May 27, 2025

Market Overview 21-05-2025 to 27-05-2025

Last week, most precious metals experienced price corrections of varying magnitude. The price falls were partly driven by the temporary de-escalation of trade conflicts, by more accurate forecasts on new possible import-export agreements, and by falling demand for some precious metals in industrial production.

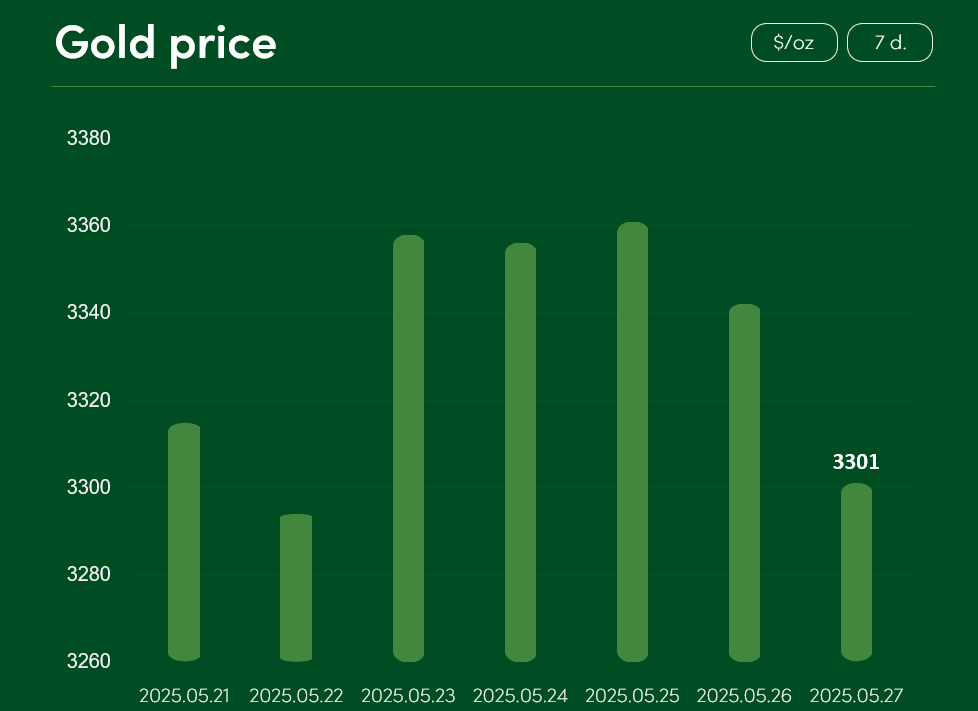

The global gold price experienced a slight correction between 21 May and 27 May, reaching $3301/oz on 27 May.

The recent growth slowdowns and corrections in gold prices has been partially driven by the easing of tensions over trade wars. Last Sunday, US President Donald Trump postponed 50% import tariffs on the European Union until 9 July. Also, according to unnamed sources, The Economic Times has reported that the US may reach an interim trade deal with the Indian government by 25 June.

Gold prices are also being held back by investors rushing to cash in record profits. Last week, investors collectively withdrew $2.9 billion from various gold funds around the world. This is the third-largest weekly loss of capital ever recorded by gold funds.

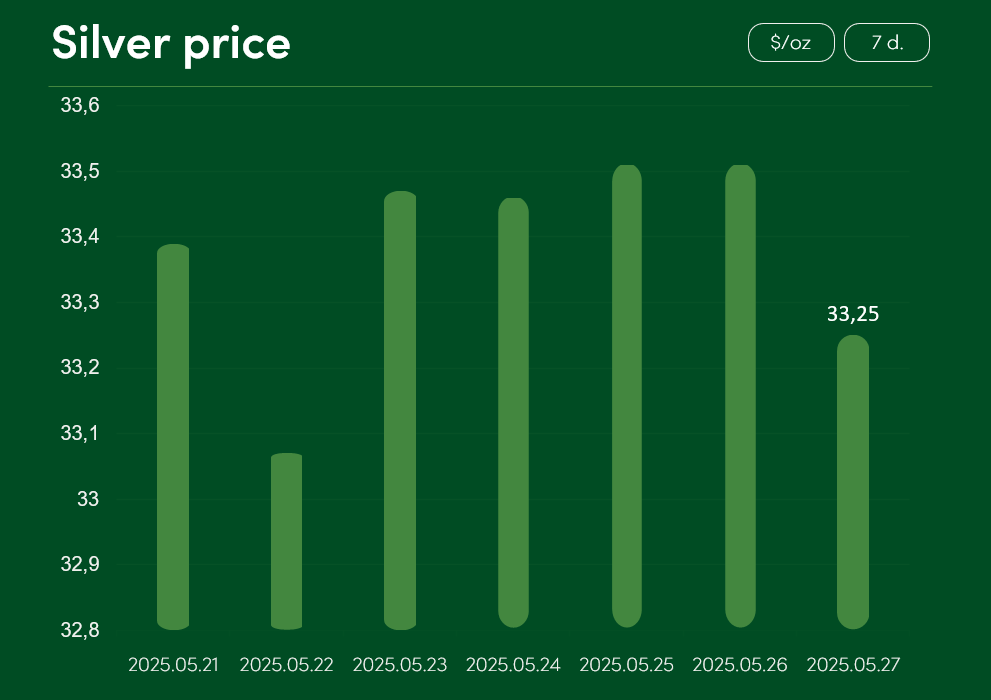

The global silver price also experienced a very slight (~0.4%) price correction between 21 May and 27 May, reaching $33.25/oz on 27 May.

The recent slowdown in silver prices is partially due to the strengthening of the US dollar. It is for this reason that dollar-denominated precious metals (gold, silver, etc.) are becoming a relatively more expensive and less viable purchase for foreign currency holders.

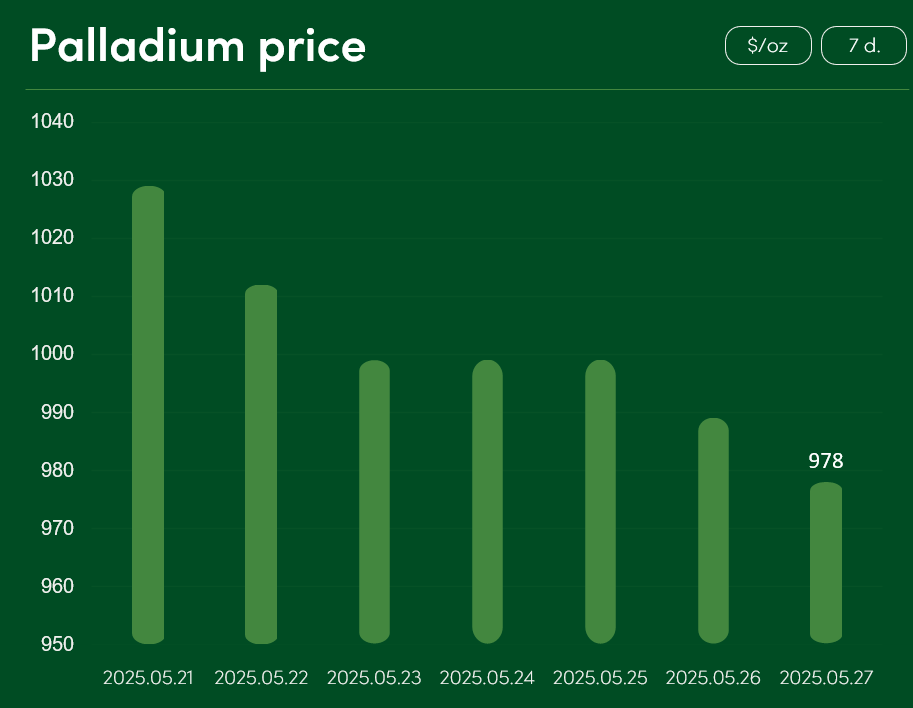

The global price of palladium fell by ~4.9% between 21 May and 27 May to $978/oz.

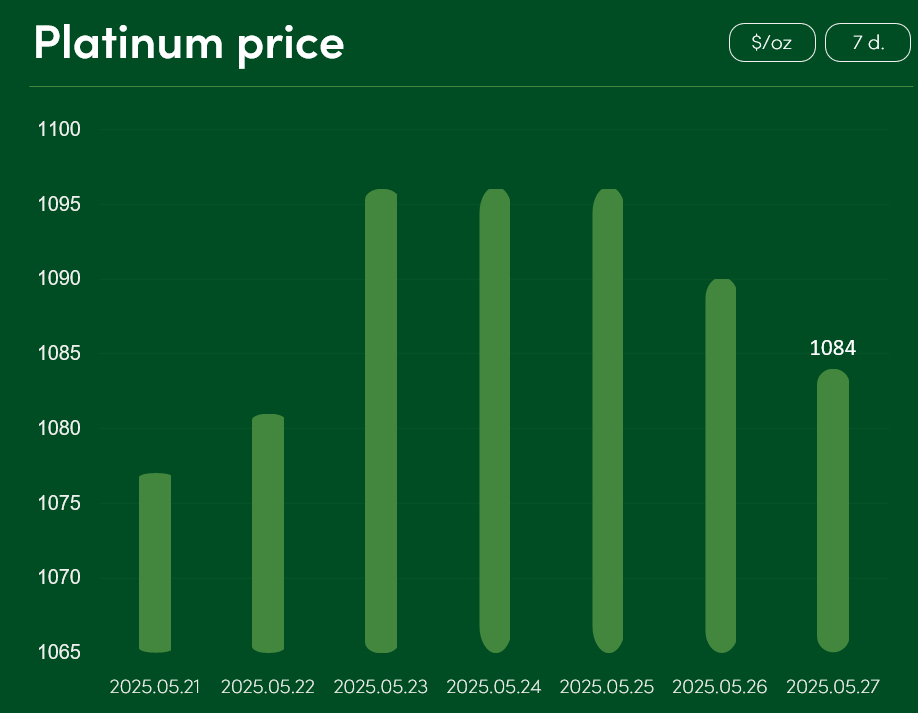

The increase in the price of palladium in recent years has been mainly limited by the difficult industrial demand situation for this precious metal. With the growing production and sales of electric vehicles, palladium and platinum metals are facing a natural decline in demand in the production of automotive catalysts.

Countries such as China are making a particularly strong contribution to the EV boom. In April, Chinese battery electric vehicle (BEV) sales rose by 58% year-on-year, reaching 822,000 units. Even though UBS—one of the world’s leading banks—forecasts a palladium supply deficit of approximately 300,000 ounces this year (representing 3% of total annual demand), overall investor sentiment towards palladium remains cautious.

The global platinum price recorded very little price change between 21 May and 27 May. On 27 May, the precious metal reached a price of $1084/oz.

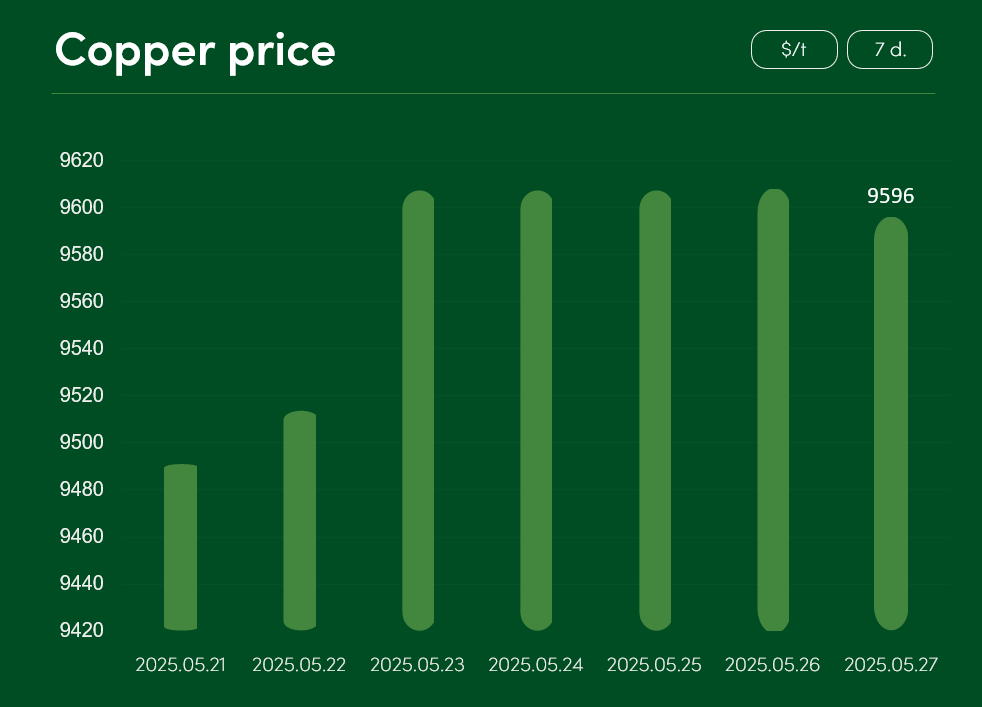

The global copper price increased by ~1.1% between 21 May and 27 May to reach $9596/tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.