August 26, 2025

Market Overview 20-08-2025 to 26-08-2025

The markets of main precious metals experienced divergent price movements during the last week. The growth in gold and silver prices was driven by the increasing likelihood of interest rate cuts in the United States, as well as by unexpected decisions by D. Trump regarding members of the Federal Reserve Board. Meanwhile, the precious metals platinum and palladium faced slight price corrections.

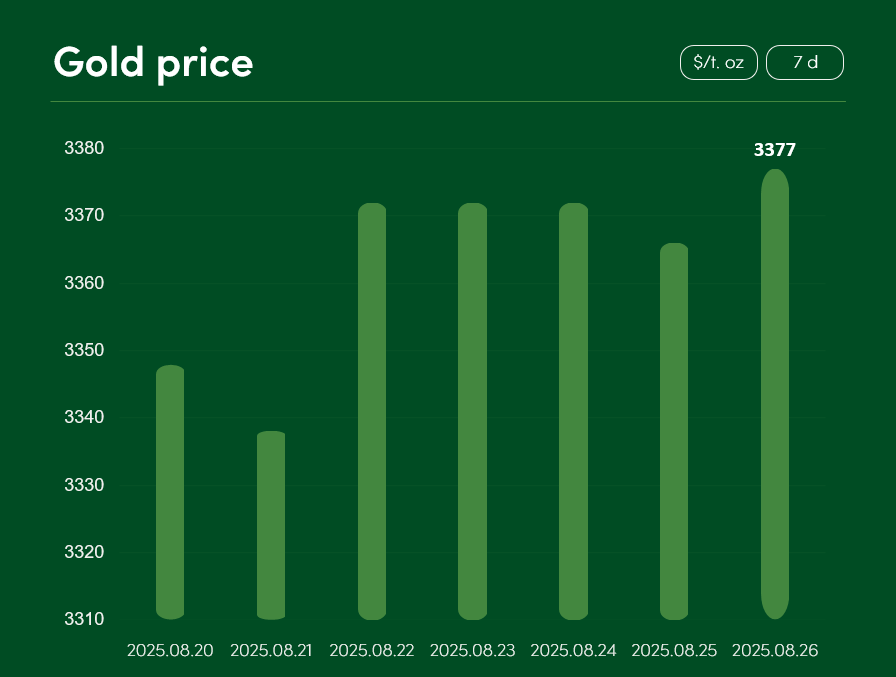

The global gold price rose by more than 0.8% between 20 and 26 August; on 26 August, a price level of $3,377/t. oz was reached.

The growth in gold prices over the past week was driven not only by the further increasing probability of interest rate cuts in the United States. Demand for this precious metal was also boosted by chaotic Federal Reserve Board news, which brought uncertainty to the financial markets.

On Monday, President Trump announced the decision to remove Federal Reserve Board member Lisa Cook from the office. The unexpected decision was officially justified on the grounds that there was reason to believe the board member had made false statements regarding one or more mortgage agreements. However, some experts interpret this move as indirect pressure on the Federal Reserve Board. D. Trump has on several occasions already hinted at his dissatisfaction with the FED’s delay in lowering US interest rates.

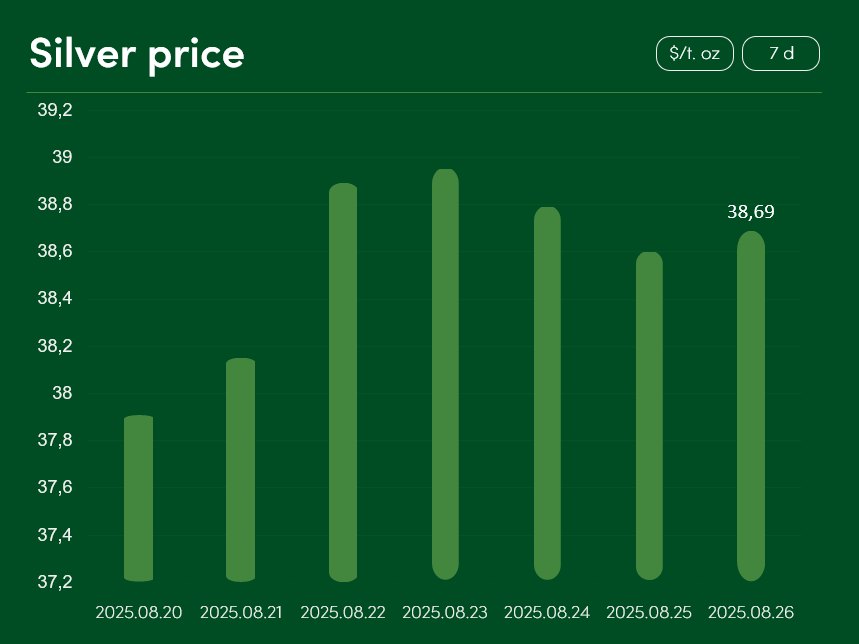

The global silver price increased by more than 2% between 20 and 26 August, reaching $38.69/t. oz.

The rise in silver prices is supported both by the aforementioned news regarding US monetary policy and the Federal Reserve Board, as well as by optimistic reports from the industrial production sector. Silver is a metal used particularly intensively in renewable energy, and in this sector, it is becoming an increasingly indispensable resource.

The latest Chinese market data revealed that the country’s solar cell exports recorded growth of as much as 73% in the first half of this year. As silver is actively used in solar cell production, for this reason in the short term the metal may become an even more popular choice among investors and traders following the latest supply-demand trends in precious metals.

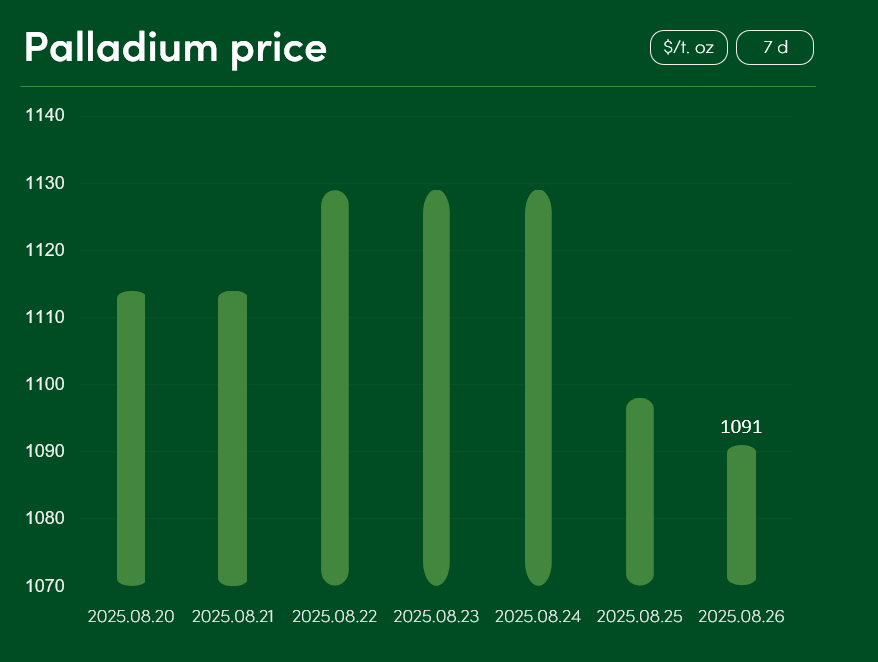

The global palladium price fell by around 2% between 20 and 26 August, reaching $1,091/t. oz.

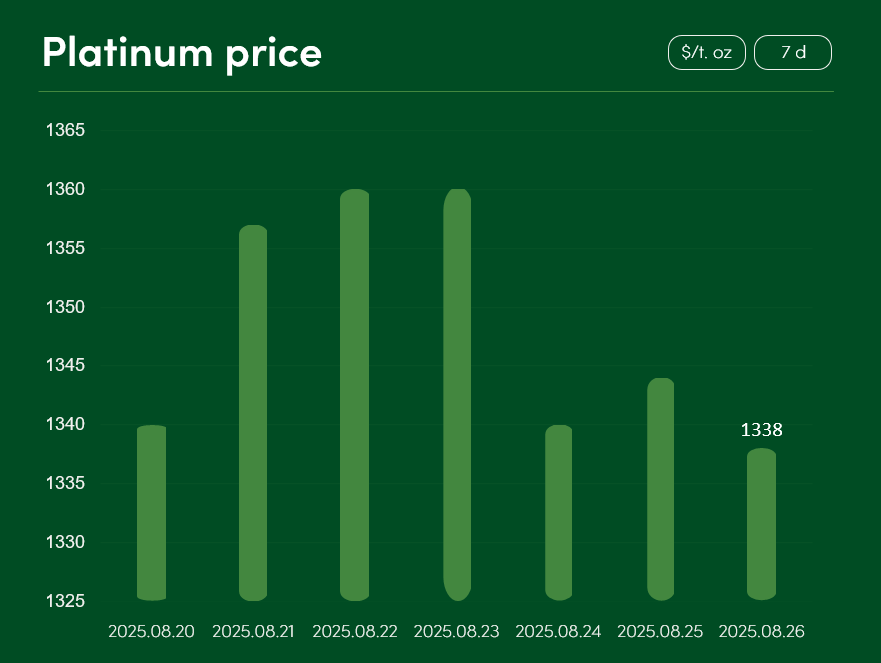

The global platinum price experienced only minor changes between 20 and 26 August; on 26 August, a price level of $1,338/t. oz was recorded.

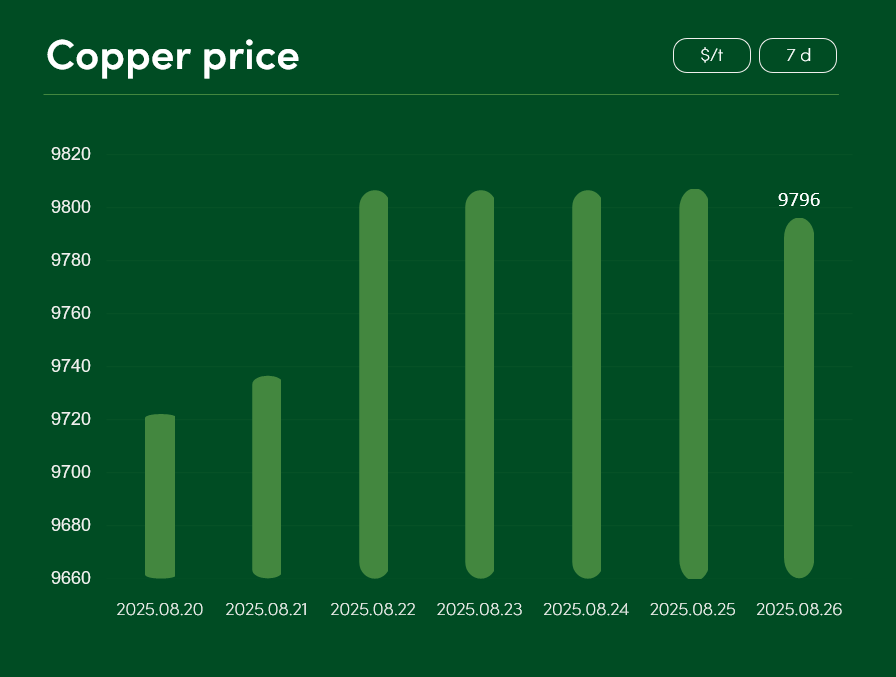

The global copper price increased by more than 0.7% between 20 and 26 August, reaching $9,796/t.

One of the reasons recently supporting the short-term growth in copper prices is related to decisions by the US judiciary. A US federal appeals court temporarily blocked a land transfer crucial for Rio Tinto and BHP’s metals mining businesses. This decision hinders the companies from developing a project that could become one of the largest copper mines in the United States, and increases market uncertainty regarding the prospects for global copper supply.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.