November 19, 2024

Market Overview 13-11-24 to 19-11-2024

Last week, precious metals markets recorded unanimous price gains, helping to partially reverse the losses of the corrections from the first half of November. The deepening global geopolitical crisis, the rush by dollar traders to cash in on the currency’s quick gains and the uncertainty surrounding US interest rate cuts are encouraging investors to return, at least temporarily, to the precious metals sector, which has already been growing at a record pace this year.

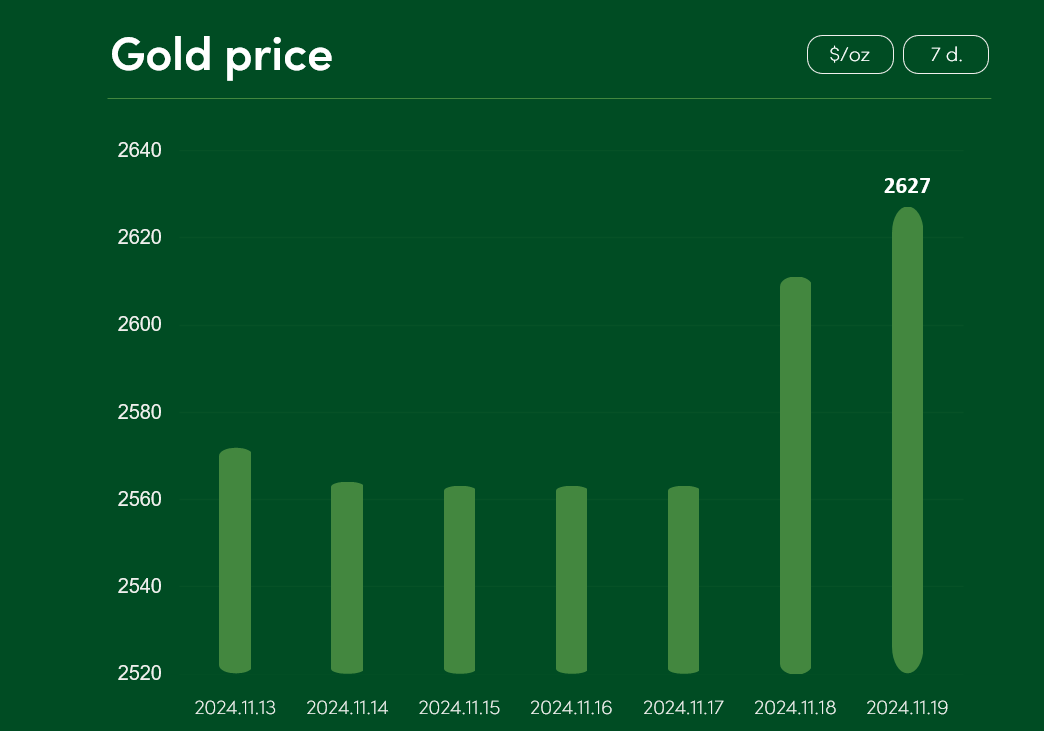

Between 13 and 19 November, gold prices rose by >2% on the exchanges, reaching $2627/oz.

The rise in gold prices recorded in the middle of this month can be partly explained by the decision of dollar traders to cash in their quick profits after the record rise of this currency following the election of Trump as US President. Gold also continues to be a reliable investment hedge in the face of rising geopolitical threats. Biden, who is in his final months at US President’s post, has formally allowed Ukraine to strike Russian territory with long-range weapons received from the United States. Investors fear that this decision increases the chances of an escalation of the conflict and complicates the process of negotiations and peaceful settlement.

Silver prices rose by ~3.4% between 13 November and 19 November and reached $31.38/oz.

The rise in silver prices, which experienced a correction in early November, was driven not only by the decision of dollar traders to cash in their quick profits from sharp rise of this currency, but also by the anticipation of favourable financial news from China. According to TradingEconomics experts, investors are expecting additional financial stimulus decisions from this market in the near future, which would accelerate the growth of China’s economy and country’s industrial consumption.

More positive changes in monetary policy are expected from the US market before the end of the year: according to Reuters analysts, there is still a roughly 60% probability that the Fed will cut US interest rates by 25 basis points (0.25%) in December. Such decision would undoubtedly attract new investments into silver market, because this metal is also heavily used in various industrial spheres.

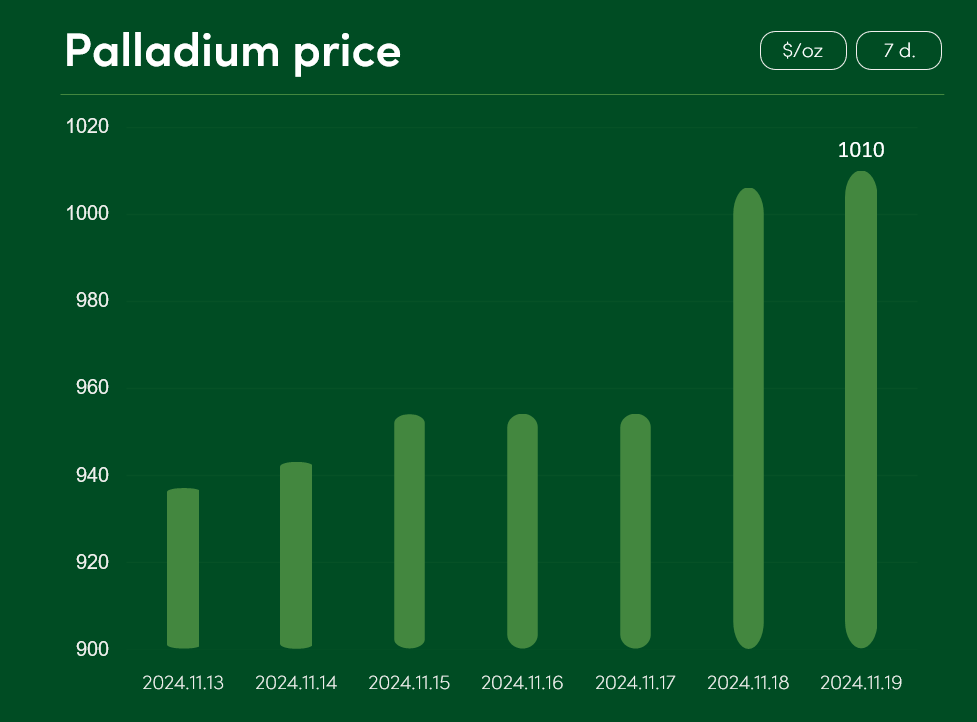

Palladium prices, recovering from the sharp corrections, recorded a ~8% rise between 13 November and 19 November to reach $1010/oz.

The platinum precious metal gained ~3% between 13 November and 19 November, reaching a price point of $967/oz.

Semi-precious copper metal increased its spot price by ~2.2% between 13 November and 19 November to reach a price point of $9108/tonne.

Neither investors nor metal mining companies doubt the long-term growth in copper demand. According to a commentary on MiningTechnology made by BHP Group, global copper demand is expected to grow steadily at a rate of 1 million tonnes per year until 2035.

It is very likely that the unexpected news from China, the third largest copper mining market, contributed to the rise in copper prices this week. According to SPglobal, on 15 November China announced its decision to abolish the 13% export duty rebate on aluminium, copper and biofuel feedstock products from 1 December. This decision will undoubtedly contribute to changes in global trade chains and potentially lead to a further consolidation of copper metal at higher price points.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.