December 29, 2025

Market Overview 23-12-2025 to 29-12-2025

Unusual precious metals movements during the holiday period

As the major winter holidays approached, the markets of key precious metals last week experienced highly unusual price movements. These were partly driven by the holiday trading schedule of major metal exchanges. The atypical price dynamics were also influenced by significant developments in the geopolitical sphere and optimistic forecasts by market analysts. Looking at the past 7-day period as a whole, the global gold price experienced only minimal changes. On December 29, the exchange price of this precious metal reached 4,492 USD per troy ounce.

The relatively small price movements were undoubtedly influenced by the limited trading schedule of global metal exchanges during the holiday period. Planned non-trading days and early holiday market closures affected both CME Group (the leading group of precious-metals futures exchanges) and the London Metal Exchange (the most important industrial-metals exchange), as well as the agendas of other key market institutions.

The recent sluggish increase in gold prices has also been supported by tangible progress in the Russia–Ukraine peace negotiations. Ukrainian President Volodymyr Zelensky stated that 90 percent of a 20-point peace plan had been agreed with the United States. Meanwhile, U.S. President Donald Trump commented on Sunday that Ukraine and Russia are “closer than ever before” to reaching a deal.

From December 23 to December 29, the global silver price increased by more than 8.8%. On December 29, the price of silver reached 77.7 USD per troy ounce.

Despite easing geopolitical tensions in the Russia–Ukraine conflict, further price growth is forecast for silver, which last week reached new all-time highs. Analysts expect that, under an optimistic scenario, the global silver price could reach 90 USD per troy ounce in 2026.

Investment demand for silver is also being supported by the prolonged geopolitical crisis in the Middle East and the escalation of tensions between the United States and Venezuela. It is expected that this year the total deficit of silver in the market (including investment demand) will reach about 187.6 million troy ounces.

From December 23 to December 29, the global palladium price fell by more than 6.5%, reaching 1,732 USD per troy ounce.

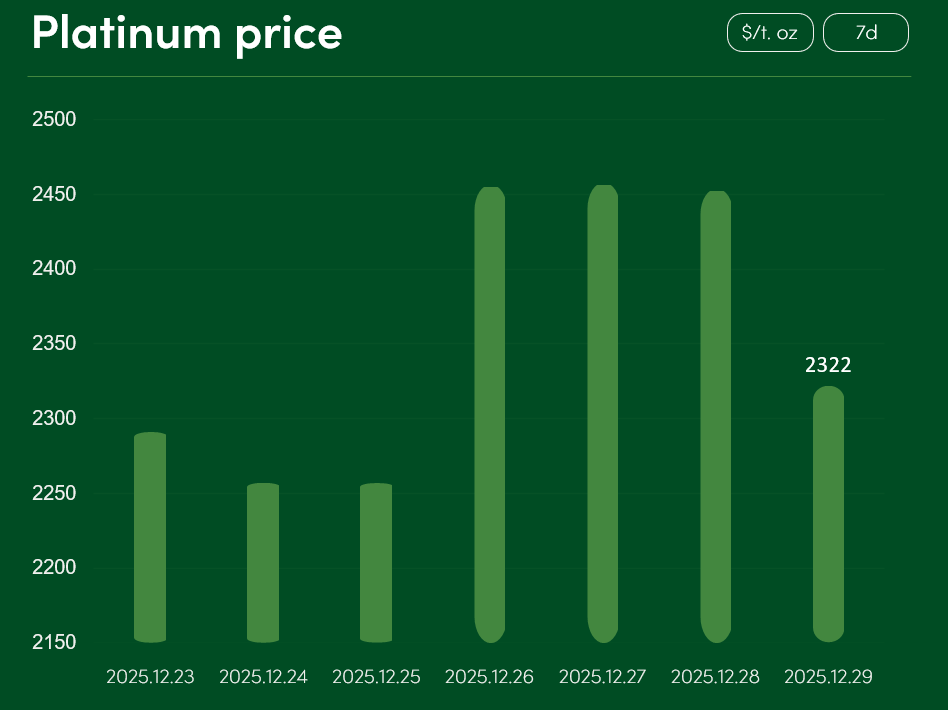

Over the same period, the global platinum price increased by more than 1.3%, reaching 2,322 USD per troy ounce.

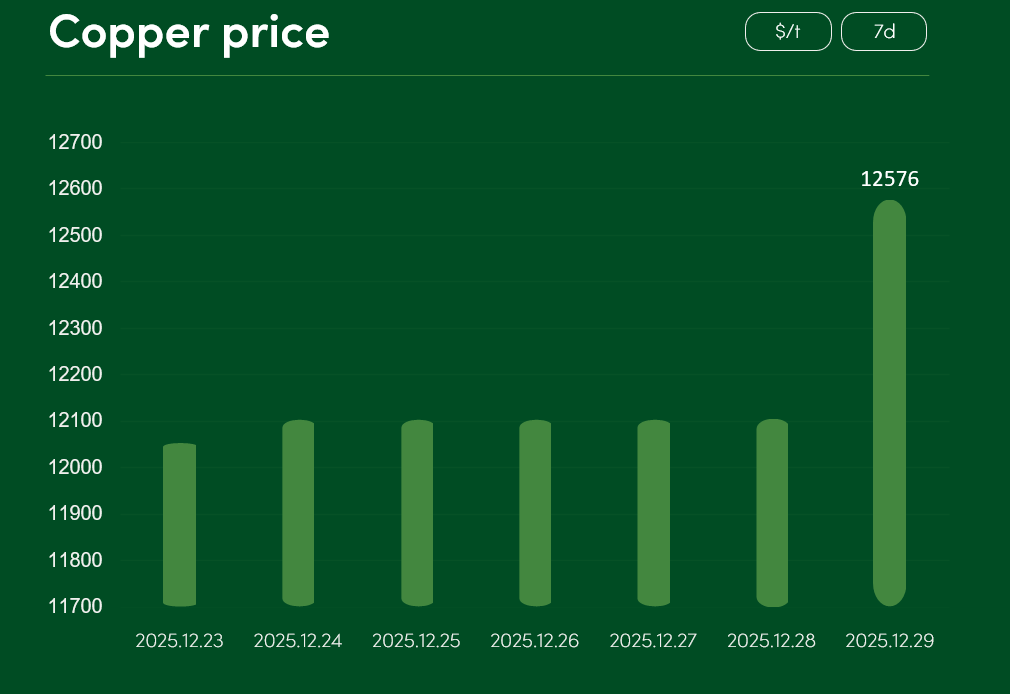

Over the past 7 days, the global copper price increased by more than 4.3%, reaching 12,576 USD per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.