September 23, 2025

Market Overview 17-09-2025 to 23-09-2025

During the past week, the main precious metals markets experienced a distinctly optimistic period of price growth. This was driven by interest rate cuts, U.S. economic policies focused on stimulating consumption, and the deepening international political crisis in the Middle East.

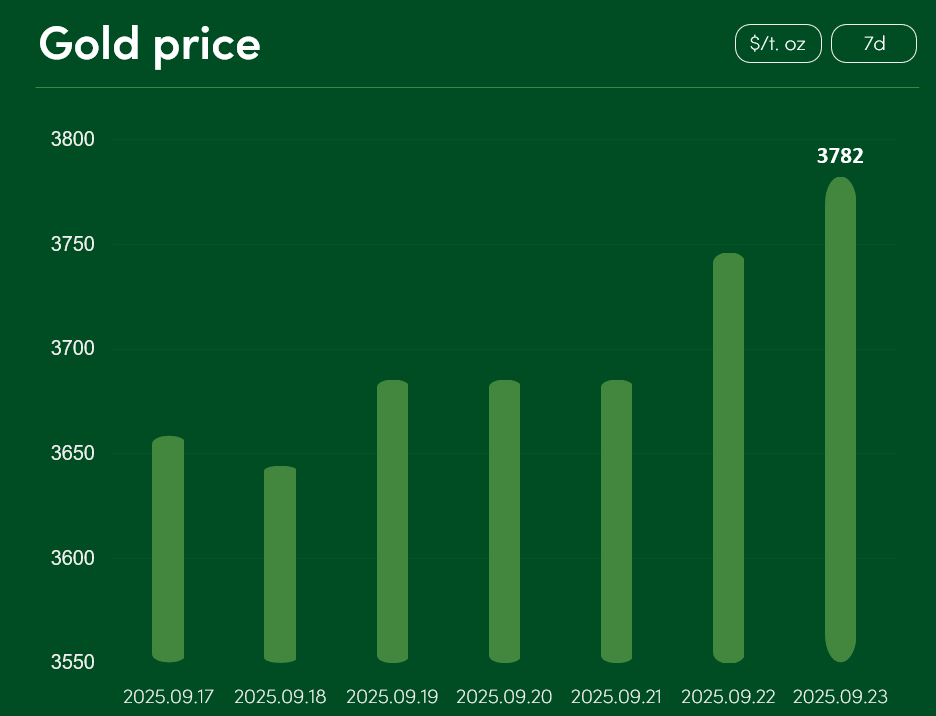

From September 17 to September 23, the global gold price rose by more than 3% and reached $3,782 per troy ounce.

New all-time highs for gold price were supported by the exceptionally favourable monetary policies of the developed world’s markets. With the FED lowering U.S. interest rates, precious metals denominated in U.S. dollars (gold, silver, etc.) are becoming a relatively cheaper investment option for foreign currency holders.

The Organisation for Economic Co-operation and Development (OECD) forecasts that U.S. interest rates will be reduced three more times by next spring. It is almost certain that the drastic monetary policy of the world’s largest economy will encourage interest rate cuts in other developed markets as well. The central banks of both Canada and Poland have recently reduced their rates. Expanding opportunities to borrow money under more favourable conditions may significantly contribute to growth in both the global stock market and precious metals markets.

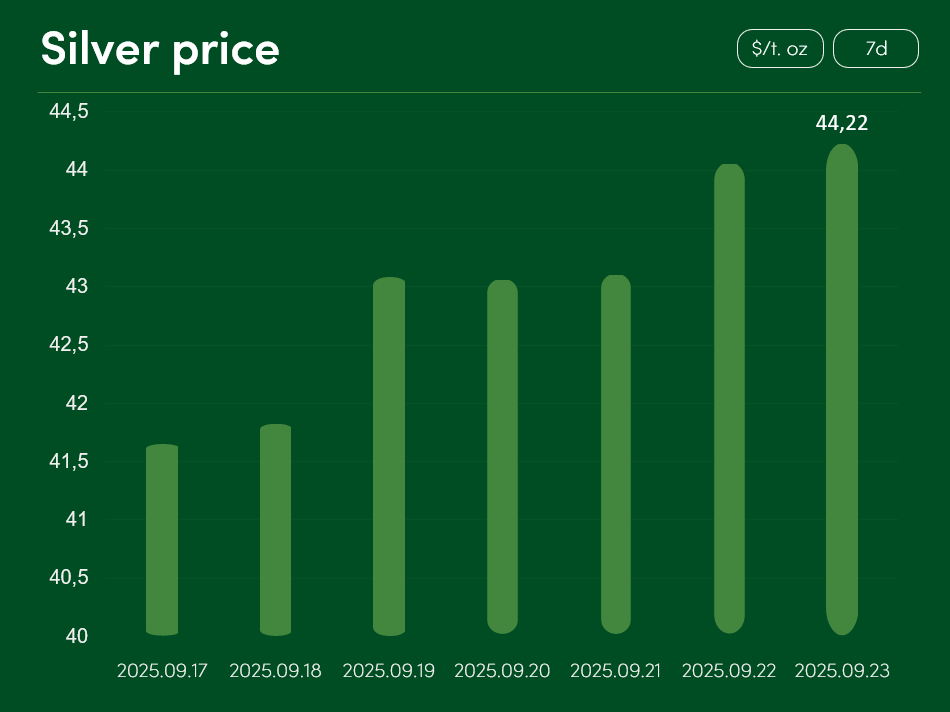

From September 17 to September 23, the global silver price rose by more than 6% and reached $44.22 per troy ounce.

The record-breaking surge in silver price was undoubtedly supported not only by interest rate cuts, but also by the escalation of the geopolitical crisis in the Middle East. As Israel’s military invasion of Palestine and the massive assault on Gaza City continue, more and more countries are recognizing Palestinian statehood. With Canada, Australia, Portugal, the United Kingdom, France, and many other Western democracies recognizing Palestine as a country, uncertainty is growing over the future of the Israel–Palestine conflict and the further development of events in the Middle East.

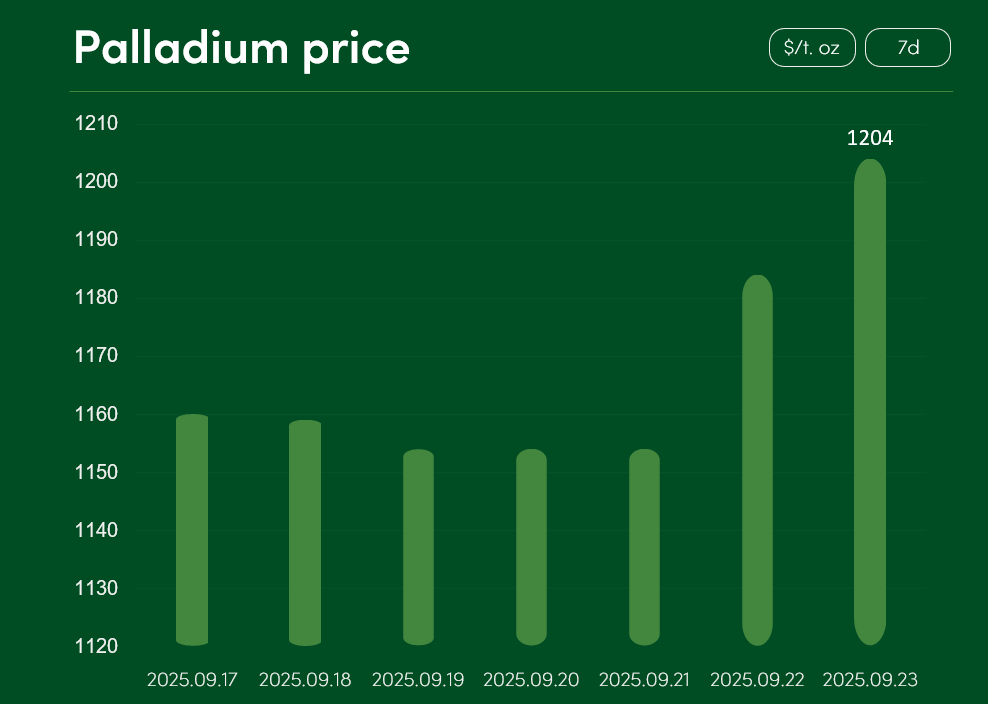

From September 17 to September 23, the global palladium price rose by around 3.8% and reached $1,204 per troy ounce.

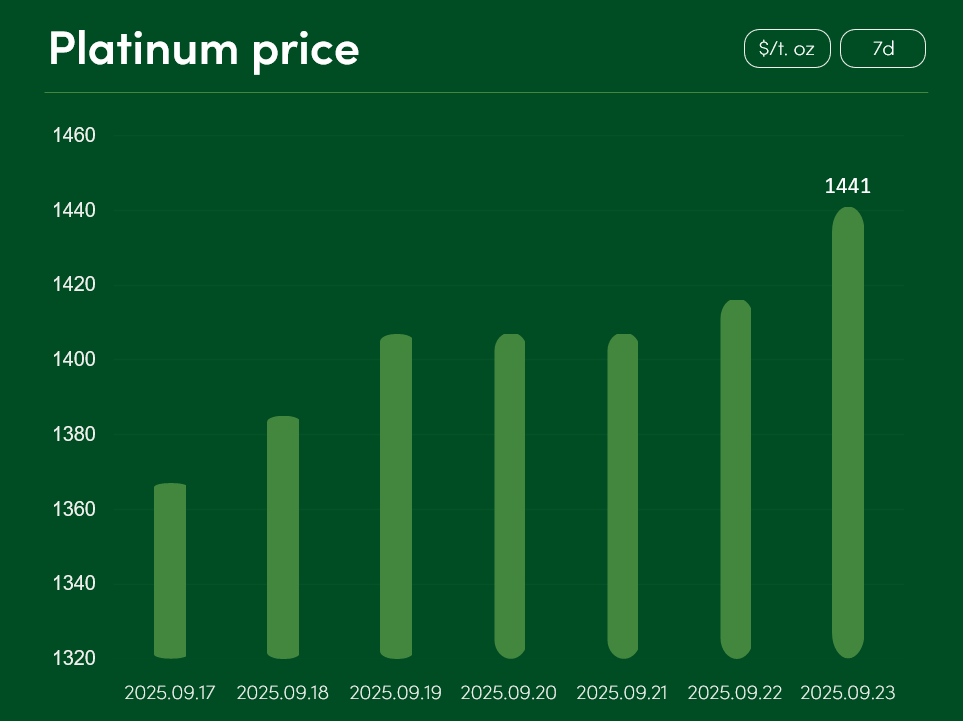

At the same time, the global platinum price increased by more than 5% and reached $1,441 per troy ounce.

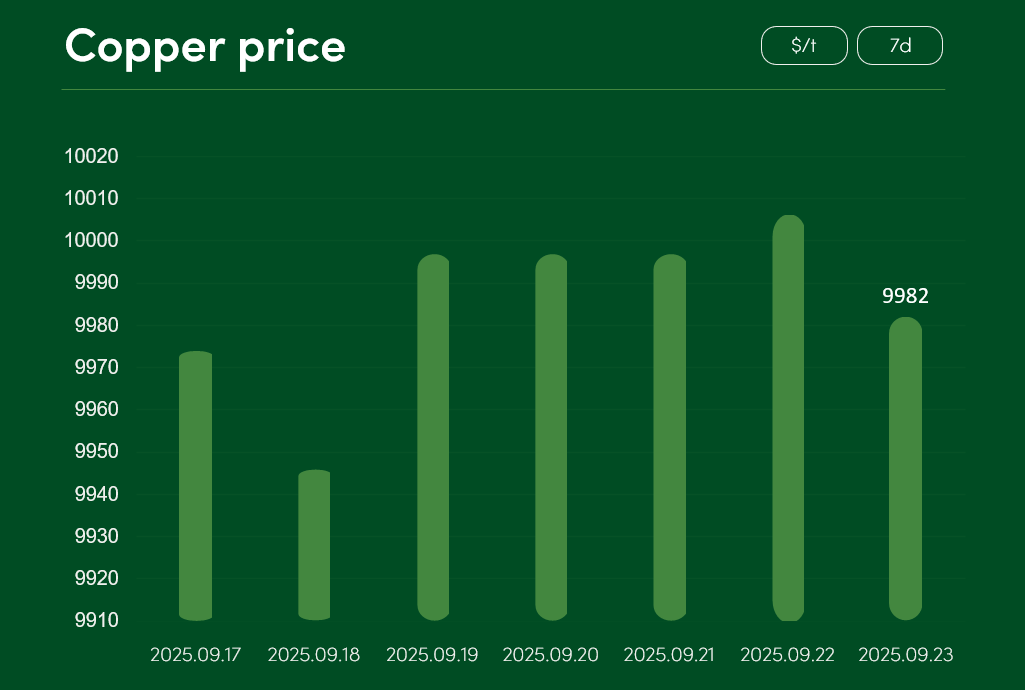

From September 17 to September 23, the global copper price faced minimal changes; on September 23 it stood at $9,982 per tonne.

The copper price rally observed since August has recently been supported both by central banks’ monetary policies favourable to consumption and industrial production, and by political news and official market statistics beneficial to the international copper production sector.

With U.S.–China negotiations continuing, increasingly optimistic signs of the large trade agreement are being noted. Reports indicate that the two countries are approaching a significant Boeing aircraft order deal, which could become a cornerstone element of a large-scale trade agreement. It has also been observed that China considerably increased its imports of copper concentrate in August, while projections indicate that the country’s refined copper output will decline in September. Temporary disruptions in the international copper supply–demand chain may, in the short term, contribute to a sharper price increase for this industrial metal.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.