October 22, 2024

Market Overview 16-10-24 to 22-10-2024

The prices of the main precious metals recorded very significant rises and new records during last week. It seems that the continuing steady reduction of interest rates in various major world markets and concerns about the uncertainty of the international geopolitical situation have been the main “drivers” of the increased investor focus on precious metals this autumn.

Gold prices on the exchanges rose by ~2.5% between 16 October and 22 October, reaching the 2736 $/oz mark.

The gains of the main precious metal are linked to overall economic optimism and geopolitical uncertainty. The European Central Bank announced another 25-basis point (0.25%) interest rate cut on 17 October. The Central Bank of the People’s Republic of China also announced a decision to cut base rates by 0.25%. The US Federal Reserve is also expected to cut interest rates by the same amount as early as November.

Gold prices are also being pushed up by the deepening crisis in the Middle East: the Israeli invasion in Lebanon, according to the New York Times, has been marked in recent days by heavy rocket strikes on Hezbollah-linked branches of the Al-Quard al-Hasan financial institution. With investors fearing an escalation of the conflict, precious metals remain as an additional hedge in many investment portfolios.

Silver prices also experienced a week of record growth due to the aforementioned monetary policy decisions and geopolitical threats. Between 16 and 22 October, this precious metal rose by >7.5% on the exchange, reaching a price point of $34.19/oz.

Silver prices recorded extremely bullish outbreak partly due to favourable monetary policy of the Chinese Central Bank. China, one of the main users of silver, not only has already formally adopted decisions to reduce banks’ reserve requirements and to cut domestic interest rates; Chinese government also chose to enlarge their means of easing of local monetary policy.

According to TradingEconomics, last Friday the Chinese Central Bank vocalised the likelihood of further cuts in banks’ reserve funds requirements by the end of this year. Such a decision would undoubtedly lead to an increase in the industrial use of silver in areas of strategic importance, such as the production of solar panels.

Palladium prices rose by >5% on the exchanges between 16 October and 22 October, reaching a price of $1075/oz.

Precious platinum metal prices have risen by around 2.3% over the past week to reach a price point of $1021/oz.

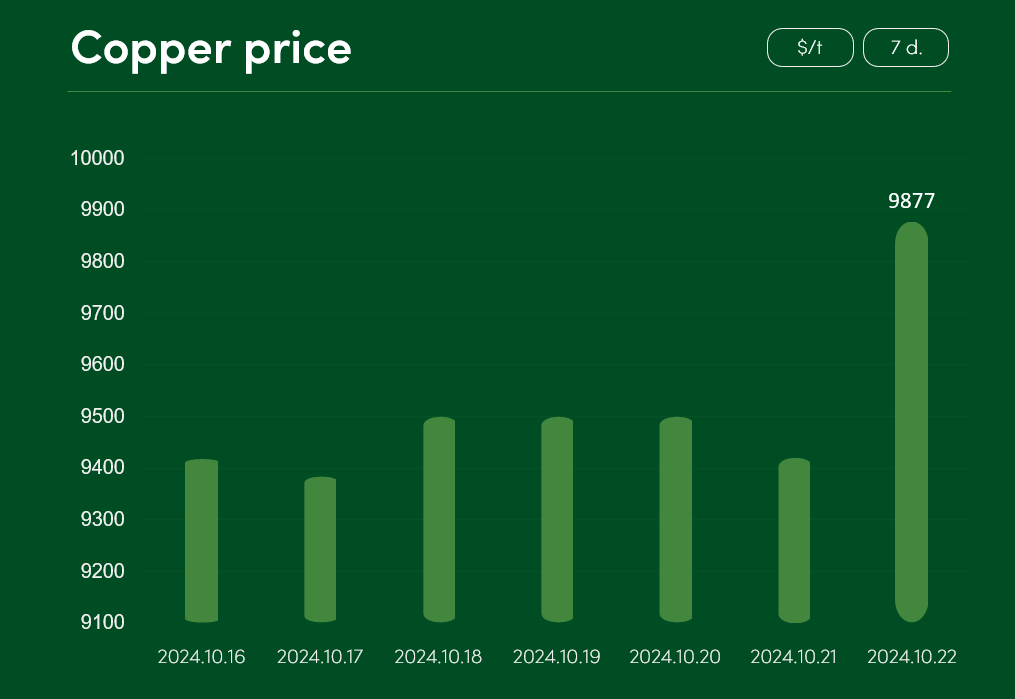

Semi-precious copper metal prices recorded an overall increase of ~4.9% over the past week and reached a price of $9877/t on 22 October.

While the long-term prospects for copper and its importance for the industrial and energy sectors are clear, copper has recently been facing price corrections, both due to the difficult economic situation in China (a major user of copper) and the sharp recovery of the dollar course.

According to TradingEconomics, this Monday, copper and many other commodities traded on the exchanges faced difficulties and temporary declines precisely due to the strengthening US dollar. Americans and foreign investors are welcoming the improving economic outlook for the United States domestic market and are quite optimistic about the latest forecasts that Trump is likely to be re-elected as US President.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.