February 4, 2025

Market Overview 29-01-2025 to 04-02-2025

Immediate hedging in response to new market threats. These words can be used to summarise the drastic gains in precious metals prices last week, fuelled by sudden changes in the global economy. Precious metals recorded record gains both as a result of tough US trade tariff decisions and China’s swift response to the changing economic order. The sharp correction in the cryptocurrency market at the beginning of this month may also have contributed to the rise of precious metals.

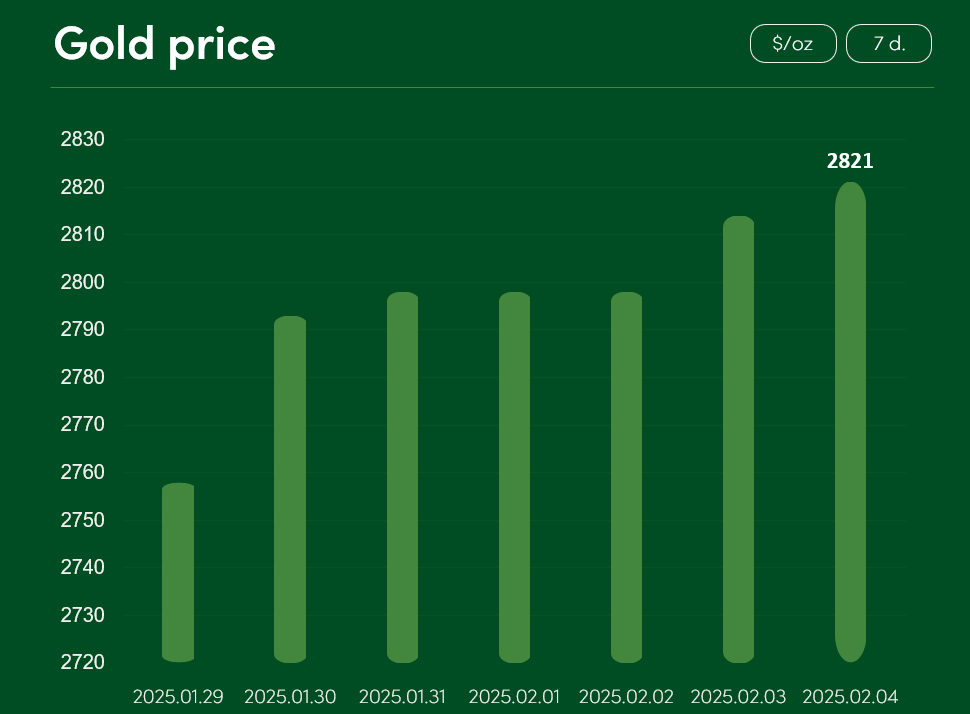

During last week, gold set its new all-time price records. The spot price of gold, which rose by >2% between 29 January and 4 February, reached $2821/oz on 4 February.

The choice of gold as an investment hedge has been driven by the escalating economic war between the US and China. US President Trump has passed the long-promised 10% import tariff on all Chinese goods. The Chinese government quickly responded to this decision with 15% import tariffs on American coal and liquified natural gas, and 10% tariffs on agricultural machinery, crude oil and large-displacement vehicles.

Investor concerns are also fuelled by Trump’s 30-day delay of decision to impose import tariffs on Canadian and Mexican goods. Amid fears of widespread trade conflict and turmoil in global supply chains, precious metals are gaining importance in the investment portfolios of governments and private investors.

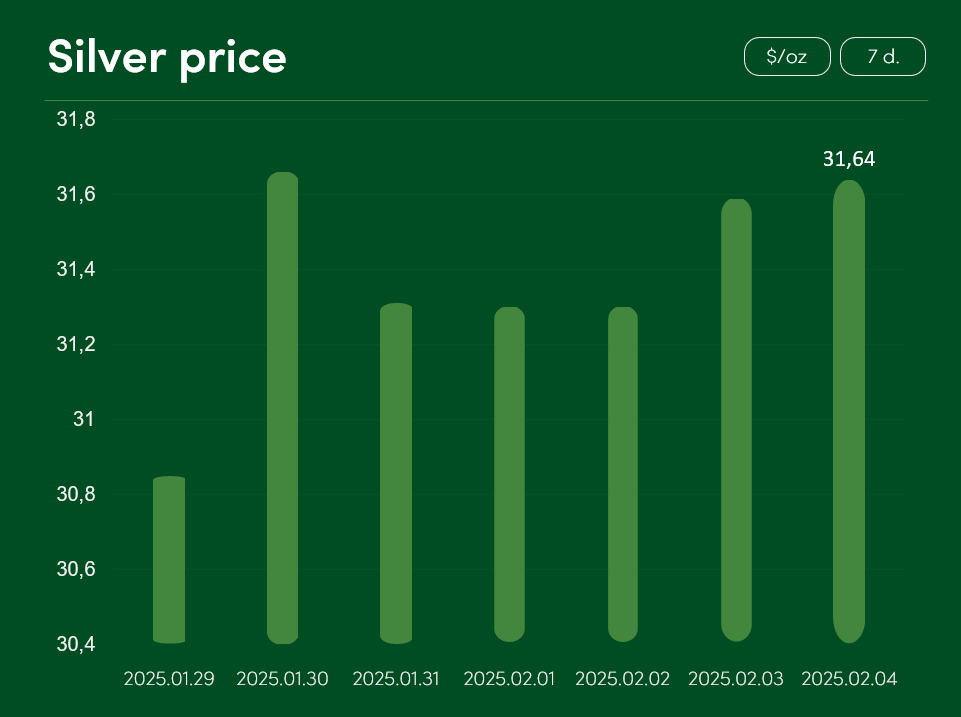

Economic uncertainty has also benefited global silver prices. Silver market prices rose by ~2.5% between 29 January and 4 February up to a point of $31.64/oz.

It is likely that silver prices were boosted not only by escalating trade conflicts, but also by the temporary turmoil of the cryptocurrency market.

When it comes to investing, the precious metals sector is considered to be a partial competitor to cryptocurrencies. Therefore, when digital currencies like Bitcoin experienced a sharp decline of over 6% in a single day last weekend due to market turmoil, the resulting downturn and investor panic helped drive more capital into the precious metals sector.

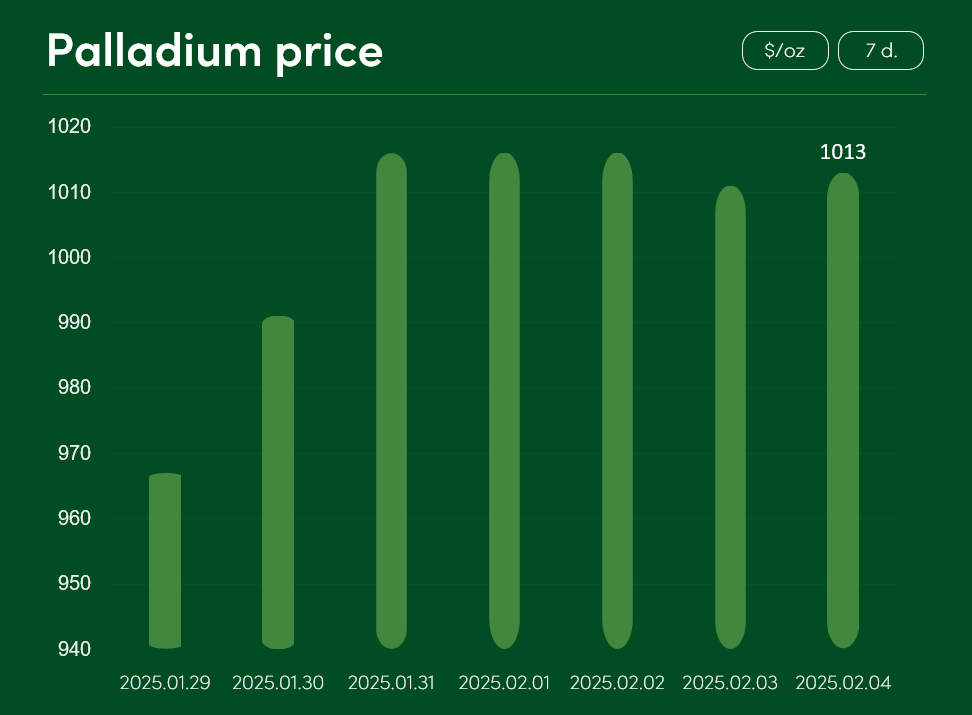

The market price of palladium rose by ~4.5% between 29 January and 4 February to reach $1013/oz.

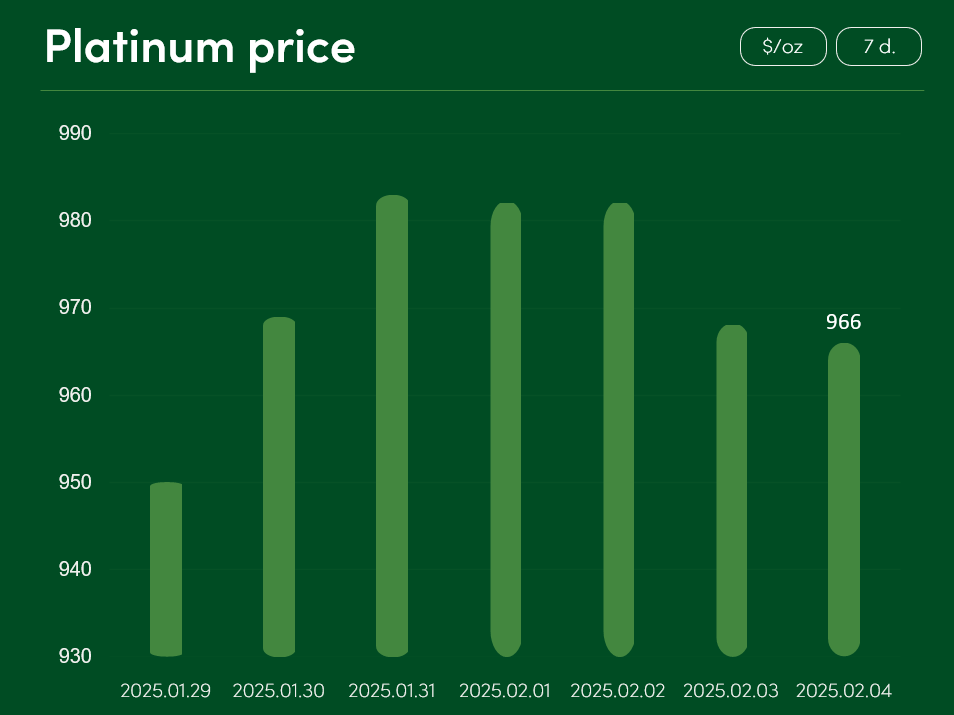

The platinum precious metal recorded more modest gains. Between 29 January and 4 February, the global platinum price rose by >1.5% to $966/oz.

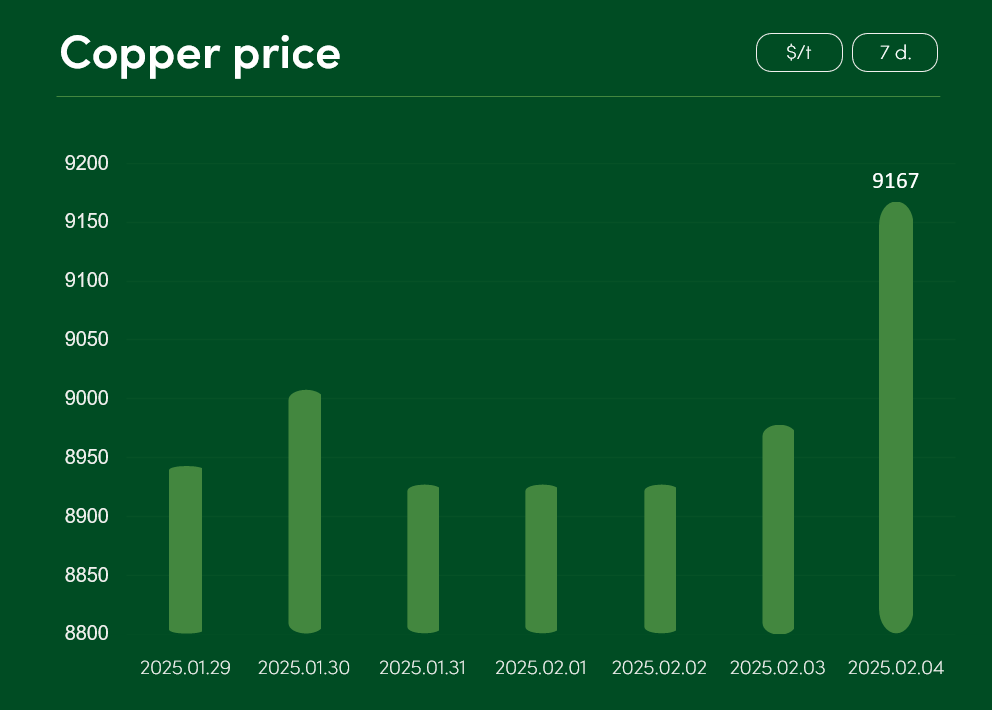

The global copper price increased by ~2.5% between 29 January and 4 February, reaching $9167/t.

Copper metal has recently been facing significant price pressure due to both global trade conflicts and the difficult economic situation in the Chinese domestic market. However, experts believe that the significant shortage of copper concentrates on the market will help to attract more trading and investment capital into this particular industrial metal.

The latest US industrial indicators are also positive. United States, the world’s second-largest consumer of copper, recently announced that the country’s manufacturing Purchasing Managers’ Index (PMI) rose for the first time this January after 26 months of constant decline. The jump in the US PMI index from 49.2 to 50.9 points also signals a likely increase in copper demand in this high value-added market.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.