January 27, 2026

Market Overview 21-01-2026 to 27-01-2026

Precious Metals Market: Exceptional Growth in Silver!

Last week, major precious metals continued their impressive price rally. Persistently elevated geopolitical tensions, growing distrust in the stability of global trade relations, and rising speculation over inevitable changes within the Federal Reserve’s leadership are driving record-high demand for precious metals across the market.

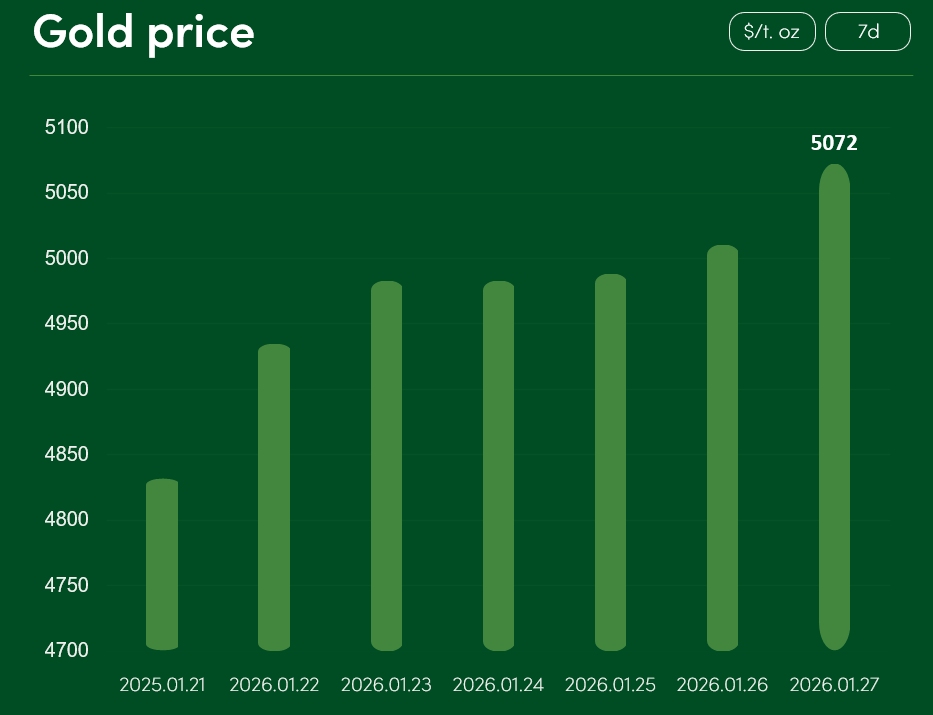

Between January 21 and January 27, the global gold price increased by more than 4.9%, reaching USD 5,072 per troy ounce on January 27. This strong weekly performance enabled gold to set a new all-time price record.

Recently, gold’s popularity has been unequivocally supported by Donald Trump’s controversial decisions. Although the U.S. president has softened his expansionist rhetoric regarding Greenland, an increasing number of threats toward key U.S. trading partners continue to surface in the public domain.

In response to the recent Canada–China agreement covering agricultural products and electric vehicle trade, Trump threatened to impose a 100% tariff on goods imported into the United States from Canada.

Trump’s aggressive trade policy has also affected South Korea. Referring to delays by the South Korean parliament in approving the Washington–Seoul trade agreement (which was agreed upon as early as July last year), Trump announced that tariffs on South Korean exports would be increased from 15% to 25%.

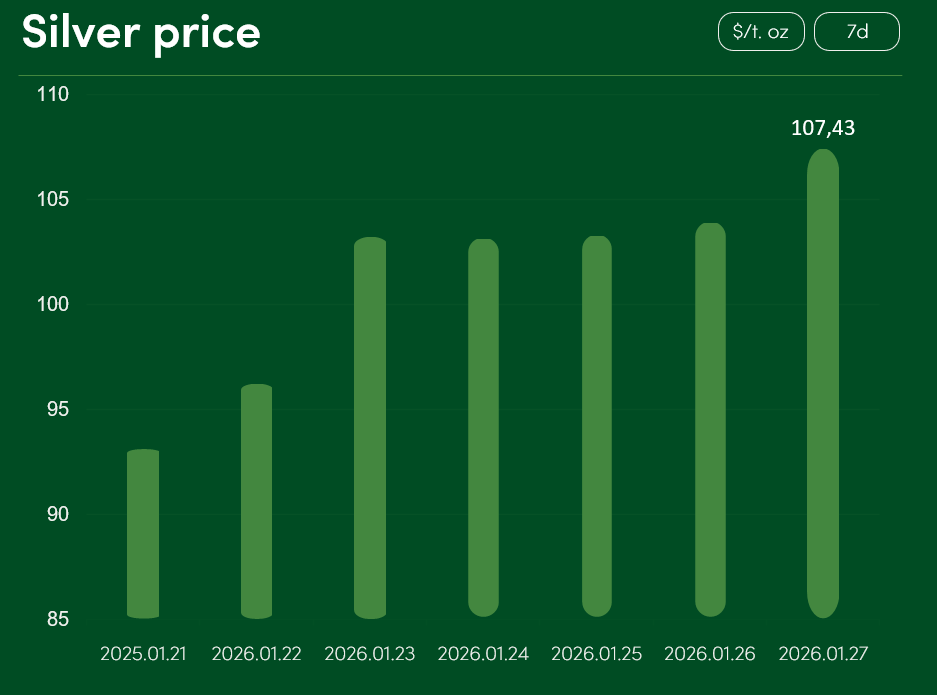

Between January 21 and January 27, global silver price recorded a phenomenal surge of more than 15%. This exceptional rally allowed the silver market to register a new all-time high, reaching USD 107.43 per troy ounce on January 27.

Silver’s recent price growth has been driven not only by chaotic developments in global trade. Demand for precious metals is increasingly supported by intensifying speculation regarding the future of the Federal Reserve’s monetary policy.

Although markets currently assign only a 2% probability to an interest rate cut at the ongoing January Federal Reserve meeting, growing attention is being paid to the future outlook of the most influential financial institution in the United States.

Expectations are increasingly building that the Federal Reserve will begin cutting interest rates in the near future. One of the key reasons behind this sentiment is the expiration of Federal Reserve Chair Jerome Powell’s term in May. Following Trump’s announcement that he will soon name a new candidate for the Fed chair position, markets are increasingly questioning the future leader’s impartiality and independence.

Given Trump’s explicit support for reducing borrowing costs and interest rates, investors are increasingly interpreting the approaching end of the moderate Jerome Powell’s term as a signal that Federal Reserve rates may be lowered in the near term. Should this scenario materialize, the U.S. dollar is likely to experience more pronounced corrections. Such an outcome could significantly boost the attractiveness of U.S. dollar-denominated precious metals (gold, silver, etc.) among holders of foreign currencies.

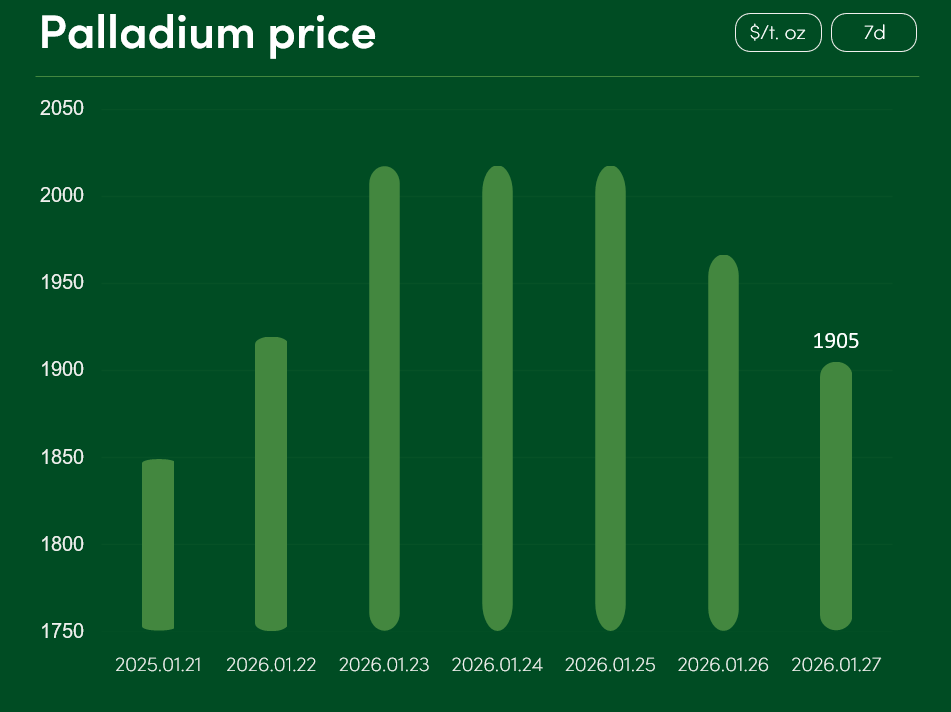

Between January 21 and January 27, global palladium prices rose by approximately 3%, reaching USD 1,905 per troy ounce.

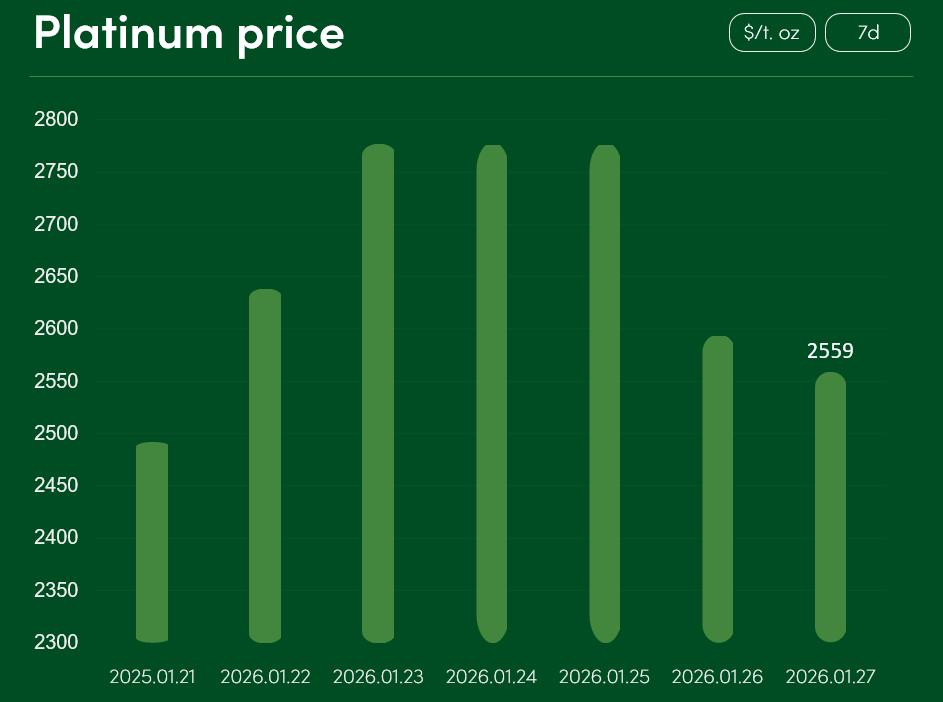

Over the same period, global platinum prices increased by around 2.7%, reaching USD 2,559 per troy ounce.

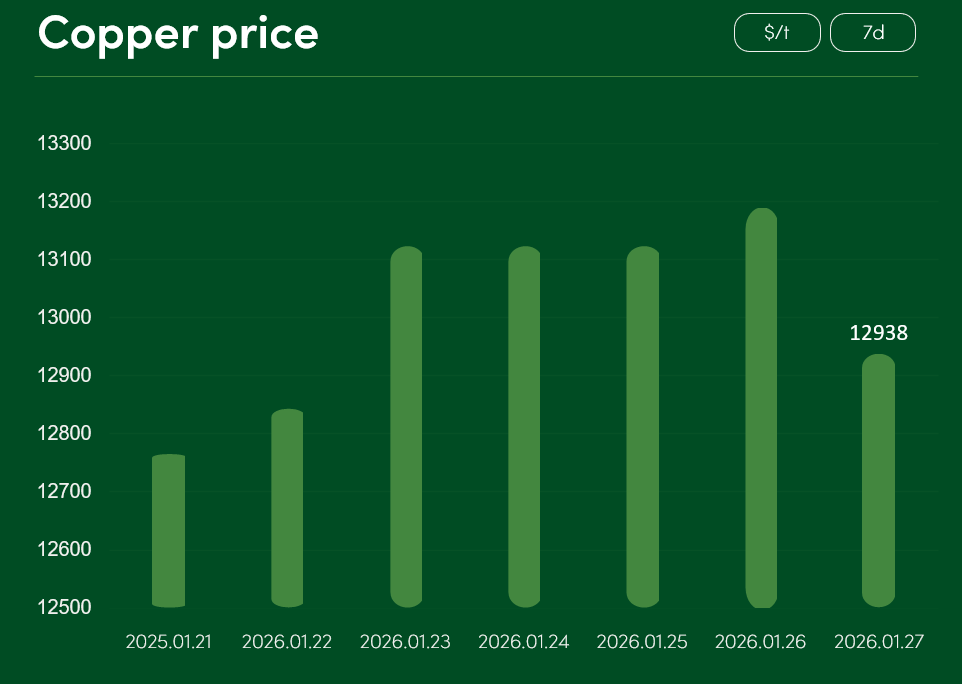

Global copper prices rose by more than 1.3% between January 21 and January 27, reaching USD 12,938 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.