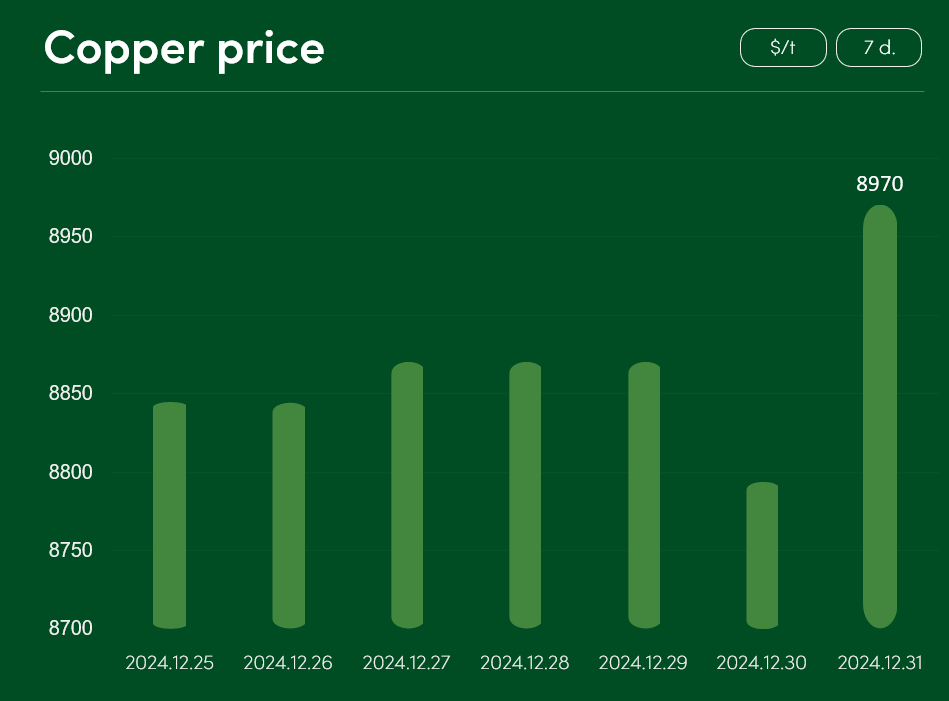

The price of semi-precious copper metal has risen by ~1.4% over the last 7 days to reach a level of $8970/t.

Although copper metal faced a number of sharp market fluctuations during 2024, this metal ends the year on a relatively optimistic note. From the beginning of 2024 to the end of the year, copper market prices rose by ~7.5%. According to some experts, this widely used industrial metal has a realistic chance of rising significantly higher in 2025 and ending the upcoming year with a price of 9500 $/t.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.