October 21, 2025

Market Overview 15-10-2025 to 21-10-2025

Last week, the main precious metals collectively experienced price corrections. The situation can be explained by both the easing of global geopolitical tensions and investors’ desire to profitably “close” part of their recently expanded precious metal positions. As stability continues to grow in the world’s largest markets, demand for key precious metals has temporarily declined.

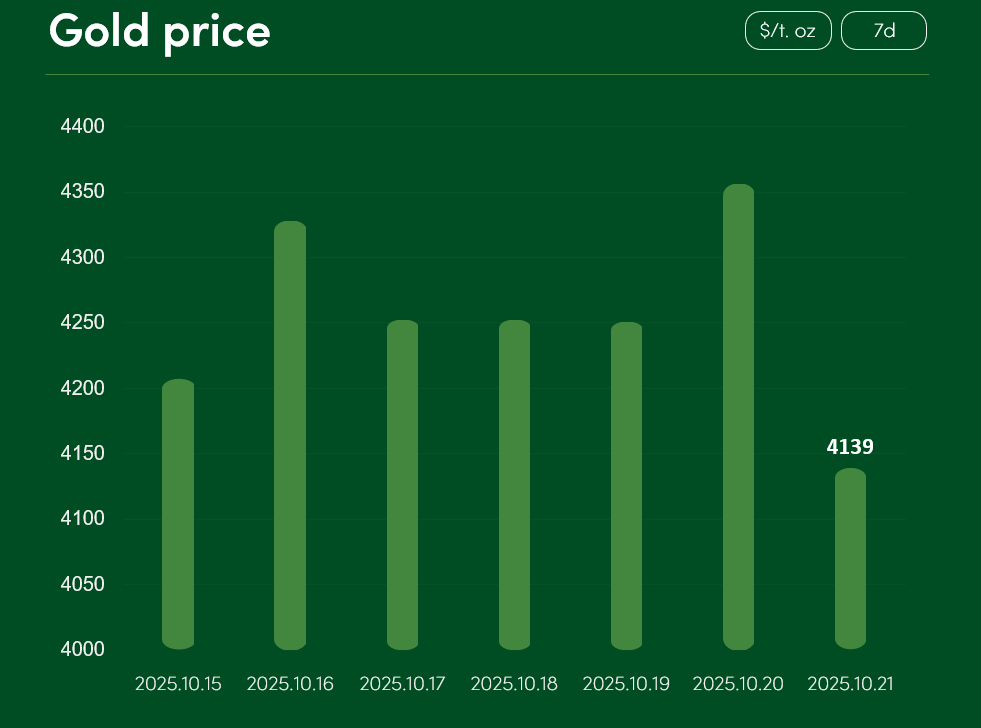

The global gold price faced a correction of over 1.6% between October 15 and October 21. On October 21, gold reached $4,139/t. oz.

It is likely that the gold correction was driven not only by the record price surge in the first half of this autumn. A temporary decrease in demand may also have been influenced by positive signals regarding a potential stabilization of U.S.– China political and trade relations.

As the meeting between Donald Trump and Xi Jinping in South Korea approaches, an additional official high-level U.S.– China gathering in Malaysia has been announced. The world interprets this news as a sign that the two largest economies are ready to seriously negotiate a trade agreement and ease restrictions affecting trade flows. Speculation was further fueled by Trump’s assurance that he expects to reach a “fair trade deal” with China during the South Korea meeting.

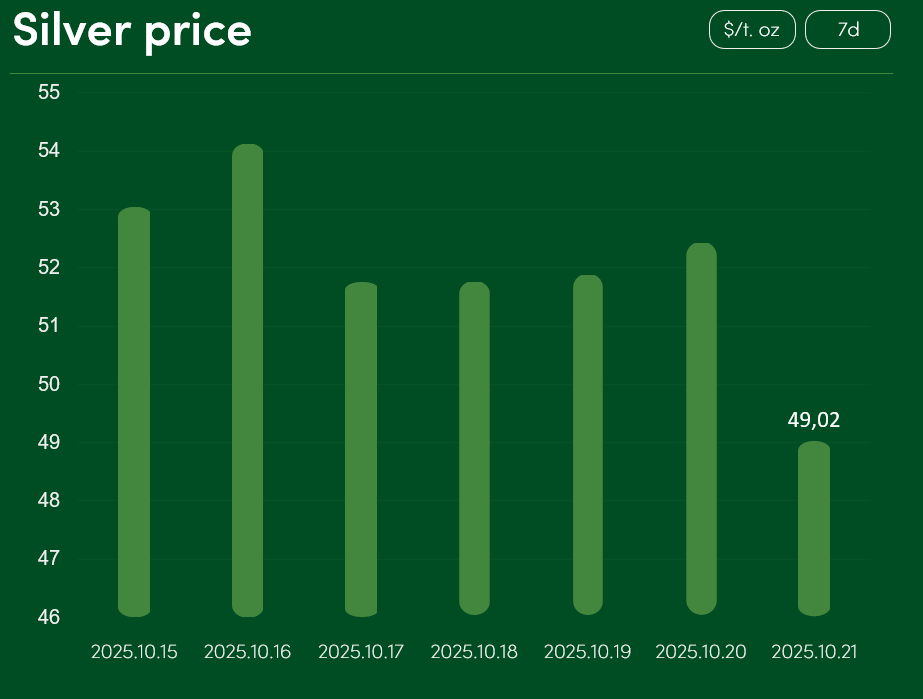

The global silver price experienced a correction of more than 7.5% between October 15 and October 21. On October 21, silver reached $49.07/t. oz.

The late-October silver correction was driven not only by profit-taking after record price growth. Markets also reacted to a shift in rhetoric surrounding possible Russia–Ukraine peace negotiations.

Reports indicate that the leaders of Ukraine and nine European allied nations officially demand that, instead of further Ukrainian territorial concessions to Russia, negotiations to end the war should be based on the current front lines. The international community interpreted this statement as a signal of Ukraine’s and its European allies’ readiness for potential peace talks.

The de-escalation of geopolitical tensions in Europe theoretically implies reduced demand for precious metals; therefore, the latest political developments from Ukraine were met by the precious metals markets with a notable price correction.

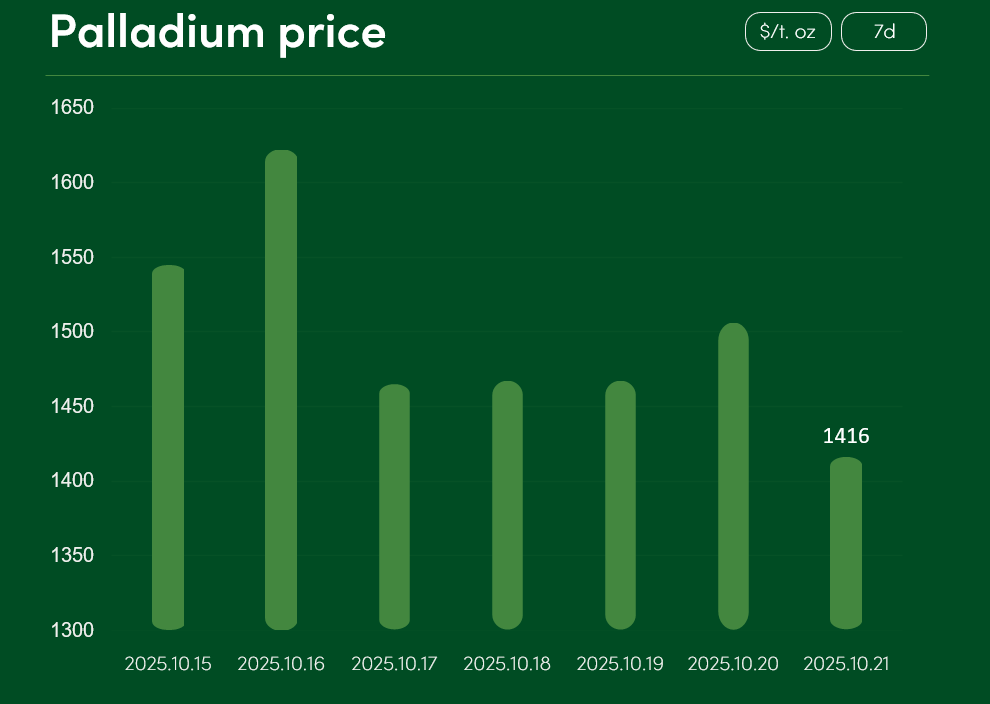

The global palladium price fell by more than 8% between October 15 and October 21, reaching $1,416/t. oz. on October 21.

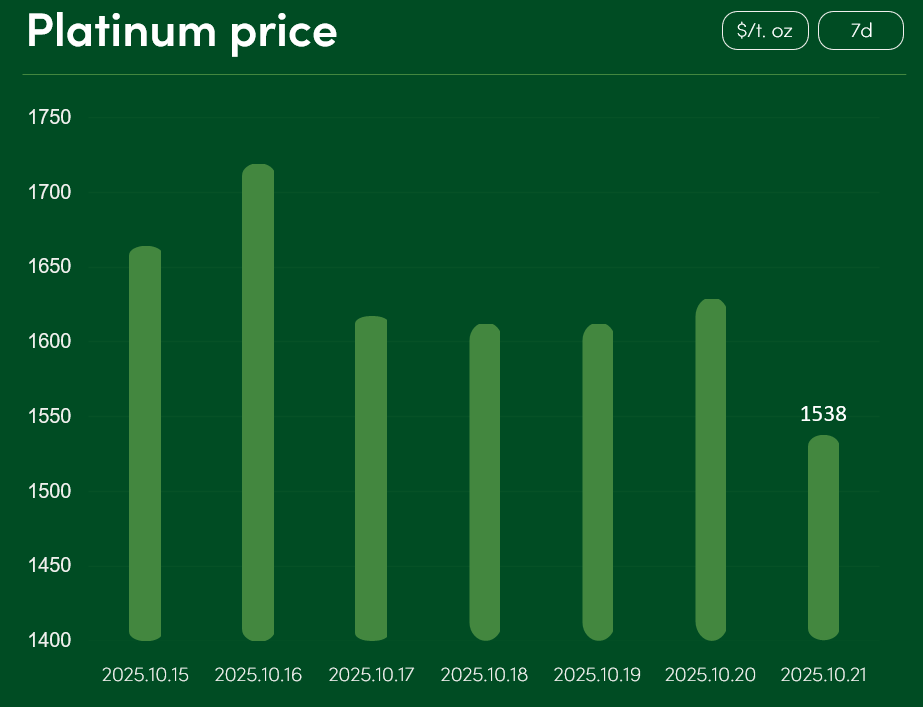

The global platinum price experienced a ~7.5% correction during the same period, reaching $1,538/t. oz. on October 21.

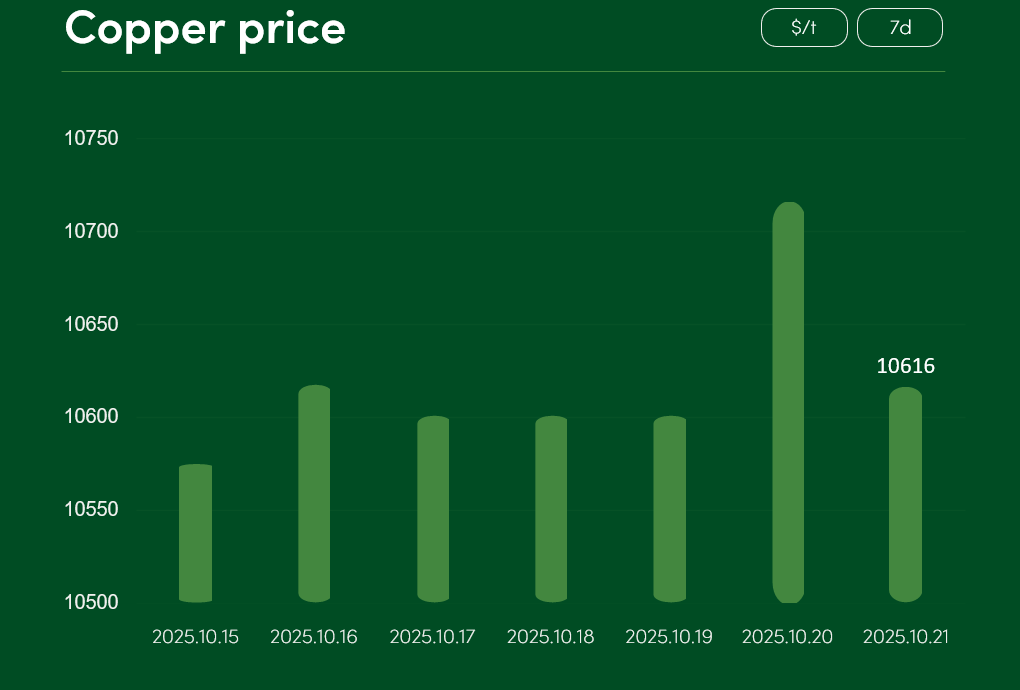

Meanwhile, the global copper price showed only minor changes between October 15 and October 21, standing at $10,616/tonne on October 21.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.