July 29, 2025

Market Overview 23-07-2025 to 29-07-2025

Precious metals market experienced a correction period last week. Investor interest in precious metals was limited by progress and eased tensions in the sphere of global trade agreements, as well as by the strengthening of the US dollar.

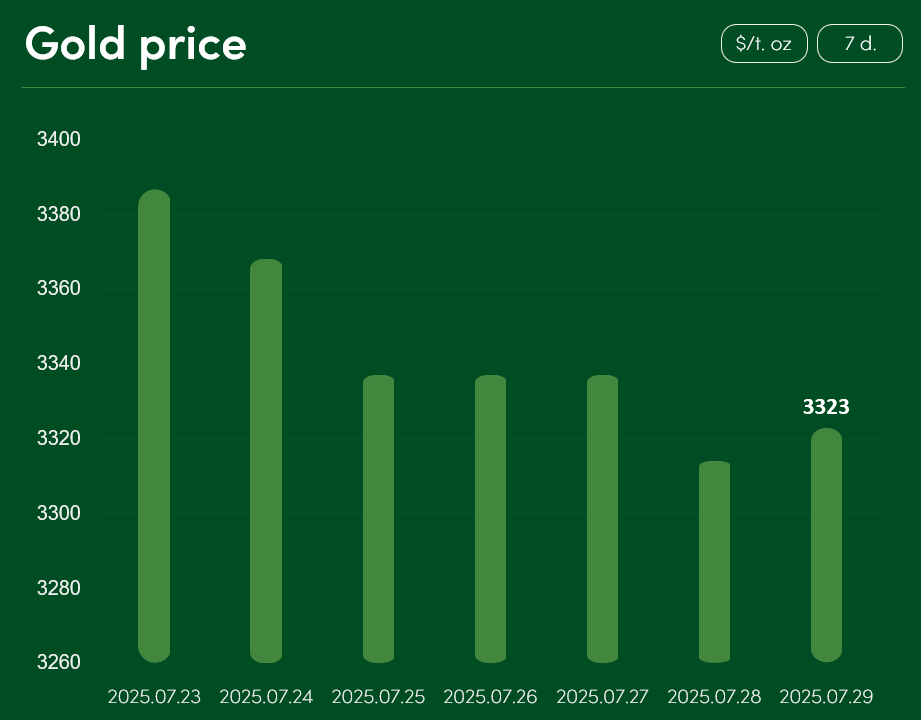

From July 23 to July 29, the global gold price decreased by more than 1.85%, reaching $3,323/troy oz.

The price correction was influenced by factors such as the trade agreement reached between the US and the EU. Following the official agreement on a reduced 15% import tariff on goods imported into the US from Europe, the world interpreted this as a significant sign of de-escalation in global trade wars.

As the markets await further progress in trade negotiations, expert attention is turning to China – it is expected that the current trade war truce between the US and China will soon be extended. Such a result could potentially trigger further price corrections in the precious metals market.

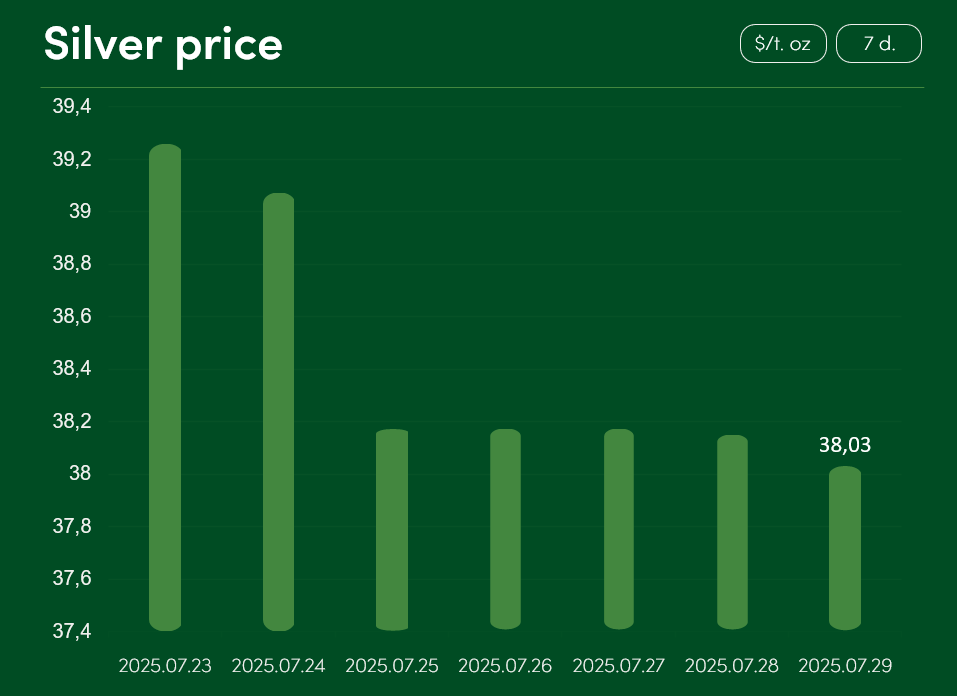

The global silver price from July 23 to July 29 experienced a correction of more than 3%, reaching $38.03/troy oz.

Silver’s price decline was driven by both trade agreement progress and the resulting appreciation of the US dollar. As the US dollar entered a period of optimistic growth, silver, gold, and other precious metals denominated in US dollars became relatively more expensive purchases for foreign currency holders.

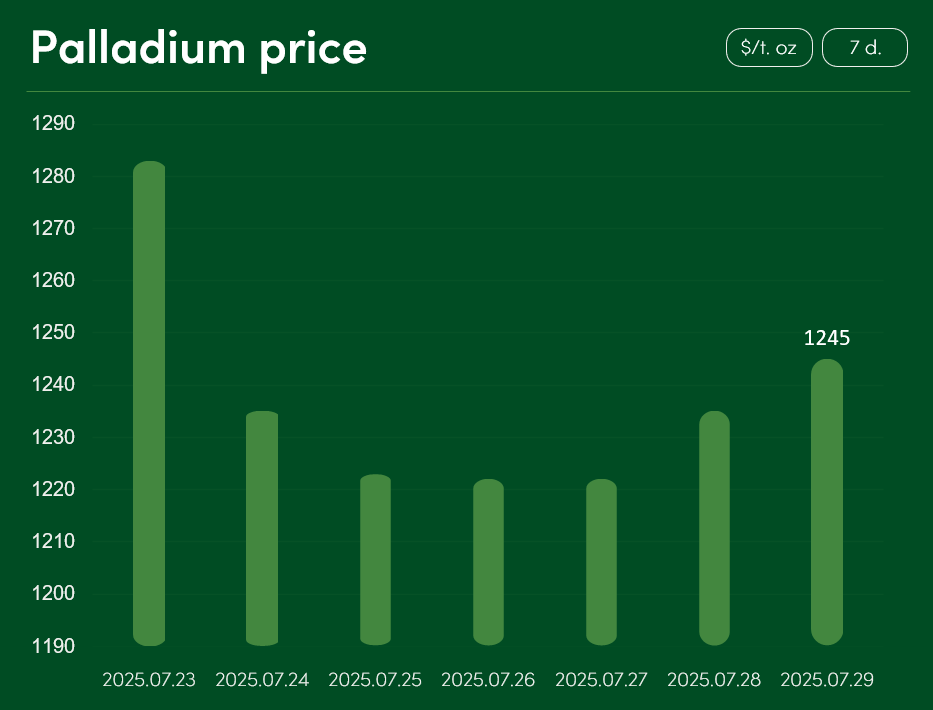

The global palladium price declined by approximately 2.9% from July 23 to July 29, reaching $1,245/troy oz.

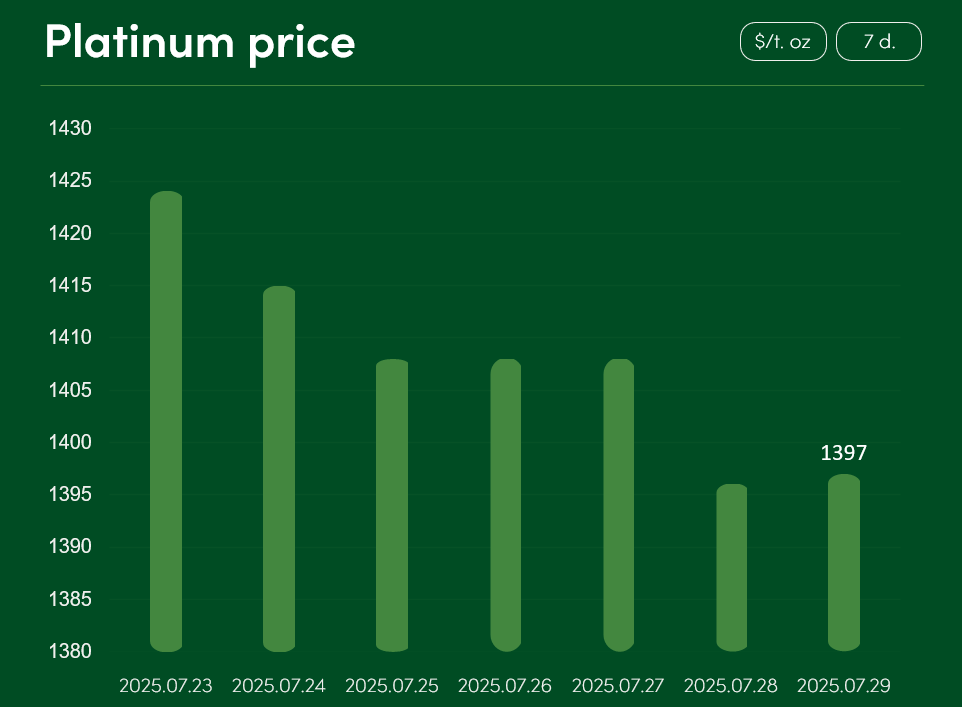

The global platinum price fell by more than 1.8% during the same period, reaching $1,397/troy oz.

Platinum price corrections are driven by the growing stability of global trade relations as well as stabilizing supply of the metal in international markets. South Africa, the leading platinum-producing region, reported a 10.4% increase in PGM output in May.

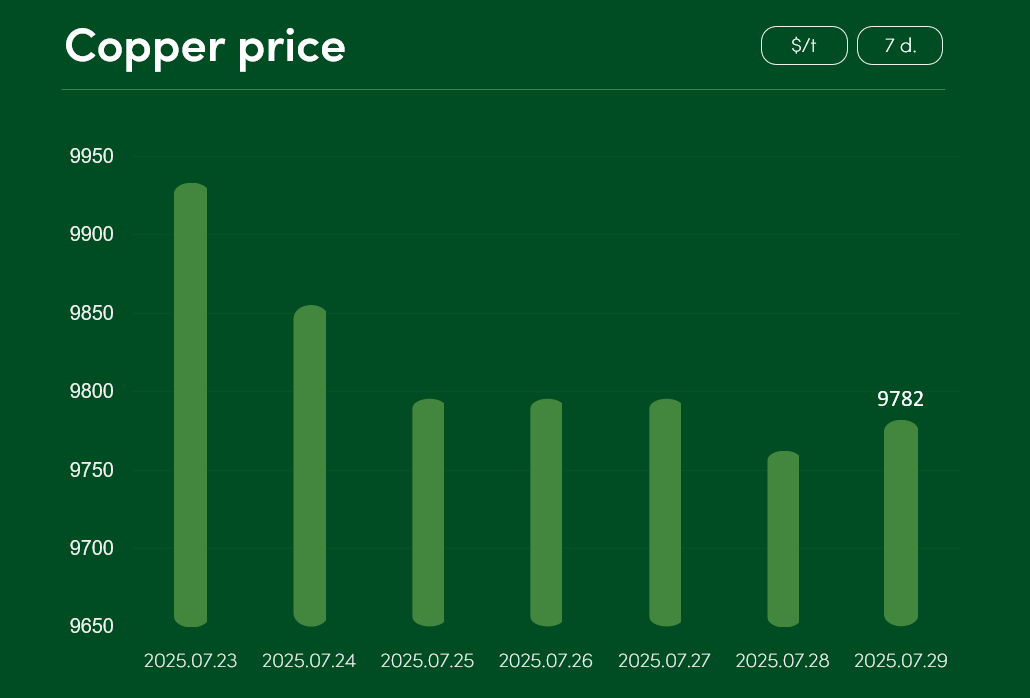

The global copper price slipped by approximately 1.5% from July 23 to July 29, reaching $9,782/t.

The correction in this widely used industrial metal was strongly influenced by uncertainty surrounding the global US copper trade import tariff, which is set to officially take effect on August 1. The Trump administration has not yet provided clarification on which exact copper products will be affected by the planned tariff, nor how authorities will treat copper shipments already en route to US.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.