January 20, 2026

Market Overview 14-01-2026 to 20-01-2026

New Gold and Silver Price Records in the Market

Last week brought positive news for precious metals investors, as new record highs were set for gold and silver prices. The growing popularity of precious metals is linked both to problematic U.S. diplomatic rhetoric and to increasing geopolitical chaos, as well as to a relatively high probability of interest rate cuts by the Federal Reserve (Fed).

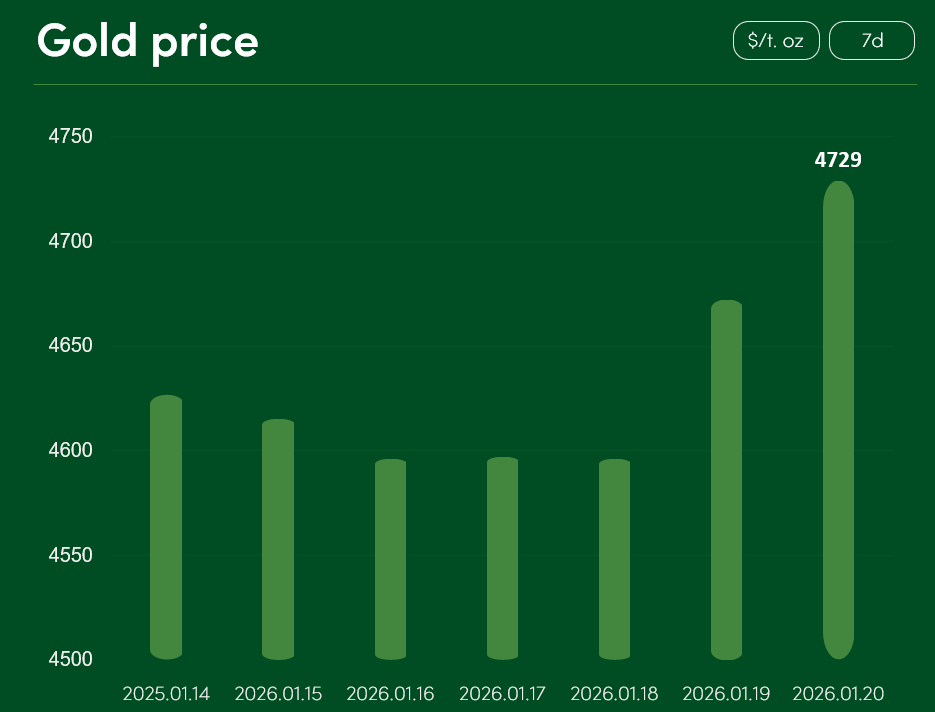

The global gold price rose by more than 2.2% between January 14 and January 20, reached a new all-time high during the period and climbed to USD 4,729 per troy ounce.

Investment demand for gold is being strongly supported by rising geopolitical tensions between the United States and Europe. As Donald Trump continues to pursue plans to gain control over Greenland through various means, the U.S. president has begun openly threatening European allies. According to Trump, a separate trade tariff will be imposed and gradually increased on European countries that oppose U.S. ambitions regarding Greenland.

Investors are also alarmed by the escalation of geopolitical crises in other regions. Following the suppression of violent protests in Iran, the local regime has launched a crackdown on alleged supporters of the protesters. High-level tensions are also evident in U.S.–Iran political relations. After Donald Trump announced 25% tariffs on countries trading with Iran, the local regime adopted an aggressive rhetoric. Iranian officials warned the governments of Qatar and Saudi Arabia that, in the event of a U.S. military attack, Iran would strike United States targets in these Arabian countries.

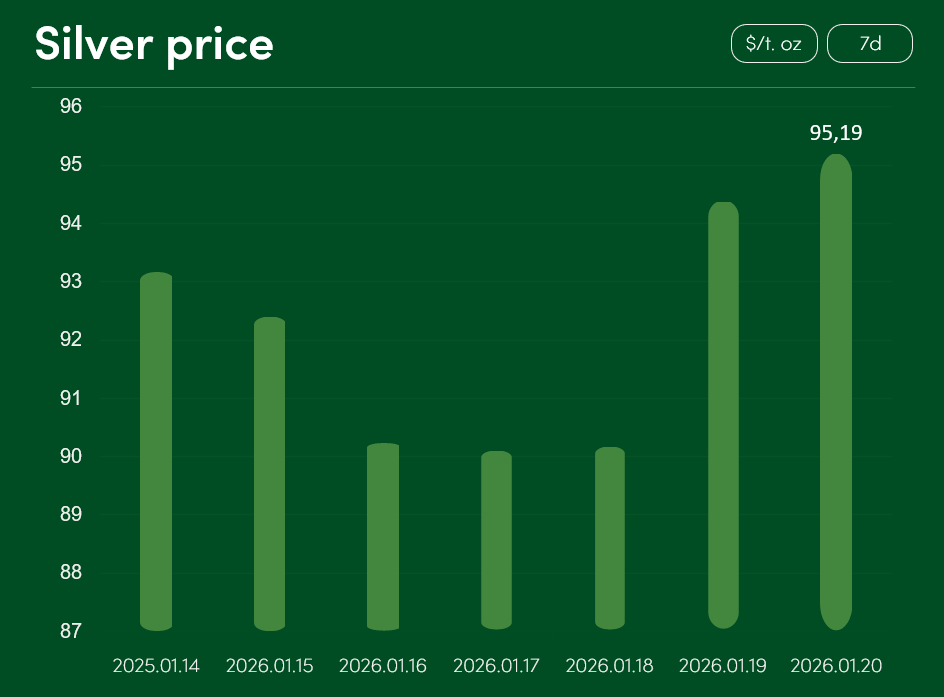

The global silver price also reached a new record between January 14 and January 20 and rose to USD 95.19 per troy ounce.

Silver price growth is being driven not only by geopolitical crises, but also by growing expectations of interest rate cuts by the Fed. After U.S. federal prosecutors opened a criminal investigation into Fed Chair Jerome Powell, some investors interpreted this move as Donald Trump’s attempt to strengthen his influence over the Federal Reserve. Given that Trump is a strong advocate of lower interest rates, near-term Fed rate cuts are becoming an increasingly realistic scenario.

Although exchange data indicate only a 5% probability that the Fed will cut interest rates as early as January, markets are much more focused on the March–April meetings. The probability that the Fed will cut interest rates by at least 0.25 percentage points as early as March currently stands at approximately 20%, while the likelihood of a 0.25% rate cut at the April Fed meeting is estimated at as much as 31%.

If the Fed meets market expectations, lower U.S. interest rates would likely lead to a correction in the U.S. dollar exchange rate; in such a scenario, U.S. dollar-denominated precious metals (gold, silver, etc.) would become more attractive to holders of foreign currencies.

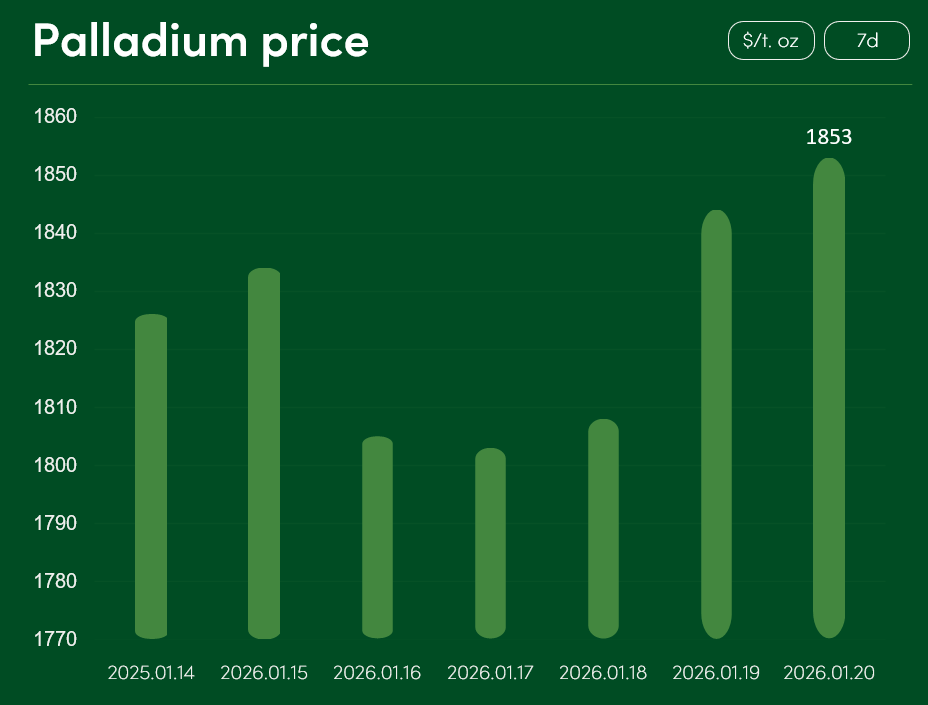

The global palladium price experienced minimal changes between January 14 and January 20. On January 20, palladium was priced at USD 1,853 per troy ounce.

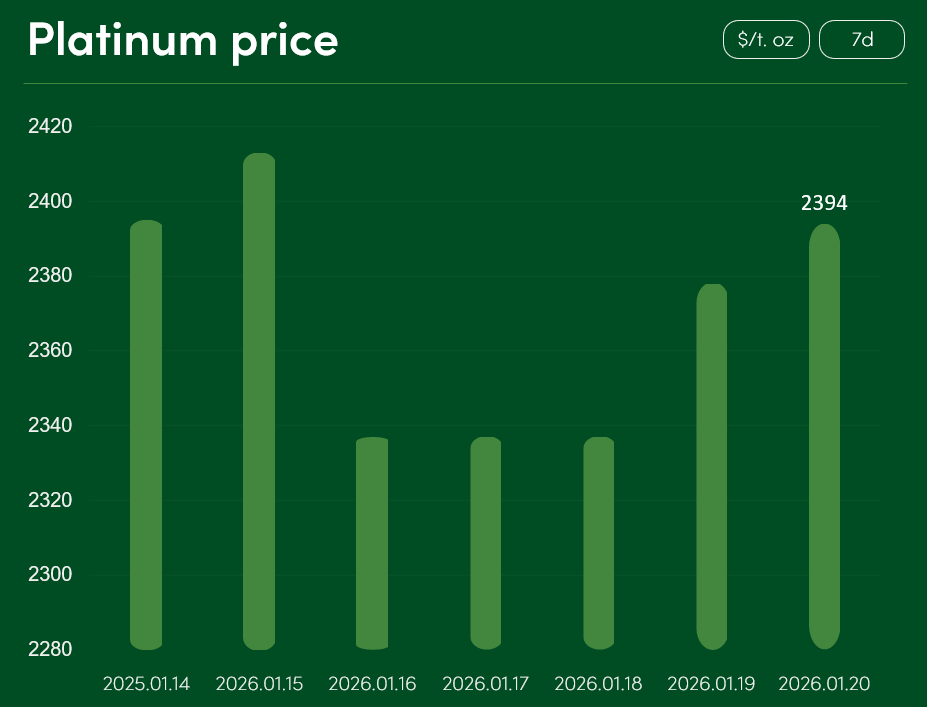

The global platinum price also saw a relatively small change over the same period. On January 20, platinum reached USD 2,394 per troy ounce.

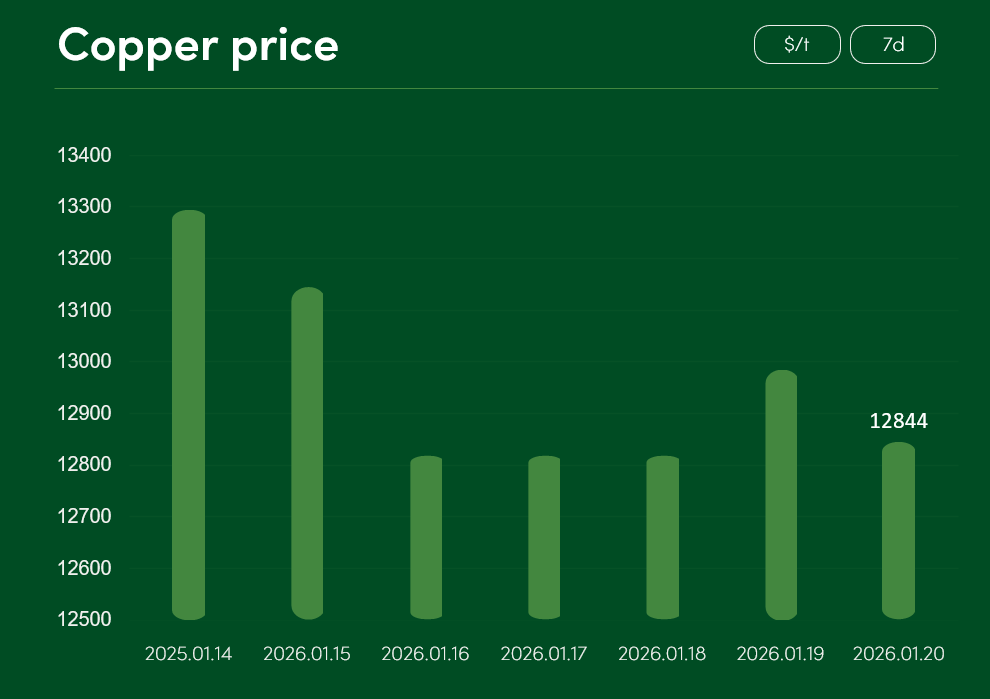

The global copper price declined by more than 3.3% between January 14 and January 20. On January 20, copper was priced at USD 12,844 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.