May 20, 2025

Market Overview 14-05-2025 to 20-05-2025

Last week, both economic news from China and unexpected changes in the U.S. credit rating contributed to price formation in the precious metals market. Although the popularity of precious metals is being driven by a weaker U.S. dollar and global geopolitical tensions, easing international trade conflicts are prompting some investor scepticism about the future of this asset class.

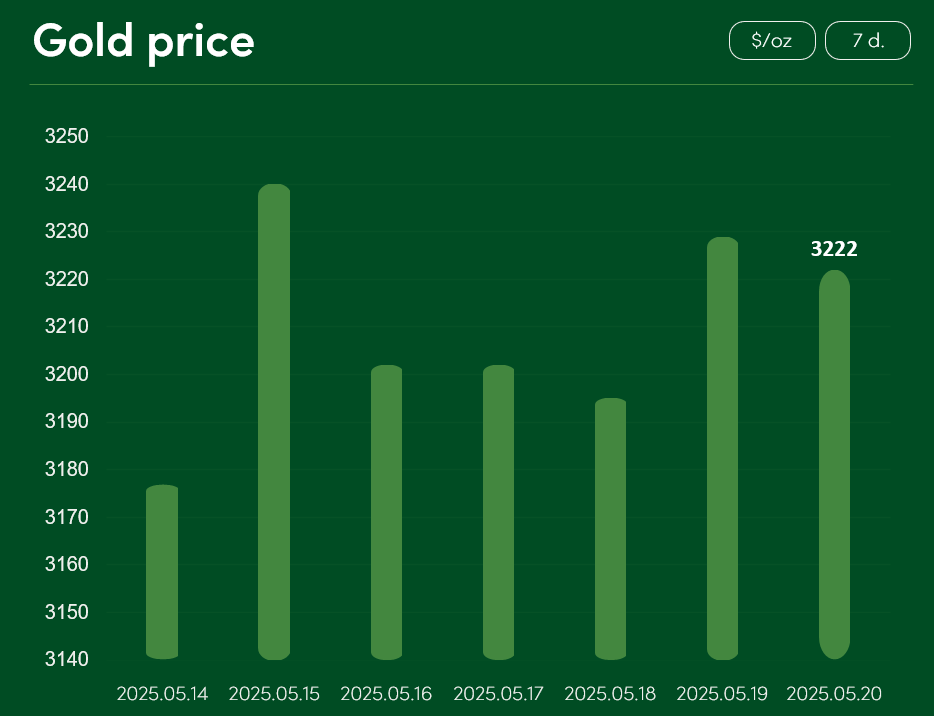

From May 14 to May 20, the global gold price increased by approximately 1.4%, reaching $3,222/oz.

Gold’s investment attractiveness was boosted in the second half of May by unexpected changes in the US financial rating. The world’s leading credit rating agency, Moody’s, downgraded the U.S. credit rating from the highest – Aaa – category to a lower – Aa1 – class. This decision triggered corrections in the dollar exchange rate; the resulting depreciation contributed to increased attention from foreign investors toward metals and commodities denominated in U.S. dollar (such as gold, silver, oil, etc.).

While gold remains a highly relevant asset class due to geopolitical risks and global economic uncertainty, some investors are beginning to question its future potential due to waning trade war tensions. Trade agreements between the U.S. and China, as well as between the U.S. and the United Kingdom, are encouraging a more optimistic outlook on possible future deals and easing tensions that were prevalent during the height of U.S. import tariff implementations.

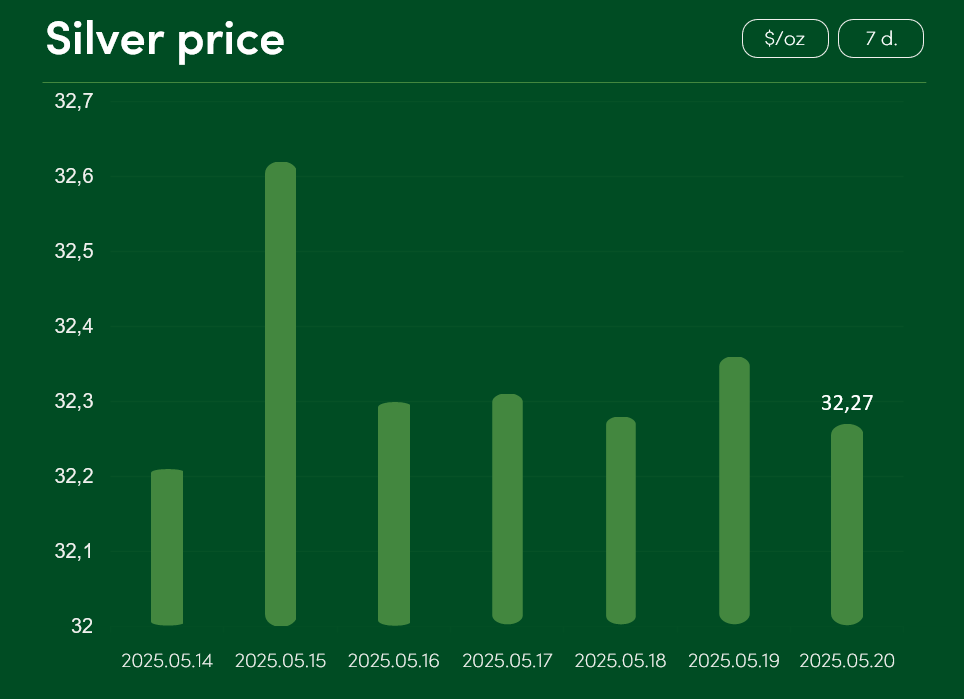

Evaluating the overall performance over the past 7 days, the global silver price recorded only marginal changes from May 14 to May 20. On May 20, silver price reached $32.27/oz.

The price growth of silver – a metal actively used in industrial applications – is undoubtedly driven by strong demand in the renewable energy sector. Recently released Q1 2025 data from China revealed a record 59.7 GW increase in electricity generation capacity in the PV sector. At the beginning of this year, Europe recorded a 30% relative rise in solar power generation, which is linked to the region’s rapidly expanding solar module segment.

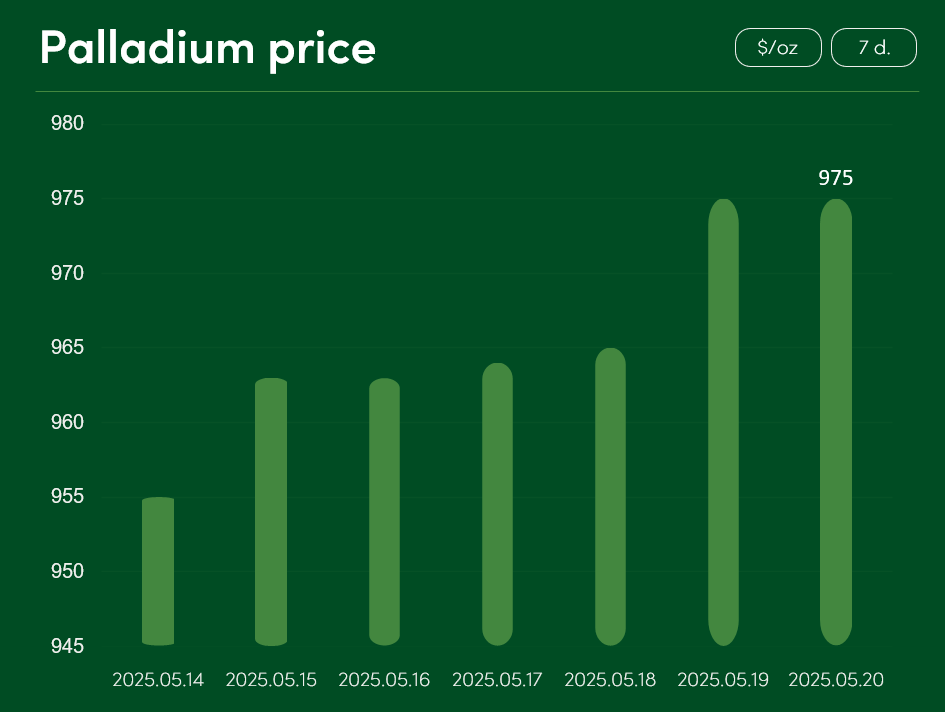

The global palladium price rose by approximately 2.1% from May 14 to May 20, reaching $975/oz.

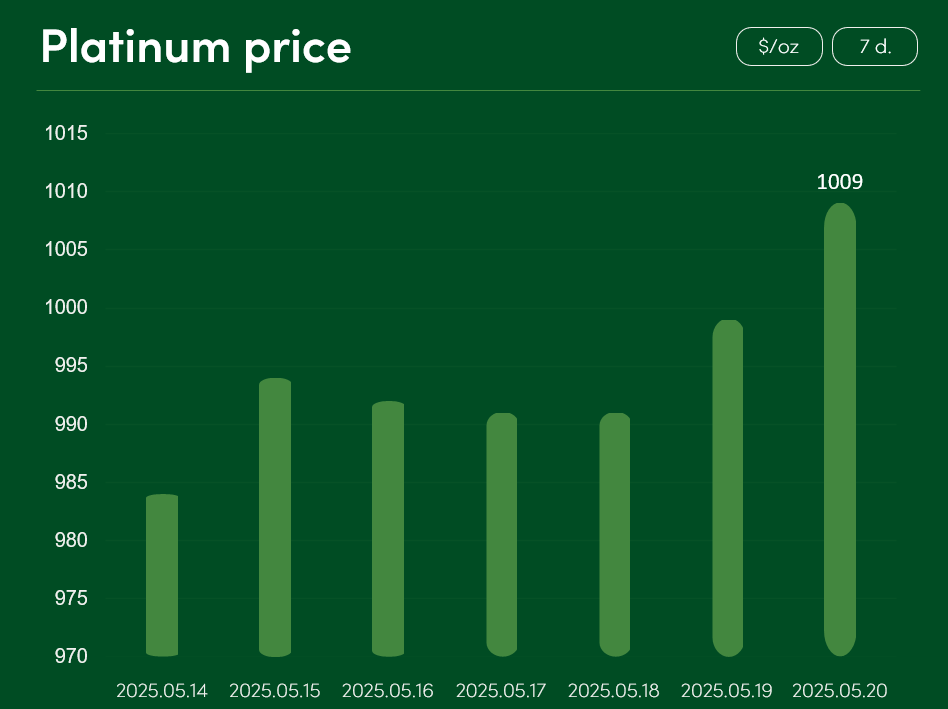

The global platinum price increased by around 2.5% over the past 7 days, reaching $1,009/oz on May 20.

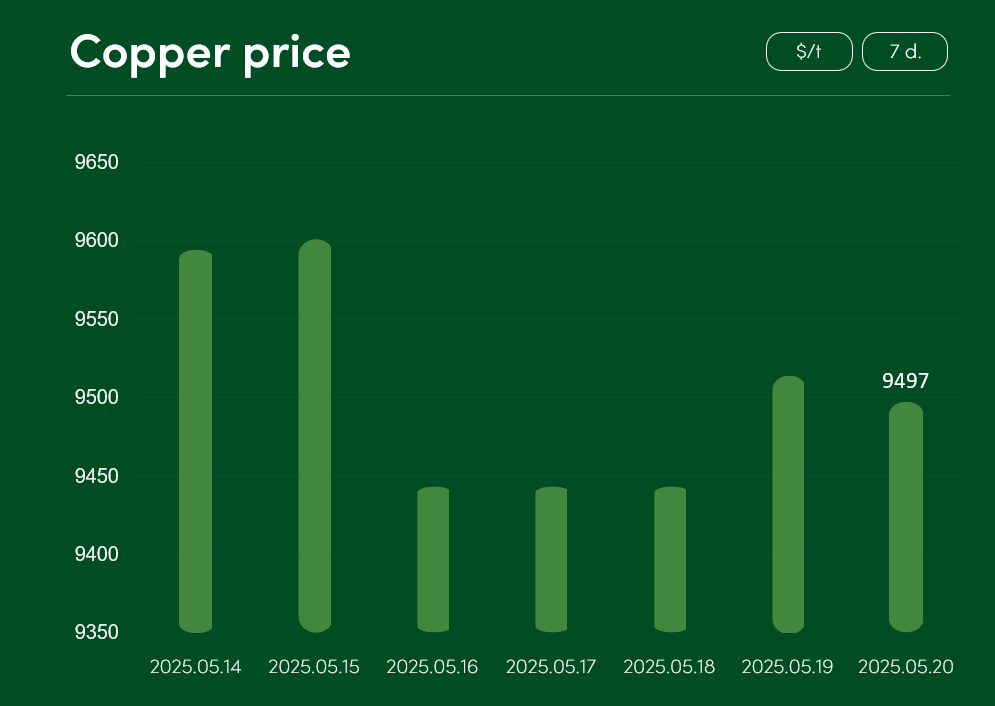

Meanwhile, the global copper price fell by around 1% from May 14 to May 20, with the price reaching $9,497/t on May 20.

Although copper is projected to face a growing supply deficit in the long term, several key factors are currently limiting its short-term price growth. In the U.S. market, fears over potential tariffs led to a sharp increase in copper imports in early spring. This unusual supply surge eliminated the typical metal’s premium in the U.S. market.

Copper prices are also facing challenges due to global supply-demand imbalance. Experts from the International Copper Study Group (ICSG) estimate that the global copper surplus will reach 289 thousand tonnes this year. At the same time, copper inventories in warehouses operated by the Shanghai Futures Exchange rose by 34% in early May, reaching 108 thousand tonnes. This clear supply-demand imbalance may trigger further price corrections in the copper market in the nearest future.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.