October 1, 2024

Market Overview 25-09-24 to 01-10-2024

After impressive price gains in the first half of September, precious metals markets have seen slight corrections and a minor pullback in overall investor optimism over the past week. To some extent, this result can be understood as a natural hesitation and uncertainty about the future direction of the record high market prices. While the raging geopolitical crises and armed conflicts are encouraging investors to allocate part of their portfolios to precious metals, investment optimism is also dampened by the recent comments from the US Federal Reserve about a more moderate plan for future interest rate cuts.

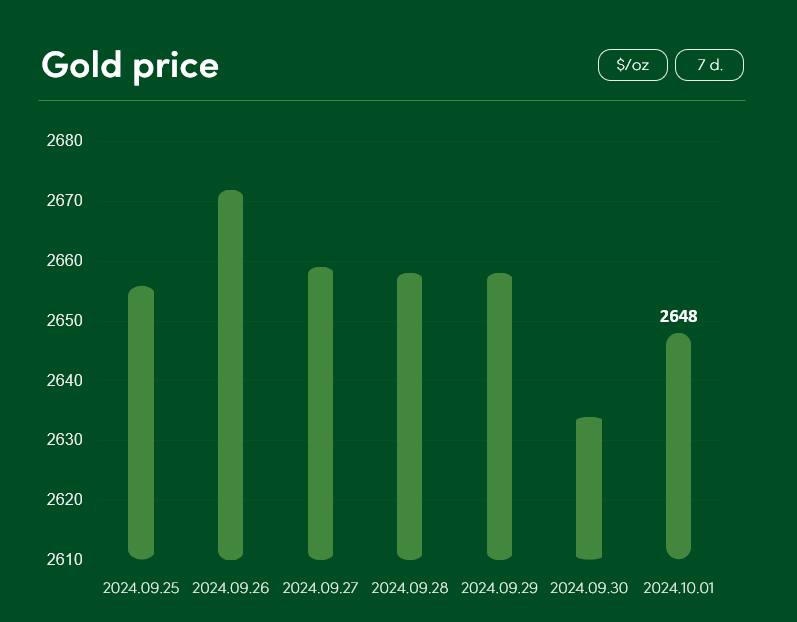

Gold prices on the exchanges fell by ~0.3% between 25 September and 1 October, and the precious metal started the October with a price of $2648/oz.

The gold metal, which has broken all-time price records many times this year, remains a very popular choice, both because of the reduction of interbank interest rates in various countries and because of the raging geopolitical crises. Some of these, such as the Israeli attacks in Lebanon, which according to the BBC have recently escalated into localised ground attacks, are becoming a serious threat to further escalation and large-scale armed conflict in the Middle East.

On the other hand, although gold is known as the main choice in the face of global turmoil, investors’ enthusiasm has been somewhat tempered by recent economic comments from the US. Federal Reserve Director J. Powell recently hinted that a 50 basis point rate cut should not be seen as the start of an aggressive interest rate cut period. He also mentioned that future US bank rate cuts are expected to come in more modest intervals of 25 basis points (0.25%).

Global silver prices fell by ~1.5% between 25 September and 1 October, reaching a price level of $31.36/oz. Obviously, the FED Director’s restrained comments had an impact on the precious metal’s investors.

The news on industrial silver demand looks much more positive. China, one of the largest users of the metal, has already cut its general bank interest rates this year and announced a separate decision in early September to cut interest rates on more than $5 trillion worth of housing loans.

Also on 17 September, the Central Bank of China announced its decision to cut the reserve requirement ratio for Chinese banks by 50 basis points (0.5%) in the near future. According to TradingEconomics, China’s monetary policy easings are helping to boost demand for silver in country’s electrification industry and solar panel manufacturing sphere.

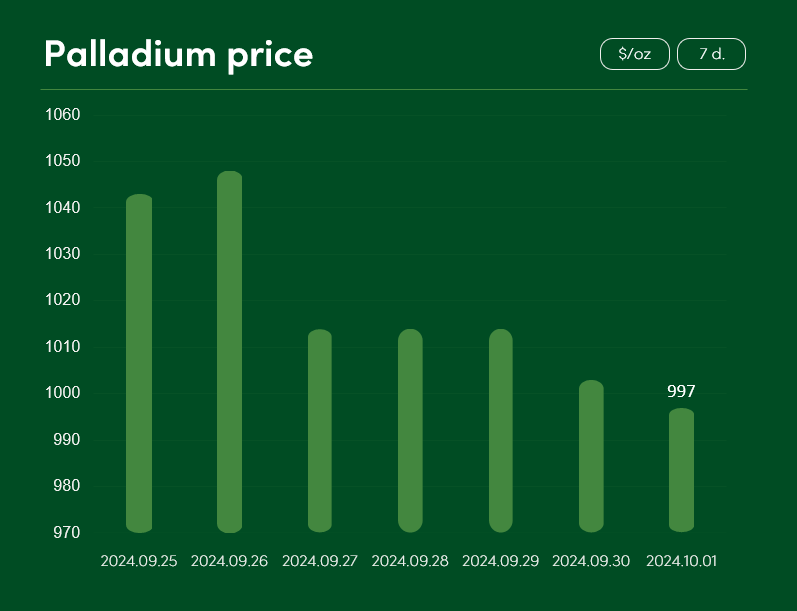

The palladium price recorded a larger price decline of ~4% last week, reaching the $997/oz mark on 1 October.

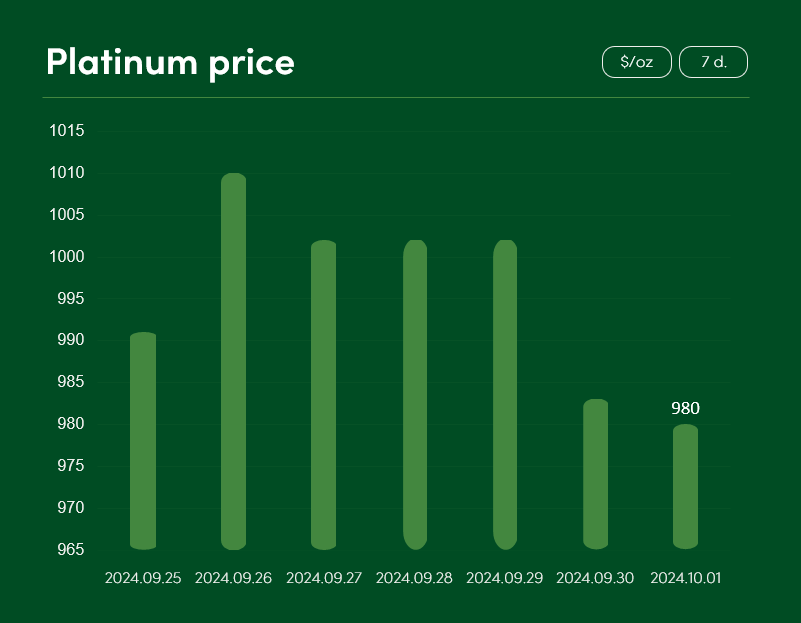

The platinum precious metal experienced a much milder correction last week, with a >1% fall in the price of the metal between 25 September and 1 October to $980/oz.

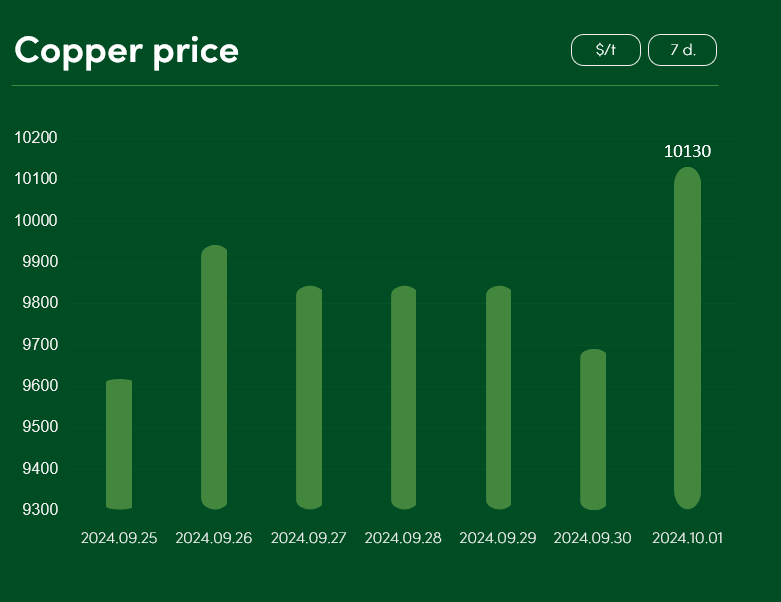

Meanwhile, the semi-precious copper metal pleased investors with its price increase in September. Copper prices, which recorded slight corrections on the exchanges last week, rose by >7% between 25 September and 1 October, reaching a price point of $1,030/t.

The increase in copper market prices this autumn is undoubtedly seen partly due to monetary easing decisions in the Chinese market. According to Statista, the Chinese market was responsible for as much as 57% of total global copper consumption in 2023. It is clear that the economic stimulus in this market, which encourages local consumption, production, and export, will have a positive impact on global copper market prices as well.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.