June 24, 2025

Market Overview 18-06-2025 to 24-06-2025

During the last week, markets of precious metals experienced mixed price movements. Gold and silver prices declined in response to growing stability in the global geopolitical landscape. Meanwhile, precious metals such as palladium saw price increases driven by specific supply issues.

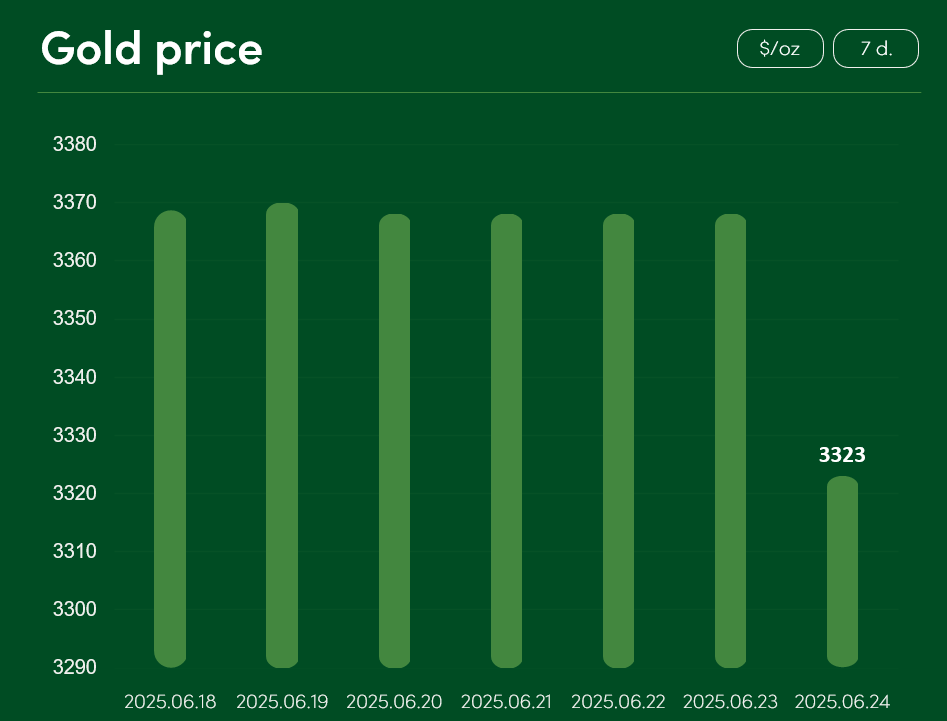

Global gold price fell by approximately 1.35% from June 18 to June 24, reaching $3323/oz.

The main factor behind the gold price decline was the de-escalation of geopolitical tensions in the Middle East. With Israel and Iran reaching a fragile ceasefire agreement, gold lost some of its appeal as an investment hedge.

On the other hand, some investors are not rushing to sell their gold assets. This decision is influenced both by the still very high geopolitical tensions and optimistic signals in US monetary policy. Although the Fed decided not to cut interest rates during its June 17-18 meeting, Federal Reserve Chair J. Powell did not rule out the potential for rate cut as early as July in his Congressional testimony. Such a move could stimulate price increases for precious metals denominated in dollars (gold, silver, etc.).

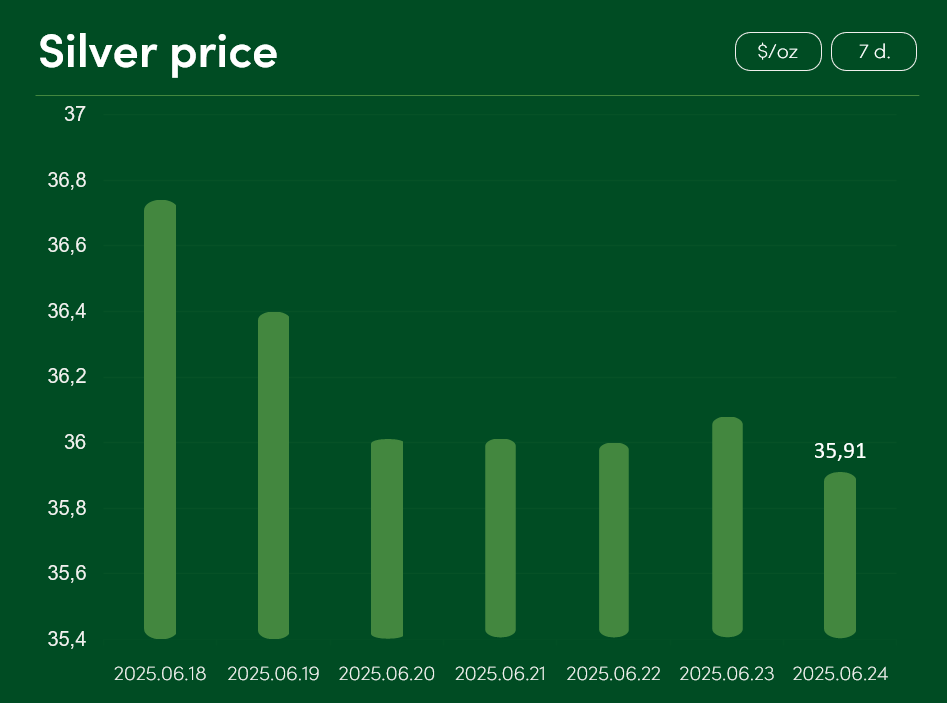

Global price of silver decreased by approximately 2.25% from June 18 to June 24, reaching $35.91/oz.

The most notable reason for the silver correction was also the de-escalation of the Iran-Israel conflict. The easing of geopolitical concerns was driven both by the fragile ceasefire and Iran’s avoidance of attacks in the Strait of Hormuz, one of the world’s key trade chokepoints. Approximately 20% of the world’s oil supply is regularly transported through the the Strait of Hormuz, as it is the only route by which oil from the Persian Gulf can be directly transported by sea to global markets.

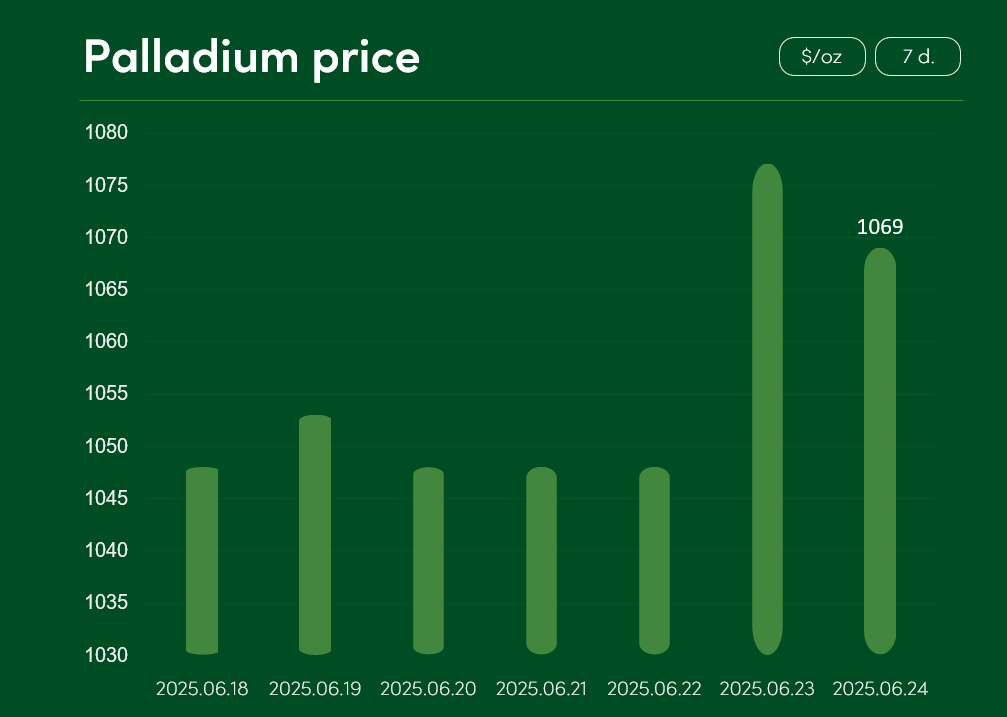

Global palladium price rose by about 2% from June 18 to June 24, reaching $1069/oz.

The recent rise in palladium prices is driven by a supply-demand imbalance. While global palladium demand remains stable, supply-side challenges persist. Supply issues were exacerbated by specific US and EU sanctions imposed on Russian palladium supplier Norilsk Nickel as well as by temporary shutdowns of South African palladium mines due to maintenance and adverse weather conditions.

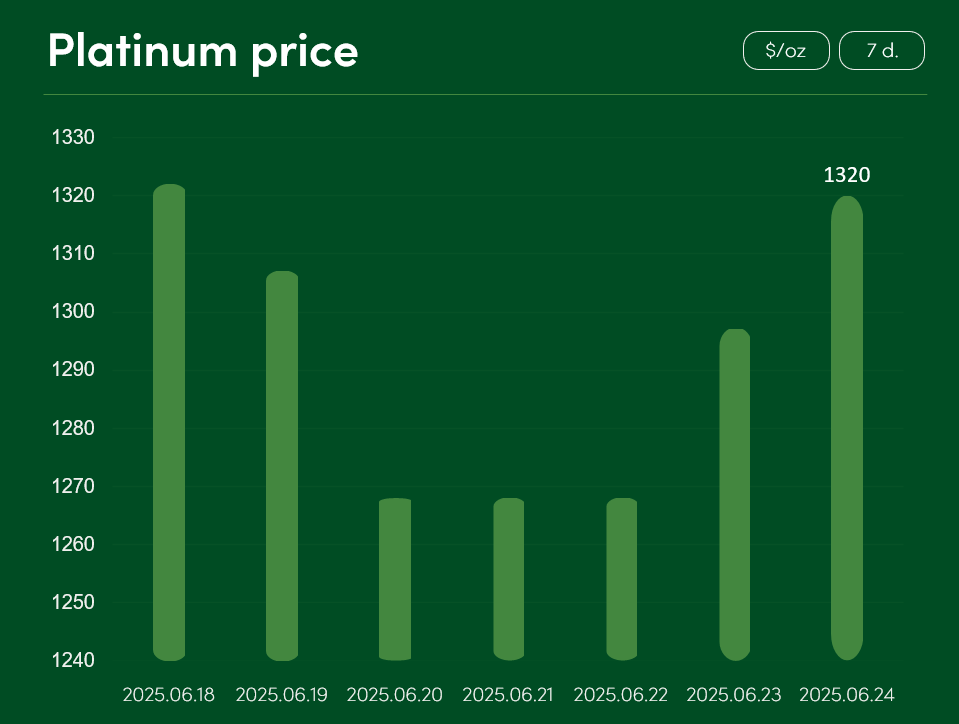

Global price of platinum showed minimal changes between June 18 and June 24. On June 24, the price of this precious metal reached $1320/oz.

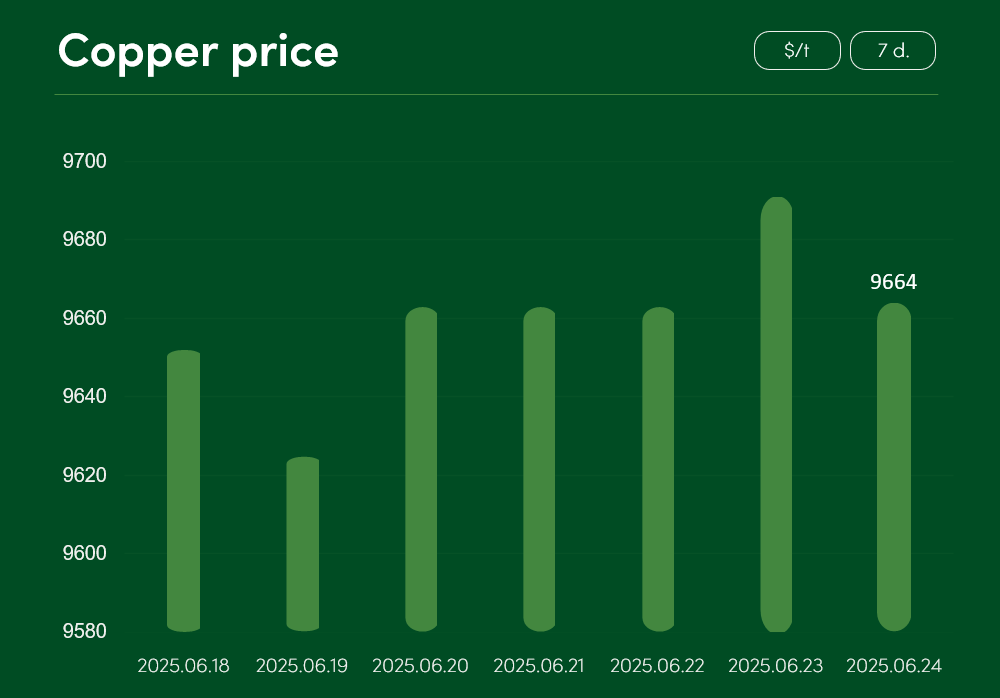

Global copper prices also did not experience significant changes from June 18 to June 24. On June 24, the industrial metal traded at $9664/t.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.