September 24, 2024

Market Overview 18-09-24 to 24-09-2024

Precious metals, which have set various price records on the exchanges since the beginning of September, have shown a very mixed performance in the last week. The gold investors, which were optimistic about newest US interest rate cut, pushed gold prices to new all-time highs. Gold’s position was also boosted by rising geopolitical threats in the Middle East region. On the other hand, platinum and palladium metals struggled to consolidate sharp price gains of the previous weeks. While the market remains optimistic about the accommodative monetary policies of the major economic powers, the trend in demand for some of the metals in daily use is viewed with concern.

Gold, which experienced a slight price correction at the end of last week, quickly returned to its upbeat growth path. Between 18 September and 24 September, the gold price rose by ~2.8% an reached $2628/oz.

The further rise in gold prices this week can be explained by optimistic developments in global monetary policy. During 18 September, US finally made a long-awaited decision: the Fed cut bank interest rates by 50 basis points (0.5%). Such decision should attract even more capital to the precious metal market during upcoming months. However, according to the news portal Reuters, public optimism is still clouded by the high inflation that was rampant between 2021 and 2022.

New opportunities to borrow money more cheaply in the US market should lead to similar easing of borrowing conditions in many other countries in the near future. The reason for this is very simple: the dollar is the global reserve currency and the main option of payments on global commodity exchanges. The heightened willingness of the whole world to borrow ‘cheap’ dollars will eventually lead many other countries to lower bank interest rates in order to maintain their competitiveness.

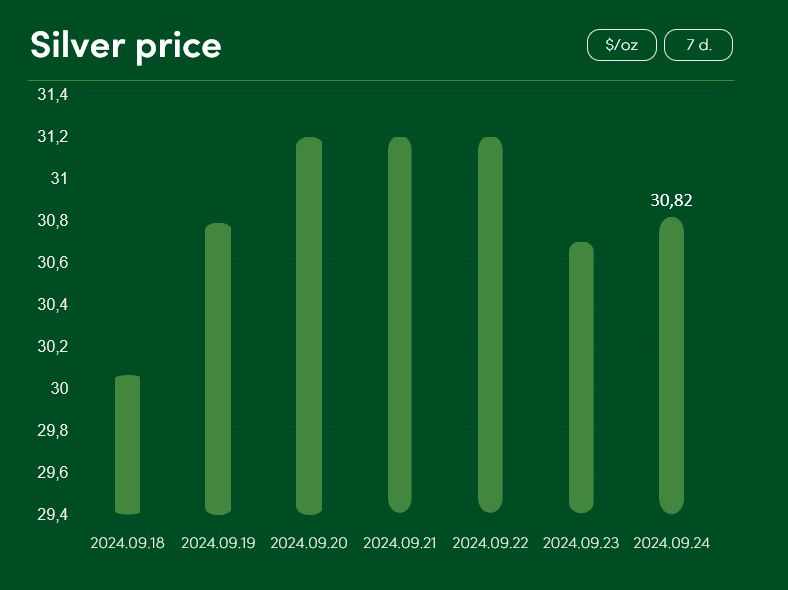

Silver prices also had a rather upbeat week. Between 18 and 24 September, the precious metal rose by ~2.5% on the exchanges, reaching a price of $30.82/oz.

The ongoing rise in silver prices can be explained not only by the accommodative monetary policy of the US, but also by the upbeat financial news from China, one of the main miners and users of silver. According to CNBC, the Chinese central bank announced on 17 September its decision to cut the reserve requirement ratio of Chinese banks by 50 basis points (0.5%) in the near future. This decision will help to free up a significant amount of money for new loans to businesses and individuals and contribute to the recovery of the Chinese economy, which is currently dealing with real estate crisis.

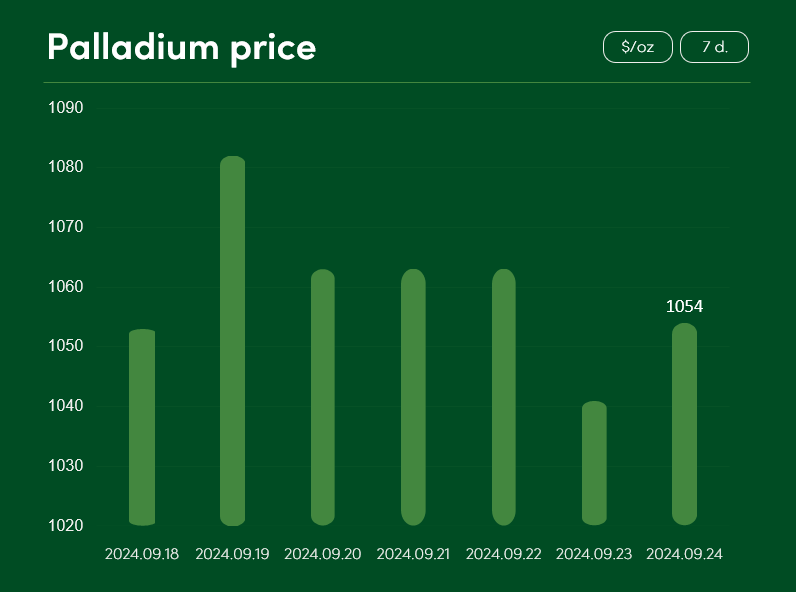

After a sharp price rise in early-mid September, palladium prices on the stock exchange have been undergoing a correction and consolidation at lower levels over the last few weeks. The palladium price curve temporarily stabilised around the ~1050 $/oz level between 18 September and 24 September.

Platinum prices also showed no significant changes between 18 and 24 September. The precious metal recorded an overall slight correction of ~0.55% this week and reached a price level of $967/oz.

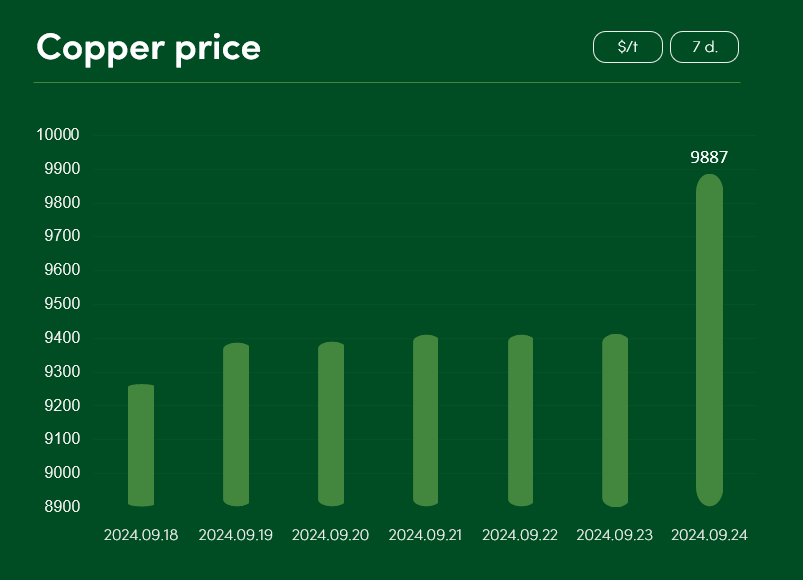

Investors are pleasantly surprised by the prolonged period of copper price appreciation. Between 18 and 24 September, the semi-precious metal rose by ~6.5% on the markets to exceed a price of $9887/t.

Although almost nobody doubts the long-term prospects of copper, according to TradingEconomics specialists, the sharp rise in copper prices observed in the short term was driven by the aforementioned favourable financial news in the US and Chinese markets. China is the world’s largest copper consumer, whose bold monetary decisions, taken to revive stagnating China’s economy, are clearly being viewed with optimism by the markets.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.