August 19, 2025

Market Overview 13-08-2025 to 19-08-2025

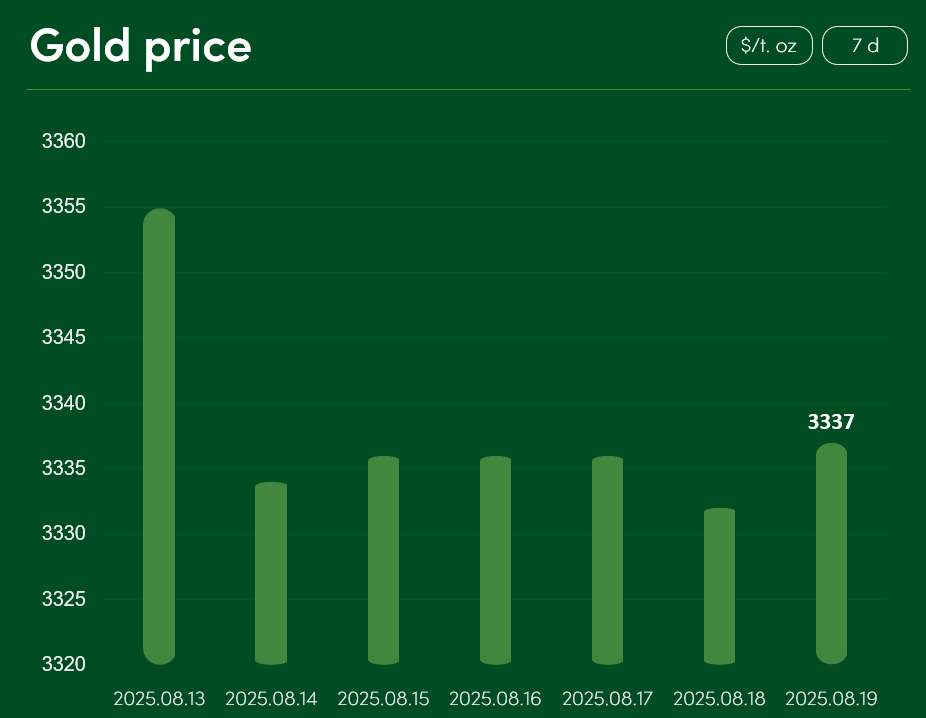

In the past week, the major precious metals markets faced price corrections. These were driven by a more pronounced easing of international geopolitical tensions. On the other hand, a sharp price decline was avoided both due to the still-uncertain geopolitical future in Ukraine and the Middle East region, and because of the increasingly anticipated monetary policy shifts in the United States.

The global gold price slipped by more than 0.5% between August 13 and August 19; on August 19 it reached $3,337/t. oz.

Gold’s correction was strongly driven by progress in de-escalating the military conflict in Ukraine. Following last week’s meeting between D. Trump and V. Putin in Alaska, the U.S. president declared that bilateral talks between V. Putin and V. Zelenskyy are being arranged, and that the United States would help guarantee Ukraine’s security if a deal is reached.

Although this progress in geopolitical de-escalation reduces gold’s attractiveness as a safe-haven investment, sharper corrections were avoided due both to the continuation of active military operations in Ukraine and to the problematic situation in the Middle East. As Israeli forces continue their offensive in the Gaza Strip, the aggression has been increasingly condemned not only by politicians from various countries but also by Israeli citizens themselves.

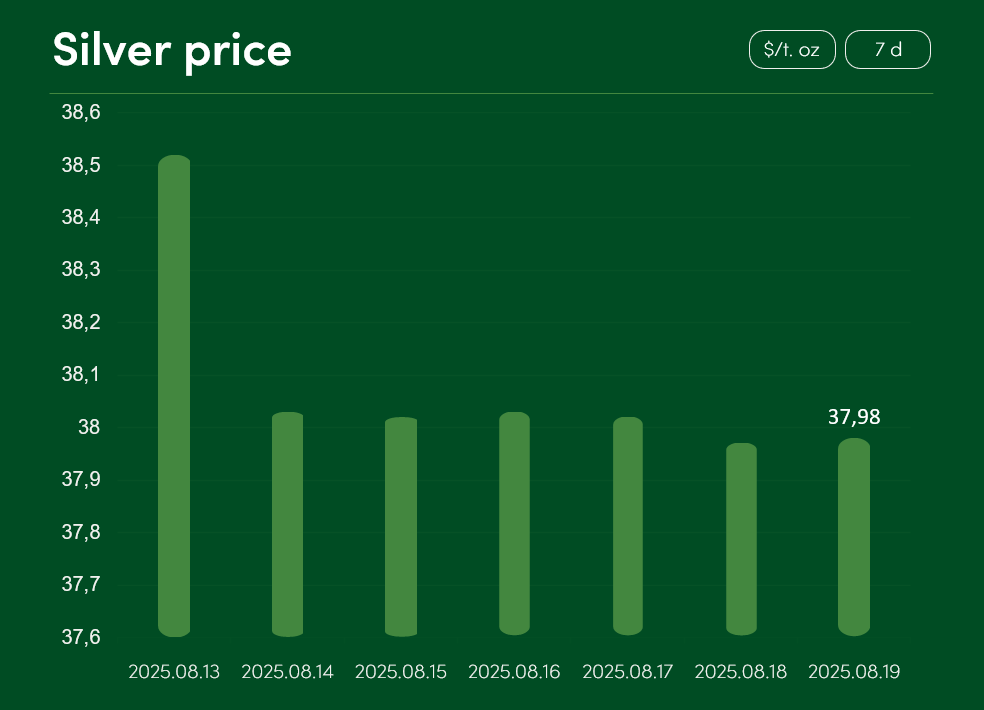

The global silver price fell by 1.4% from August 13 to August 19, reaching $37.98/t. oz.

Although the easing of global geopolitical tensions contributed to silver’s correction, a steeper decline was avoided thanks to the sharply increased probability of U.S. interest rate cuts. Based on current market trends, there is as much as an 83% probability that the Federal Reserve will lower interest rates at its next meeting (September 17). Such a decision would likely trigger corrections of the U.S. dollar exchange rate and increase the attractiveness of dollar-denominated precious metals (gold, silver, etc.) for foreign investors.

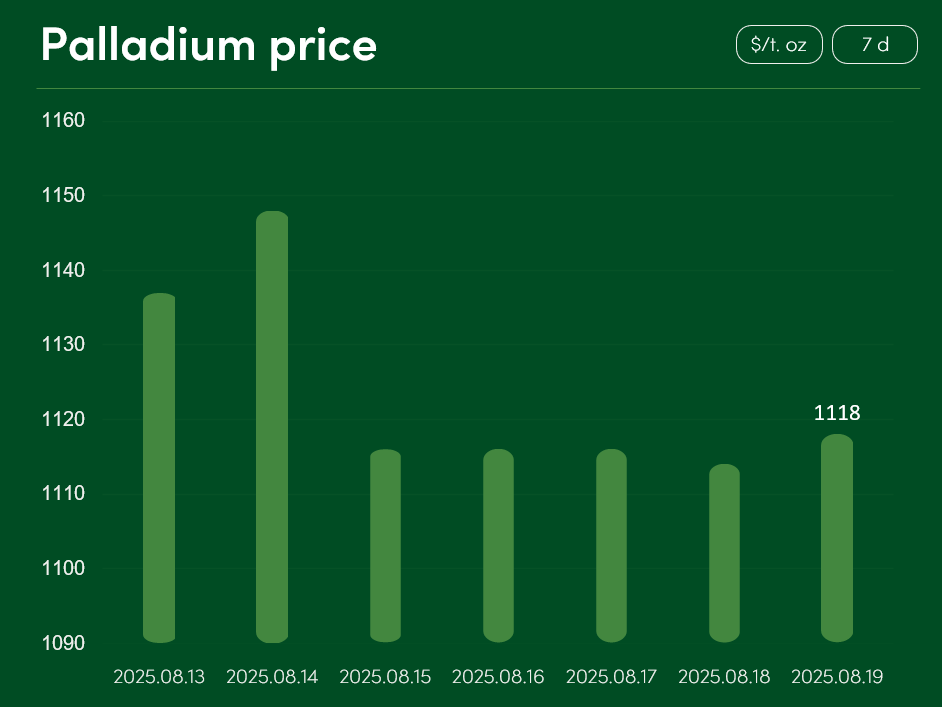

The global palladium price fell by more than 1.6% from August 13 to August 19, reaching $1,118/ t. oz.

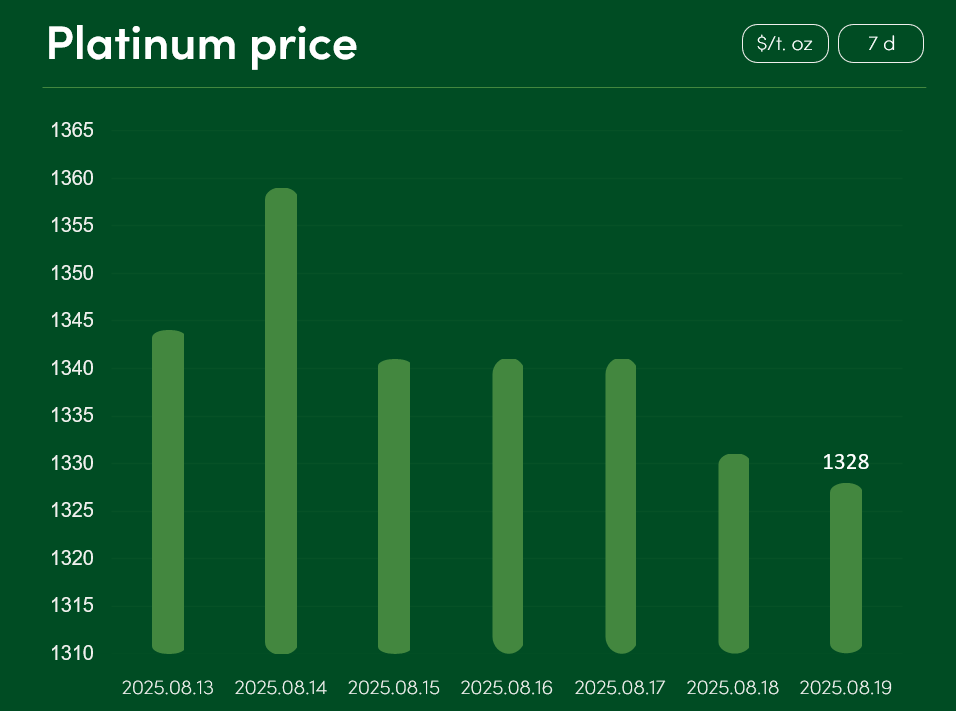

Platinum dropped by more than 1.15% in the same period, reaching $1,328/t. oz.

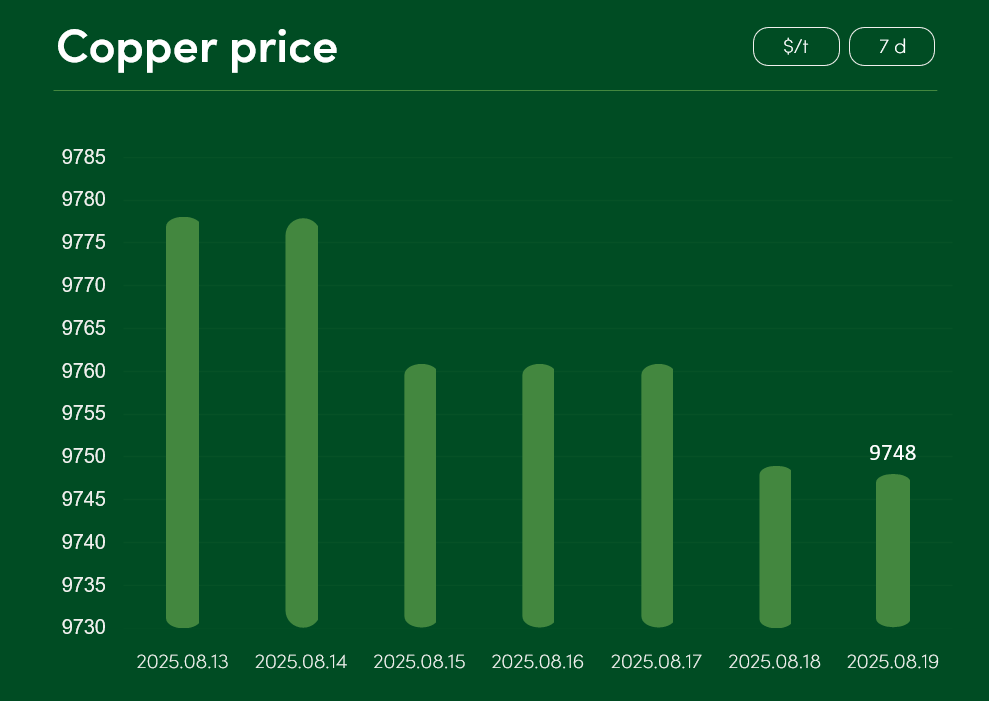

The global copper price slipped by about 0.3% between August 13 and August 19, reaching $9,748/t.

In the short term, corrections in this industrial metal are being driven not only by U.S. exemptions on copper import tariffs, but also by specific supply disruptions. At the end of July, due to rock collapse, operations at El Teniente – the world’s largest underground copper mine – were temporarily suspended. It is projected that these disruptions will reduce El Teniente’s copper output by 20,000–30,000 tons in the short term.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.