February 25, 2025

Market Overview 19-02-2025 to 25-02-2025

Last week, the major precious metals markets exhibited a highly mixed and uneven price performance. The lack of stability in the markets is fuelled by the growing uncertainty in the global trading space and by diverging investor views on the future of global monetary policy and inflation. Sudden changes in global political rhetoric and harsh economic statements by the US, which could lead to new economic disagreements, are also contributing to the chaotic situation.

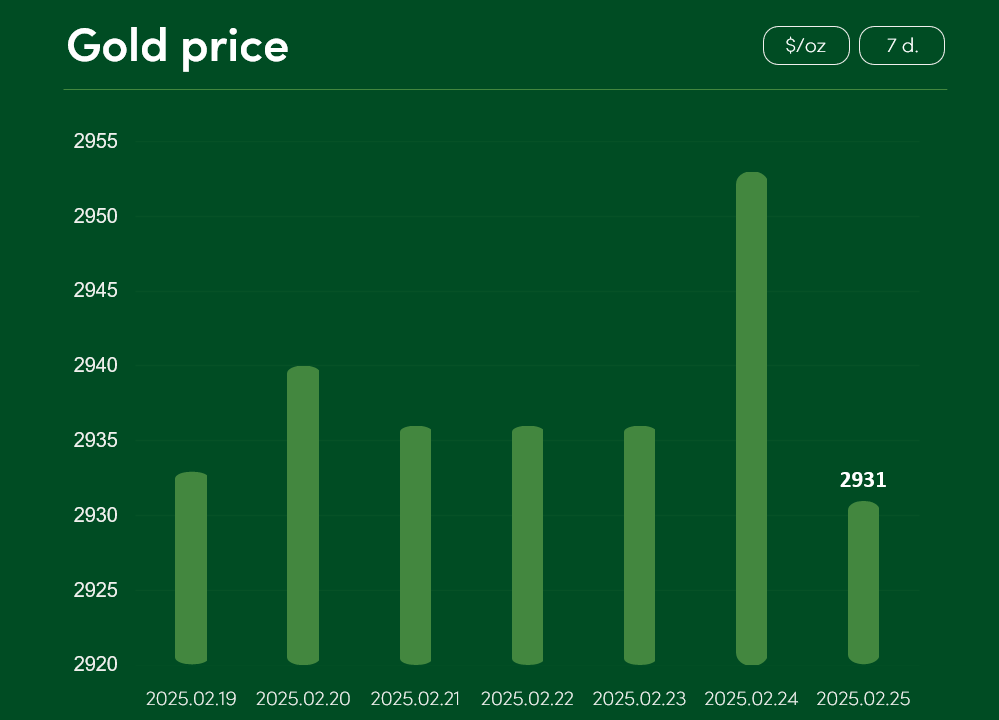

The global gold exchange price experienced both a sharp rise and a sharp correction between 19 and 25 February. Although a new all-time price record was set on 24 February, it was followed by a sharp fall, which brought the global gold price down to $2931/oz.

Despite the usual unpleasant correction following record price spikes, the investment community remains bullish on gold. Demand for the precious metal is also supported by aggressive US trade policy. President Trump recently announced that the deferred 25% tariffs on Mexican and Canadian imports will be applied after the end of scheduled 30-day break.

The popularity of gold is not only driven by investors’ desire to hedge against the possible consequences of trade conflicts. The precious metal is also supported by various stock market participants. The SPDR Gold Trust, the world’s largest gold exchange-traded fund, reported last Friday that the amount of gold it manages has increased to 904.38 tonnes, the highest level since August 2023.

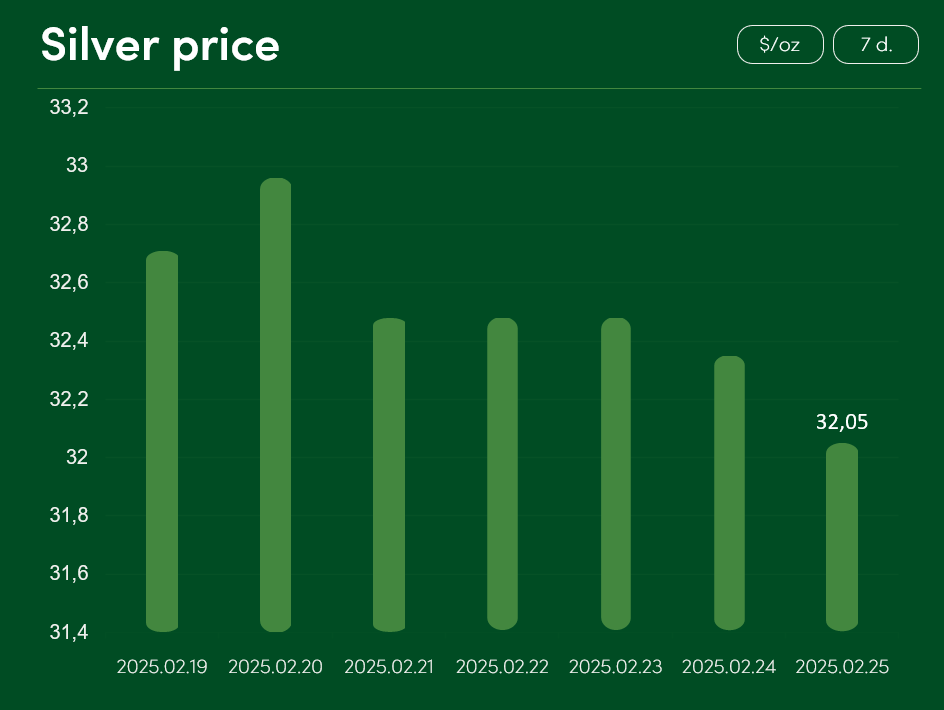

The global silver price fell by 2% between 19 February and 25 February to $32.05/oz.

Although silver, which continues its record-breaking growth this year, has been affected by a short-term correction, investors’ optimistic hopes for higher silver prices are driven by many factors. One of them is the favourable monetary policy decisions in various markets.

In order to boost the sharp fall in inflation, various markets, including the US and the EU, have been actively cutting bank interest rates over the past year. This year, three more rate cuts are expected from the ECB, along with similar monetary policy decisions from other major markets (e.g., China).

Interest rate cuts and stimulus to money circulation may contribute to market price increases for various industrial metals (including silver).

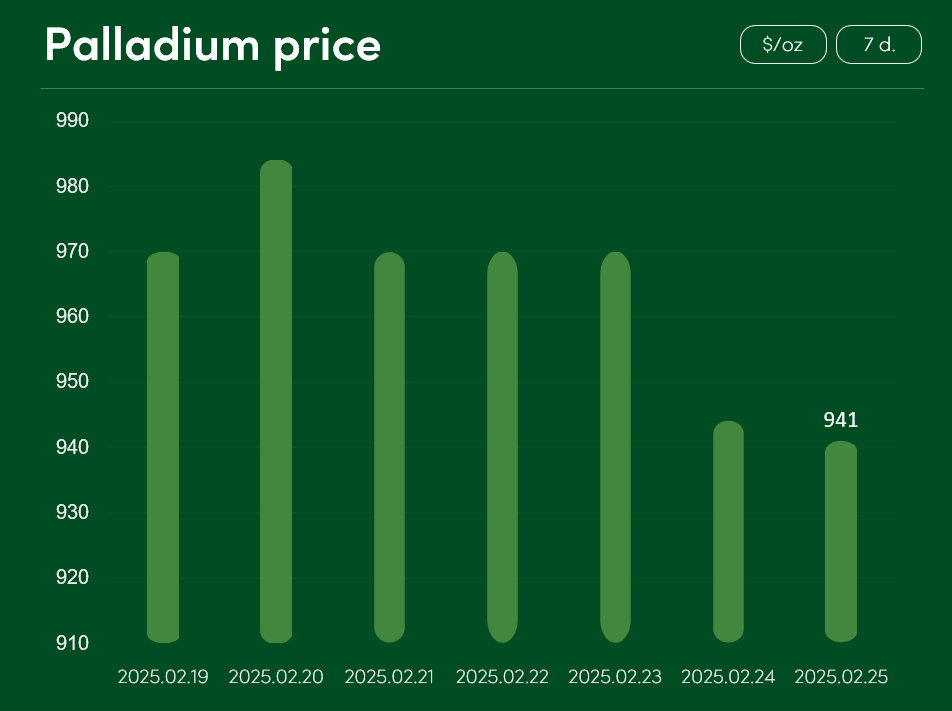

The market price of palladium fell by 3% between 19 February and 25 February to $941/oz.

The downward pressure on palladium prices is strongly supported by factors such as aggressive US trade policy. Although Trump has announced plans to “save” the US automotive industry (and thus potentially boost domestic demand for palladium), investors are reacting to his aggressive tariffs by swapping precious metals such as palladium for safer alternatives (gold, silver, etc.).

Another driving factor in decline of palladium market prices is the thaw in diplomatic relations between the US and Russia. Palladium investors are concerned that as Russia, the world’s largest producer of palladium, regains direct export access to various markets, this will contribute to a further decline in the price of the metal.

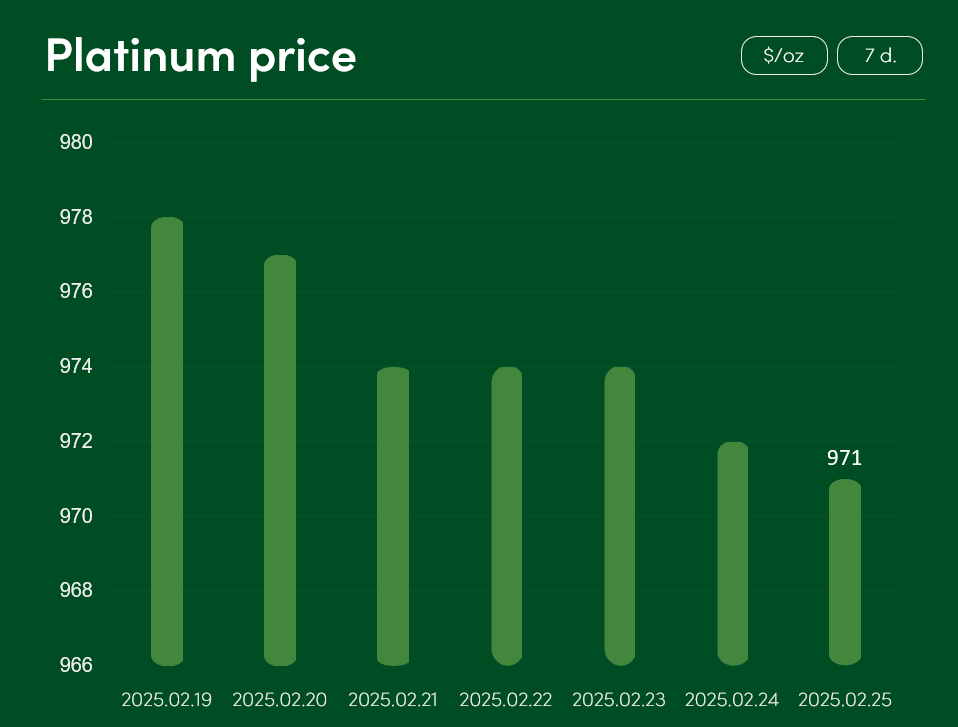

The global price of platinum fell only slightly between 19 February and 25 February, with the precious metal reaching $971/oz on the exchanges on 25 February.

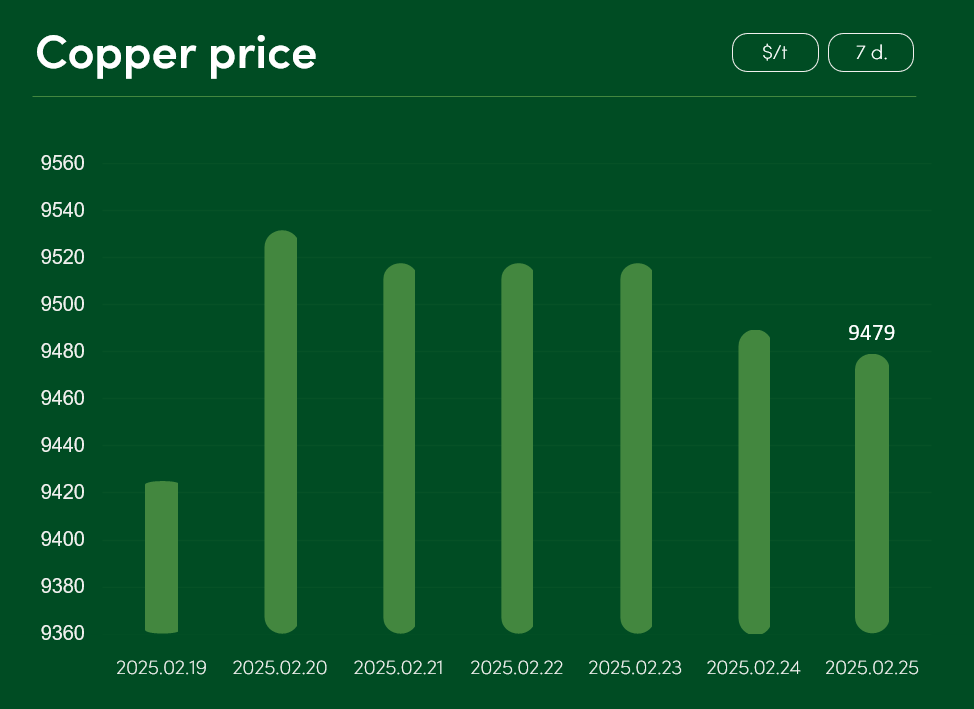

The global price of copper rose by ~0.5% between 19 and 25 February and reached $9479/t on 25 February.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.