January 21, 2025

Market Overview 15-01-2025 to 21-01-2025

At first glance, the precious metals market did not experience any exceptional developments during the last week. Most precious metals prices recorded either modest gains or small corrections. However, this calm may soon come to an end. Last week was not lacking in geopolitical developments, nor in economic announcements and decisions by China and the US, which could lead to more pronounced metal price dynamics in the future.

Between 15 January and 21 January, the global gold market price rose by ~1.1% to reach 2723 $/oz on 21 January.

Although gold prices confidently rose in the first half of January, the visible slowdown of last week can be attributed to a number of contradictory market signals. On the one hand, with the swearing in of Trump as President of the United States, a tougher import policy in the United States, an escalation of trade conflicts and a growing demand for the precious metal can be expected.

On the other hand, the markets are also reacting to news that signals a possible correction in gold. Last Sunday, a ceasefire agreement between Israel and Hamas was finally reached. The increase in geopolitical stability in the Middle East may strongly contribute to a decrease in investment demand for gold.

Global interest rate trends are also not very favourable for precious metals. The US is expected to cut interest rates by just 0.5% this year, and there is an almost 100% consensus among market participants that a positive decision on next rate cut will not be taken at the next Fed meeting. The central bank of Japan is also not taking an encouraging stance when it comes to interest rates: analysts at Reuters say that a 0.25 rate hike is expected in that country in the nearest future. The global slowdown in interest rate cuts this year may add to the pressure on current record-high gold prices.

The global silver market price did not register any significant changes between 15 January and 21 January, reaching $30.48/oz on 21 January.

Although this week was not spectacular for silver, the metal’s phenomenal price rise from the beginning of 2024 is driven by both the tense geopolitical situation, and by the wide use of silver in industrial production. In the first half of January, silver prices were also supported by increased concerns about potential supply problems for the precious metal and growing uncertainty about the future of US-China trade relations.

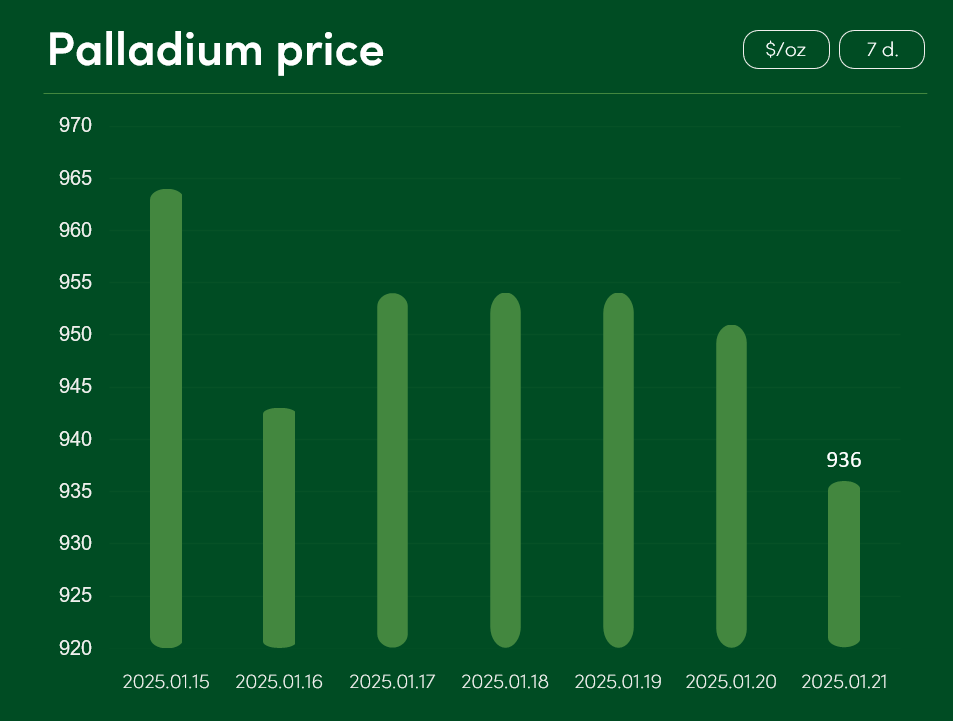

The palladium market price declined by ~3% last week and reached $936/oz on 21 January.

Global spot price of platinum recorded almost no change between 15 January and 21 January, reaching $939/oz on 21 January.

The global spot price of copper increased by ~2% between 15 January and 21 January, reaching $9222/tonne.

Although the beginning of January looks very favourable for copper, investors and experts are looking at the future prospects of the metal with concern. The likely imposition of US tariffs on China, Mexico and Canada would have a negative impact on global demand and price stability for industrial metals, including copper.

On the other hand, more optimistic news can be found in the Chinese domestic market. The world’s largest copper user, which is struggling with a real estate crisis and economic slowdown, increased its monthly imports of copper concentrate by 12% during the last December. Such news, coupled with the return to work of a number of Chinese smelters, could drive copper prices higher. In 2025, the global supply levels of copper concentrate are likely to be lower than the production demand for this material. In a favourable market environment, this factor may contribute to the increase in global copper prices.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.