November 18, 2025

Market Overview 12-11-2025 to 18-11-2025

Another Wave of Price Declines in the Precious Metals Market

Last week, the major precious metals markets recorded a consistent price downturn. This was linked both to the partial stabilization of U.S. government operations and to a decreasing likelihood of the Federal Reserve cutting interest rates. As investors await delayed official U.S. labour market statistics for October, a partial reduction of market anxiety was observed, as well as lower interest in investing in precious metals.

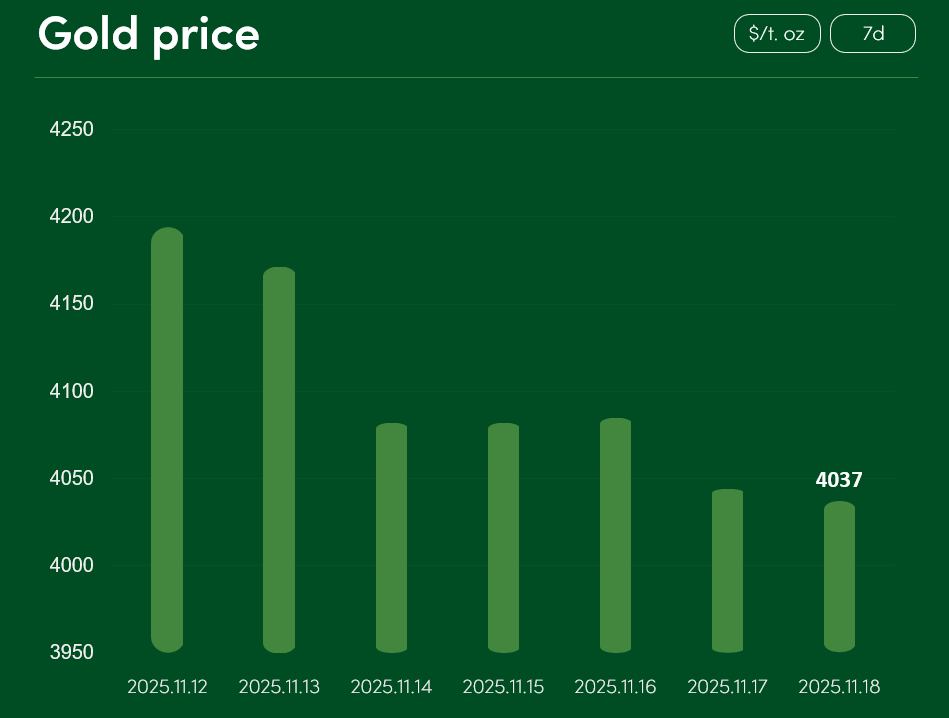

The global gold price decreased by more than 3.7% between November 12 and November 18, reaching $4,017 per troy ounce.

A sharper decline in gold prices has been influenced by the partial return of political stability in the U.S. domestic market. Last Wednesday, after President D. Trump signed a special bill, a temporary budget financing package was approved, and government operations were resumed.

Markets interpreted the end of the longest government shutdown in U.S. history as a significant reduction in U.S. political and economic risks. It is likely that this contributed to price declines in other precious metals markets as well.

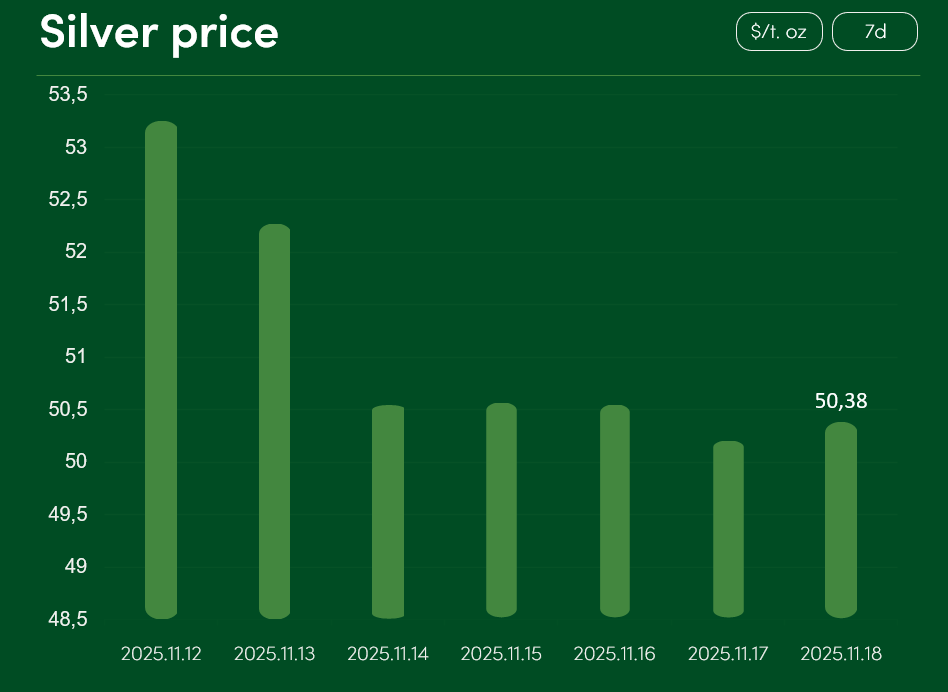

The global silver price fell by more than 5.3% between November 12 and November 18, reaching $50.38 per troy ounce.

The notable decline in silver prices was also supported by positive developments in managing the U.S. political-financial crisis. As the government resumed its operations and Federal Reserve officials issued moderate comments regarding interest rate cuts, the probability of such rate reductions dropped significantly. This outlook supports a stronger U.S. dollar and decreases the attractiveness of dollar-denominated precious metals (gold, silver, etc.).

Although silver is facing price pressure, a deeper correction has been partially avoided due to seasonal growth in physical demand. In India – the world’s most populous country – the so-called wedding season has begun. From November to February, sales of silver products (coins, cutlery, and other silver goods) typically increase significantly.

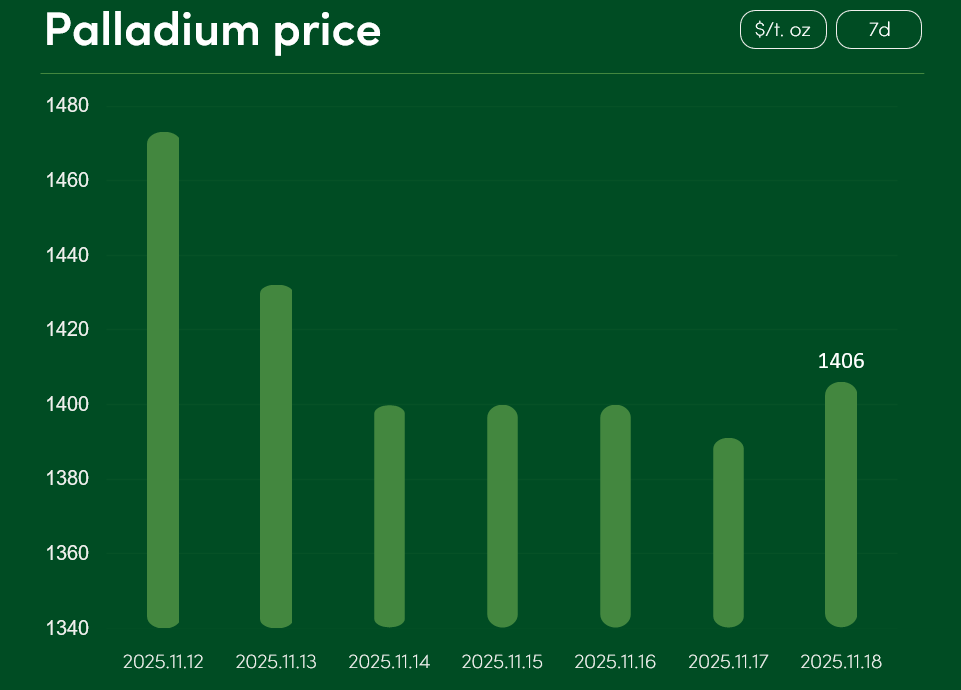

The global palladium price declined by ~4.5% between November 12 and November 18, reaching $1,406 per troy ounce.

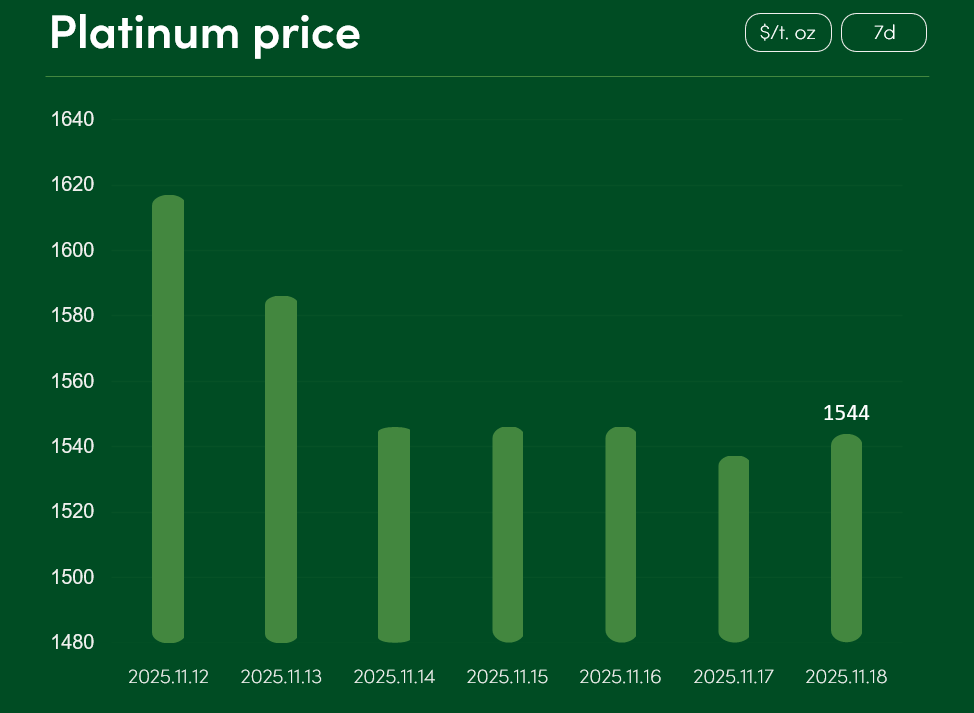

The global platinum price also fell by ~4.5% during the same period, settling at $1,544 per troy ounce.

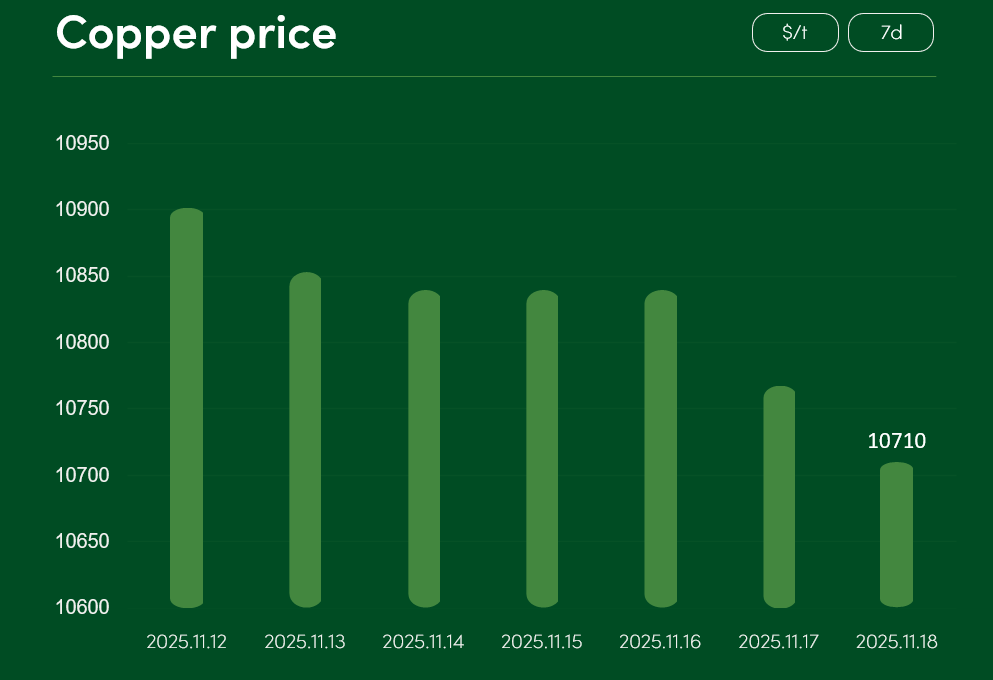

The semi-precious copper market experienced only minimal changes. On November 18, the global copper price reached $10,710 per tonne.

SUBSCRIBE TO OUR NEWSLETTER and stay updated on metal prices and market insights!

By providing my email address, I confirm that I agree to receive newsletters and that my data will be processed for direct marketing purposes in accordance with NOVITERA’s privacy policy. I can unsubscribe at any time by clicking the link at the bottom of the newsletter.