April 22, 2025

Market Overview 16-04-2025 to 22-04-2025

Last week, the major precious metals faced very diverging market price movements. They were driven by the continuing uncertainty in international trade, by news and unexpected challenges in the area of interest rate cuts, and by the weakening of the US dollar against other major world currencies.

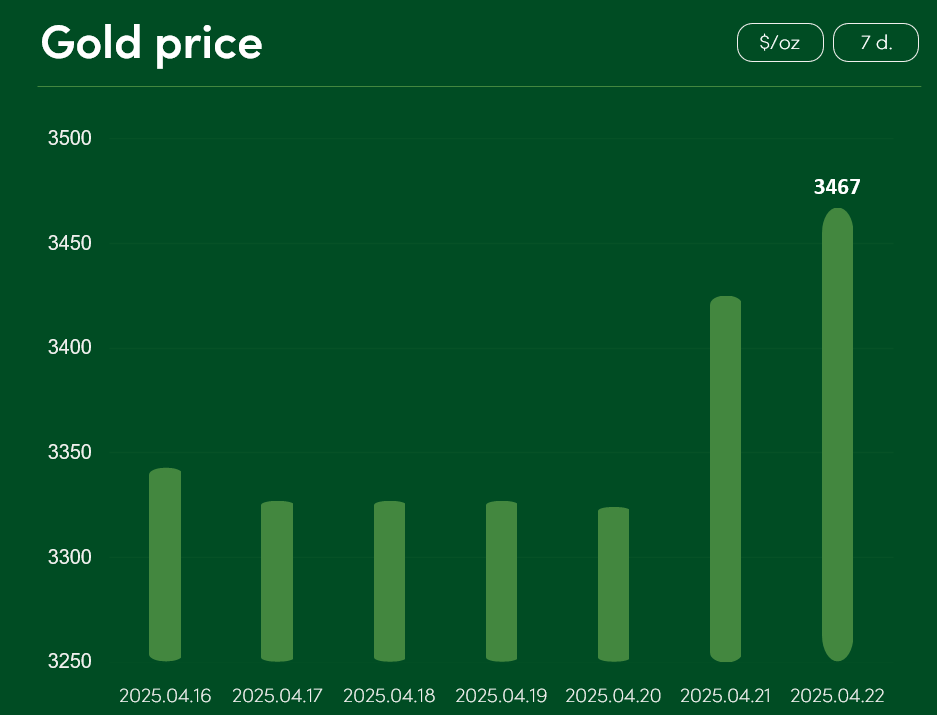

The global gold spot price rose by ~3.7% between 16 April and 22 April, reaching $3467/oz on 22 April.

The continued escalation of US-China trade tensions and US President Trump’s aggressive intervention in the country’s Federal Reserve policy contributed to the new gold price record. Dissatisfied with Fed Chairman Powell’s delay in lowering US interest rates, Trump implicitly threatened to dismiss him from his post. This politicised interference in the activities of the US central bank was seen by investors as yet another threat, and they increased their choice of gold as a time-tested investment hedge.

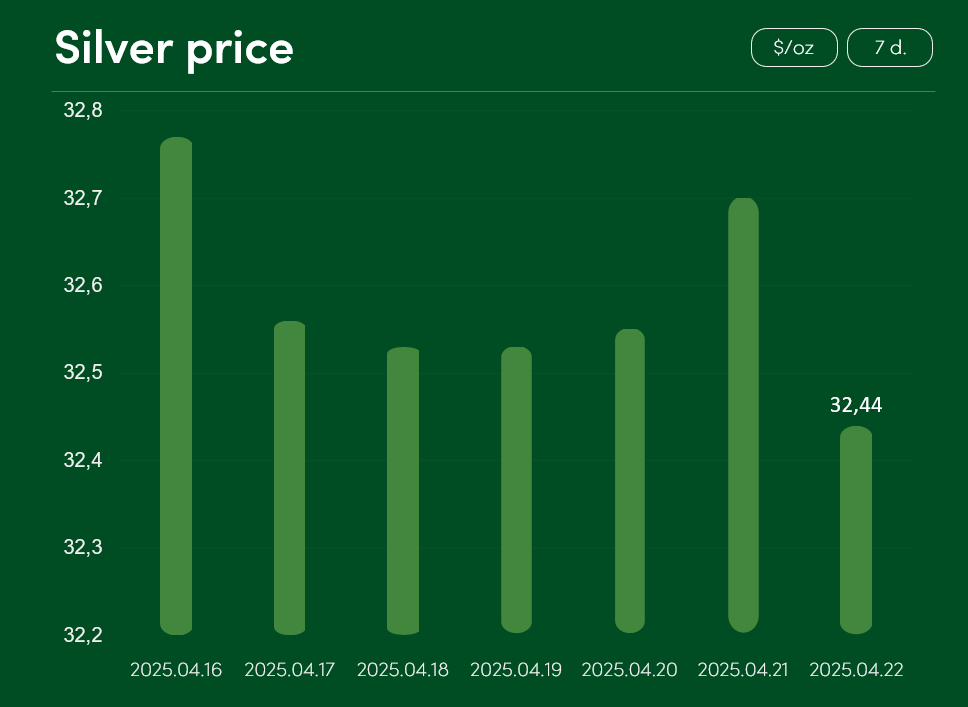

The silver price recorded a slight correction last week. Between 16 April and 22 April, silver experienced a slight decline of ~1%, reaching a price of $32.44/oz on 22 April.

Although silver has experienced a temporary decline in price, there are a number of favourable factors boosting demand for this investment-industrial metal. The weakening of the dollar due to an aggressive US trade policy is making silver metal (denominated in this currency) a more favourable investing choice for holders of other fiat currencies.

Also, in the context of global geopolitical crises and trade wars, the continuous adoption of new interest rate cuts is helping to boost silver prices in the short term. On 17 April, the European Central Bank announced its 7th interest rate cut from June 2024. Countries such as the United Kingdom and Canada are also likely to make interest rate cuts in the near future.

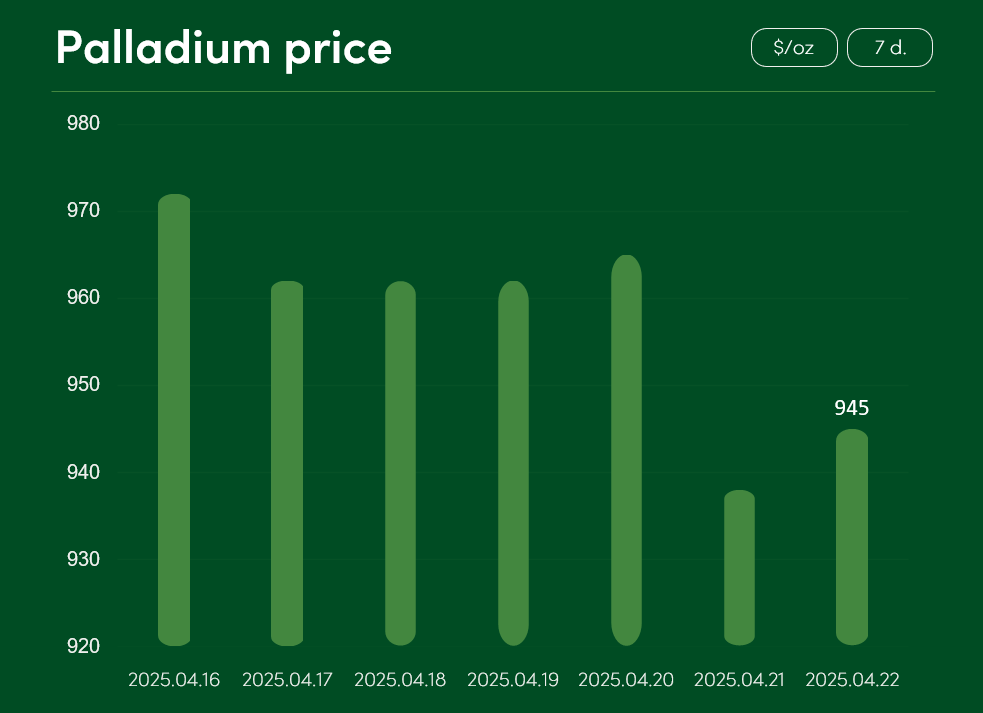

The global palladium price experienced a minimal correction of ~2.7% between 16 and 22 April. On 22 April, the price of $945/oz was reached.

The platinum precious metal has avoided any significant price changes over the past week. On 22 April, the global platinum price reached $969/oz.

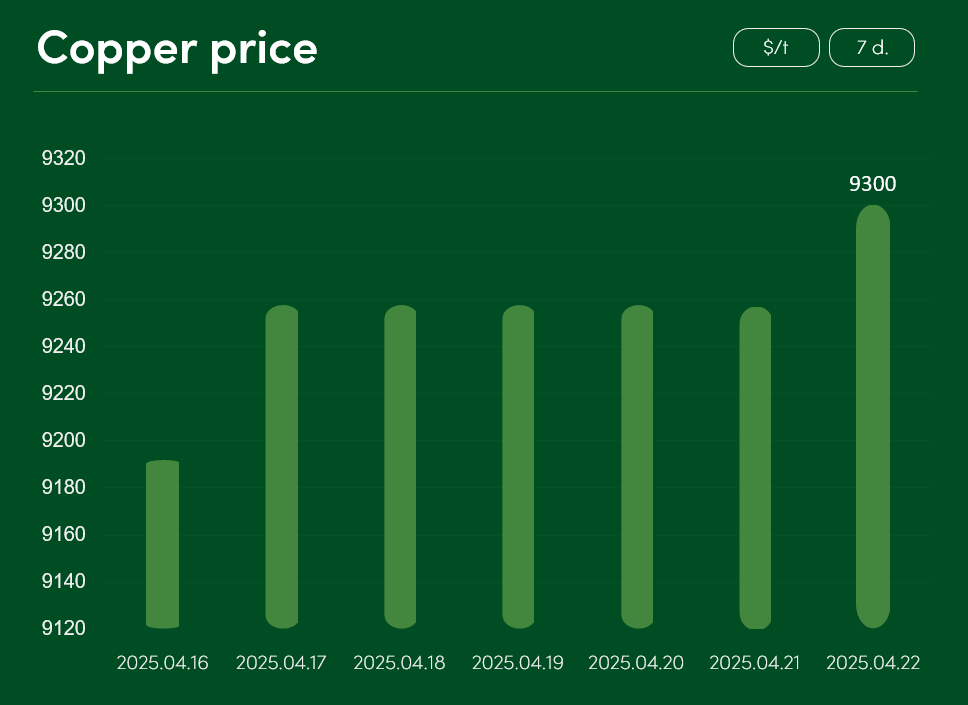

The global copper price increased by ~1.2% between 16 April and 22 April, reaching $9300/tonne on 22 April.

Although copper prices experienced a sharp correction at the beginning of April, several important market factors have shaped the recent growth in demand for this metal. Fears of the likely imposition of global tariffs on US copper imports have led to a temporary increase in copper imports into the US. Investors are also anxiously watching the copper refining crisis in the Chinese market. The shortage of copper concentrate used for the production of refined copper is driving the persistence of negative metal treatment-refining rates in China and contributing to the supply problems of refined copper for industrial production.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.