November 25, 2025

Market Overview 19-11-2025 to 25-11-2025

Precious Metals Markets Face Increasing Price Uncertainty

Although the main precious metals avoided any sharp price movements over the past week, the markets were not short of events that could influence their pricing in the near future. Weak U.S. economic indicators, rising expectations of a FED interest rate cut, and changing geopolitical stances among major countries are prompting investors to more seriously reconsider the prospects of precious metals as investment instruments.

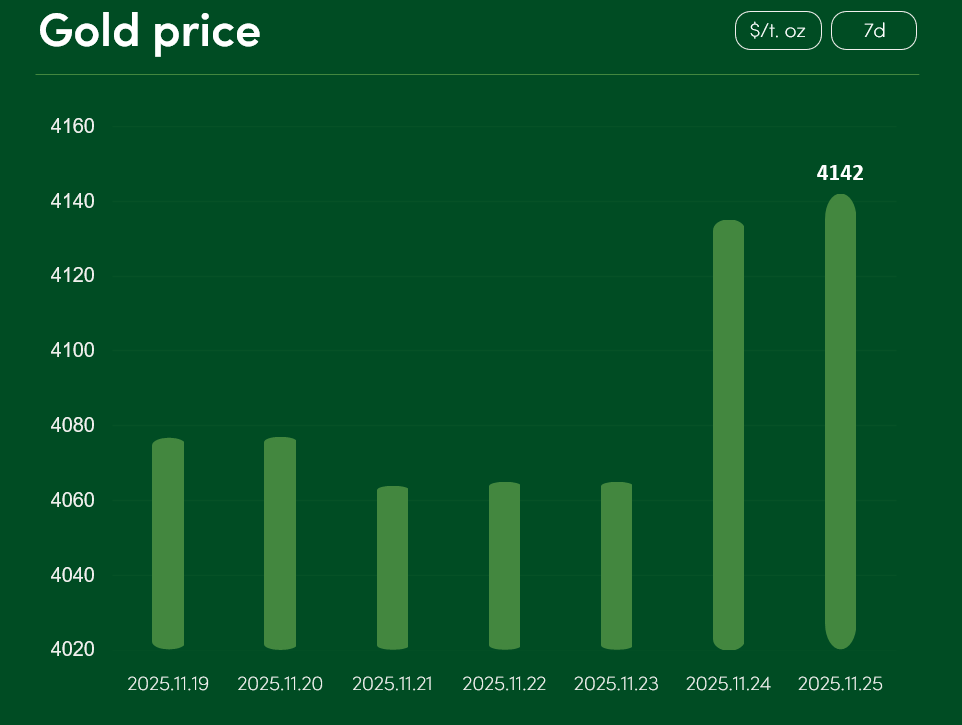

Between November 19 and November 25, the global gold price increased by more than 1.5% and reached $4,142 per troy ounce.

Currently, the gold price is being strongly supported by weak U.S. economic data. It was reported that this September, U.S. retail sales rose by just 0.2%. This result is significantly weaker than the expert-forecasted 0.4% sales increase. Also, according to the latest statistical assessments, private U.S. companies have been recording an average of 13.5 thousand job losses per week over the past four weeks.

The pessimistic U.S. economic indicators have prompted FED officials to discuss a possible interest rate cut in December. Based on current market pricing, the probability of a rate cut specifically in December has climbed to as high as 84%.

If this forecast materializes, the anticipated 0.25% rate cut could contribute to an increase in the investment appeal of dollar-denominated precious metals (gold, silver, etc.) for buyers from foreign markets.

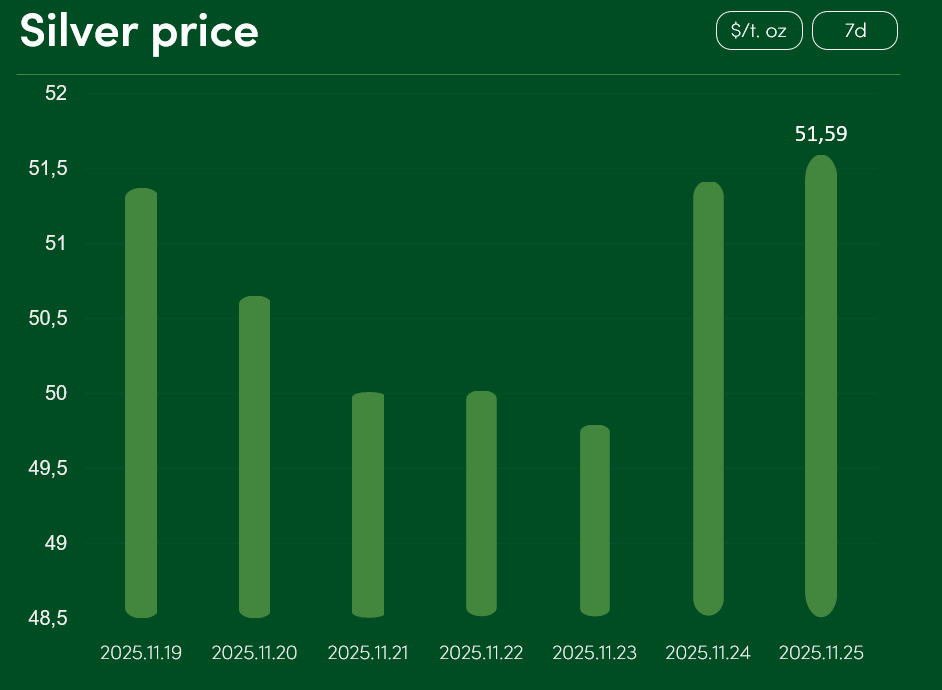

Between November 19 and November 25, the global silver price experienced only minor fluctuations. On November 25, the price of silver reached $51.59 per troy ounce.

Experts note that forecasting silver’s short-term price dynamics is currently extremely challenging. While the U.S. economic strain and the projected FED rate cut are highly favourable for the metal, growing stability in the global geopolitical landscape could instead lead to further price corrections.

One of the potential directions of geopolitical de-escalation is Ukraine. According to the latest remarks from U.S. government officials, Ukraine’s leadership has reportedly accepted a U.S.-proposed Russia–Ukraine peace agreement. Should this peace deal actually come into effect, a significant geopolitical de-escalation could have a strong impact on precious metal price corrections.

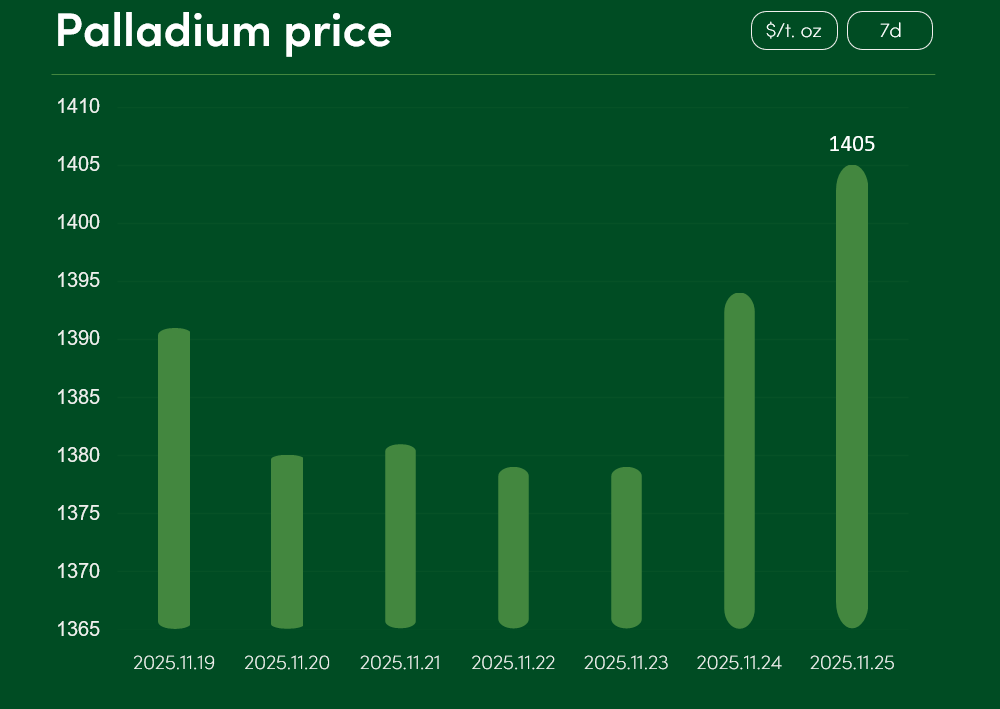

The global palladium price faced minimal changes between November 19 and November 25. On November 25, the price of this precious metal reached $1,405 per troy ounce.

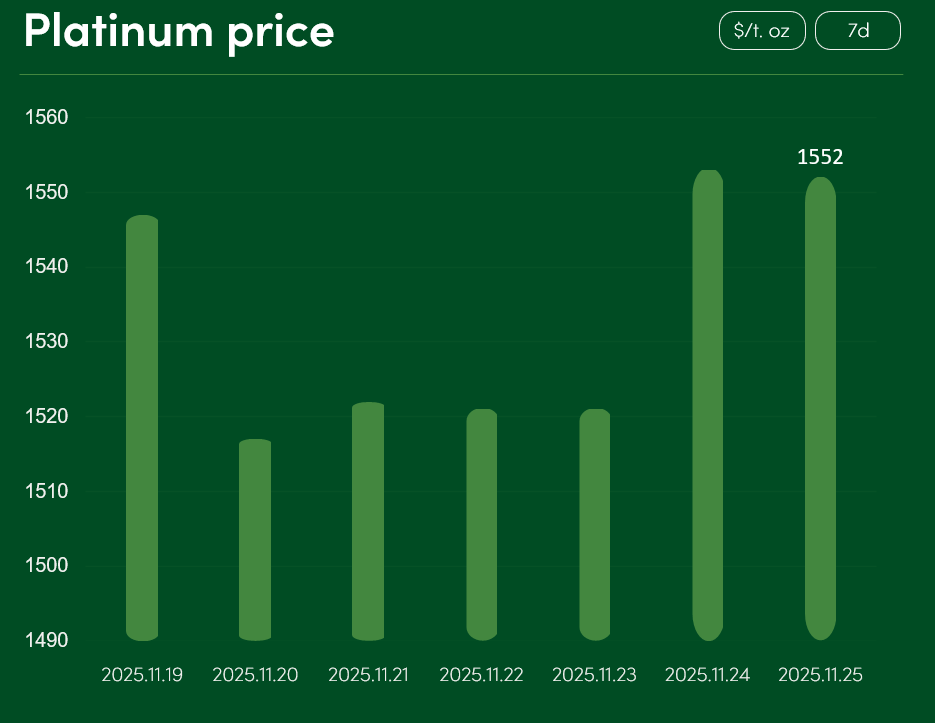

During the same period, the global platinum price also saw only very slight movements. On November 25, platinum reached $1,552 per troy ounce.

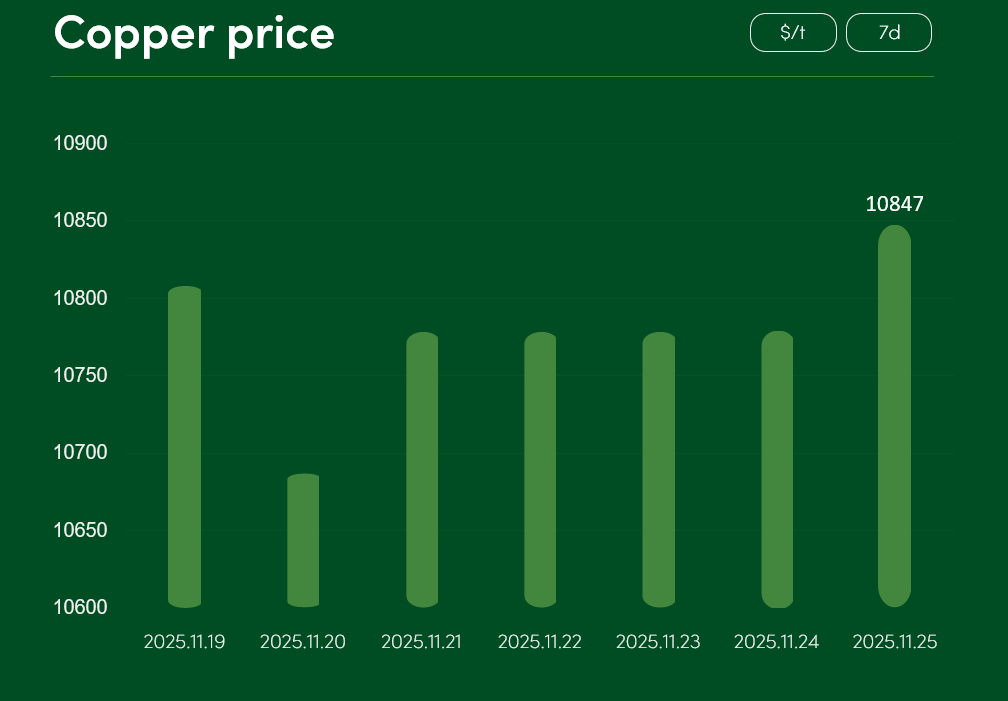

Copper, which continues consolidating around the $10,000/t level, also experienced a relatively calm period between November 19 and November 25. On November 25, copper reached $10,847/t.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.