April 29, 2025

Market Overview 23-04-2025 to 29-04-2025

Last week saw no shortage of political statements or economic news that could contribute significantly to a more active price movement in the market of precious metals. The main news was related to the de-escalation of the US import wars, the supply problems in the Chinese market and the optimistic monetary decisions of the world’s major economies.

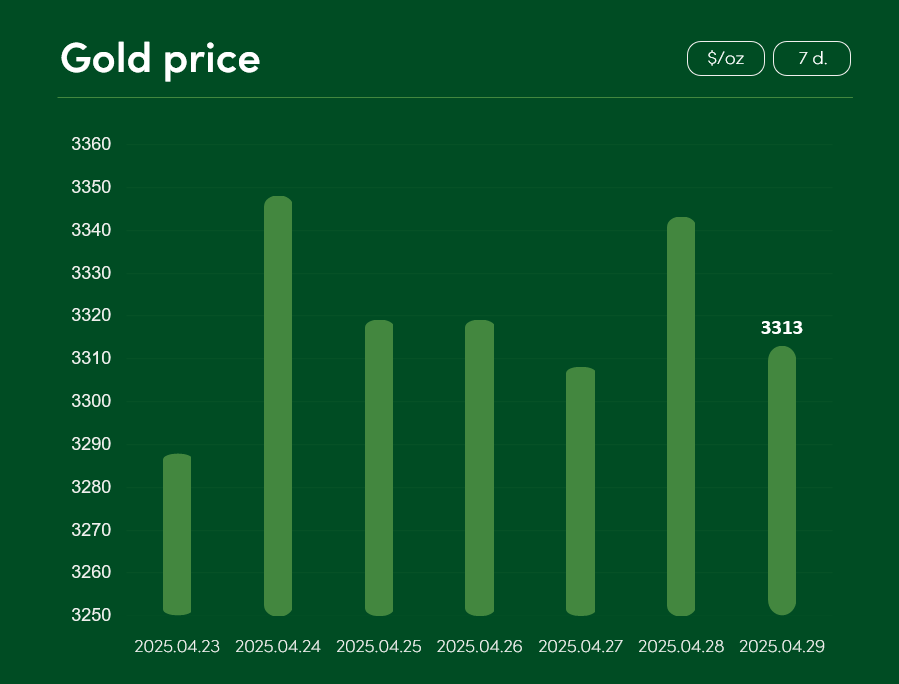

The global gold price rose by >0.75% between 23 April and 29 April, reaching $3313/oz on 29 April.

The recent slowdown in gold’s appeal as an investment hedge is not only driven by this year’s repeatedly broken all-time highs. The easing of tensions in the US trade wars is also restoring investor confidence. On Monday, US Treasury Secretary Scott Bessent stated that, during the current 90-day postponement of new trade tariffs, several countries had already approached the US with “very attractive” trade offers. He also emphasized that a favourable trade deal with the Indian government could be reached in the near future.

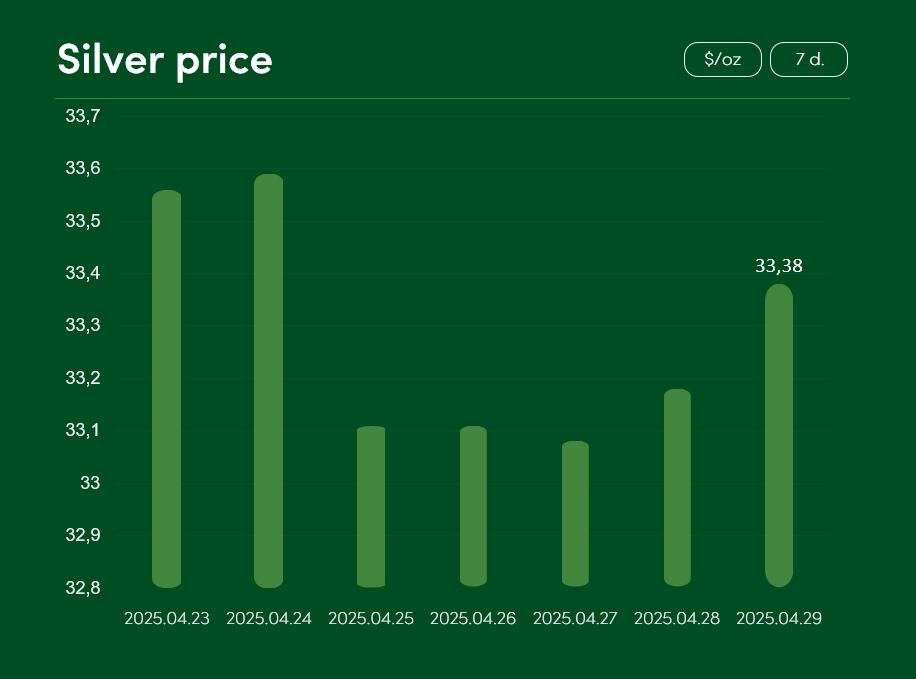

The global silver price fell by ~0.5% between 23 April and 29 April to $33.38/oz.

Silver metal, which is actively used in both investment and industrial production, has recently been on the rise due to both the prevailing geopolitical crises and favourable monetary policy decisions in the world’s major economies. Actively applied interest rate cuts may have a particularly favourable impact on silver prices in the short-medium term.

With inflation in the UK falling to 2.6%, the Governor of the Bank of England, Andrew Bailey, has signalled a likely decision to cut interest rates as early as next month. The central banks of Poland, Australia and Canada have also signalled possible rate cuts in the near future. Financial policies in the wealthy markets that encourage consumption are likely to contribute to a consolidation of silver at higher price levels.

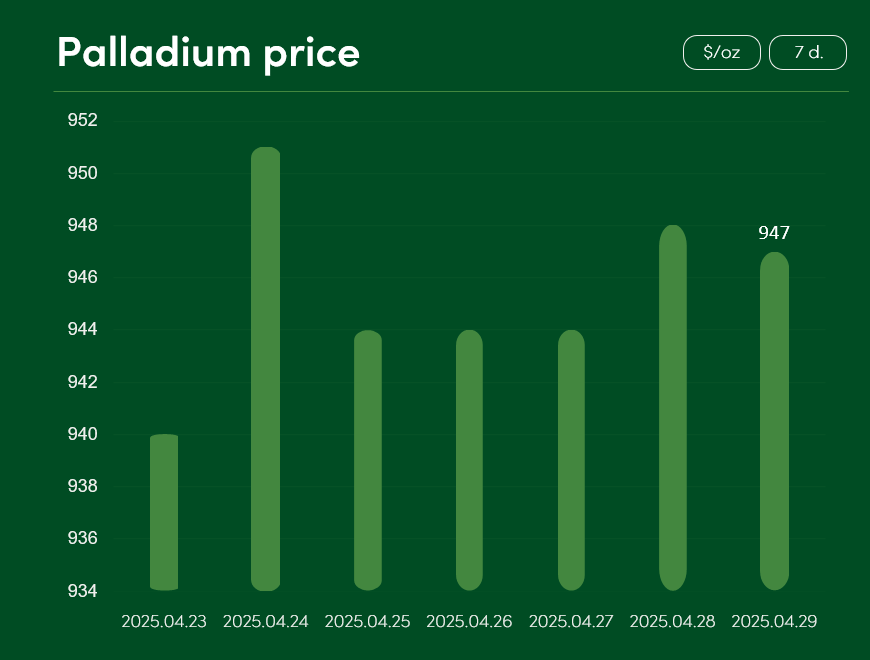

The global palladium price recorded minimal changes between 23 and 29 April. On 29 April, the price reached 947 $/oz.

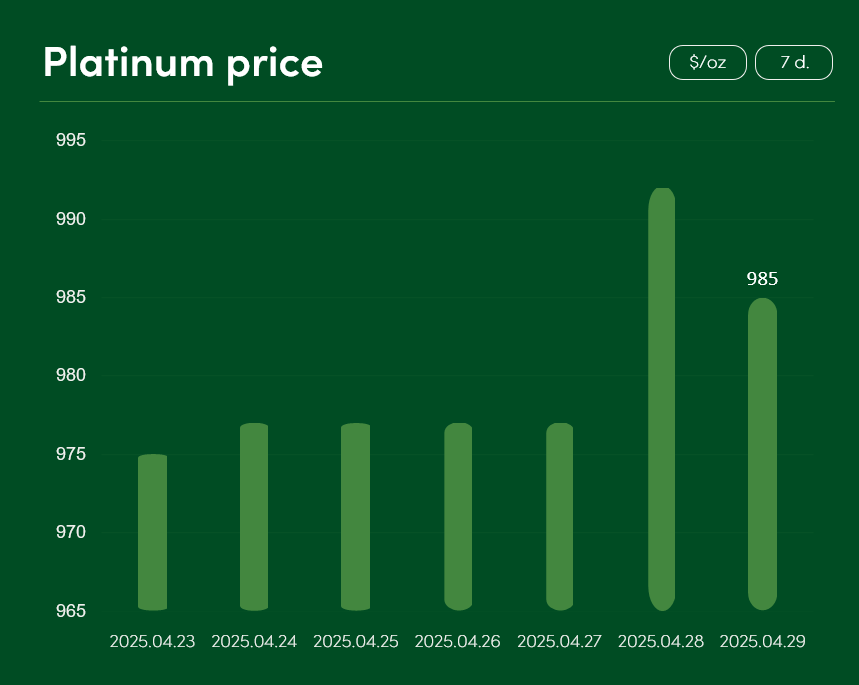

The global platinum price recorded a minimal price increase of ~1.1% between 23 April and 29 April, reaching 985 $/oz on 29 April.

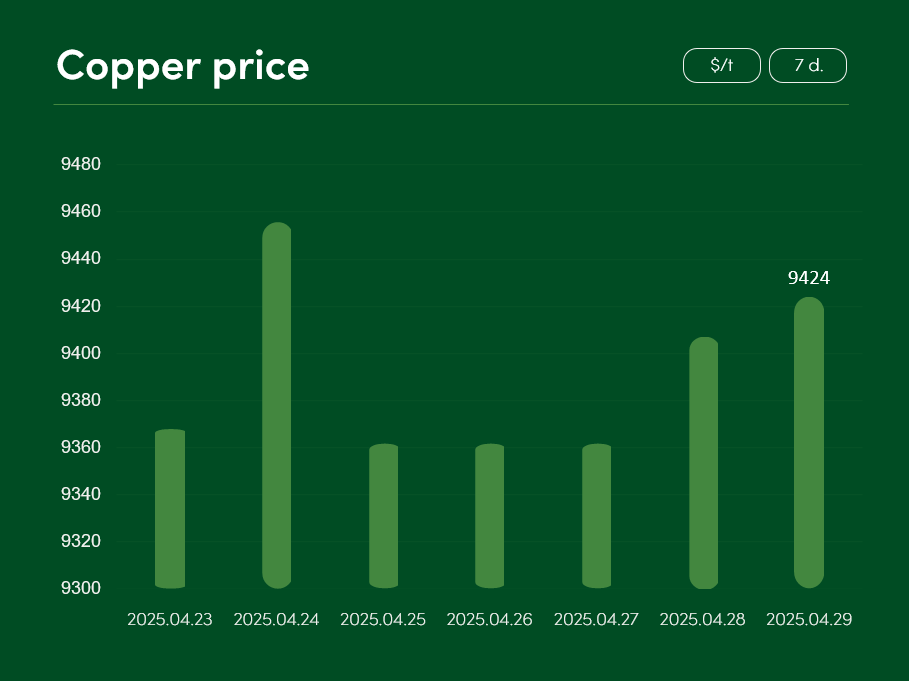

The global copper price increased by 0.6% between 23 April and 29 April, reaching $9424/t.

The recent rise in copper prices has been fuelled by growing concerns about possible US import tariffs on the industrial metal, as well as by growth of supply problems in China, one of the main markets of copper.

China recently reported a record decline in copper stocks. This market has also been experiencing copper refining/production problems for some time now due to a shortage of copper concentrate and other reasons. This might contribute significantly to a more pronounced shortage of copper and an increase in the price of this industrial metal in the short-medium term.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.