October 28, 2025

Market Overview 22-10-2025 to 28-10-2025

Precious Metals Market Continues to Decline!

Last week, the main precious metals experienced a more pronounced downturn. This was driven by both an evident easing of risks in US–China trade relations and growing investor concerns about the overvaluation of key precious metals.

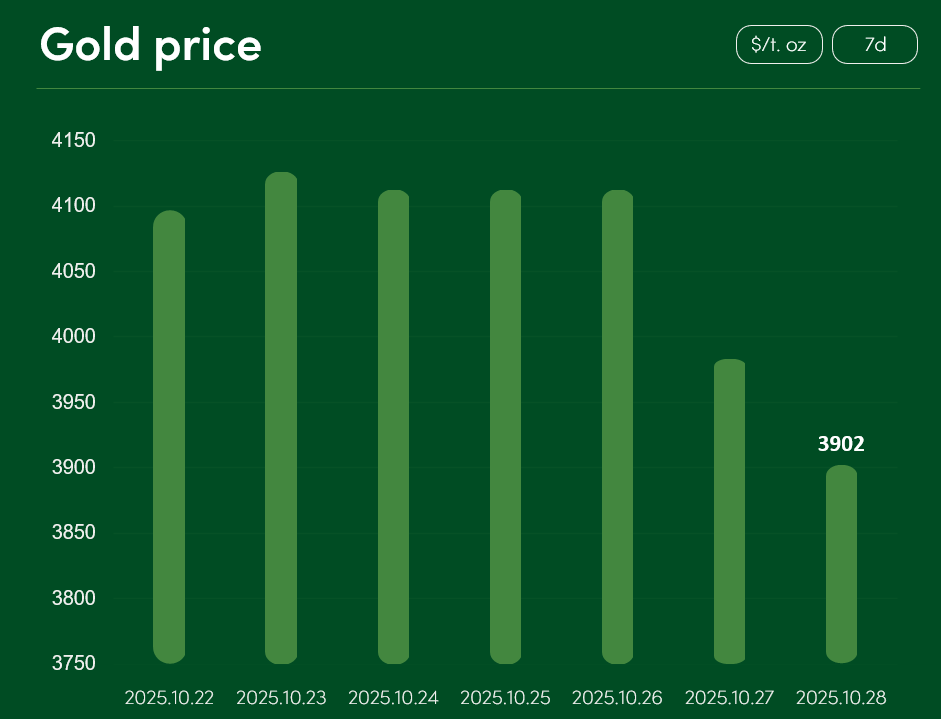

The global gold price decreased by approximately 4.7% from 22 to 28 October, reaching $3,902/t. oz.

The decline in gold prices is significantly influenced by the easing of tensions in international US–China trade relations. Following a meeting between representatives of both countries in Malaysia, US Treasury Secretary Scott Bessent stated that additional 100% tariffs on China are effectively “off the table.”

It was also reported that US and Chinese officials agreed on the guidelines for a trade deal, and as Donald Trump prepares to meet Xi Jinping, he announced that the countries will conclude a mutually successful agreement. Should this expectation materialise, increased global trade stability could notably reduce the long-term demand for precious metals in international markets.

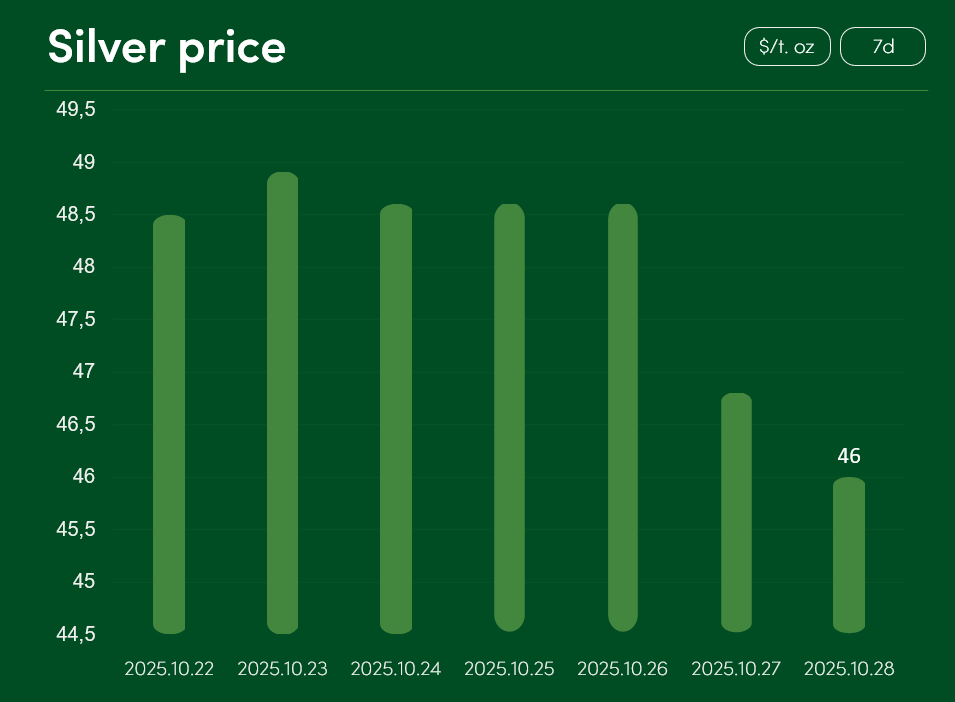

The global silver price fell by more than 5% from 22 to 28 October, reaching $46/t. oz.

The decline in silver prices is undoubtedly driven by both rising stability in the global trade sector and increasing concern among market participants over the excessively high valuation of silver as an investment asset.

However, despite a clear downward correction following record highs, stronger market declines are likely being offset by the 96% probability of a US interest rate cut at the end of October. The gradual reduction of US interest rates supports a weaker US dollar exchange rate, thereby enhancing the attractiveness of dollar-denominated precious metals (such as gold and silver) in international markets.

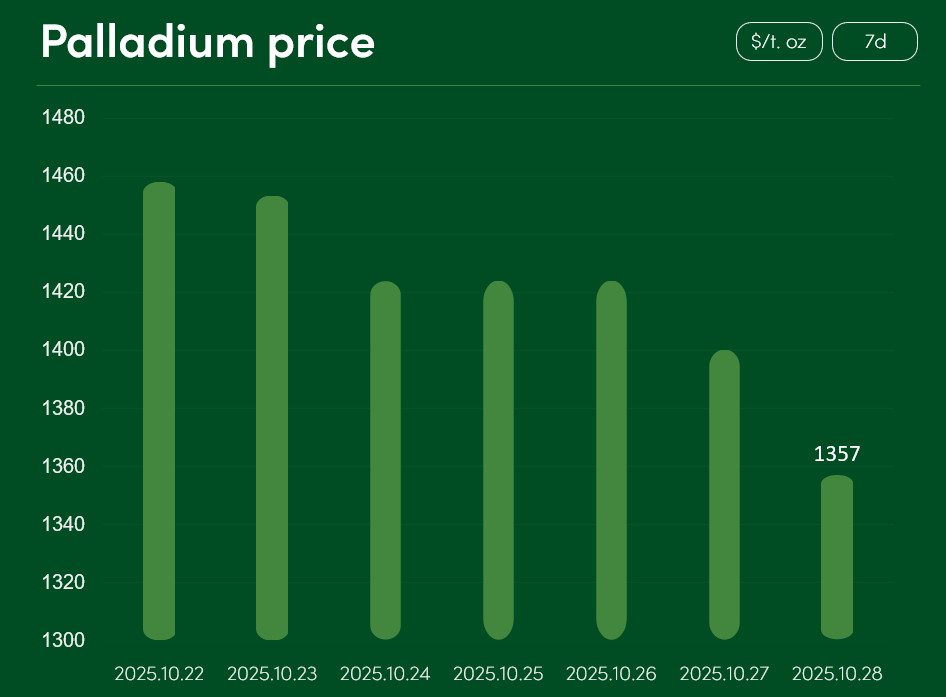

The global palladium price decreased by approximately 6.9% from 22 to 28 October, reaching $1,357/t. oz.

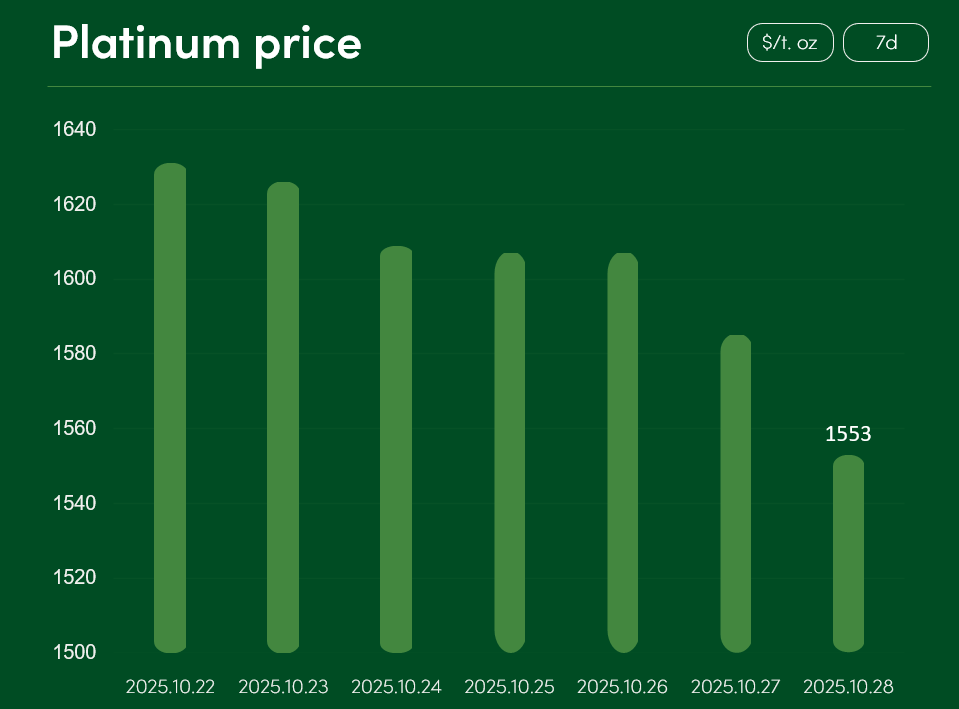

The global platinum price declined by more than 4.7%, reaching $1,553/t. oz.

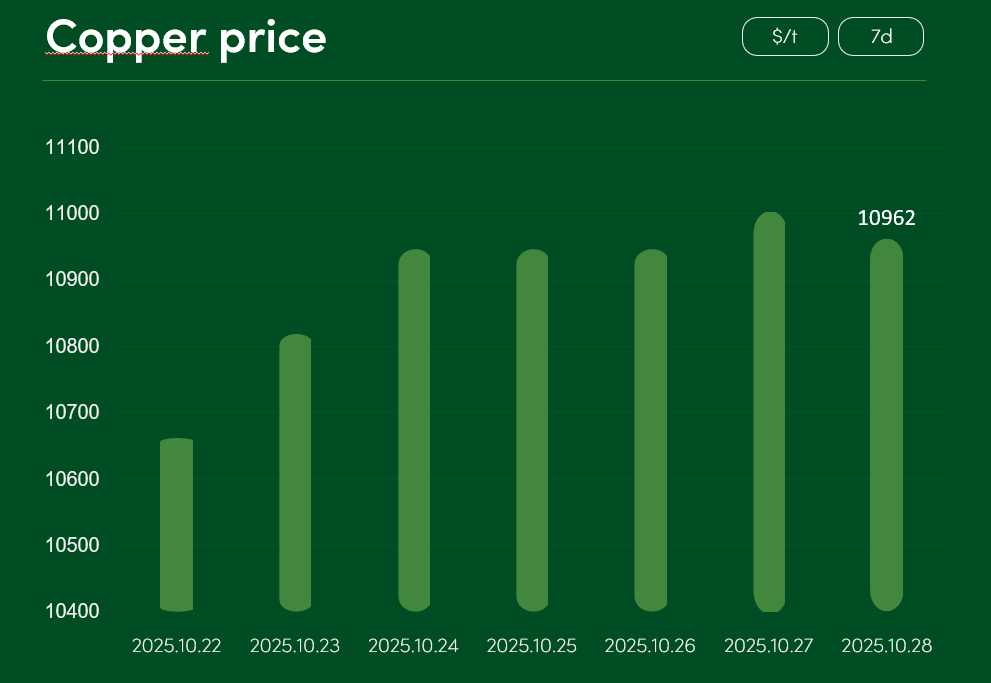

Meanwhile, the global copper price increased by around 2.6% during the same period, reaching $10,962 per tonne.

Although optimism in the copper market is fuelled by expectations of a US–China trade agreement, the prices of this industrial metal have recently been constrained by supply-side issues.

One of the largest copper producers, Freeport-McMoRan, has cut its copper sales forecast following a fatal incident at its Grasberg mine. Additional supply disruptions are currently arising from Codelco’s El Teniente mine, as well as from key production areas in the Dominican Republic and the Democratic Republic of Congo.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.