March 25, 2025

Market Overview 19-03-2025 to 25-03-2025

Precious metals prices, which rose to record highs last week, successfully managed to consolidate their positions at higher price points. Meanwhile, the markets for some industrial metals experienced another period of bullish price increases. The upbeat mood in the metals markets is fuelled by both the favourable outlook for interest rate cuts and the intensifying trade wars.

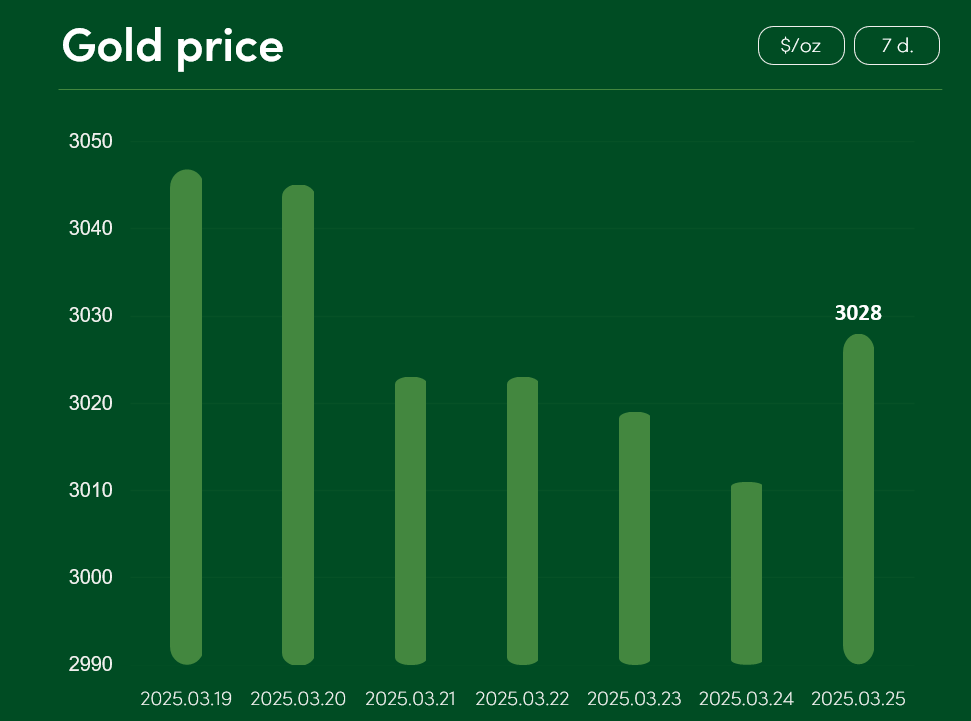

The global gold price faced a slight correction after setting new all-time price records on 19-20 March. Looking at the last 7 days, a ~0.6% fall in the price was recorded. On 25 March, the global gold price reached 3028 $/oz.

Strong current gold price course is not only supported by rising global geopolitical tensions but also by intensifying trade wars. The US has already imposed import taxes on Mexican, Canadian and Chinese goods and has adopted global tariffs on aluminium and steel imported into the country. However, president Trump does not seem to be stopping here: The US President has spoken of plans to impose new tariffs on cars and pharmaceuticals imported into the United States. Trump also plans to impose a 25% import tax on all countries that will buy gas and oil from Venezuela.

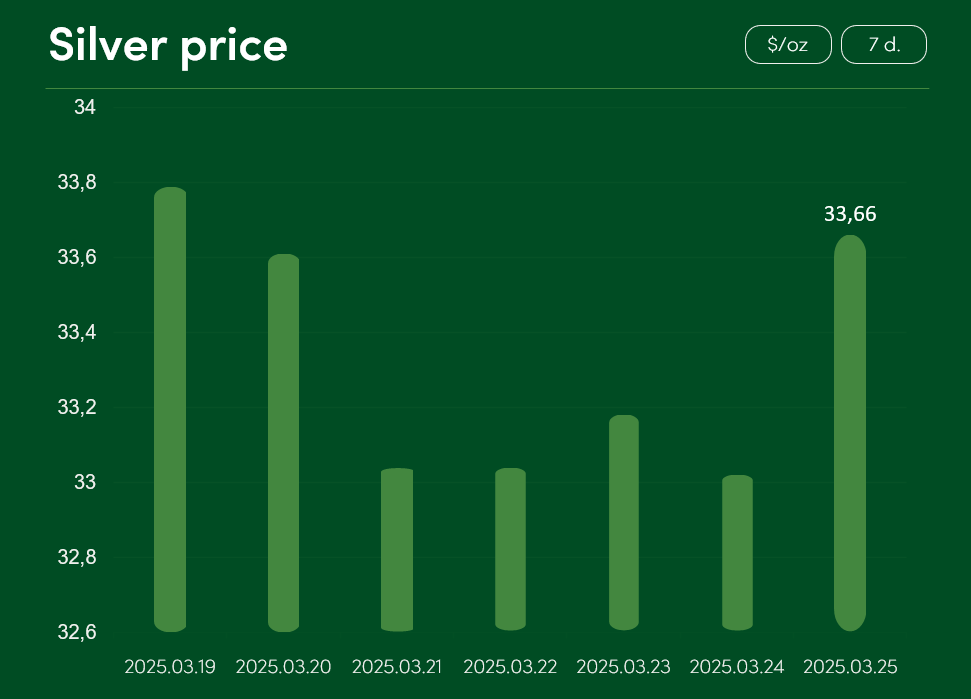

The global silver price recovered most of the losses of the small short-term correction between 19 March and 25 March, reaching $33.66/oz on 25 March.

The exceptionally high silver prices of late have been supported not only by geopolitical risks in the Middle East and fiscal stimulus measures of China and Germany. Investors are increasingly expecting favourable monetary policy decisions this year from the US Federal Reserve, which regulates interest rates of world’s largest economy.

Although US interest rates remained unchanged at the last Fed meeting, Fed officials have stated that a 0.5% cut in interest rates is still expected this year. With US inflation rates reaching relatively low levels and the growing turmoil of the trade wars, investors are increasingly speculating about another, additional interest rate cut in 2025. Such a decision would very likely contribute to the further rise in prices of various investment instruments, including silver.

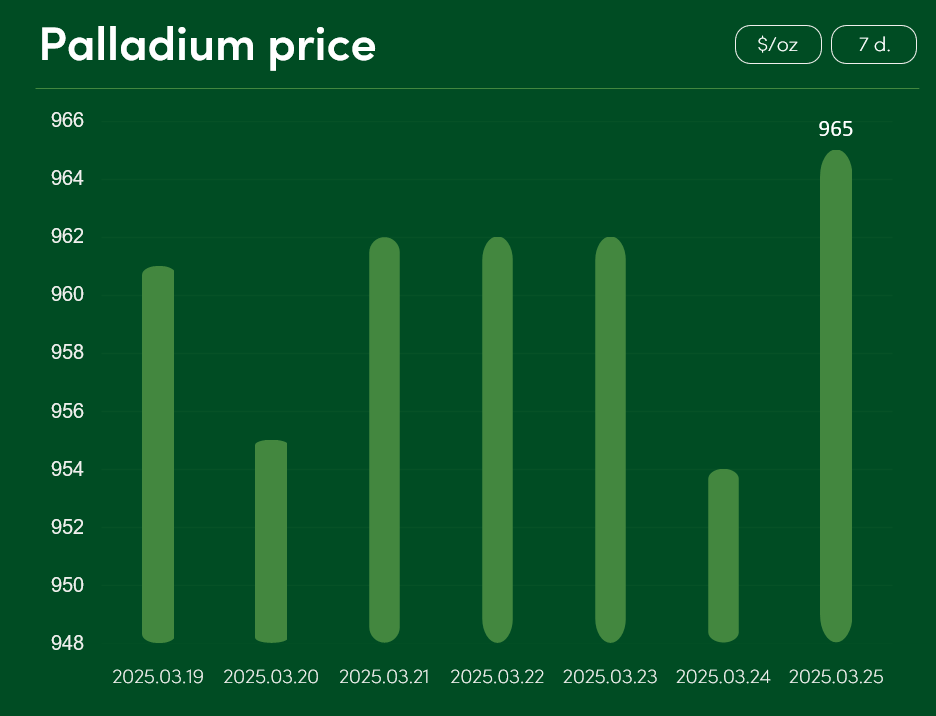

The global palladium price has recorded minimal price changes over the last 7 days. On 25 March, the price of $965/oz was reached.

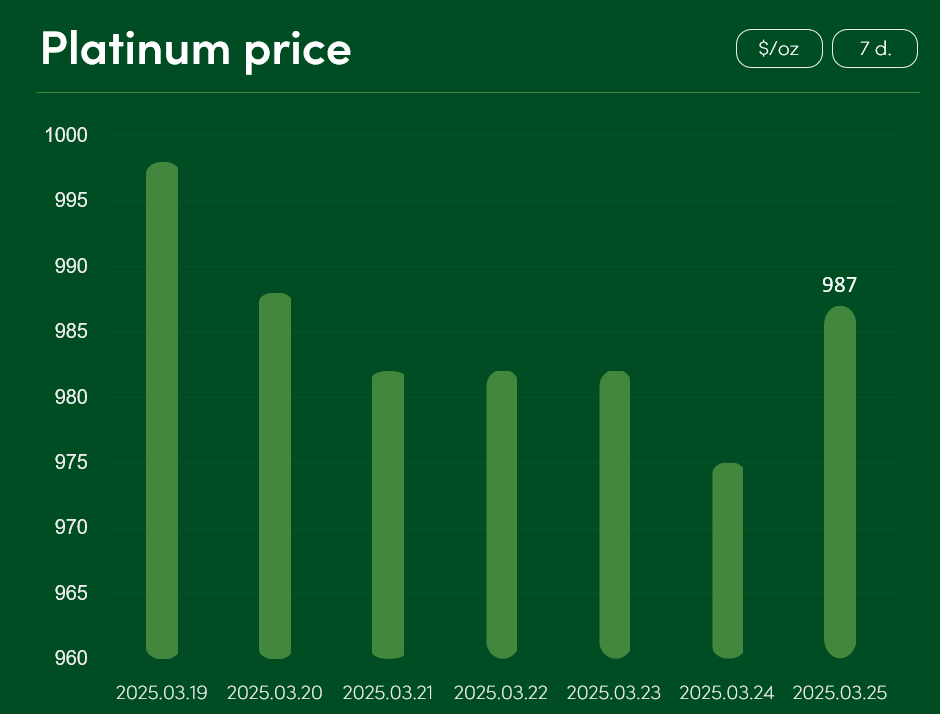

The global platinum price declined by ~1% between 19 March and 25 March to reach $987/oz on 25 March.

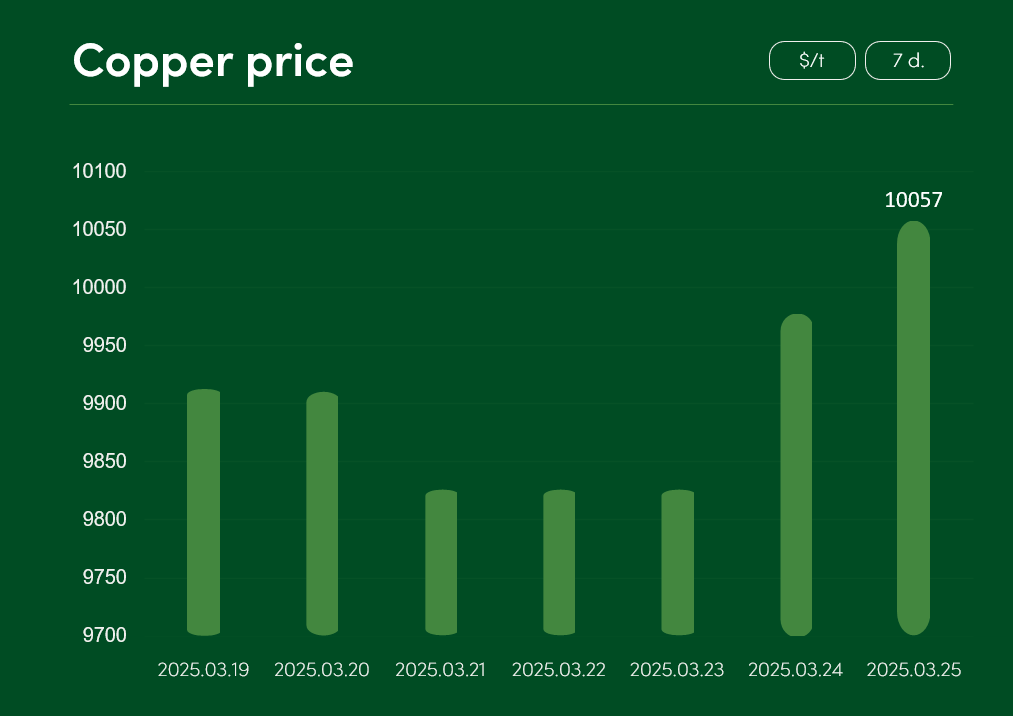

The global copper price increased by ~1.45% between 19 March and 25 March to reach 10057 $/t on 25 March.

The $10000/t copper price barrier was not only breached due to the aforementioned fiscal stimulus measures in China and the demand-supply imbalance in that country but also due to the prevailing market fears about possible tariffs on copper imports.

Following the signing of the copper import investigation order by US President Trump in February, speculation has been rife that a 25% tariff on copper imports to the United States could be expected soon from the country’s leadership. This has contributed to record copper import enquiries from the US market. Preliminary estimates suggest that the flow of copper imports to the United States will increase to around 500 000 tonnes this month (instead of the usual amount of 70000 tonnes).

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.