November 26, 2024

Market Overview 20-11-24 to 26-11-2024

The precious metals market, which saw a correction in prices during last week, reacted sensitively both to sudden changes in the global geopolitical environment and to the new protectionist economic measures planned by the US to boost domestic production growth. As the dollar continues to appreciate, commodities such as copper, oil and other commodities that are bought and sold on the markets using US dollars are facing the challenge of demand and price declines.

Between 20 November and 26 November, the gold spot price fell by ~1% to reach $2625/oz on 26 November.

Although gold started the week on a very bullish note, the precious metal’s prices were hit hard in the second half of the week. Investors retreated slightly from gold due to the prospects of higher geopolitical stability in the Middle East. According to unofficial sources of CNN, the planned Israeli cabinet vote this Tuesday for a ceasefire with Hezbollah has already received the support from Prime Minister Netanyahu.

Gold prices have been influenced not only by the increase in global political stability, but also by the public announcement of US economic plans. On Monday, the country’s newly elected President Trump announced plans to impose import tariffs of 25% on Canada and Mexico and additional tariffs of 10% on imports from China. The US dollar continues to appreciate in response to the optimistic outlook for domestic growth. Because of that, the global investment community is consequently more sluggish on investing into various commodities such as gold, oil, copper and other essential resources. The explanation here is simple: strengthening dollar means that commodities purchased in this currency become more expensive for those foreign investors who make their purchases by exchanging local currencies for dollars.

The silver market price also experienced a price correction between 20 November and 26 November. Over the past week, the silver market price has fallen by ~1.4% to reach $30.41/oz.

In addition to the already mentioned reasons of increasing geopolitical security and protectionist US policies, other news from the political sphere of United States may have also triggered a correction in silver prices. While US government is worriedly preparing for changes after the elections, Trump nominated Scott Bessent, a hedge fund investor who advocates the gradual introduction of new tariffs and the avoidance of high inflation, for the post of Treasury Secretary. This choice was seen by investors as an additional safety net, allowing them to step back a little from precious metals as an investment hedge.

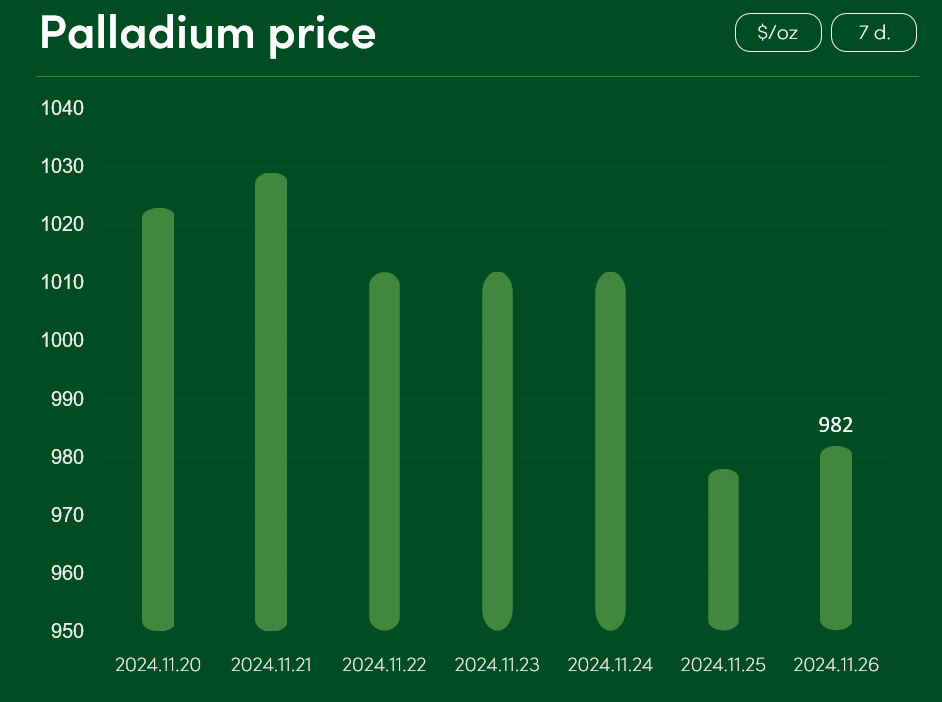

The global palladium exchange price fell by 4% between 20 November and 26 November to $982/oz.

The platinum price also recorded a correction: between 20 November and 26 November, the exchange price of this precious metal fell by 3% to $932/oz.

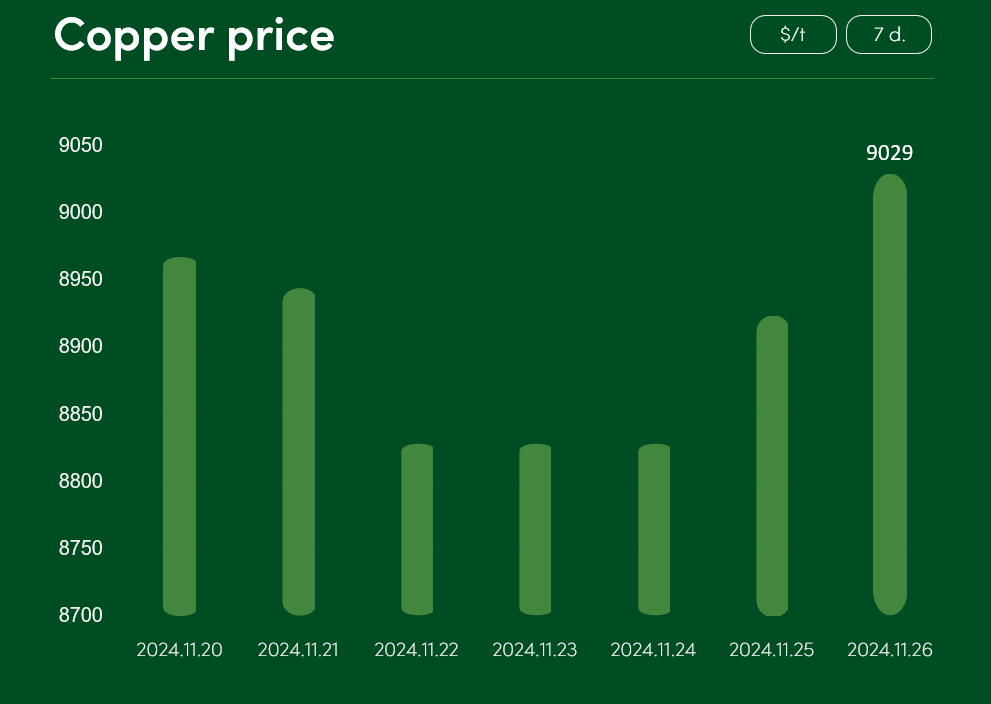

While the price of semi-precious copper metal recorded an increase of ~0.7% over the last week, reaching a price of $9029/t, copper is currently also recording a decline of ~9.2% from the price of $9943/t reached in early October.

Copper’s difficulties in establishing itself in the $10000/tonne range can be partly explained by protectionist US policies and the strengthening of the dollar, as well as by the challenges to copper demand in the Chinese market. China, a major copper user, has recently been experiencing a slowdown in economic growth and a decline in copper demand. This is prompting financial experts such as Goldman Sachs to adjust their copper price forecasts. According to Trackinsight, Goldman Sachs analysts have changed their previous copper price forecast of $12000/t for the end of 2024 to a price of $10100/t, which is expected in 2025.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.