October 29, 2024

Market Overview 23-10-24 to 29-10-2024

Precious metals markets have seen solid, and (to some point) unexpected price surges over the past week. As October draws to a close, the investment appeal of various precious metals has been reinforced by the tense geopolitical situation in the Middle East region, the talks in the US about the imposition of new sanctions on Russia, the upbeat financial indicators of the world’s most powerful economies, and the anticipation of upcoming favourable monetary policy decisions.

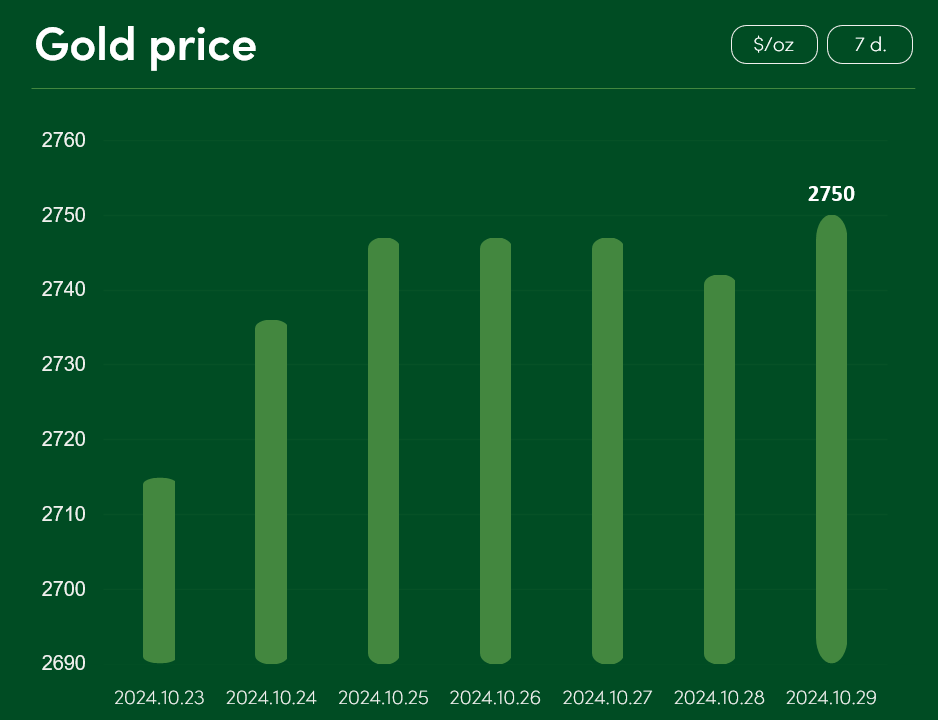

The global gold price rose by ~1.3% on the metal exchanges between 23 October and 29 October, reaching a price point of $2750/oz.

Gold, which set great many of new all-time price records during this autumn, has been performing well recently, thanks to both the extremely accommodative monetary policies of the world’s major powers and the overall warming of the financial indicators of major global economies.

The US is following the growth-boosting economic trend of the Europe. European Central Bank cut its interbank interest rates for the third time this year, and, although the Fed only made its first rate cut of 0.5% at the end of September, according to TradingEconomics analysts, the markets are pricing in as much as a 98% probability of a further 25 basis point (0.25%) cut in US bank rates in early November. Clearly, the availability of cheaper borrowing in the context of tense geopolitical situation around the world is encouraging investors to move more actively into spheres of precious metals investment and mining.

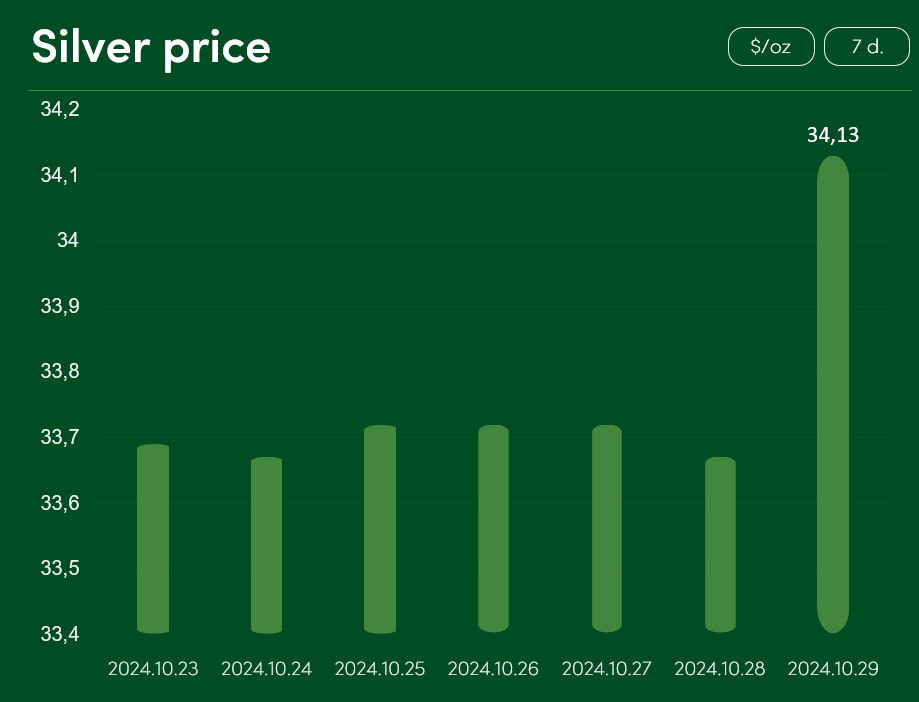

The precious silver metal, which has been confidently surging to the level of all-time price highs since the beginning of the year, recorded a more modest increase of ~1.35% between 23 October and 29 October, reaching $34.13/oz.

Silver, which recorded a price increase of almost 20% between the beginning of September and the end of October, has recently attracted more attention as an investment instrument used to protect against geopolitical threats.

According to TradingEconomics experts, silver’s success over the past week has been driven by rising political tensions in the US with the upcoming presidential elections, as well as by protracted conflicts in the Middle East. Israeli missile strikes in Lebanon’s Bekaa Valley killed at least 60 people and left dozens injured. The persistence of high tensions in the region and the fear that conflicts could escalate into a full-scale Israeli-Arab war have led investors to look for safer alternatives to put their money to work. One of those options is investing into silver.

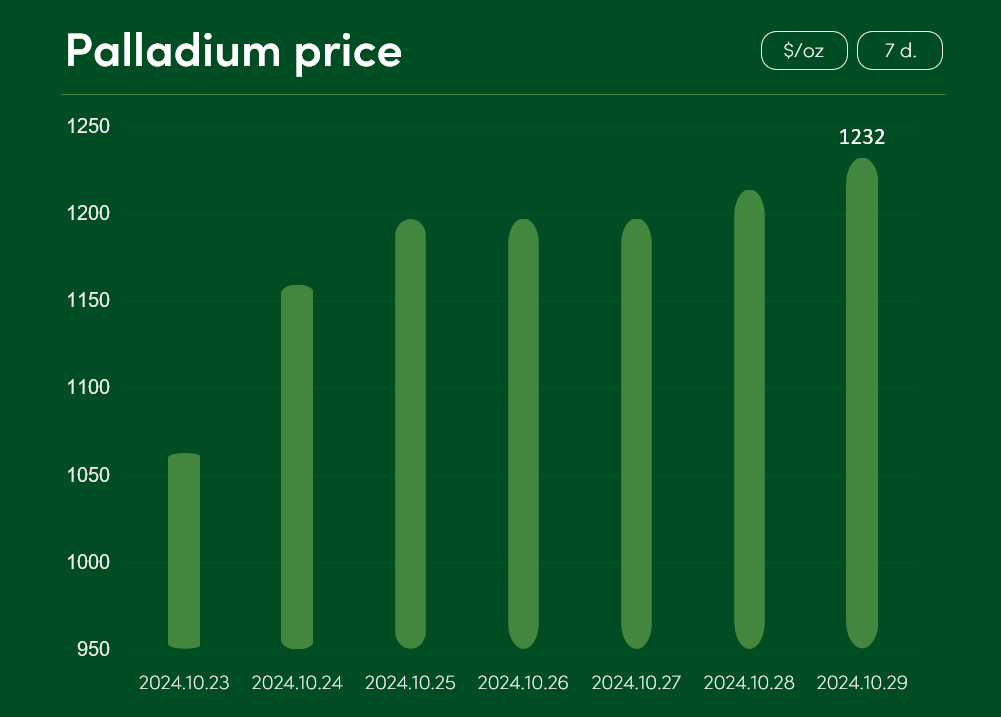

The price of palladium recorded a phenomenal period of growth last week: between 23 October and 29 October, the price of this metal rose by more than 15.5% and reached a point of $1232/oz.

The spike in palladium prices can be partly attributed to new US sanctions efforts: according to Bloomberg, US representatives at the G7 meeting in Washington may have expressed a desire to impose joint sanctions on Russian palladium and titanium.

The message of import sanctions has been met with a strong market reaction, precisely because of Russia’s unequivocal dominance in the palladium mining sector. It is estimated that the Russian mining giant MMC Norilsk Nickel alone accounts for around 40% of global palladium supply.

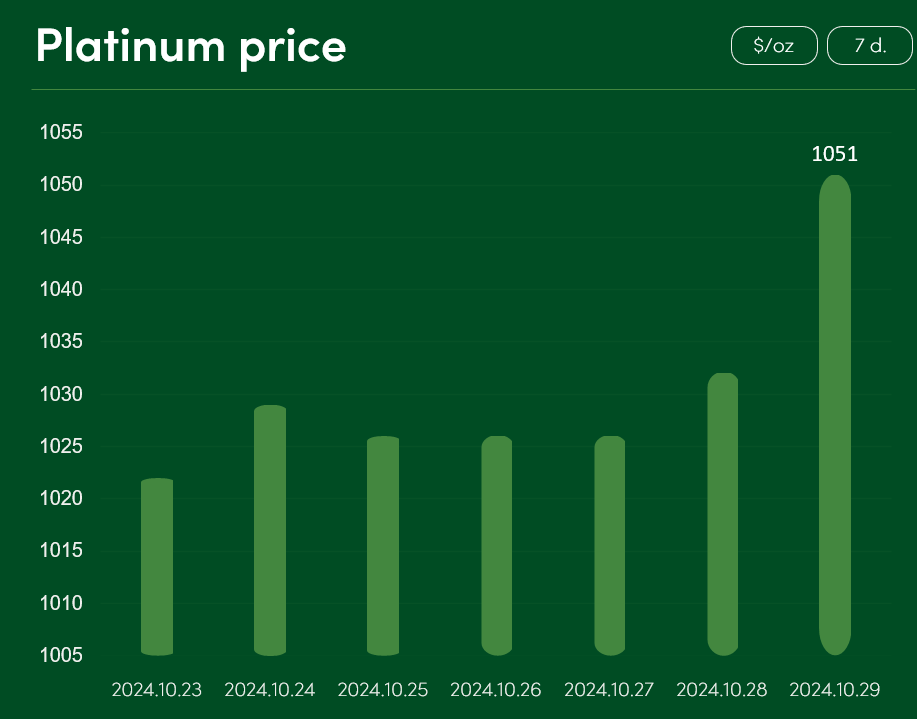

The platinum price rose by >2.5% between 23 and 29 October to a price of $1051/oz.

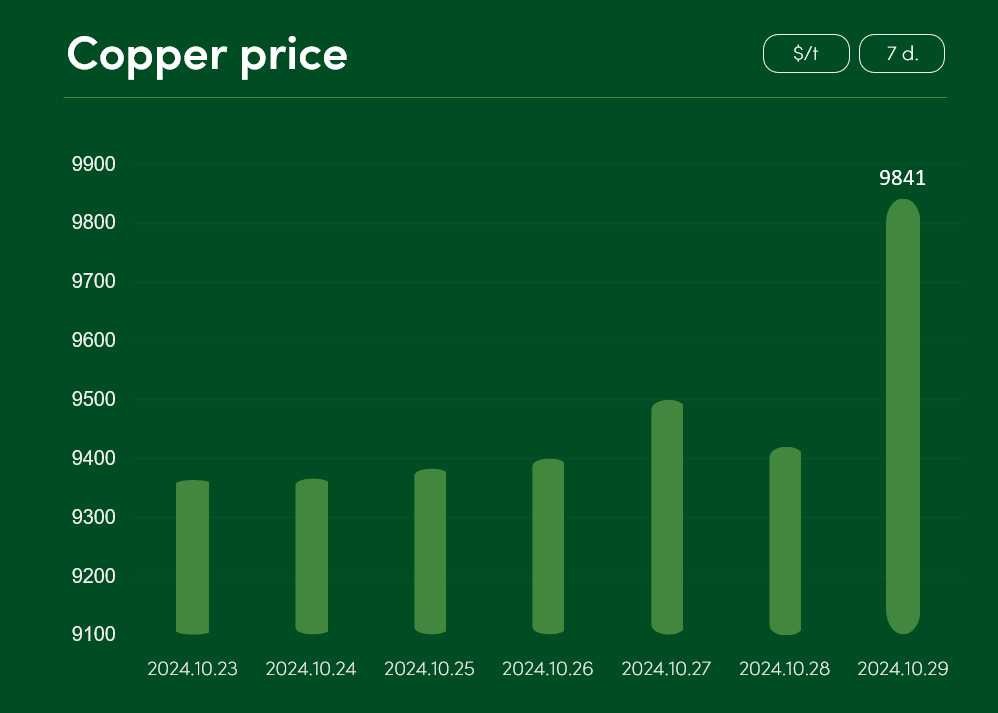

Semi-precious copper metal prices increased by ~5% between 23 October and 29 October to reach $9841/t.

During this September-October, the markets have already observed a couple of similar rises in copper prices after corrections. Although copper prices (which have some serious trouble staying at $10,000/t price level for longer periods of time) are facing the short term corrections partly due to economic problems of China (copper‘s main consumer), investors are looking forward to possible positive changes.

During November 4-8, upcoming Chinese National People’s Congress is expected to bear news, related to the introduction of additional governmental measures, meant to stimulate the Chinese domestic economic growth. The positive outcome would serve the growth of demand for various basic resources of industrial production in China, including more significant demand boost for copper.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.