September 30, 2025

Market Overview 24-09-2025 to 30-09-2025

Last week, the precious metals markets extended their period of optimistic growth. Investor interest in precious metals has recently been strongly linked to political tensions in the U.S., planned new international tariffs, expected interest rate cuts, and an analyst-identified supply deficit in precious metals.

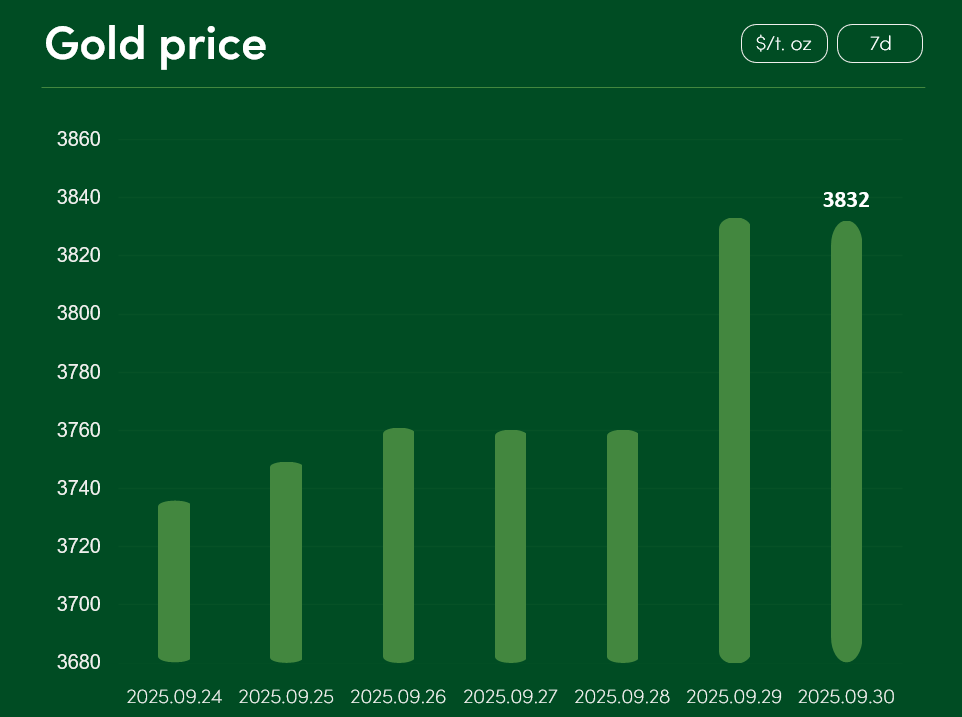

The global gold price rose by more than 2.5% between September 24 and September 30, reaching $3,832/t. oz.

New record all-time highs for gold are partly supported by U.S. political and economic instability. The U.S. government faces a potential temporary shutdown if Democrats and Republicans fail to reach an agreement on federal spending in the nearest future.

The rise in precious metal prices is also fuelled by new escalations in the U.S. trade war sphere. Donald Trump announced that starting October 1, the U.S. will impose import tariffs on heavy trucks, pharmaceuticals, and various types of furniture.

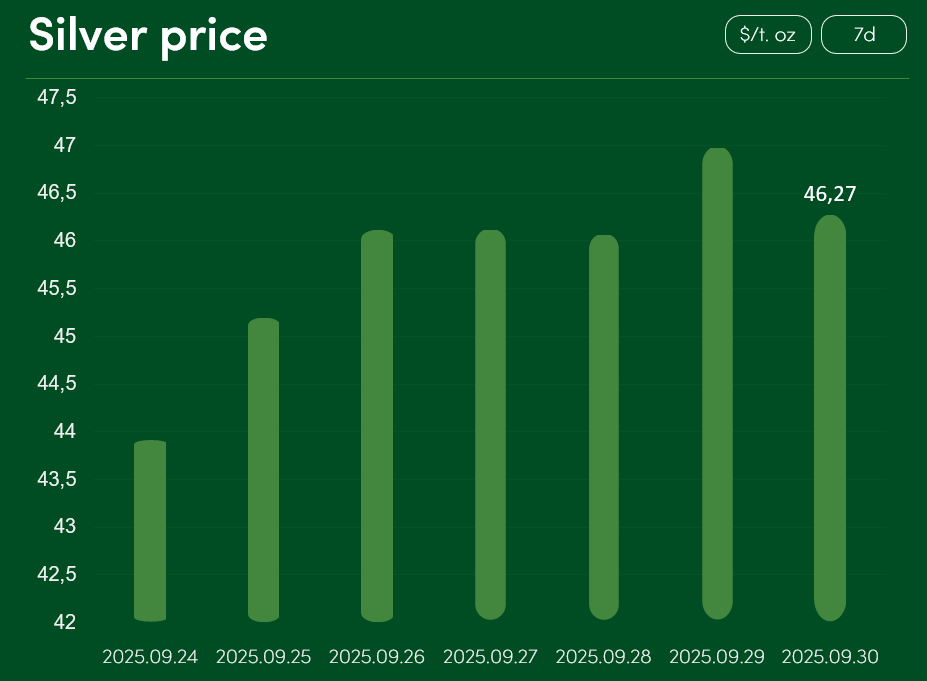

The global silver price rose by more than 5.3% between September 24 and September 30, reaching $46.27/t. oz.

Silver price growth is supported both by U.S. political-trade turmoil and by U.S. monetary policy favourable to the precious metals market and consumption growth. In mid-September, the FED cut U.S. benchmark interest rates by 25 basis points (0.25%). Based on current market data, there is little doubt that an identical decision will be taken at the October FED meeting.

Silver price growth is also driven by deficit supply-demand forecasts. Experts note that the silver market will record a supply shortage for the fifth consecutive year; for 2025, the deficit of the metal is expected to reach ~117 million ounces.

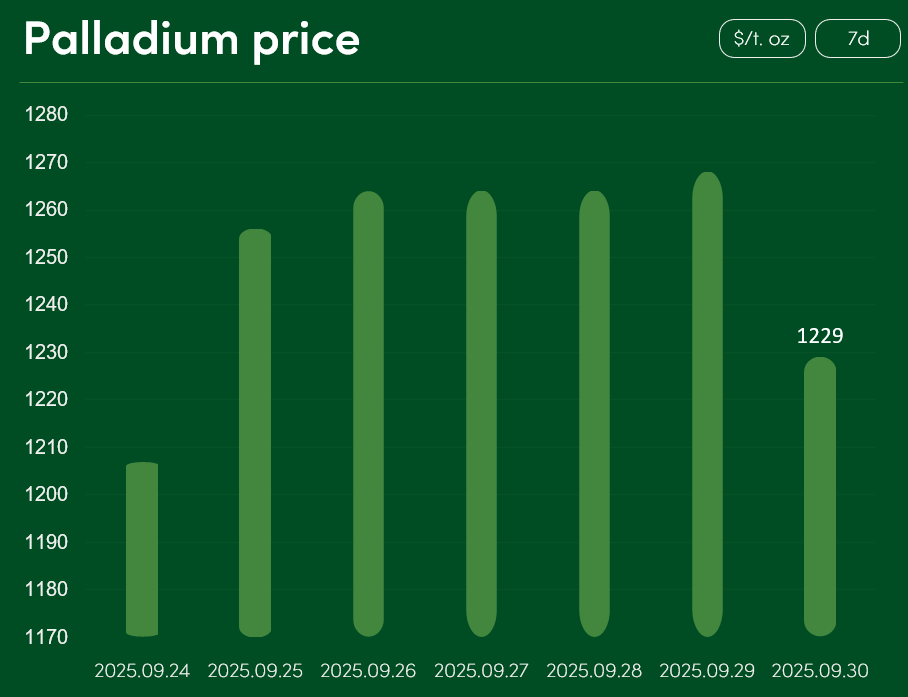

The global palladium price saw a relatively small increase between September 24 and September 30; on September 30, palladium was priced at $1,229/t. oz.

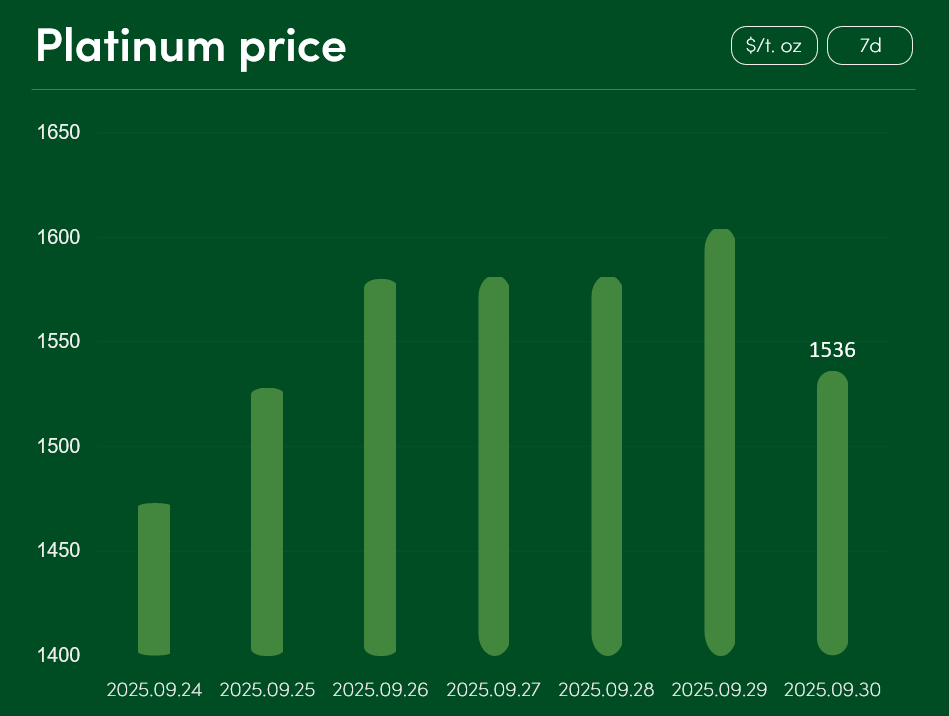

The global platinum price rose by more than 4% between September 24 and September 30, reaching $1,536/t. oz.

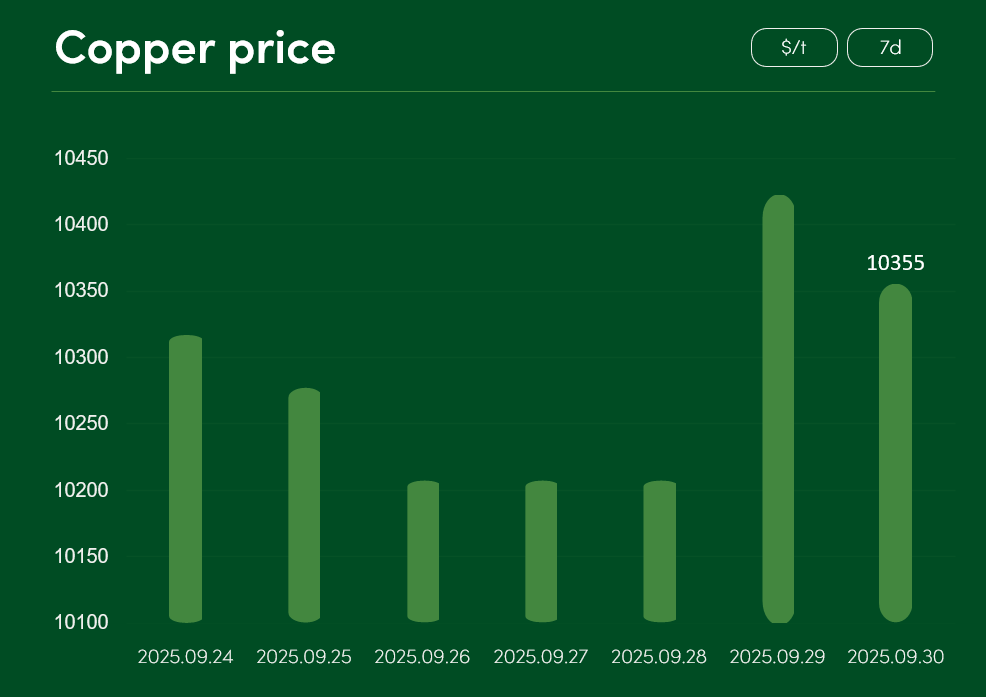

The global copper price experienced minimal fluctuations between September 24 and September 30. On September 30, the market price of copper reached $10,355 per tonne.

Copper price growth and consolidation at the $10,000 per tonne mark in recent weeks have been supported by a sharp decline in Chinese supply. Official projections suggest that in 2025 and 2026, output of China’s TOP 10 non-ferrous metals (including copper) will grow only 1.5% annually; this is significantly lower than the previously forecast 5% growth.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.