July 22, 2025

Market Overview 16-07-2025 to 22-07-2025

Last week, the global precious metals market continued its upward price trend. Investor interest in precious metals was driven by optimistic statements from the Chinese government regarding economic policy, the increased likelihood of a FED interest rate cut in September, and subtle signals in the public domain pointing to the formation of alternative trade agreement prospects.

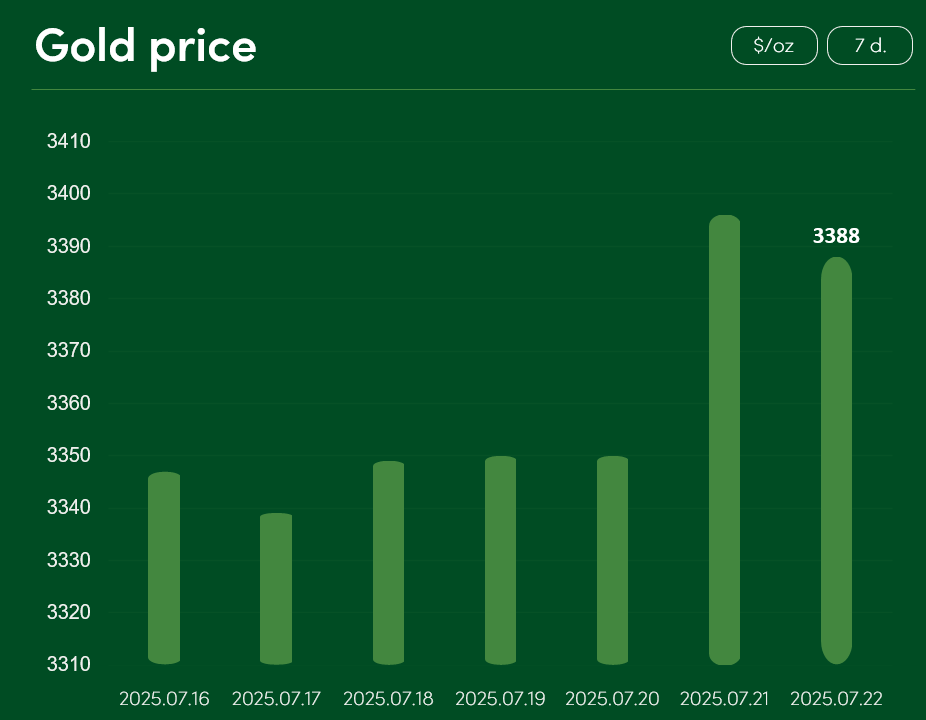

The global gold price rose by more than 1.2% from July 16 to July 22, reaching $3,388/oz.

The continued growth in gold prices is increasingly supported by the emergence of new alternative trade agreement paths. In the event that concrete agreements with the United States are not reached by the set August 1 deadline, markets such as the European Union have warned of possible retaliatory measures and are actively seeking potential allies among the world’s major economies.

Amidst the tense EU–US economic relations, US Commerce Secretary H. Lutnick stated he is confident that the United States will reach an agreement with Europe.

When evaluating the prospects for alternative deals, attention turns to the push from China’s businesses: they encourage to seize this “historic opportunity” and reach a “tangible” EU–China trade agreement.

In the coming days, EU political leaders in Tokyo and Beijing will meet with representatives from Japan and China. While the European delegation does not expect tangible results from talks with Chinese officials, agreements focused on economic security and defence industry cooperation are expected to be signed with the Japanese government.

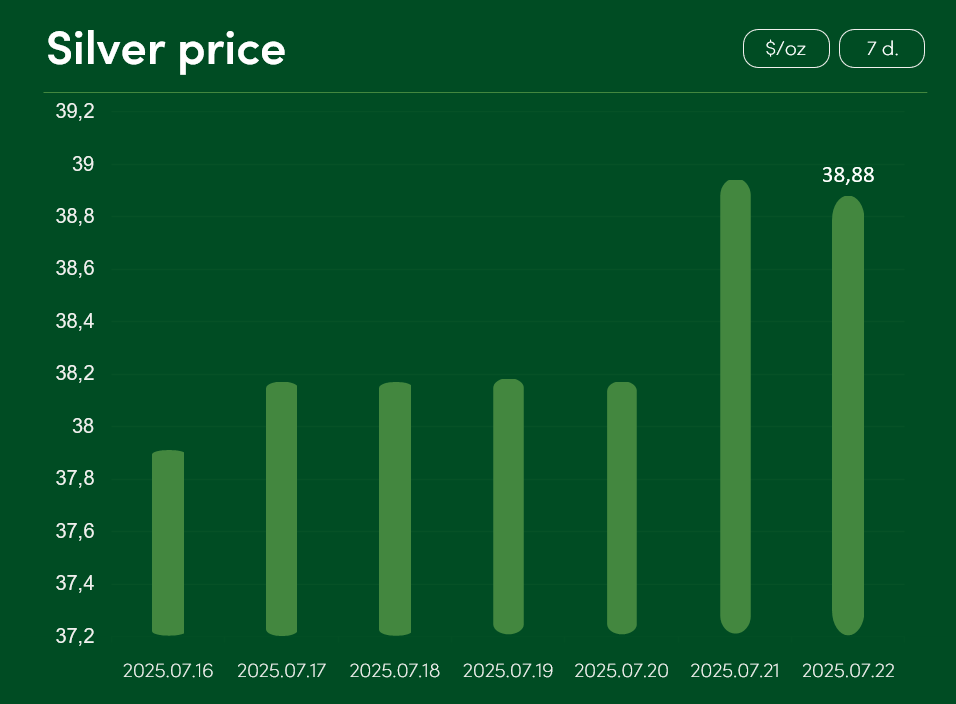

The global silver price rose by more than 2.5% between July 16 and July 22, reaching $38.88/oz.

Silver price growth continues to be driven by both the rising potential for alternative trade agreements and positive news from the Chinese market.

China’s Ministry of Industry and Information Technology publicly announced a commitment to stabilize growth in key strategic sectors such as machinery production, electrical equipment manufacturing, and the automotive industry.

The Chinese government’s action plan also includes support for ten core national industries, including steel, non-ferrous metals, petrochemicals, and construction materials.

Since silver is widely used in industrial production, particularly in the electronics, electrical equipment, and automotive sectors, these new Chinese economic initiatives may drive a noticeable increase in domestic silver demand.

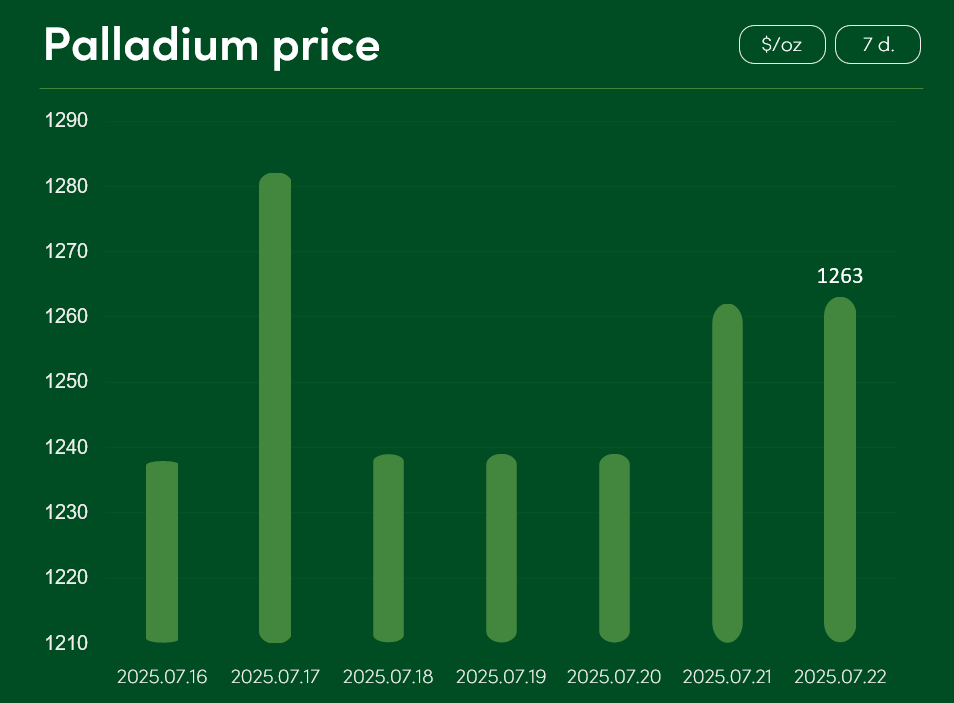

The global palladium price rose by approximately 2% between July 16 and July 22, reaching $1,263/oz.

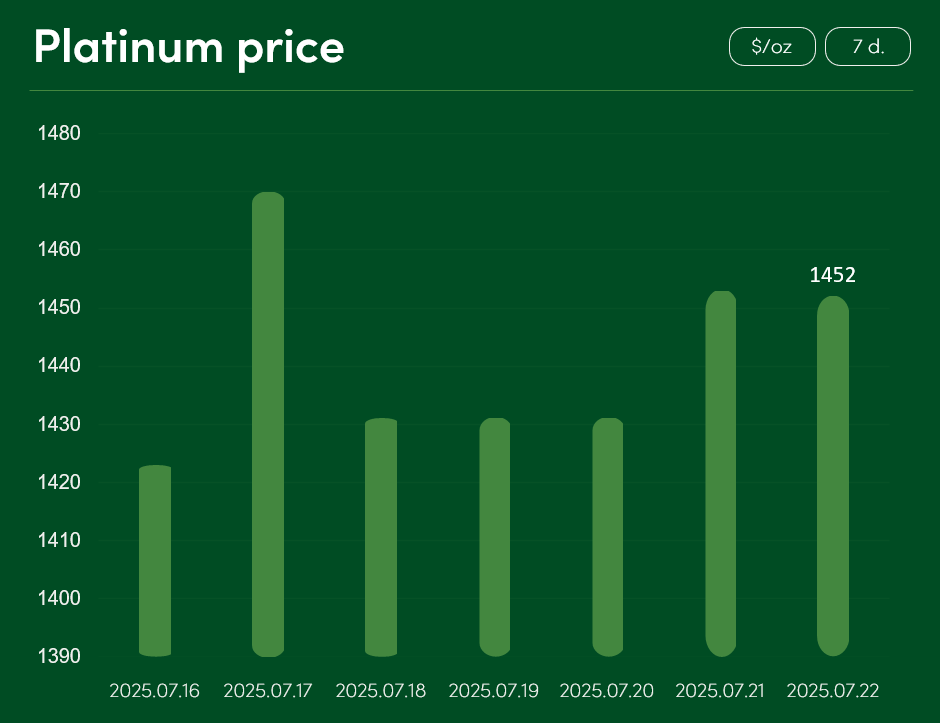

The global platinum price increased by more than 2% in the same period, reaching $1,452/oz.

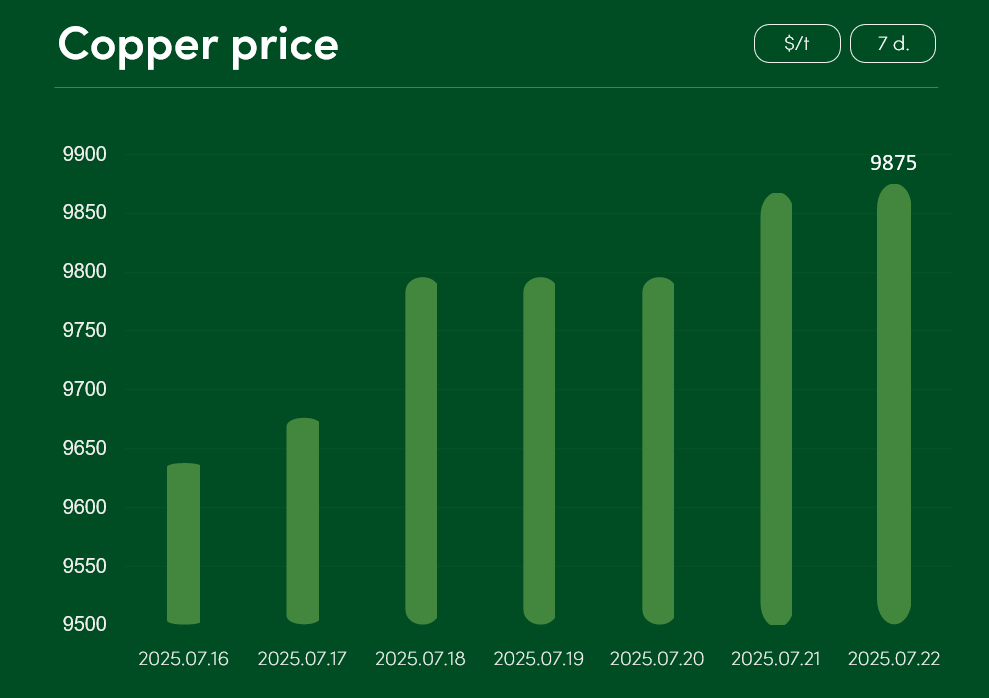

The global copper price rose by more than 2.4% from July 16 to July 22, reaching $9,875/t.

One of the most significant contributors to the recent increase in copper prices is the decision by US President D. Trump and his administration to impose a 50% tariff on all copper imports to the United States starting August 1.

Amid the threat of the new tariff, the US copper premium over the London Metal Exchange (LME) benchmark surged to as high as 25%.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.